Navigating the complexities of student loan repayment can feel like deciphering a cryptic code. Understanding your loan status is crucial for responsible financial management, ensuring timely payments, and avoiding potential pitfalls. This guide provides a comprehensive overview of how to effectively check your student loan status, interpret the information presented, and troubleshoot any issues you may encounter along the way. We’ll explore various methods, highlight key terms, and offer practical advice to empower you to take control of your student loan journey.

From understanding the nuances of different loan statuses (deferment, forbearance, repayment) to mastering online portals and troubleshooting common login issues, this guide serves as your ultimate resource for navigating the world of student loan management. We’ll delve into the security measures implemented by reputable lenders to protect your sensitive information and offer practical tips to safeguard your online accounts from potential threats.

Understanding Student Loan Status Websites

Navigating the world of student loan repayment can feel overwhelming, but understanding how to use your loan servicer’s website is a crucial first step towards effective management. These websites provide a centralized location for accessing vital information regarding your loan balance, repayment schedule, and other important details. Familiarizing yourself with these platforms empowers you to proactively manage your debt and avoid potential pitfalls.

Student Loan Website User Interface Comparison

A key aspect of effectively managing your student loans involves understanding the user interfaces of different loan servicing websites. The design and functionality of these websites can significantly impact your ability to quickly and easily access the information you need. Below is a comparison of three hypothetical major student loan websites, focusing on key usability factors. Note that specific features and designs vary between actual websites and may change over time.

| Website | Ease of Navigation | Information Clarity | Mobile Responsiveness |

|---|---|---|---|

| LoanServicer A | Intuitive menu structure, clear labeling of sections. Easy to find key information like balance and payment due date. | Information is presented concisely and clearly, using plain language and avoiding jargon. Data is well-organized and easy to understand. | Website adapts seamlessly to different screen sizes, with easy-to-use touch controls. |

| LoanServicer B | Navigation could be improved. Some features are buried deep within the website, requiring multiple clicks to access. | While information is present, it’s sometimes presented in a dense or confusing manner. Using simpler language and better visual organization would improve clarity. | Mobile version is functional but not as polished as the desktop version. Some features are difficult to use on smaller screens. |

| LoanServicer C | Navigation is generally good, but the search function could be more robust. Finding specific information may require some trial and error. | Information is mostly clear, but some sections could benefit from more visual aids, such as charts or graphs, to better illustrate data. | Mobile version is well-designed and easy to use, offering a comparable experience to the desktop version. |

Typical Features of Student Loan Status Websites

Most student loan status websites share a common set of features designed to provide borrowers with comprehensive information and tools for managing their loans. These typically include account summary information displaying current loan balance, interest rate, and minimum payment amount; detailed repayment schedules showing future payment amounts and due dates; payment history, allowing you to track past payments; tools for making online payments; options for modifying repayment plans; and contact information for customer support. Additionally, many websites offer resources such as financial planning tools, FAQs, and articles on managing student loan debt.

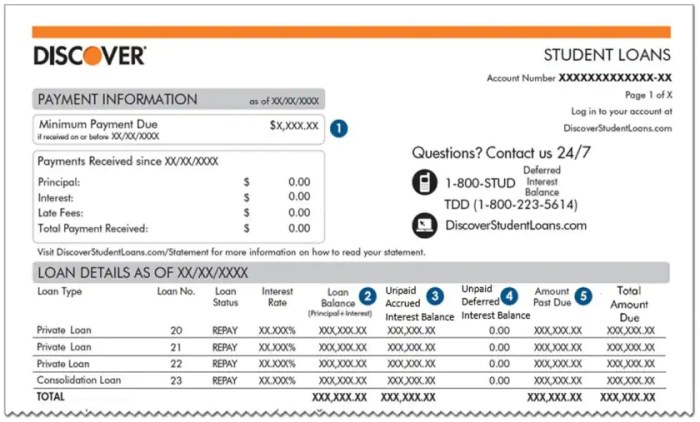

Accessing and Interpreting a Student Loan Repayment Schedule

Accessing and understanding your repayment schedule is crucial for effective loan management. The process generally involves logging into your account on the loan servicer’s website using your credentials (username and password). Once logged in, navigate to the “My Account” or “Repayment Schedule” section. This section usually presents your repayment schedule in a tabular format, listing each payment’s due date and amount. Some websites may also provide a visual representation, such as a graph or chart, to show the loan’s amortization over time. The schedule will typically indicate the total amount owed, the interest accrued, and the principal amount paid with each installment. Carefully reviewing this schedule allows you to plan your budget effectively and avoid late payments.

