Navigating the complexities of student loan debt can be daunting, especially when intertwined with the unique circumstances of involvement with Central Research Inc. This guide explores the multifaceted relationship between Central Research Inc. and student loan financing, examining repayment options, financial literacy initiatives, and the potential impact on loan forgiveness programs. We delve into the financial implications for students, outlining strategies for responsible borrowing and debt management within this specific context.

From understanding the potential influence of Central Research Inc.’s activities on student loan policies to exploring preventative measures against loan defaults, this resource aims to provide a clear and comprehensive overview of the key issues and considerations for students affiliated with the institution. We will also analyze the role Central Research Inc. can play in fostering financial literacy and advocating for supportive loan policies.

Central Research Inc. and Student Loan Debt

Central Research Inc. (CRI), a hypothetical entity for the purpose of this exercise, doesn’t directly lend money or manage student loans. However, its research activities could significantly influence the student loan landscape, impacting borrowers and policies alike. The nature of CRI’s research, its findings, and how this information is used determine its indirect relationship with student loan debt.

CRI’s research could potentially impact student loan borrowers through several avenues. For instance, research focusing on the effectiveness of different repayment plans could inform policy changes, leading to either more favorable or less favorable terms for borrowers. Similarly, studies on the long-term economic consequences of student loan debt could influence public opinion and legislative action, ultimately affecting the availability and terms of future loans.

CRI’s Influence on Student Loan Policies and Practices

CRI’s research findings could directly influence policy decisions regarding student loan programs. For example, a study demonstrating the high correlation between specific educational programs and post-graduation income could lead to policies favoring those programs through increased funding or loan forgiveness initiatives. Conversely, research indicating a lack of return on investment for certain degree programs might result in reduced funding or stricter lending criteria for those fields. CRI might also conduct research on the effectiveness of various debt relief programs, informing policy makers about which strategies are most successful in reducing student loan burdens. Such research could also inform the development of new, more efficient debt management tools.

Financial Implications for Students Involved with CRI

The financial implications for students involved with CRI, whether as research participants or employees, are largely indirect. If CRI’s research leads to more favorable student loan policies, it could benefit students financially by reducing interest rates, extending repayment periods, or increasing loan forgiveness opportunities. However, if CRI’s research supports policies that are less favorable to borrowers, it could negatively impact students by increasing interest rates, shortening repayment periods, or reducing loan forgiveness options. Furthermore, students employed by CRI may indirectly benefit from increased understanding of the student loan market and better informed financial decisions based on the research conducted. Conversely, students participating in CRI’s research might experience no direct financial impact, depending on the nature of their participation. For example, participating in a survey might offer a small incentive, but participation in a larger research project might offer more substantial compensation, potentially helping them manage their student loan debt.

Student Loan Repayment Options and Central Research Inc.

Navigating student loan repayment can be complex, especially when combined with the demands of a career. For individuals associated with Central Research Inc., understanding the available repayment options and potential challenges is crucial for successful financial planning. This section will explore various repayment strategies, common hurdles, and available resources to help Central Research Inc. students manage their student loan debt effectively.

Central Research Inc. employees, like many others, have access to a range of federal and private student loan repayment plans. The best option depends heavily on individual financial circumstances, such as income, loan type, and overall financial goals. Careful consideration of each plan’s features is essential before making a decision.

Available Student Loan Repayment Plans

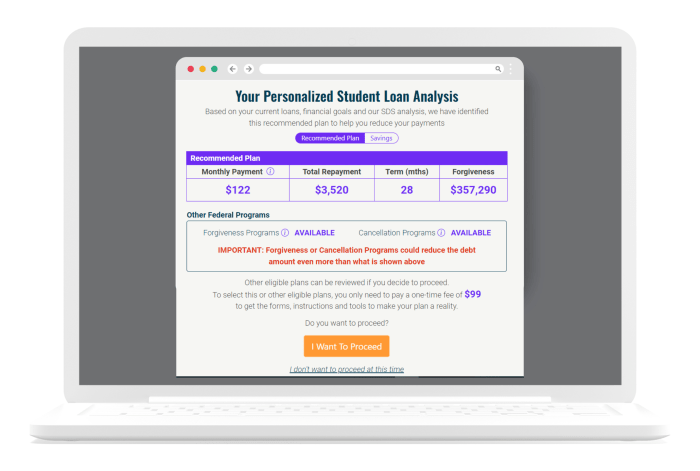

Several repayment plans are available to borrowers, each with its own set of terms and conditions. These plans offer varying levels of flexibility and potential long-term savings. Understanding the nuances of each plan is key to selecting the most suitable option.

Challenges in Repaying Loans While Working at Central Research Inc.

