Navigating the complexities of higher education often involves the significant financial commitment of student loans. Understanding the terms, benefits, and potential drawbacks of these loans is crucial for responsible borrowing. This guide delves into the specifics of Chipper student loans, providing a detailed analysis to empower prospective borrowers with informed decision-making.

We will explore Chipper’s loan features, eligibility requirements, and application process, comparing them to other available options. A thorough examination of interest rates, repayment plans, and customer service experiences will shed light on the overall borrower experience. Furthermore, we will address potential risks, discuss alternative loan providers, and analyze the long-term financial implications of choosing a Chipper student loan.

Chipper Student Loan Overview

Chipper Student Loans offers a streamlined and accessible financing solution for students pursuing higher education. Designed to ease the financial burden associated with tuition and related expenses, the program provides various benefits aimed at supporting students throughout their academic journey. This overview details the program’s key features, eligibility requirements, application process, and a comparison with other student loan options.

Chipper Student Loan Features and Benefits

Chipper Student Loans distinguishes itself through several key features. These include competitive interest rates, flexible repayment plans tailored to individual financial circumstances, and the potential for reduced interest rates based on academic performance or timely payments. Furthermore, the program often includes financial literacy resources and guidance to help borrowers manage their debt effectively. The benefit of a simplified application process, combined with a dedicated support team, aims to reduce the stress often associated with securing student loans.

Chipper Student Loan Eligibility Criteria

Eligibility for a Chipper Student Loan typically involves meeting specific requirements. These generally include being a currently enrolled student or accepted student at an accredited institution, demonstrating financial need through a demonstrated credit history, and maintaining a satisfactory academic standing. Specific GPA requirements or minimum credit scores may vary depending on the loan program and the lender. Proof of enrollment, along with supporting financial documentation, is typically required during the application process.

Chipper Student Loan Application Process

The application process for a Chipper Student Loan is designed to be user-friendly. First, prospective borrowers will need to complete an online application form, providing necessary personal and financial information. This is followed by the submission of supporting documentation, such as proof of enrollment and financial aid award letters. Once the application is reviewed and approved, the loan funds are typically disbursed directly to the educational institution to cover tuition fees and other eligible expenses. Regular communication with the lender throughout the process is encouraged to ensure a smooth and timely loan disbursement.

Comparison of Chipper Student Loans with Other Student Loan Options

Chipper Student Loans can be compared to other options available, such as federal student loans and private student loans offered by banks or credit unions. While federal loans often offer lower interest rates and various repayment options, the application process can be more complex. Private loans, on the other hand, may have higher interest rates but offer more flexibility in terms of loan amounts and disbursement schedules. Chipper Student Loans aim to provide a balance, offering competitive interest rates and a simplified application process compared to some private loan options, while maintaining a level of accessibility similar to federal loan programs, though not backed by the government. The best option depends on individual circumstances, financial needs, and risk tolerance.

Interest Rates and Repayment Plans

Understanding Chipper’s interest rates and repayment options is crucial for effectively managing your student loan debt. Choosing the right repayment plan can significantly impact your overall cost and repayment timeline. This section will detail Chipper’s offerings and their financial implications.

Chipper strives to offer competitive interest rates, though the exact rates vary depending on several factors including creditworthiness, loan amount, and the specific loan program. While precise figures are best obtained directly from Chipper, it’s beneficial to compare their offerings to market averages for student loans. Generally, market averages fluctuate based on economic conditions and lender policies. For instance, a recent survey might indicate that average interest rates for federal student loans are around 5-7%, while private loans may range from 6-10% or even higher, depending on risk assessment. Chipper’s rates should be compared against these benchmarks to assess their competitiveness. It is important to remember that rates are subject to change.

Chipper’s Repayment Plan Options

Chipper likely offers a variety of repayment plans to cater to different financial situations and borrower preferences. These plans typically differ in monthly payment amounts, loan terms, and the total interest paid over the life of the loan. Understanding these differences is vital for making an informed decision.

