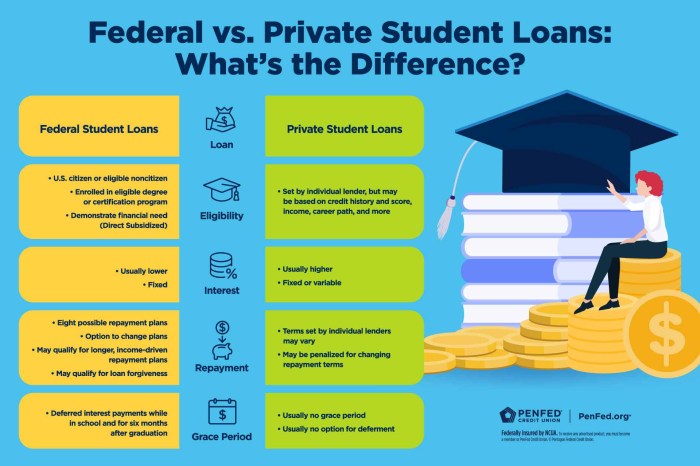

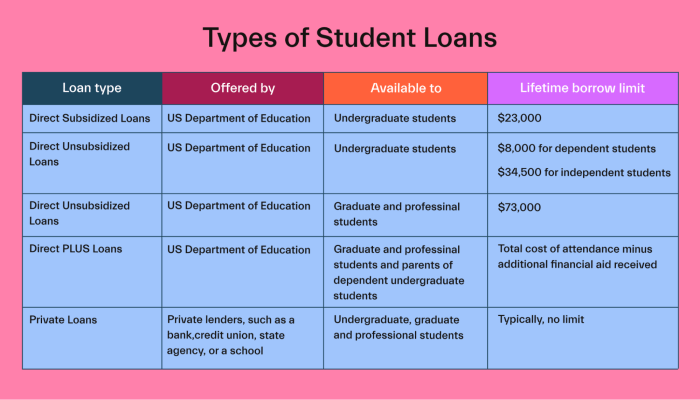

Navigating the world of student loans can feel overwhelming, especially when faced with the choice between subsidized and unsubsidized options. Understanding the nuances of each loan type is crucial for responsible financial planning and long-term success. This guide will illuminate the key differences, helping you make informed decisions about your educational financing. This exploration will delve into interest rates, eligibility criteria, repayment options, and the long-term financial implications of each loan type. We’ll examine how these loans affect your credit score and explore strategies for responsible repayment. By the end, you’ll have a clearer understanding of which loan best suits Read More …