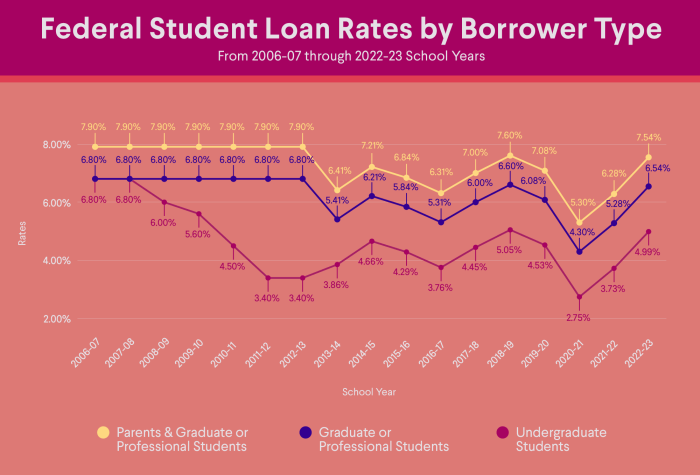

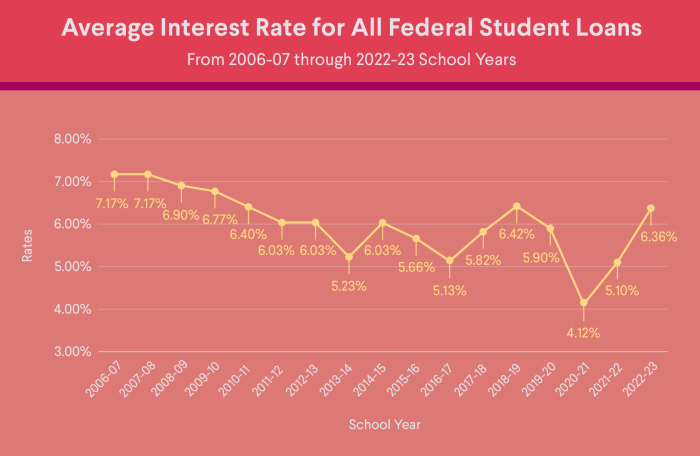

Navigating the world of student loans can feel overwhelming, especially when understanding how interest rates impact your repayment journey. This guide demystifies the complexities of student loan interest, exploring the various factors that influence rates, and providing practical strategies for managing your debt effectively. From federal versus private loans to the nuances of fixed and variable rates, we’ll equip you with the knowledge to make informed decisions about your financial future. Understanding interest rates is crucial for long-term financial planning. The choices you make regarding loan types and repayment plans will significantly impact the total amount you repay. This guide Read More …