Comparison of Repayment Plan Options

The following table provides a hypothetical comparison of different repayment plans. Remember that actual figures will depend on your specific loan amount, interest rate, and chosen plan. These examples are for illustrative purposes only and should not be taken as a definitive representation of Chipper’s offerings.

| Plan Name | Monthly Payment Example | Total Interest Paid | Loan Term (Years) |

|---|---|---|---|

| Standard Repayment | $300 | $5,000 | 10 |

| Extended Repayment | $200 | $8,000 | 15 |

| Graduated Repayment | $250 (increasing gradually) | $6,500 | 12 |

| Income-Driven Repayment (Example) | $150 (adjusted annually based on income) | $10,000 (potentially higher due to longer repayment period) | 20 (or potentially longer) |

Impact of Repayment Plan Choice on Total Interest Paid

The choice of repayment plan directly impacts the total interest paid over the life of the loan. Shorter-term plans, while requiring higher monthly payments, generally result in lower overall interest costs. Conversely, longer-term plans offer lower monthly payments but lead to significantly higher total interest paid due to the extended repayment period and accumulating interest charges. For example, choosing an extended repayment plan might result in lower monthly payments but could ultimately cost thousands more in interest over the loan’s lifespan compared to a standard repayment plan. Borrowers should carefully weigh the trade-off between affordability and long-term cost.

Chipper’s Customer Service and Support

Chipper Student Loans prioritizes providing borrowers with accessible and responsive customer support. Understanding the complexities of student loan management, they offer multiple avenues for assistance, aiming to ensure a smooth and positive borrowing experience. Their commitment to effective communication is a key component of their overall service.

Chipper offers various methods for contacting their customer support team. This commitment to accessibility reflects their dedication to borrower satisfaction.

Contacting Chipper Customer Support

Borrowers can reach Chipper’s customer support team through several channels, including phone, email, and a comprehensive online help center. The phone number is prominently displayed on their website, allowing for direct contact with a representative. Email support offers a convenient option for non-urgent inquiries or for providing detailed information. Finally, the online help center provides a searchable knowledge base covering frequently asked questions, troubleshooting guides, and helpful resources related to loan management and repayment. This multi-faceted approach caters to the diverse communication preferences of their borrowers.

Customer Service Experiences

While anecdotal evidence varies, a significant portion of online reviews praise Chipper for their responsive and helpful customer service. Many borrowers report positive experiences with quick response times to inquiries and effective resolution of their concerns. For instance, a common positive comment highlights the patience and clarity exhibited by support representatives when explaining complex loan terms or repayment options. However, some negative experiences have also been reported, primarily citing longer-than-expected wait times during peak periods or occasional difficulties reaching a live representative. These negative experiences, though less frequent, underscore the need for continued improvement in scaling their support resources to meet fluctuating demand.

Handling a Loan Modification Request

Let’s imagine Sarah, a Chipper borrower, experiences a sudden job loss and is struggling to make her monthly payments. She contacts Chipper’s customer support via phone. After verifying her identity, the representative guides her through the process of submitting a loan modification request. This involves providing documentation supporting her financial hardship, such as a layoff notice and updated income statements. Chipper’s system then reviews her application, considering her financial situation and loan history. Within a specified timeframe (e.g., 10-14 business days), Sarah receives a decision regarding her request. If approved, the modification might involve a temporary reduction in monthly payments, an extended repayment period, or a switch to an income-driven repayment plan. Throughout the process, Sarah receives regular updates and clear communication from her assigned representative, keeping her informed about the status of her request. Even if her request is denied, she receives a detailed explanation of the decision and potential alternative options.

Borrower Resources for Loan Management

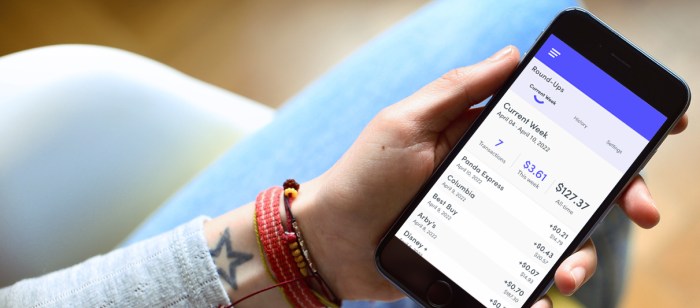

Chipper provides a range of resources to assist borrowers in effectively managing their loans. Their online portal offers secure access to account information, including payment history, upcoming due dates, and repayment schedules. Interactive tools and calculators help borrowers estimate their monthly payments under different scenarios or explore various repayment plan options. Educational materials, such as FAQs, articles, and webinars, are available to address common questions and concerns related to loan management, financial literacy, and responsible borrowing practices. This comprehensive suite of resources empowers borrowers to actively participate in managing their loans and make informed decisions about their financial future.

