Understanding how interest is calculated on student loans is crucial for responsible financial planning. The seemingly simple process involves several key factors, including the type of interest rate (fixed or variable), the method of calculation (simple or compound), and the chosen repayment plan. Navigating these elements empowers borrowers to make informed decisions, potentially saving significant money over the loan’s lifespan. This guide will unravel the complexities of student loan interest calculations, providing a clear understanding of the factors influencing your repayment journey. From the initial loan disbursement to the final payment, interest significantly impacts the total cost. This exploration will Read More …

Kategori: Student Loan Management

How Long Will Student Loans Be in Forbearance?

Navigating the complexities of student loan repayment can feel overwhelming, especially when considering forbearance. Understanding how long your loans might remain in forbearance is crucial for effective financial planning. This exploration delves into the various forbearance programs, influencing factors, potential consequences, and viable alternatives, empowering you to make informed decisions about your student loan debt. This guide aims to clarify the intricacies of student loan forbearance, providing a comprehensive overview of the available options, the factors that determine their duration, and the long-term implications of choosing forbearance. We will also examine alternative repayment strategies and discuss potential future changes in Read More …

How Do I Find My Student Loan Provider?

Navigating the complexities of student loan repayment can feel overwhelming, especially when you’re unsure who your lender is. Knowing your loan provider is crucial for managing your debt effectively, from making timely payments to exploring repayment options. This guide provides a clear path to identifying your student loan provider, utilizing readily available resources and straightforward methods. From deciphering loan documents to leveraging online tools and contacting relevant institutions, we’ll explore various avenues to help you pinpoint your lender and gain control of your financial future. Understanding this crucial piece of information empowers you to proactively manage your student loans and Read More …

Hardship Withdrawal for Student Loans A Guide

Navigating the complexities of student loan repayment can be challenging, especially during unforeseen financial hardships. This guide provides a comprehensive overview of hardship withdrawals for student loans, exploring eligibility criteria, the application process, and the financial implications involved. We’ll delve into alternative solutions, legal protections, and long-term financial planning strategies to help you navigate these difficult circumstances effectively. Understanding your options is crucial when facing financial distress. Whether you’re struggling with unemployment, medical expenses, or other unforeseen events, knowing your rights and available resources can significantly alleviate stress and pave the way for a more stable financial future. This guide Read More …

How Do I Get Money From My Student Loan?

Navigating the complexities of student loan disbursement and repayment can feel overwhelming. This guide provides a comprehensive overview of accessing your student loan funds, understanding repayment options, and managing your finances effectively. We’ll explore various repayment plans, deferment and forbearance options, and even strategies for loan consolidation and refinancing to help you find the best path forward. From understanding the different types of loans available (federal versus private) to exploring strategies for minimizing interest and avoiding late payments, this guide aims to empower you with the knowledge and tools necessary to manage your student loan debt successfully. We’ll cover everything Read More …

Financial Advisors for Student Loans A Comprehensive Guide

Navigating the complexities of student loan debt can feel overwhelming, especially for recent graduates or those facing significant repayment burdens. Understanding your options and seeking professional guidance can significantly ease this process. This guide explores the crucial role of financial advisors specializing in student loan management, offering insights into their services, strategies for debt reduction, and how to find a reputable advisor to help you chart a course toward financial freedom. From identifying the various types of advisors and their fee structures to outlining effective debt management strategies like consolidation and income-driven repayment plans, we’ll equip you with the knowledge Read More …

Find Someone to Pay My Student Loans

The crushing weight of student loan debt is a reality for millions, prompting many to explore options beyond traditional repayment methods. This exploration often leads to the question: “Can someone else pay my student loans?” While the answer isn’t a simple yes or no, understanding the available resources and navigating the potential pitfalls is crucial. This guide delves into legitimate avenues for student loan debt relief, exploring government programs, income-driven repayment plans, refinancing options, and negotiation strategies. It also highlights the importance of financial literacy and awareness of potential scams. Successfully navigating the complex landscape of student loan repayment requires Read More …

Filing Separately for Student Loans A Comprehensive Guide

Navigating the complexities of student loan repayment can feel overwhelming, especially when considering the impact of your tax filing status. Filing jointly or separately on your tax return significantly influences your eligibility for income-driven repayment plans, potential loan forgiveness programs, and overall tax liability. This guide explores the nuances of filing separately for student loans, examining the financial implications and offering insights to help you make informed decisions. We’ll delve into how individual incomes affect eligibility for income-driven repayment, the potential benefits and drawbacks based on income levels, and the long-term financial consequences of your choice. Understanding the impact on Read More …

Experian Student Loans Credit Score Impact

Understanding how your student loans affect your Experian credit score is crucial for financial well-being. This comprehensive guide delves into the intricacies of Experian’s student loan reporting, exploring how this data is collected, its impact on your creditworthiness, and strategies for effective management. We’ll cover accessing your report, disputing inaccuracies, and leveraging this information to navigate student loan repayment and forgiveness programs effectively. From the initial data collection process to the potential implications for loan forgiveness programs, we’ll illuminate the relationship between Experian’s reporting and your student loan journey. We’ll also provide practical advice on how to utilize this information Read More …

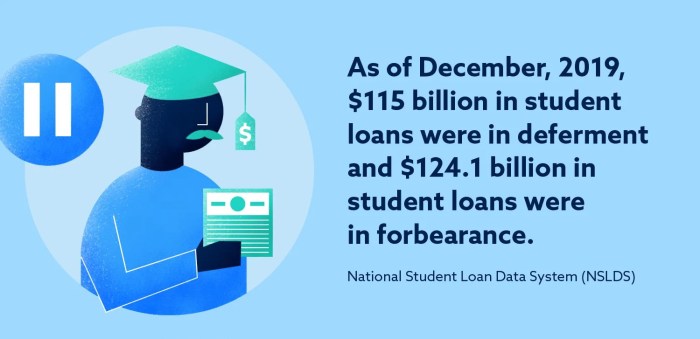

Does Student Loan Deferment Affect Credit Score?

Navigating the complexities of student loan repayment can be daunting, and understanding the potential impact of deferment on your credit score is crucial. Many borrowers choose deferment to temporarily pause payments, but this decision carries implications that extend beyond immediate financial relief. This exploration delves into the multifaceted relationship between student loan deferment and your creditworthiness, offering insights to help you make informed choices. This guide clarifies how deferments are reported, the factors influencing their impact, and strategies for mitigating potential negative consequences. We’ll also explore alternatives to deferment and provide a roadmap for managing your credit effectively, both during Read More …