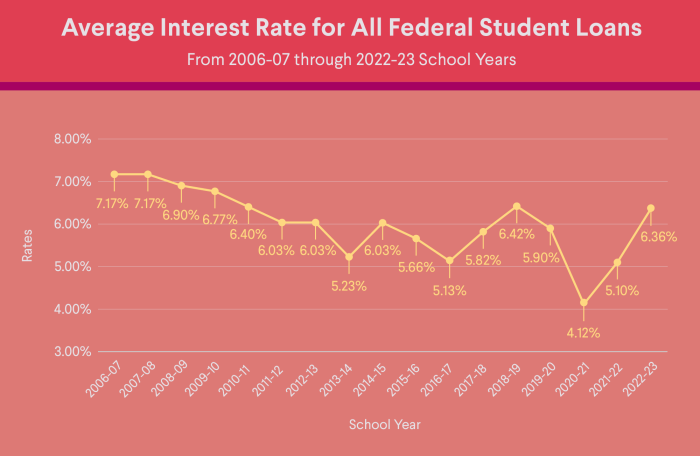

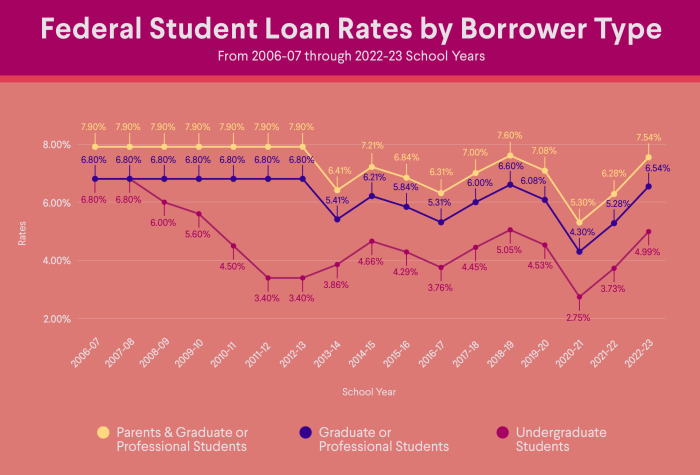

Navigating the complex landscape of student loan interest rates can feel overwhelming. Understanding the current rates is crucial for both current borrowers and those planning future education financing. This guide delves into the factors influencing these rates, exploring the differences between federal and private loans, fixed versus variable options, and the impact of economic shifts. We’ll also examine repayment strategies and resources to help you make informed decisions about your student loan debt. From understanding the interplay between inflation and interest rates to exploring various repayment plans and loan forgiveness programs, we aim to provide a clear and comprehensive overview. Read More …