Navigating the complexities of student loan repayment often leaves borrowers questioning the nuances of interest calculations. Understanding whether interest accrues yearly or monthly is crucial for effective financial planning. This exploration delves into the mechanics of these calculations, highlighting the significant impact on your overall loan cost. We’ll examine the mathematical formulas, explore various repayment strategies, and uncover the best ways to minimize your interest burden. From understanding the factors influencing interest rates – such as credit history and loan type – to exploring the benefits and drawbacks of loan consolidation and refinancing, this guide provides a comprehensive overview. We’ll Read More …

Kategori: Student Loan Management

Student Loan Hardship Deferral Guide

Navigating the complexities of student loan repayment can feel overwhelming, especially during unexpected financial hardship. Understanding your options for deferment is crucial to preventing a snowball effect of debt and potential negative impacts on your credit. This guide provides a clear path through the process of applying for a student loan hardship deferral, outlining eligibility criteria, application procedures, and the long-term financial implications. We’ll also explore alternative repayment plans and resources available to help you manage your student loan debt effectively. This comprehensive resource aims to demystify the often-confusing world of student loan deferment, empowering you to make informed decisions Read More …

Student Loan IBR Application Guide

Navigating the complexities of student loan repayment can feel overwhelming, but understanding Income-Based Repayment (IBR) plans can significantly alleviate financial stress. This guide provides a comprehensive overview of the student loan IBR application process, from eligibility criteria and documentation requirements to managing your plan and exploring loan forgiveness options. We’ll break down the intricacies of different IBR plans, offering clear explanations and practical advice to empower you in making informed decisions about your student loan debt. We aim to demystify the application process, addressing common challenges and providing solutions for potential roadblocks. Whether you’re just starting to explore IBR or Read More …

Student Loan 12 Month Grace Period Explained

Navigating the complexities of student loan repayment can feel daunting, but understanding the 12-month grace period is a crucial first step. This period, offered after graduation or leaving school, provides a temporary reprieve before repayment begins. However, it’s not a free pass; interest often accrues during this time, potentially increasing your overall debt. This guide will illuminate the nuances of this grace period, helping you make informed decisions about your financial future. We’ll explore eligibility requirements, interest implications, repayment plan options, and the consequences of default. Understanding these factors empowers you to develop a proactive repayment strategy, minimizing financial stress Read More …

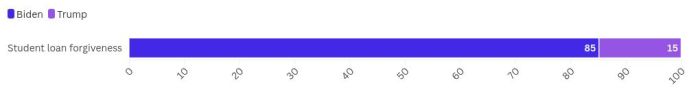

Student Loan Change Navigating New Realities

The landscape of student loan repayment is constantly shifting, presenting both challenges and opportunities for borrowers. From fluctuating interest rates and evolving forgiveness programs to the impact of policy changes and the rise of refinancing options, understanding these dynamics is crucial for effective debt management. This exploration delves into the complexities of student loan changes, providing insights and strategies to navigate this evolving financial terrain. This guide aims to equip borrowers with the knowledge necessary to make informed decisions regarding their student loan debt. We’ll examine various repayment plans, explore the potential benefits and risks of refinancing, and analyze the Read More …

Student Loan Counseling Near Me Find Help Now

Navigating the complexities of student loan debt can feel overwhelming. The search for “student loan counseling near me” often reflects a critical need for guidance and support. Whether you’re struggling with repayments, exploring repayment options, or simply seeking clarity on your financial future, understanding your options and finding a qualified counselor is crucial. This guide provides a comprehensive overview of the process, helping you find the right resources and make informed decisions. From understanding the various types of counseling available—including credit counseling, debt management, and repayment plan assistance—to identifying reputable counselors and evaluating their qualifications, we’ll cover all the essential Read More …

Student Loan Consolidation A Comprehensive Guide

Navigating the complexities of student loan debt can feel overwhelming, but understanding your options is the first step towards financial freedom. Student loan consolidation offers a potential pathway to simplify repayment, potentially lowering monthly payments and streamlining the process. This guide explores the intricacies of consolidation, empowering you to make informed decisions about your financial future. From understanding the various types of consolidation programs available – federal versus private – to assessing the impact on your credit score and long-term financial health, we’ll cover the essential aspects to consider. We’ll delve into the advantages and disadvantages, providing practical examples and Read More …

Student Loan Deferment Application Guide

Navigating the complexities of student loan repayment can be daunting, especially when unexpected life events arise. Understanding the student loan deferment application process is crucial for borrowers facing financial hardship or temporary setbacks. This guide provides a comprehensive overview of eligibility, the application process itself, available deferment types, and the long-term financial implications of this option. We’ll also explore alternative solutions and equip you with the knowledge to confidently navigate this important decision. From understanding eligibility requirements based on individual circumstances to mastering the application process and comparing various deferment options, this resource serves as your complete guide. We’ll delve Read More …

SoFi Mohela Student Loans A Comprehensive Guide

The transfer of student loan servicing rights from Mohela to SoFi represents a significant shift for millions of borrowers. This transition brings both opportunities and challenges, prompting crucial questions about repayment plans, customer service, and the overall borrower experience. Understanding the nuances of SoFi’s approach to student loan management is key to navigating this new landscape and making informed financial decisions. This guide delves into the intricacies of SoFi’s student loan servicing, examining its history, its diverse repayment options, and the support systems it offers borrowers. We’ll compare SoFi’s practices to those of its predecessor, Mohela, highlighting key differences and Read More …

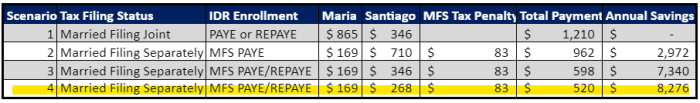

Should I File Separately for Student Loans?

Navigating the complexities of student loan repayment and tax filing can feel overwhelming, especially when considering the implications of filing jointly versus separately. The decision of whether to file separate tax returns while managing student loan debt significantly impacts your tax liability, eligibility for repayment plans, and even future financial aid opportunities. This guide explores the multifaceted considerations involved in making this crucial decision. Understanding your income, debt, and repayment plan is paramount. Your spouse’s income, your student loan debt amount, and the type of repayment plan you’re on all play a role in determining the most advantageous filing status. Read More …