Navigating the world of student loans can feel overwhelming, especially when faced with the complexities of repayment plans, interest rates, and eligibility requirements. This guide delves into the specifics of Chesla CT student loans, offering a clear and concise overview of the programs available to Connecticut students. We’ll explore the application process, various repayment options, and strategies for effective debt management, empowering you to make informed decisions about your financial future.

From understanding the different loan types offered by Chesla to mastering the art of repayment planning, this resource serves as your comprehensive handbook for securing and managing your student loan journey. We aim to demystify the process, providing you with the tools and knowledge to confidently navigate the complexities of student loan financing.

Chesla CT Student Loan Programs Offered

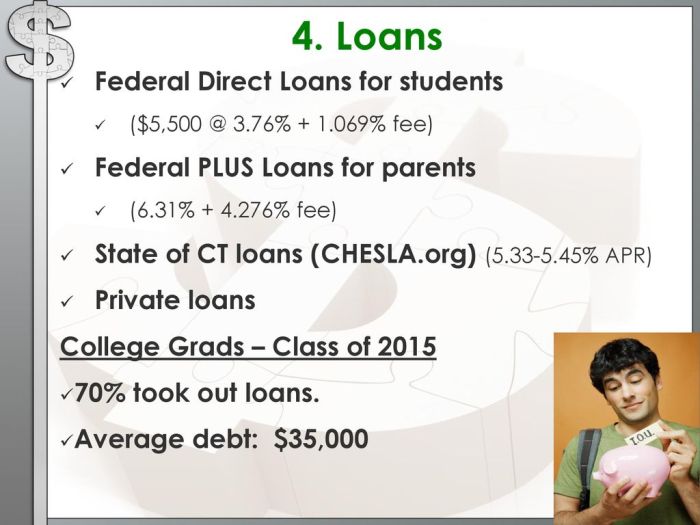

Chesla, the Connecticut Higher Education Supplemental Loan Authority, doesn’t directly offer its own unique student loan programs in the same way that a private lender might. Instead, Chesla acts as a guarantor for certain federal student loans and offers programs designed to assist Connecticut residents in accessing and managing federal student loan options. Understanding this distinction is crucial to navigating the student loan landscape in Connecticut.

Chesla’s Role in Connecticut Student Loan Programs

Chesla’s primary function is to guarantee certain federal student loans for Connecticut residents. This guarantee helps borrowers secure loans even if they might not qualify based solely on their credit history. By acting as a guarantor, Chesla reduces the risk for lenders, making it easier for students to obtain the funding they need for their education. Chesla does not offer its own proprietary loan products with unique interest rates or repayment plans. Their programs are focused on improving access to existing federal loan programs.

Federal Student Loan Programs Available Through Chesla

The specific federal student loan programs available will depend on the student’s eligibility criteria, determined by the federal government. These programs typically include:

| Program Name | Loan Type | Interest Rate Information | Repayment Options |

|---|---|---|---|

| Direct Subsidized Loans | Federal | Interest rate set by the federal government; may vary annually. Interest does not accrue while the borrower is in school at least half-time. | Standard, graduated, extended, income-driven repayment plans. |

| Direct Unsubsidized Loans | Federal | Interest rate set by the federal government; may vary annually. Interest accrues from the time the loan is disbursed. | Standard, graduated, extended, income-driven repayment plans. |

| Direct PLUS Loans (for Graduate and Professional Students) | Federal | Interest rate set by the federal government; may vary annually. Interest accrues from the time the loan is disbursed. | Standard, graduated, extended, income-driven repayment plans. |

| Direct PLUS Loans (for Parents) | Federal | Interest rate set by the federal government; may vary annually. Interest accrues from the time the loan is disbursed. | Standard, graduated, extended, income-driven repayment plans. |

Eligibility Criteria for Federal Student Loans

Eligibility for federal student loans is determined by the federal government and is based on factors such as: enrollment status (at least half-time), financial need (for subsidized loans), credit history (for PLUS loans), and completion of the Free Application for Federal Student Aid (FAFSA). Specific requirements may vary depending on the loan program. For example, parents applying for a Direct PLUS Loan on behalf of their child will undergo a credit check, while students applying for Direct Subsidized or Unsubsidized loans generally do not.