Potential Risks and Drawbacks

Taking out any student loan, including one from Chipper, involves inherent risks. It’s crucial to understand these potential drawbacks before committing to a loan to ensure you make an informed decision and avoid future financial hardship. Failing to fully grasp the implications could lead to unforeseen difficulties.

Borrowing money for education is a significant financial commitment that requires careful planning and consideration of the potential consequences. While student loans can open doors to educational opportunities, they also represent a substantial debt that needs responsible management.

Defaulting on a Chipper Student Loan

Defaulting on a Chipper student loan, like any other loan, carries severe consequences. This can significantly damage your credit score, making it harder to obtain loans, credit cards, or even rent an apartment in the future. Default can also lead to wage garnishment, where a portion of your earnings is directly seized by the lender to repay the debt. Furthermore, Chipper may pursue legal action to recover the outstanding amount, potentially resulting in additional fees and legal costs. In some cases, default can impact your ability to secure future employment, especially in fields requiring security clearances. For example, a person defaulting on a student loan may find it difficult to obtain employment in the government or finance sector.

Comparison of Chipper Loan Terms to Other Lenders

Chipper’s loan terms, including interest rates, repayment plans, and fees, should be compared to those offered by other lenders before making a decision. Interest rates can vary significantly between lenders, potentially impacting the total cost of the loan over its lifetime. Some lenders might offer more flexible repayment options, such as income-driven repayment plans, while others may have stricter terms. A thorough comparison allows borrowers to identify the loan that best aligns with their financial circumstances and repayment capabilities. For instance, a comparison might reveal that a federal student loan program offers lower interest rates and more flexible repayment plans compared to Chipper’s offerings, especially for borrowers with specific financial needs.

Hidden Fees and Charges

It’s important to thoroughly review Chipper’s loan agreement to identify any hidden fees or charges. While some fees might be explicitly stated, others could be buried within the fine print. These could include origination fees, late payment fees, or prepayment penalties. Understanding all associated costs is essential for accurate budgeting and financial planning. For example, an origination fee might be a percentage of the loan amount, added upfront, increasing the overall cost of borrowing. Similarly, late payment fees can accumulate quickly, significantly impacting the total amount owed.

Chipper Student Loan Alternatives

Choosing the right student loan is crucial, and Chipper isn’t the only option available. Exploring alternatives allows you to compare features, interest rates, and repayment terms to find the best fit for your individual financial situation. This section Artikels several alternatives and compares them to Chipper loans.

Several factors influence the best student loan choice, including credit history, income, the type of degree pursued, and the total loan amount needed. Understanding these factors helps you effectively evaluate different loan options and make informed decisions. A thorough comparison ensures you secure the most favorable terms and minimize long-term financial burdens.

Alternative Student Loan Options

The following list provides examples of alternative student loan providers, along with general interest rate ranges and loan terms. Note that these rates and terms are subject to change and depend on individual creditworthiness and other factors. Always check the lender’s website for the most up-to-date information.

- Lender: Sallie Mae

Interest Rate Range: Variable, typically 4.5% – 10.5%

Loan Terms: Varies, typically 5-15 years - Lender: Discover Student Loans

Interest Rate Range: Variable, typically 3.5% – 11%

Loan Terms: Varies, typically 5-20 years - Lender: Wells Fargo Student Loans

Interest Rate Range: Variable, typically 4% – 12%

Loan Terms: Varies, typically 5-15 years - Lender: Federal Student Loans (Direct Loans)

Interest Rate Range: Fixed, varies by loan type and year.

Loan Terms: Varies by loan type, typically 10-20 years

Comparison of Chipper and a Competitor: Chipper vs. Sallie Mae

To illustrate a direct comparison, let’s examine Chipper against Sallie Mae, a prominent player in the student loan market. The following visual representation highlights key differences.

