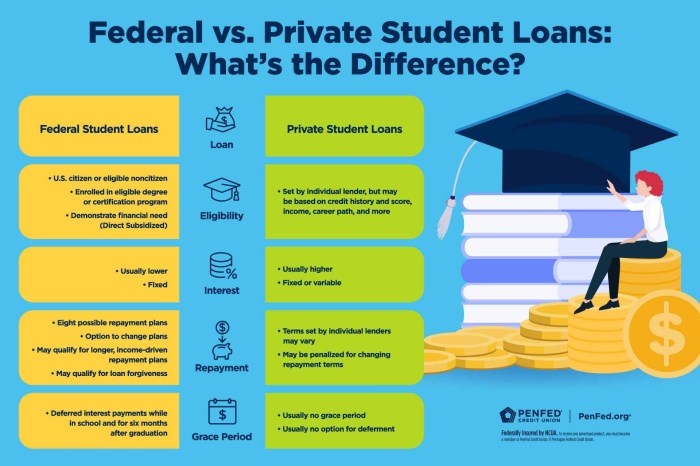

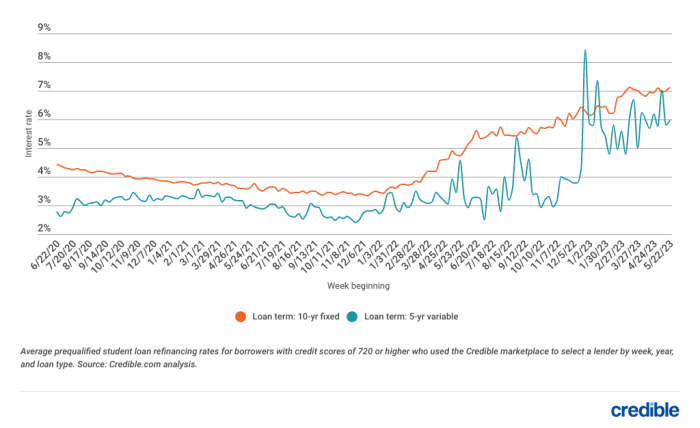

Navigating the complexities of student loan debt can feel overwhelming, but refinancing offers a potential pathway to lower monthly payments and significant long-term savings. This guide delves into Citizen Bank’s student loan refinancing program, examining eligibility requirements, interest rates, the application process, and ultimately helping you determine if refinancing with Citizen Bank is the right financial decision for your circumstances. We’ll explore the advantages and disadvantages of refinancing, compare Citizen Bank’s offerings to those of its competitors, and provide a detailed hypothetical example illustrating the potential financial benefits. By the end, you’ll have a clear understanding of whether Citizen Bank’s Read More …