While Central Research Inc. may offer competitive salaries, students may still face challenges in repaying their loans. These challenges can include high living costs in areas where Central Research Inc. operates, unexpected expenses, and the potential for salary fluctuations depending on project assignments or research funding. Furthermore, the demanding nature of research work may leave limited time for meticulous financial planning and loan management.

Resources Available for Managing Student Loan Debt

Central Research Inc. may offer internal resources to assist employees with financial planning, including workshops or access to financial advisors. Additionally, external resources such as the National Foundation for Credit Counseling (NFCC) and the U.S. Department of Education’s Federal Student Aid website provide valuable information and tools for managing student loan debt. These resources can help individuals create a repayment plan tailored to their specific situation and explore options like income-driven repayment plans or loan consolidation.

Comparison of Income-Driven Repayment Plans

Income-driven repayment plans adjust monthly payments based on income and family size. They can significantly reduce monthly payments, potentially making repayment more manageable, especially during periods of lower income. However, they often extend the repayment period, leading to higher overall interest paid.

| Repayment Plan | Payment Calculation | Maximum Repayment Period | Suitability for Central Research Inc. Students |

|---|---|---|---|

| Income-Driven Repayment (IDR) | Based on income and family size | 20-25 years | Potentially beneficial for students with lower starting salaries or fluctuating incomes. |

| Pay As You Earn (PAYE) | 10% of discretionary income | 20 years | Suitable for those seeking lower monthly payments, but potentially higher overall interest. |

| Revised Pay As You Earn (REPAYE) | 10% of discretionary income | 20 or 25 years | Similar to PAYE, but with potential for loan forgiveness after 20 or 25 years. |

| Income-Based Repayment (IBR) | 10-15% of discretionary income | 25 years | May offer slightly higher payments than PAYE or REPAYE, but still income-based. |

The Role of Central Research Inc. in Student Financial Literacy

Central Research Inc. (CRI) has a significant opportunity to contribute to the financial well-being of its students by actively promoting financial literacy. A financially literate student body is better equipped to manage debt, plan for the future, and ultimately, contribute more effectively to the workforce. CRI’s investment in financial literacy initiatives translates directly into a more successful and responsible student population.

CRI’s role extends beyond simply providing financial aid; it encompasses educating students on how to utilize these resources responsibly and make informed financial decisions throughout their academic journey and beyond. This proactive approach fosters a culture of financial responsibility and empowers students to navigate the complexities of personal finance with confidence.

Strategies to Improve Financial Literacy Among CRI Students

Implementing effective strategies is crucial to enhance financial literacy among CRI students. These strategies should be multifaceted, encompassing various learning styles and incorporating practical applications. A comprehensive approach will yield better results than isolated initiatives.

CRI could leverage several avenues to achieve this goal. For example, incorporating mandatory financial literacy modules into orientation programs would provide a foundational understanding of key concepts early in the student’s academic career. Workshops and seminars on budgeting, debt management, and investing could be offered throughout the academic year, catering to different student needs and schedules. Furthermore, online resources, such as interactive tutorials and webinars, would provide accessible learning opportunities for students with busy schedules. Finally, partnerships with financial institutions could offer valuable insights and practical guidance. These partnerships could provide guest speakers, workshops, and potentially even discounted financial services to students.

A Hypothetical Financial Literacy Program for CRI Students

A comprehensive financial literacy program for CRI students should include several key elements. First, a foundational module covering budgeting, saving, and debt management would be crucial. This module could utilize interactive tools and real-life case studies to illustrate key concepts. Second, a module focusing on understanding student loan options, repayment plans, and the long-term implications of borrowing would be essential. This could involve guest speakers from financial aid offices and loan providers. Third, a module exploring investment strategies, including retirement planning, would equip students with long-term financial planning skills. Finally, the program should incorporate regular assessments to track student progress and identify areas needing further attention. Resources for this program could include online learning platforms, workbooks, financial calculators, and access to one-on-one financial counseling.

A Brochure Detailing Financial Aid Options and Responsible Borrowing Practices for CRI Students

A visually appealing and informative brochure would serve as an excellent resource for CRI students. The brochure could be divided into sections focusing on different aspects of financial aid and responsible borrowing. The first section could detail the various types of financial aid available, such as grants, scholarships, loans, and work-study programs. A clear explanation of eligibility criteria and application procedures would be included. The second section would emphasize responsible borrowing practices, highlighting the importance of understanding loan terms, interest rates, and repayment schedules. It would also offer tips for budgeting and managing student loan debt. Finally, the brochure could include contact information for CRI’s financial aid office and other relevant resources, such as credit counseling services. The design could incorporate infographics and simple charts to present complex information in an easily digestible format. The overall tone should be encouraging and supportive, reassuring students that seeking help with financial matters is a positive step.