Differences Between Federal Loan Types

The key differences between federal loan types lie in interest accrual and eligibility. Subsidized loans do not accrue interest while the student is enrolled at least half-time, making them more affordable. Unsubsidized loans accrue interest from disbursement, meaning the borrower will owe more upon graduation. PLUS loans are available to graduate/professional students and parents, and they typically require a credit check. The interest rates for all these loans are set by the federal government and are subject to change annually.

Chesla CT Student Loan Application Process

Applying for a Chesla CT student loan involves several steps, each requiring specific documentation. Understanding this process ensures a smoother application experience and a timely disbursement of funds. The entire process is designed to be straightforward, but careful preparation is key.

The application process is generally completed online through the Chesla website. However, some situations may require supplemental paper documentation. It’s advisable to keep copies of all submitted materials for your records.

Required Documentation

The necessary documentation varies depending on the stage of the application process. Providing complete and accurate information upfront will expedite the review.

- Initial Application: This typically includes your Social Security number, date of birth, contact information, and details about your chosen educational institution and program. You will also need to provide information about your expected family contribution (EFC) as determined by the FAFSA.

- Financial Verification: Depending on your application, Chesla may request further documentation to verify your financial information. This could include tax returns, bank statements, and pay stubs. This step helps Chesla determine your eligibility for a loan and the appropriate loan amount.

- Loan Acceptance and Promissory Note: Once your application is approved, you will need to electronically sign a promissory note, agreeing to the terms and conditions of the loan. This legally binds you to repay the loan according to the repayment schedule.

Step-by-Step Application Process

The application process follows a logical sequence, from initial submission to loan disbursement. Each step is crucial for a successful application.

- Complete the FAFSA: The Free Application for Federal Student Aid (FAFSA) is the first step. This determines your eligibility for federal aid, including your Expected Family Contribution (EFC). Your EFC will be used to determine your eligibility for a Chesla CT student loan.

- Create a Chesla Account: Create an online account on the Chesla website. This account will be used to track your application’s progress and manage your loan once it’s approved.

- Complete the Chesla Application: Fill out the online application form, providing accurate and complete information. Double-check all entries before submitting.

- Submit Required Documentation: Upload any necessary supporting documents as requested by the system. This may include tax returns, bank statements, or other financial documentation.

- Review and Accept Loan Offer: Once Chesla reviews your application, they will send you a loan offer. Carefully review the terms and conditions before accepting the loan.

- Sign the Promissory Note: Electronically sign the promissory note, legally agreeing to repay the loan.

- Loan Disbursement: Once all steps are complete, the funds will be disbursed to your educational institution.

Application Process Flowchart

A visual representation of the application process can be helpful. Imagine a flowchart beginning with “Complete FAFSA,” leading to “Create Chesla Account,” then “Complete Chesla Application,” followed by “Submit Documentation.” A decision point follows: “Application Approved?” If yes, it leads to “Review & Accept Loan Offer,” then “Sign Promissory Note,” and finally “Loan Disbursement.” If no, it leads to “Request Additional Information” and loops back to “Submit Documentation.” This loop continues until the application is approved or denied.

Chesla CT Student Loan Repayment Options

Understanding your repayment options is crucial for effectively managing your Chesla CT student loan debt. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline. Several plans are available, each with its own set of benefits and drawbacks. Careful consideration of your financial situation is key to selecting the most suitable option.

Chesla offers a variety of repayment plans designed to accommodate different financial circumstances and repayment preferences. These plans differ in their payment structures, eligibility criteria, and the overall length of the repayment period. Let’s explore the available options in detail.

