Navigating the complexities of student loan debt can feel overwhelming, especially when dealing with multiple private loans. Student loan consolidation for private loans offers a potential solution, allowing borrowers to combine several loans into a single, more manageable payment. This process can simplify repayment, potentially lower monthly payments, and offer a clearer path to becoming debt-free. However, it’s crucial to understand the nuances before making a decision, as consolidation isn’t always the best approach for everyone. This guide explores the benefits, drawbacks, and crucial considerations involved in consolidating private student loans. We’ll delve into the mechanics of private loan consolidation, Read More …

Kategori: Student Loan Debt

Student Loan Changes 2024 A Comprehensive Overview

The landscape of student loan repayment is shifting in 2024, presenting both challenges and opportunities for borrowers. Proposed changes to repayment plans, loan forgiveness programs, and interest rates promise significant alterations to the student loan experience. Understanding these changes is crucial for navigating the complexities of repayment and maximizing financial well-being. This overview delves into the specifics of these modifications, examining their potential impact on various borrower demographics and offering insights into the long-term implications. We will analyze the proposed alterations to income-driven repayment (IDR) plans, explore adjustments to loan forgiveness programs, and assess the projected effects on interest rates Read More …

Maximizing Tax Benefits: A Guide to Writing Off Student Loan Interest

Navigating the complexities of student loan repayment can feel overwhelming, but understanding the potential tax benefits available can significantly ease the burden. This comprehensive guide explores the intricacies of writing off student loan interest, providing a clear path to potentially reducing your tax liability. We’ll delve into eligibility requirements, documentation needs, the tax form process, and even offer insights into potential future legislative changes. By the end, you’ll be equipped with the knowledge to confidently claim the deductions you deserve. From understanding the different types of deductions and credits available to mastering the art of accurate record-keeping, we’ll cover every Read More …

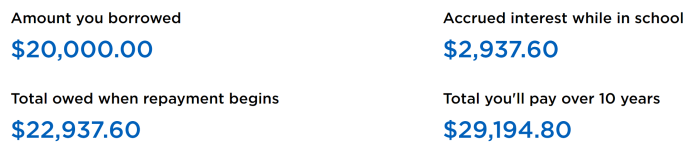

Student Loan Accrued Interest Explained

Navigating the complexities of student loan debt can feel overwhelming, especially when understanding the often-misunderstood concept of accrued interest. This seemingly simple term holds significant weight in determining the ultimate cost of your education. Understanding how interest accrues, the factors influencing its growth, and strategies for managing it are crucial for responsible financial planning and long-term well-being. This guide provides a comprehensive overview of student loan accrued interest, demystifying the process and equipping you with the knowledge to make informed decisions about your repayment strategy. We will explore various loan types, repayment plans, and the long-term financial implications of accrued Read More …

What is a High Interest Rate for Student Loans? A Comprehensive Guide

Navigating the complexities of student loan interest rates can feel overwhelming. What constitutes a “high” interest rate is subjective, influenced by factors like prevailing economic conditions and individual financial circumstances. This guide provides a clear understanding of student loan interest rates, helping you assess whether your rate is high and what steps you can take to manage your debt effectively. We’ll explore various loan types, the factors influencing interest rates (including credit score, loan term, and economic climate), and practical strategies for managing high-interest loans. Understanding these elements empowers you to make informed decisions about your student loan debt and Read More …

When Student Loan Forgiveness: Economic, Social, and Political Ramifications

The question of when, and even if, student loan forgiveness will occur is a complex issue reverberating through the American economy and society. It’s a debate fueled by soaring student debt levels, impacting millions and raising significant questions about economic stability, social equity, and the very future of higher education. This exploration delves into the multifaceted implications of widespread student loan forgiveness, examining its potential benefits and drawbacks across various sectors. From the potential short-term economic stimulus to long-term inflationary pressures, the analysis considers the diverse perspectives of economists, policymakers, and individuals directly affected by student debt. We will navigate Read More …

Programs to Help With Student Loans

Navigating the complexities of student loan debt can feel overwhelming, but understanding the available assistance programs is crucial for financial well-being. This guide provides a comprehensive overview of federal and state programs designed to alleviate the burden of student loan repayment, offering insights into eligibility criteria, application processes, and effective debt management strategies. We’ll explore various repayment plans, loan forgiveness options, and resources to help borrowers make informed decisions and achieve long-term financial stability. From income-driven repayment plans to loan forgiveness programs targeting specific professions, the landscape of student loan assistance is diverse. This guide aims to demystify the process, Read More …

What Happens If You Dont Pay Student Loans: A Comprehensive Guide

The weight of student loan debt is a significant reality for millions. While the promise of higher education is alluring, the financial repercussions of defaulting on these loans can be far-reaching and profoundly impact your future. This guide explores the immediate and long-term consequences of failing to meet your student loan obligations, offering a clear understanding of the potential ramifications and outlining strategies for navigating this challenging situation. From the initial impact on your credit score and communication from loan servicers to the potential for wage garnishment and legal action, we delve into the complexities of student loan default. We Read More …

What Happens If I Dont Pay My Student Loans? A Comprehensive Guide

The weight of student loan debt is a significant concern for many, and the consequences of defaulting can be far-reaching and deeply impactful. Understanding what happens if you don’t pay your student loans is crucial for navigating this complex financial landscape. This guide explores the immediate and long-term repercussions, outlining the legal ramifications, available debt management options, and the profound effect on your daily life. From damaged credit scores and wage garnishment to limitations on future borrowing and potential legal action, the implications of student loan default are substantial. However, understanding these consequences empowers you to make informed decisions and Read More …

What Happens If I Never Pay My Student Loans: A Comprehensive Guide

The weight of student loan debt is a significant concern for many, and the question of what happens if repayment is neglected looms large. This guide explores the potential consequences of failing to meet your student loan obligations, covering the immediate repercussions, long-term credit implications, legal ramifications, and the impact on future financial opportunities. We’ll examine the various stages of delinquency, from initial missed payments to potential wage garnishment, and delve into the available options for repayment and relief. Understanding these potential outcomes is crucial for making informed decisions about managing your student loan debt. Navigating the complexities of student Read More …