Methods for Checking Student Loan Status

Staying informed about your student loan status is crucial for responsible financial management. Understanding your loan balance, repayment schedule, and any potential issues is essential to avoid late payments and negative impacts on your credit score. Several methods exist for accessing this information, each with its own advantages and disadvantages.

Checking your student loan status can be accomplished through various channels, each offering a unique set of benefits and drawbacks. The optimal method often depends on individual preferences, technological comfort, and the urgency of the information needed.

Online Loan Portals

Accessing your loan information through the official online portal of your loan servicer is generally the most efficient and convenient method. These portals typically offer a comprehensive overview of your loan details, including current balance, payment history, repayment schedule, and contact information for your servicer.

The advantages of using an online portal include 24/7 access, the ability to view detailed information quickly, and the convenience of managing your account from anywhere with an internet connection. However, disadvantages include the need for internet access and the potential for technical difficulties or website outages. Furthermore, some individuals may feel uncomfortable sharing personal information online.

Information typically required to access your loan status via the online portal usually includes your Social Security number, date of birth, and possibly your loan identification number. Some portals may also utilize multi-factor authentication for enhanced security.

Phone Calls to Loan Servicers

Contacting your loan servicer directly via phone is another common method for checking your loan status. This method can be particularly helpful for individuals who prefer personal interaction or require clarification on complex issues.

While phone calls offer the advantage of speaking directly with a representative who can answer specific questions and provide personalized assistance, they can be time-consuming, requiring you to navigate phone menus and potentially wait on hold. Furthermore, the availability of representatives may vary depending on the time of day and day of the week.

To access your loan status via phone, you will generally need your Social Security number, date of birth, and loan identification number. The representative may also ask for additional information to verify your identity.

Mail Correspondence

Requesting your loan status information via mail is the least efficient method, but it remains an option for individuals without reliable internet access or who prefer traditional communication methods.

The main disadvantage of using mail is the significant delay in receiving a response. It can take several days or even weeks to receive an updated statement. However, it offers the benefit of a physical record of your loan information. This method may also be preferable for those concerned about online security.

To request your loan status via mail, you will need to send a written request to your loan servicer, including your name, address, Social Security number, date of birth, and loan identification number. The servicer’s mailing address can typically be found on your loan documents or their website.

Interpreting Loan Status Information

Understanding your student loan status requires familiarity with the terminology and information presented on your loan servicer’s website or statement. This section clarifies common terms and provides examples of different loan statuses. Accurate interpretation ensures you can effectively manage your repayment.

Student loan statements often use specific terms and abbreviations. Understanding these is crucial for navigating your loan journey. For example, “principal” refers to the original amount borrowed, while “interest” is the cost of borrowing money. “Capitalization” means adding accrued interest to the principal balance, increasing the total amount owed. Knowing the difference between these terms allows for accurate budget planning and repayment strategy development.

Common Loan Status Terms and Abbreviations

Several terms describe the current state of your student loans. These terms indicate whether you are currently making payments, have a temporary pause in payments, or are in default.

| Term | Description | Example |

|---|---|---|

| In Repayment | You are currently making regular monthly payments on your loan. | Your monthly payment is $200, and you’re consistently making these payments on time. |

| Deferment | A temporary postponement of payments, usually due to specific circumstances like returning to school or experiencing unemployment. Interest may or may not accrue depending on the type of loan. | You’ve deferred your payments for six months while attending graduate school. Your loan servicer has confirmed this deferment period. |

| Forbearance | Similar to deferment, it’s a temporary suspension of payments. However, forbearance is often granted for reasons other than those qualifying for deferment, such as financial hardship. Interest typically accrues during forbearance. | You’ve requested forbearance due to unexpected job loss and are working with your loan servicer to create a repayment plan once your financial situation improves. |

| Default | You have failed to make payments for a specified period (typically 90 days), resulting in serious consequences such as damage to your credit score and potential wage garnishment. | Failure to make payments for over three months has resulted in your loan being placed in default. |

| Current | Your loan is in good standing; payments are up-to-date. | Your payment history shows all payments are current. |

