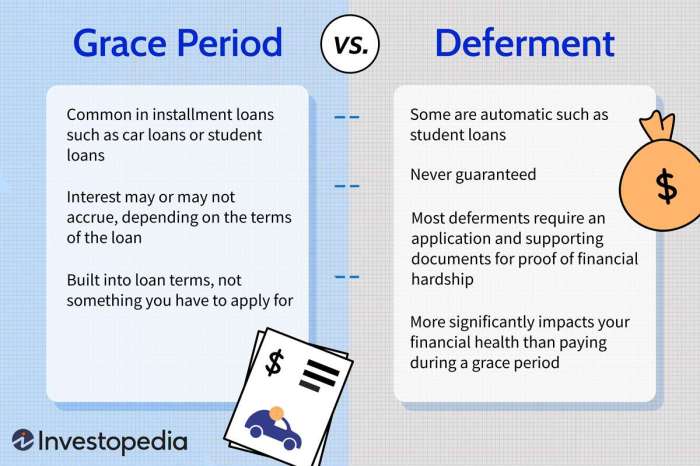

Navigating the complexities of student loan repayment can feel overwhelming, especially when faced with unexpected financial hurdles. One potential solution often explored is student loan deferment. This guide delves into the intricacies of deferment, providing a clear understanding of its meaning, various types, application processes, and potential long-term implications. We’ll explore the key differences between deferment and forbearance, examine the eligibility criteria for different deferment types, and analyze the impact on interest accrual and overall loan cost. Ultimately, understanding deferment empowers borrowers to make informed decisions about managing their student loan debt. This comprehensive guide aims to demystify the process Read More …