Chesla CT Student Loan Repayment Plan Comparison

The following table compares the key features of several common Chesla CT student loan repayment plans. Note that specific eligibility requirements and plan details may be subject to change, so it’s always best to consult the official Chesla website or contact them directly for the most up-to-date information.

| Plan Name | Payment Structure | Eligibility Requirements | Advantages/Disadvantages |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payments over a 10-year period. | Generally available to all borrowers. | Advantages: Predictable payments, relatively short repayment period. Disadvantages: Higher monthly payments compared to other plans. |

| Graduated Repayment Plan | Payments start low and gradually increase over time. | Generally available to all borrowers. | Advantages: Lower initial payments, helpful for borrowers anticipating increased income. Disadvantages: Payments increase significantly over time, potentially leading to financial strain later. |

| Extended Repayment Plan | Fixed monthly payments over a longer period (up to 25 years, depending on loan amount). | Generally available to all borrowers; specific loan amounts may apply. | Advantages: Lower monthly payments. Disadvantages: Longer repayment period, higher total interest paid. |

| Income-Driven Repayment (IDR) Plan (Example: ICR) | Monthly payments are calculated based on your discretionary income and family size. | Specific income and family size requirements apply; may require recertification annually. | Advantages: Lower monthly payments based on income, potential for loan forgiveness after 20-25 years (depending on the specific IDR plan and adherence to requirements). Disadvantages: Longer repayment period, potential for higher total interest paid. |

Sample Repayment Schedule

The following is a hypothetical example illustrating repayment schedules under different plans for a $20,000 loan at a 5% interest rate. These are simplified examples and do not include any potential fees. Actual repayment schedules will vary depending on the loan amount, interest rate, and chosen repayment plan.

Note: This is a simplified illustration and does not reflect all potential factors affecting actual repayment amounts.

| Plan Name | Monthly Payment (approx.) | Total Paid (approx.) | Repayment Period |

|---|---|---|---|

| Standard Repayment | $212 | $25,440 | 10 years |

| Graduated Repayment (Year 1) | $150 | N/A | 10 years |

| Extended Repayment | $106 | $25,440 | 20 years |

| IDR Plan (Example – ICR) | Varies based on income | Varies based on income | 25 years (potential for forgiveness) |

Understanding Chesla CT Student Loan Interest Rates and Fees

Chesla CT student loans, like other federal and private student loans, involve interest rates and fees that significantly impact the overall cost of borrowing. Understanding these components is crucial for responsible financial planning and budgeting throughout your education and repayment period. This section details how these rates and fees are determined and what to expect.

Chesla CT student loan interest rates are primarily determined by several factors. The type of loan plays a significant role; for example, subsidized loans often have lower interest rates than unsubsidized loans because the government pays the interest during certain periods. The prevailing market interest rates also influence the rates offered. These rates fluctuate based on economic conditions, and Chesla adjusts its rates accordingly. Finally, the creditworthiness of the borrower may be considered for some loan types, although this is less common with government-backed programs. A borrower with a strong credit history might receive a slightly lower interest rate compared to a borrower with a less established credit profile.

Chesla CT Student Loan Fees

Several fees may be associated with Chesla CT student loans. These fees contribute to the overall cost of borrowing and should be factored into your financial planning.

- Origination Fee: This is a one-time fee charged when the loan is disbursed. It’s typically a percentage of the loan amount and is deducted from the loan proceeds before the funds are sent to the borrower’s institution. For example, a 1% origination fee on a $10,000 loan would result in a $100 deduction.

- Late Payment Fee: If a payment is made after the due date, a late payment fee may be assessed. The exact amount varies and is usually specified in the loan agreement. Late fees can significantly impact the total cost of the loan over time if payments are consistently late.

- Returned Payment Fee: If a payment is returned due to insufficient funds, a returned payment fee is typically charged. This fee adds to the overall cost of the loan and can be substantial, particularly if multiple payments are returned.