Example Student Loan Status Page Information

A typical student loan status page will display key information in a clear and organized manner. This information is essential for tracking your loan progress and making informed decisions about your repayment strategy.

| Information Category | Example Data |

|---|---|

| Loan Balance | $25,000 |

| Monthly Payment | $250 |

| Interest Rate | 5% |

| Next Payment Due Date | October 26, 2024 |

| Loan Status | In Repayment |

| Payment History | Shows a record of past payments, including dates and amounts. |

Troubleshooting Common Issues

Accessing your student loan information online should be straightforward, but occasionally you might encounter difficulties. This section addresses common problems and offers solutions to help you regain access to your loan details quickly and efficiently. Understanding these potential issues can save you time and frustration.

Several factors can contribute to problems accessing your student loan information. These range from simple issues like forgetting your password to more complex problems related to website maintenance or account discrepancies. Addressing these issues promptly will allow you to manage your loans effectively.

Forgotten Login Credentials

Recovering access when you’ve forgotten your login details is a common occurrence. Most student loan websites offer a password reset feature. This usually involves entering your username or the email address associated with your account. The website will then send a password reset link to your registered email. Follow the instructions in the email to create a new password, ensuring it’s strong and secure, incorporating a mix of uppercase and lowercase letters, numbers, and symbols. If you are unable to access your registered email account, you may need to contact your loan servicer directly for assistance.

Account Locked

Repeated incorrect login attempts can result in your account being temporarily locked for security reasons. This is a protective measure to prevent unauthorized access. If this happens, you will usually see a message on the login screen indicating your account is locked. Most systems provide an “unlock account” or “contact us” option. Using this option, you will likely need to verify your identity through a series of security questions or by providing additional information linked to your account. Following the instructions provided by the website or contacting customer support directly is the best course of action.

Website Errors or Maintenance

Occasionally, you might encounter technical issues with the student loan website itself. These could include server errors, temporary outages, or scheduled maintenance. If you encounter an error message, try refreshing the page or checking the website’s status page for announcements of maintenance or outages. If the problem persists, try accessing the website later or contact the loan servicer’s customer support for assistance. They may be able to provide alternative methods of accessing your loan information or explain the nature of the website issue.

Incorrect or Outdated Information

Ensuring the information you provide during login is accurate and up-to-date is crucial. If you’ve recently changed your email address or other contact details, make sure to update your profile information on the student loan website. Inconsistent information can lead to login failures. Regularly review and update your contact information to avoid potential access problems.

Security and Privacy Considerations

Protecting your personal information when managing your student loans online is crucial. Your loan details, financial information, and personal identifying data are valuable targets for identity theft and fraud. Taking proactive steps to safeguard your accounts is essential to prevent financial and personal harm.

Securing your online student loan accounts involves a multi-faceted approach encompassing both technological safeguards and responsible online behavior. Negligence in this area can lead to compromised accounts, financial losses, and significant personal distress. Therefore, understanding and implementing best practices is paramount.

Best Practices for Secure Online Account Access

Safeguarding your online student loan account requires a combination of strong passwords, regular account monitoring, and vigilance against phishing attempts. Strong passwords should be unique, complex, and regularly changed. Avoid using easily guessable information such as birthdays or pet names. Regularly reviewing your account statements for unauthorized activity is also vital. Suspicious activity should be reported immediately to your loan servicer. Furthermore, be wary of unsolicited emails or text messages requesting login credentials. These are common phishing tactics designed to steal your information. Always access your account directly through the official website, verifying the URL before entering any personal data.

Identifying and Avoiding Phishing Scams

Phishing scams are a major threat to online security. These scams typically involve fraudulent emails, text messages, or websites that mimic legitimate loan servicers to trick individuals into revealing their personal information. Legitimate student loan servicers will never request your login credentials, Social Security number, or banking information via email or text. Always be suspicious of unsolicited communications requesting personal information. If you receive a suspicious communication, contact your loan servicer directly through their official website or phone number to verify its authenticity. Never click on links or attachments in suspicious emails.

Security Measures Implemented by Reputable Student Loan Websites

Reputable student loan websites implement several security measures to protect user data. These measures often include:

- Data Encryption: Sensitive data transmitted between your computer and the loan servicer’s website is encrypted, making it unreadable to unauthorized individuals.

