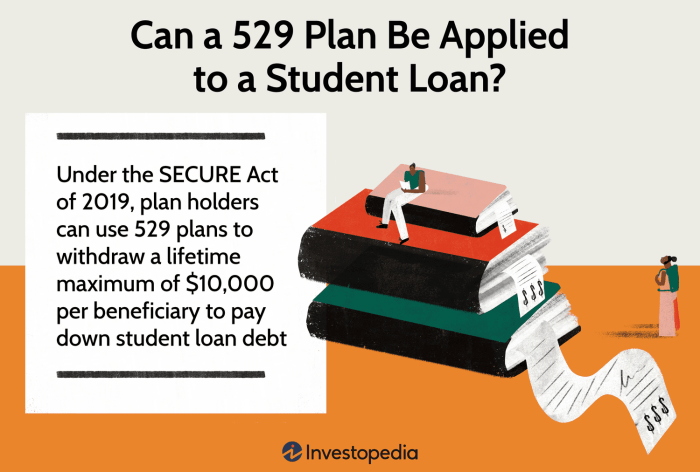

Navigating the complexities of higher education financing often leaves students and families grappling with substantial student loan debt. While 529 plans are traditionally associated with directly paying for college tuition and expenses, a growing number are exploring the possibility of using these funds to tackle student loan repayments. This exploration delves into the financial implications, legal considerations, and strategic advantages and disadvantages of utilizing 529 funds in this unconventional manner, providing a comprehensive overview to help you make informed decisions. This analysis will cover the tax implications of such withdrawals, comparing them to the potential benefits of maintaining the investment Read More …