- Default Fee: In the event of loan default (failure to make payments according to the loan agreement), significant fees and penalties may apply. These can include collection agency fees, negatively impacting your credit score, and potentially leading to wage garnishment or tax refund offset.

Chesla CT Student Loan Interest Rate Comparison

The table below provides a hypothetical comparison of interest rates for different Chesla CT student loan types. Note that these rates are examples and may not reflect current rates. It is crucial to check the official Chesla website for the most up-to-date information.

| Loan Type | Interest Rate (Example) |

|---|---|

| Subsidized Loan | 3.5% |

| Unsubsidized Loan | 4.5% |

| Parent PLUS Loan | 5.5% |

| Graduate PLUS Loan | 6.0% |

Managing Chesla CT Student Loan Debt

Effective management of your Chesla CT student loan debt is crucial for your financial well-being. Understanding your repayment options and proactively addressing potential challenges will help you navigate this process successfully and avoid negative impacts on your credit score and financial future. This section provides strategies and resources to help you manage your loans effectively.

Successful student loan management requires a proactive approach. By understanding your repayment options and actively planning for your future, you can minimize stress and ensure a smoother repayment process.

Strategies for Effective Student Loan Debt Management

Several strategies can significantly improve your ability to manage your Chesla CT student loan debt. These strategies focus on organization, planning, and proactive communication with your loan servicer.

- Create a Budget: Track your income and expenses to determine how much you can realistically allocate towards your student loan payments each month. This will help you avoid missed payments and potential penalties.

- Prioritize Loan Payments: If you have multiple loans, consider prioritizing higher-interest loans to minimize the total interest paid over the life of the loans. Strategies like the avalanche method (paying off the highest interest loan first) or the snowball method (paying off the smallest loan first to build momentum) can be effective.

- Explore Repayment Plans: Chesla CT offers various repayment plans, including standard, extended, graduated, and income-driven repayment options. Carefully consider each option to determine which best suits your financial situation and long-term goals. A longer repayment period will reduce your monthly payments but may result in paying more interest overall.

- Automate Payments: Setting up automatic payments ensures that your payments are made on time, avoiding late fees and negative impacts on your credit score.

- Communicate with Your Servicer: If you anticipate difficulty making your payments, contact your loan servicer immediately. They may be able to offer forbearance, deferment, or other options to help you manage your debt.

Resources for Borrowers Experiencing Repayment Difficulty

Chesla CT and the federal government offer several resources to assist borrowers facing challenges with their student loan repayments. These resources can provide guidance, support, and potentially modify repayment terms to prevent default.

- Chesla CT Customer Service: Contact Chesla CT directly to discuss your situation and explore available options. They can provide information on repayment plans, hardship programs, and other assistance.

- Federal Student Aid Website: The Federal Student Aid website (studentaid.gov) offers comprehensive information on repayment options, including income-driven repayment plans and loan forgiveness programs. This is a valuable resource for understanding your rights and available options.

- National Foundation for Credit Counseling (NFCC): The NFCC provides free and low-cost credit counseling services, including assistance with student loan debt management. A credit counselor can help you create a budget, explore repayment options, and negotiate with your loan servicer.

Calculating Monthly Payments

The monthly payment amount for your Chesla CT student loan will depend on the loan amount, interest rate, and repayment plan selected. While precise calculations require using a loan amortization calculator (easily found online), a simplified understanding of the factors involved is crucial.

The formula for calculating a simple monthly payment (ignoring compounding) is a basic approximation:

Monthly Payment ≈ (Loan Amount + Total Interest) / (Number of Months in Repayment Period)

However, actual monthly payments will vary due to the compounding of interest. Using an online loan calculator that accounts for compounding interest provides a much more accurate estimate.

For example, a $20,000 loan at 5% interest over 10 years (120 months) would have an approximate total interest payment (this is a simplification; actual interest will be higher due to compounding) of $5,000. Using the simplified formula, the approximate monthly payment would be ($20,000 + $5,000) / 120 = $208.33. However, a loan calculator would provide a more precise figure, reflecting the effect of compounding interest.