- Multi-Factor Authentication (MFA): Many websites now require MFA, which adds an extra layer of security by requiring a second form of verification, such as a one-time code sent to your phone or email, in addition to your password.

- Secure Socket Layer (SSL) Certificates: Reputable websites use SSL certificates, indicated by a padlock icon in the address bar, to encrypt communication and ensure data security.

- Regular Security Audits and Updates: Loan servicers regularly audit their systems for vulnerabilities and implement software updates to patch security flaws.

- Fraud Detection Systems: Sophisticated systems monitor account activity for suspicious patterns, alerting the servicer to potential fraudulent activity.

Visual Representation of Loan Information

Understanding your student loan status is significantly enhanced by visual representations of your loan data. Graphs and charts can make complex financial information more accessible and easier to comprehend, allowing for better financial planning and management. A clear visual representation helps you track your progress towards loan repayment and identify potential areas of concern.

Visual representations of loan information, such as amortization schedules and balance tracking graphs, provide a clear and concise overview of your loan’s repayment process and outstanding balance. This allows for easier understanding of the overall loan terms and progress made toward repayment.

Sample Amortization Schedule Graphic

The following describes a sample graphic illustrating a typical student loan amortization schedule. The graphic would be a line graph or a table. For a line graph, the horizontal (x) axis would represent the time period, typically months, over the loan’s lifetime. The vertical (y) axis would represent the monetary value, displaying the principal balance, interest paid, and total payment amount. Each month would be represented by a data point on the graph. A line would connect these points, illustrating the gradual decrease in the principal balance over time. A second line would show the cumulative interest paid, illustrating its initial prominence and gradual decline as the loan nears repayment. A third line could represent the total monthly payment, remaining constant over the loan’s term. Labels would clearly identify each line and the axes. The graph’s title would clearly state “Student Loan Amortization Schedule.” A table would present the same information in a tabular format with columns for Month, Beginning Balance, Payment Amount, Interest Paid, Principal Paid, and Ending Balance. This would allow for precise numerical tracking of each component of the loan repayment.

Visual Representation of Loan Balances and Interest Accrual

Loan balances are typically represented visually using bar graphs or line graphs, showing the outstanding balance over time. A decreasing bar graph, for example, would clearly illustrate the reduction in the principal balance as payments are made. Line graphs are particularly useful for illustrating the change in the loan balance over time, providing a visual representation of the repayment progress. Interest accrual can be shown using a separate line on the same graph, illustrating the accumulation of interest over time. This allows for a direct comparison between the principal balance reduction and the interest accruing. The use of color-coding can further enhance understanding. For instance, the principal balance could be represented in blue, and interest accrual in red. This clear distinction makes it easy to visualize the impact of interest on the overall loan repayment. A combined representation of both loan balance and interest accrual provides a holistic view of the loan’s financial trajectory. For instance, if a borrower makes an extra payment, the visual representation would clearly demonstrate the accelerated reduction in both the principal balance and the overall interest paid.

Last Point

Successfully checking your student loan status is more than just accessing a number; it’s about gaining a clear understanding of your financial obligations and proactively managing your repayment plan. By utilizing the methods and strategies Artikeld in this guide, you can confidently monitor your loan progress, identify potential issues early on, and ultimately pave the way for a smoother and more successful repayment journey. Remember to prioritize online security and utilize the resources available to you to ensure a stress-free experience.

Q&A

What if I forgot my username or password for my student loan website?

Most websites offer a “Forgot Password” or “Forgot Username” option. Follow the prompts to reset your credentials. If you continue to experience problems, contact your loan servicer directly for assistance.

How often should I check my student loan status?

It’s recommended to check your student loan status at least once a month to monitor your payments, interest accrual, and overall loan balance. More frequent checks may be beneficial if you anticipate changes in your financial situation.

What does “in deferment” mean?

Deferment is a temporary postponement of your student loan payments. Eligibility is typically based on specific circumstances, such as returning to school or experiencing unemployment. Interest may or may not accrue during deferment, depending on your loan type.

What is the difference between deferment and forbearance?

Both deferment and forbearance temporarily postpone payments, but deferment is typically granted based on specific qualifying circumstances, while forbearance is often granted due to temporary financial hardship. Interest accrual rules vary between the two.