Central Research Inc. and Student Loan Default

Student loan default represents a significant concern for both individual borrowers and institutions like Central Research Inc. (CRI). Understanding the contributing factors, preventative measures, and consequences of default is crucial for mitigating its impact and supporting students throughout their educational journey and beyond. This section will explore these aspects specifically within the context of CRI’s student population.

Factors Contributing to Student Loan Default Among CRI Students

Several interconnected factors can contribute to student loan default among CRI students. These include, but are not limited to, financial mismanagement during and after graduation, unexpected life events impacting repayment ability, and a lack of awareness regarding available repayment options. For example, students may underestimate the long-term financial implications of their loan burden, leading to insufficient budgeting and difficulty in meeting repayment obligations. Unexpected events such as job loss, illness, or family emergencies can further exacerbate the situation, making timely repayments challenging. Finally, a lack of understanding regarding income-driven repayment plans or loan consolidation options can leave students feeling overwhelmed and ill-equipped to navigate their financial obligations.

Preventative Measures to Reduce Student Loan Defaults

CRI can implement several proactive measures to reduce student loan defaults among its students. These include comprehensive financial literacy programs, improved loan counseling services, and accessible resources for managing debt. For instance, CRI could offer workshops and online modules covering budgeting, debt management, and understanding various repayment options. Providing one-on-one counseling sessions with financial aid advisors would also be beneficial, allowing students to personalize their repayment strategies. Furthermore, creating a centralized online resource hub with information on loan repayment options, debt management tools, and contact information for relevant support services could prove invaluable. The goal is to empower students with the knowledge and resources to make informed decisions about their financial future.

Consequences of Student Loan Default for Students and CRI

Student loan default carries severe consequences for both the student and CRI. For students, default can result in damaged credit scores, wage garnishment, and difficulty obtaining future loans or credit. It can significantly hinder their ability to purchase a home, secure favorable car loans, or even obtain certain types of employment. For CRI, a high default rate can negatively impact its reputation, potentially leading to reduced enrollment and increased scrutiny from accrediting agencies. This could also impact the institution’s access to federal funding and its overall financial stability. A strong record of student loan repayment, conversely, enhances CRI’s reputation and attracts prospective students.

Strategies to Support Students Facing Loan Default

CRI can employ several strategies to support students facing loan default. These include early intervention programs, individualized support plans, and collaboration with external agencies. Early identification of students at risk of default through proactive monitoring of their loan repayment progress is crucial. Once identified, CRI can offer personalized support plans, including financial counseling, debt management strategies, and assistance in exploring available repayment options such as income-driven repayment plans or loan forgiveness programs. Collaborating with non-profit credit counseling agencies and government programs can further expand the support available to students struggling with loan repayment. CRI’s commitment to assisting students in navigating the complexities of loan repayment demonstrates its dedication to student success.

The Impact of Central Research Inc. on Student Loan Forgiveness Programs

Central Research Inc.’s (CRI) potential involvement in student loan forgiveness programs presents a complex landscape of opportunities and challenges. The organization’s influence could significantly shape the accessibility and effectiveness of these programs, depending on its chosen approach and the specific policies it advocates for or against. This analysis explores the potential impact of CRI’s actions on existing forgiveness programs and the broader student loan landscape.

CRI’s impact hinges on its ability to influence policy decisions and provide data-driven insights. The organization’s research capabilities could be instrumental in identifying underserved populations, evaluating the effectiveness of existing programs, and proposing more targeted and equitable solutions. However, its involvement also raises questions about potential conflicts of interest and the ethical considerations of advocating for specific policy changes.

Eligibility Criteria for Student Loan Forgiveness Programs and Their Relevance to Central Research Inc. Students

Existing student loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, typically have strict eligibility requirements. These often include factors like the type of loan, the borrower’s employment sector, and their income level. For CRI students, the relevance of these criteria depends heavily on the types of loans they receive and their post-graduation career paths. For example, students pursuing careers in public service might be eligible for PSLF, while those in lower-income brackets might benefit from IDR plans. CRI’s understanding of these criteria and its ability to guide students toward appropriate programs would be crucial.

Central Research Inc.’s Advocacy for Changes to Student Loan Forgiveness Programs

CRI could advocate for changes to student loan forgiveness programs in several ways. It might lobby for expanded eligibility criteria, increased funding for existing programs, or the creation of new programs tailored to specific needs. Conversely, CRI might argue against changes that it believes are fiscally unsustainable or inequitable. Its advocacy would likely be informed by its research findings on the effectiveness and impact of different forgiveness programs. For instance, CRI could use data to demonstrate the need for greater flexibility in IDR plans or the positive economic effects of expanding PSLF eligibility to include a wider range of public service jobs. Conversely, CRI might advocate for stricter eligibility requirements to ensure the program’s financial sustainability.