Chesla CT Student Loan Deferment and Forbearance Options

Navigating the complexities of student loan repayment can be challenging, and sometimes unforeseen circumstances necessitate temporary pauses in payments. Chesla CT student loans offer deferment and forbearance options to help borrowers manage their financial obligations during difficult periods. Understanding the differences between these options and the eligibility requirements is crucial for responsible loan management.

Deferment and forbearance are both temporary pauses in your Chesla CT student loan payments, but they differ significantly in their eligibility criteria and implications. Deferment typically requires demonstrating a specific hardship, while forbearance is often granted based on a borrower’s request, although the lender retains the right to approve or deny the request. Both options can impact the total amount repaid due to accruing interest.

Conditions for Deferment

Deferment of Chesla CT student loans is generally granted only under specific circumstances defined by the lender. These circumstances typically include unemployment, enrollment in a graduate or professional degree program, or experiencing a period of military service. Specific documentation, such as a layoff notice, enrollment verification, or military orders, is usually required to support the deferment application. The length of the deferment period varies depending on the specific circumstance and is subject to the lender’s approval.

Conditions for Forbearance

Forbearance offers a more flexible approach to temporary payment pauses compared to deferment. While specific reasons are usually required, the criteria are broader and may include temporary financial hardship not directly covered by deferment options. This might involve unforeseen medical expenses, natural disasters affecting income, or other significant financial setbacks. Forbearance requests are usually reviewed on a case-by-case basis by the lender. The length of the forbearance period is also determined by the lender, and it may be subject to renewal if the financial circumstances persist.

Application Process for Deferment and Forbearance

The application process for both deferment and forbearance typically involves submitting a request to Chesla CT along with supporting documentation relevant to the claimed hardship or reason for the requested pause in payments. This documentation could include pay stubs, enrollment verification, medical bills, or other evidence supporting the claim. Chesla CT will review the application and supporting documentation to determine eligibility. The specific procedures and required forms can be found on the Chesla CT website or by contacting their customer service department.

Implications of Deferment and Forbearance on Loan Repayment

While both deferment and forbearance provide temporary relief from making payments, it’s crucial to understand that interest typically continues to accrue during these periods. This means the total amount owed will increase, potentially leading to a higher overall repayment cost. For loans with subsidized interest, the government may pay the interest during the deferment period, depending on the specific loan program and eligibility. However, this is not typically the case with unsubsidized loans or during forbearance. Therefore, borrowers should carefully consider the long-term financial implications before opting for deferment or forbearance. It’s advisable to contact Chesla CT directly to understand the specific interest capitalization rules applicable to your loan.

Contacting Chesla CT for Student Loan Assistance

Reaching out to Chesla CT for assistance with your student loan is crucial for addressing any questions, concerns, or issues that may arise throughout the loan lifecycle. Effective communication ensures a smooth borrowing experience and helps prevent potential problems. Various methods are available to facilitate this communication.

Chesla CT provides several avenues for borrowers to seek assistance. Understanding these options allows you to choose the most convenient and efficient method for your needs. Whether you prefer a phone call, email, or written correspondence, Chesla aims to provide responsive and helpful support.

Chesla CT Contact Information

The following table summarizes the various ways to contact Chesla CT for student loan assistance. It is recommended to keep this information readily available for quick reference.

| Contact Method | Details |

|---|---|

| Phone | (Insert Chesla CT Phone Number Here) – Please note that specific phone numbers may vary depending on the type of inquiry or the specific program. It’s advisable to check the Chesla CT website for the most up-to-date contact information. |

| (Insert Chesla CT Email Address Here) – When emailing, clearly state your account information (name, student loan ID number) and briefly describe your inquiry to ensure a prompt response. | |

| Mailing Address | (Insert Chesla CT Mailing Address Here) – For formal correspondence or documents requiring physical delivery, utilize the official mailing address. Remember to include your account information and a clear description of your request. |

Utilizing Chesla CT’s Online Resources

Beyond direct contact, Chesla CT likely offers a comprehensive online portal or website with a frequently asked questions (FAQ) section and other helpful resources. These online tools can often provide quick answers to common questions, saving you time and effort. Exploring these resources before contacting Chesla directly can be a very efficient first step.

