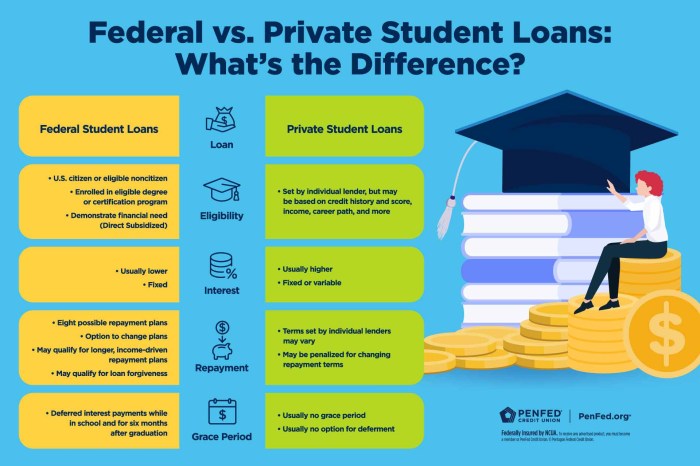

Navigating the complexities of student loans can feel overwhelming, especially within the specific context of a state like Missouri. This guide offers a clear and concise overview of Missouri’s student loan landscape, covering various programs, repayment options, and the overall impact on the state’s economy. We’ll explore the financial realities facing Missouri graduates and provide practical resources to help borrowers manage their debt effectively. From understanding eligibility criteria for state-sponsored programs to comparing interest rates and repayment plans, we aim to demystify the process. We’ll also delve into the broader economic implications of student loan debt in Missouri, examining its Read More …