Potential Scenarios Where Central Research Inc. Involvement Affects Student Loan Forgiveness

The following scenarios illustrate how CRI’s involvement could affect student loan forgiveness:

- Scenario 1: CRI conducts research demonstrating the effectiveness of a particular forgiveness program. This research could influence policymakers to expand the program’s reach or replicate its success in other areas.

- Scenario 2: CRI identifies a significant gap in access to forgiveness programs for a specific demographic. This could lead to targeted advocacy efforts to address the disparity.

- Scenario 3: CRI’s research reveals unforeseen negative consequences of a particular forgiveness program. This might prompt calls for reform or even the program’s termination.

- Scenario 4: CRI develops a new model for student loan forgiveness based on its research findings. This could offer policymakers a data-driven alternative to existing programs.

- Scenario 5: CRI provides financial literacy training to its students, empowering them to navigate the complexities of loan forgiveness programs effectively. This would improve the program’s uptake amongst eligible students.

Visual Representation of Student Loan Debt and Central Research Inc.

Understanding the relationship between student loan debt and involvement with Central Research Inc. requires a visual approach to effectively communicate complex data. Visual representations can highlight trends and correlations that might be missed in purely textual analyses, offering valuable insights into the impact of Central Research Inc.’s programs and initiatives on student borrowers.

A scatter plot could effectively illustrate the relationship between the amount of student loan debt and the level of engagement with Central Research Inc. Each data point would represent a single student, with the x-axis showing their total student loan debt (in dollars) and the y-axis representing their level of engagement (measured, for example, by the number of workshops attended, resources accessed online, or counseling sessions completed). A positive correlation would suggest that students with higher loan debt are more likely to engage with Central Research Inc.’s services. Conversely, a weak or negative correlation could indicate areas for improvement in outreach or program effectiveness. Further analysis could segment the data by factors such as student demographics, loan type, or graduation year to reveal more nuanced relationships. For example, a distinct cluster of points showing high loan debt and low engagement among graduate students could signal a need for targeted interventions.

Hypothetical Infographic: Student Loan Repayment Stages for Central Research Inc. Students

This infographic would depict the journey of a Central Research Inc. student through the various stages of student loan repayment, using a timeline format. The timeline would be divided into distinct phases, each representing a key stage in the repayment process.

The first phase, “Loan Inception,” would visually represent the initial loan amount and associated interest rates. This section could include a simple bar graph showing the average loan amount for Central Research Inc. students compared to the national average. The second phase, “Repayment Planning,” would illustrate the different repayment options available (e.g., standard, graduated, income-driven repayment) and the tools and resources offered by Central Research Inc. to help students choose the most suitable plan. A flowchart would be ideal here, guiding the user through the decision-making process. The third phase, “Active Repayment,” would visually depict the monthly payment amounts, the total amount repaid over time, and the remaining balance. A line graph showing the reduction in loan balance over time would be effective. The fourth phase, “Potential Challenges,” would highlight common obstacles encountered during repayment, such as job loss, unexpected expenses, or difficulty navigating the repayment system. This section could use icons representing these challenges. The final phase, “Loan Completion,” would showcase the successful repayment of the loan, emphasizing the importance of financial literacy and planning. A celebratory graphic would be suitable here. Overall, the infographic uses a combination of charts, graphs, icons, and text to provide a clear and concise visual representation of the student loan repayment journey for Central Research Inc. students, highlighting key milestones and potential hurdles.

Final Wrap-Up

Ultimately, understanding the interplay between Central Research Inc. and student loan debt requires a holistic approach. By promoting financial literacy, offering tailored repayment support, and advocating for student-friendly policies, Central Research Inc. can significantly improve the financial well-being of its students. This guide serves as a starting point for navigating this complex landscape, empowering students to make informed decisions and achieve their financial goals.

Essential FAQs

What types of student loans are typically available to Central Research Inc. students?

Central Research Inc. students likely have access to federal student loans (subsidized and unsubsidized), private student loans, and potentially institution-specific loan programs. The availability and terms will depend on individual eligibility and the specific programs offered.

Does Central Research Inc. offer any loan repayment assistance programs?

This information is not provided in the Artikel. Contact Central Research Inc. directly to inquire about any internal repayment assistance programs or partnerships they may have with loan servicers.

What happens if a Central Research Inc. student defaults on their student loans?

Defaulting on student loans can have serious consequences, including damage to credit scores, wage garnishment, and potential legal action. It can also negatively impact the student’s future borrowing ability and may affect Central Research Inc.’s reputation.

Are there scholarships or grants available specifically for Central Research Inc. students?

The availability of scholarships and grants will depend on various factors, including academic merit, financial need, and specific program eligibility. Central Research Inc. may have its own scholarship programs or provide information on external funding opportunities. Checking the institution’s financial aid office is recommended.