Illustrative Example: Sarah’s Journey with a Chesla CT Student Loan

Sarah, a bright and ambitious student from Connecticut, dreamt of becoming a veterinarian. To achieve this goal, she knew she would need financial assistance, and she turned to Chesla CT student loans. Her journey, while challenging at times, ultimately highlighted the potential benefits and the realities of navigating the student loan process.

The Application Process

Sarah began by thoroughly researching the various Chesla CT loan programs offered. She carefully compared interest rates, repayment options, and eligibility requirements to find the best fit for her needs. The online application was straightforward, requiring her to provide documentation such as her acceptance letter from veterinary school, her FAFSA information, and her parent’s tax returns (as a dependent student). She found the process relatively user-friendly, completing the application within a few days. After submitting her application, she received confirmation and was kept updated on the progress via email. The entire process, from application to approval, took approximately three weeks.

Loan Disbursement and Educational Expenses

Once approved, the funds were disbursed directly to her university according to the school’s disbursement schedule. This streamlined the payment process, ensuring her tuition, fees, and other educational expenses were covered promptly. Sarah meticulously tracked her expenses to ensure she used the loan funds responsibly.

Choosing a Repayment Plan

Upon graduation, Sarah faced the reality of repaying her student loan. She explored the various repayment plans offered by Chesla CT, considering her income and financial goals. She ultimately opted for an income-driven repayment plan, which adjusted her monthly payments based on her income. This provided her with flexibility during the early stages of her career, when her income was relatively low.

Managing Repayment and Unexpected Challenges

While Sarah diligently made her monthly payments, an unexpected car repair created a temporary financial strain. She contacted Chesla CT immediately to explore her options. She was relieved to learn about the available deferment options, which allowed her to temporarily postpone her payments without penalty. This provided her with the breathing room she needed to address the unexpected expense without defaulting on her loan. This experience underscored the importance of open communication with the lender and the availability of support systems during unforeseen circumstances.

Financial and Emotional Impact

The student loan debt undoubtedly added a layer of financial responsibility to Sarah’s life. However, she viewed it as an investment in her future career. The initial stress of managing the loan was gradually replaced by a sense of accomplishment as she consistently made payments and saw her loan balance decrease. The emotional burden was lessened by the knowledge that she had a reliable repayment plan and access to support from Chesla CT.

Wrap-Up

Securing a student loan is a significant financial undertaking, and understanding the nuances of Chesla CT student loans is crucial for responsible borrowing. By carefully considering the various loan programs, repayment options, and available resources, you can create a sustainable repayment plan that aligns with your financial goals. Remember, proactive planning and informed decision-making are key to successfully managing your student loan debt and achieving financial stability.

FAQ Overview

What happens if I miss a Chesla student loan payment?

Missing payments can result in late fees, damage your credit score, and potentially lead to loan default. Contact Chesla immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Can I refinance my Chesla CT student loan?

Yes, you may be able to refinance your Chesla student loan with another lender, potentially securing a lower interest rate or a more favorable repayment plan. However, refinancing may impact your eligibility for certain federal loan programs.

What is the difference between deferment and forbearance?

Deferment temporarily postpones your payments, and under certain circumstances, interest may not accrue. Forbearance allows for temporary payment reductions or suspensions, but interest usually continues to accrue.

Where can I find the most up-to-date information on Chesla CT student loan interest rates?

The most accurate and current interest rate information can be found directly on the Chesla website or by contacting their customer service department.