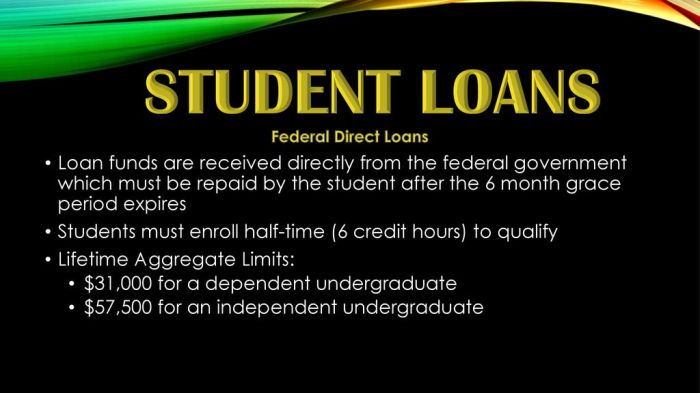

Navigating the world of student loans can feel overwhelming, especially when considering the diverse options offered by banks. This guide provides a clear and concise overview of student loans from banks, covering everything from eligibility requirements and application processes to repayment strategies and the crucial comparison with federal student loan options. We’ll delve into the specifics of different loan types, interest rates, and the role of co-signers, empowering you to make informed decisions about financing your education. Understanding the nuances of bank student loans is key to securing the best possible financing for your higher education journey. This involves carefully Read More …