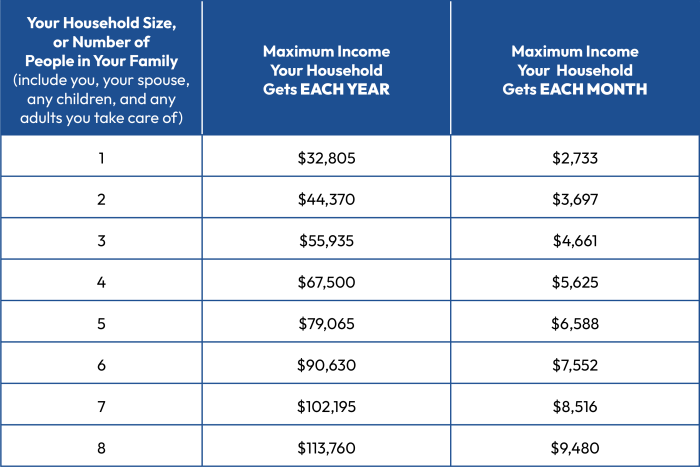

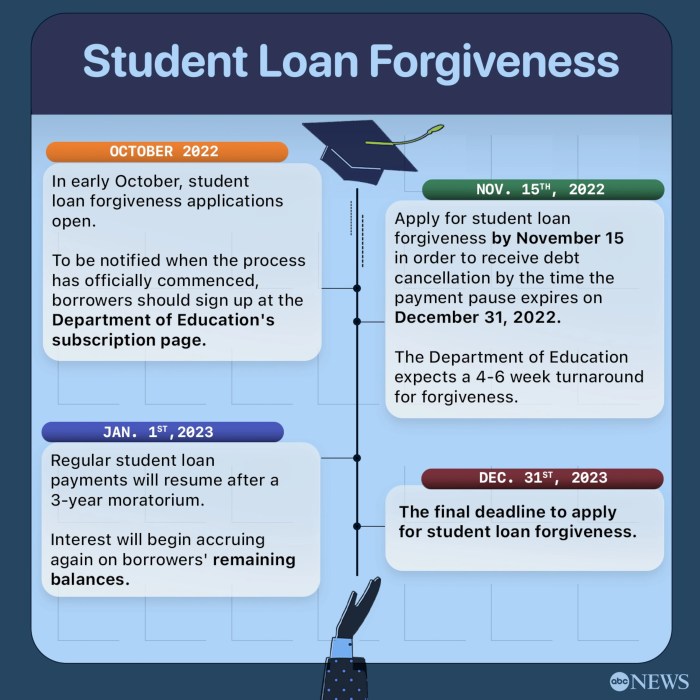

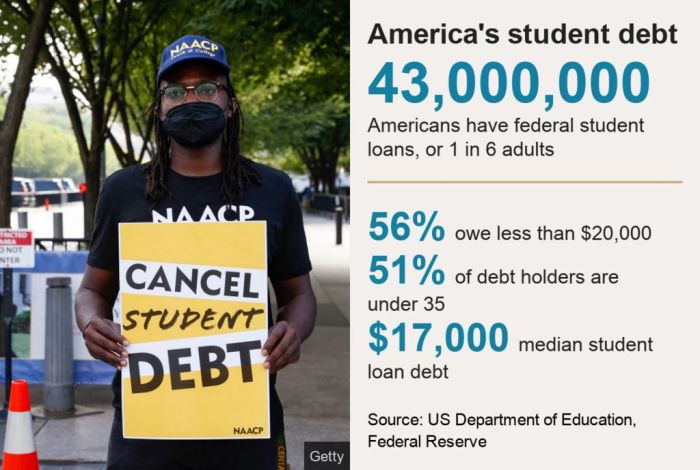

Navigating the complex landscape of student loan debt can feel overwhelming, but understanding the available assistance programs is crucial for borrowers seeking financial relief. This guide explores various federal and state initiatives, repayment plans, and refinancing options designed to alleviate the burden of student loans and pave the way for a more secure financial future. We’ll delve into eligibility criteria, application processes, and the long-term impact these programs can have on both individual borrowers and the economy. From income-driven repayment plans tailored to individual financial situations to potential loan forgiveness programs, the options available can significantly impact a borrower’s ability Read More …