Visual Representation: Imagine a bar graph with two bars side-by-side for each feature. The horizontal axis lists the features: Interest Rate, Repayment Options, Customer Service, Loan Amount Limits, and Fees. The vertical axis represents the value (higher bar indicates better value, relative to each other). For example, if Chipper offers a more flexible repayment plan, its bar for “Repayment Options” would be taller than Sallie Mae’s. If Sallie Mae offers lower interest rates, its bar for “Interest Rate” would be taller. The graph visually demonstrates the strengths and weaknesses of each lender across various key aspects, allowing for easy comparison. For instance, Sallie Mae might have a taller bar for “Loan Amount Limits” representing a higher maximum loan amount available, while Chipper might have a taller bar for “Customer Service” due to a highly rated customer support system. The differences in bar heights would clearly illustrate where each lender excels and where it might fall short.

Impact of Chipper Loans on Borrowers’ Financial Health

Taking out a student loan, including one from Chipper, is a significant financial decision with long-term implications. Understanding the potential impact on your financial health is crucial before borrowing. This section will explore how Chipper loans can affect your credit score, budget, and overall financial well-being, along with strategies for effective debt management.

Borrowing for education can provide opportunities for increased earning potential in the future, but it’s essential to weigh the benefits against the potential long-term financial burdens. Careful planning and responsible borrowing habits are key to minimizing the risks associated with student loan debt.

Long-Term Financial Implications of Chipper Student Loans

Taking out a Chipper student loan can significantly impact your financial health for years to come. The monthly payments represent a recurring expense that will affect your disposable income and ability to save for other goals, such as a down payment on a house, investing, or paying off other debts. The total amount repaid, including interest, will likely exceed the original loan amount, meaning the true cost of your education is higher than the initial loan principal. This is especially true if you choose a longer repayment term, which will reduce your monthly payment but increase the total interest paid. For example, a $30,000 loan at 7% interest repaid over 10 years will cost significantly less than the same loan repaid over 20 years. The longer repayment period means significantly higher total interest payments.

Effect of Chipper Loans on Credit Score

Your Chipper student loan repayment history directly impacts your credit score. On-time payments demonstrate responsible borrowing behavior and positively affect your creditworthiness. Conversely, late or missed payments can severely damage your credit score, making it more difficult to obtain loans, credit cards, or even rent an apartment in the future. A good credit score is essential for securing favorable interest rates on future loans and accessing other financial products. Maintaining a good repayment history with Chipper is crucial for building and preserving your credit.

Impact of Different Repayment Strategies on Borrowers’ Budgets

Different repayment strategies significantly affect a borrower’s budget. A longer repayment term results in lower monthly payments but higher overall interest costs. Shorter repayment terms mean higher monthly payments but less interest paid over the life of the loan. Income-driven repayment plans adjust monthly payments based on income, offering flexibility but potentially extending the repayment period. For instance, a borrower with a $50,000 loan might choose a 10-year plan with higher monthly payments but lower total interest, or a 20-year plan with lower monthly payments but substantially higher total interest. The optimal strategy depends on individual financial circumstances and priorities.

Effective Management of Chipper Student Loan Debt

Effective management of student loan debt requires careful planning and proactive strategies. Creating a detailed budget that includes loan payments is crucial for ensuring timely repayments and avoiding late fees. Exploring options such as refinancing to lower interest rates or consolidating multiple loans into a single payment can simplify debt management. Regularly reviewing your loan terms and exploring available repayment options can help optimize your repayment strategy. For example, a borrower might consolidate high-interest loans into a lower-interest loan, saving money over the life of the loan. Additionally, budgeting tools and financial advisors can provide valuable support in navigating student loan repayment.

Final Wrap-Up

Securing a student loan is a substantial financial undertaking, demanding careful consideration of all aspects. This comprehensive review of Chipper student loans provides a clear understanding of their benefits and potential drawbacks, empowering prospective borrowers to make well-informed choices. By comparing Chipper’s offerings with alternatives and understanding the long-term financial implications, individuals can navigate the student loan landscape with greater confidence and financial responsibility. Remember to always thoroughly research and compare options before committing to a loan.

Common Queries

What are the late payment penalties for Chipper student loans?

Late payment penalties vary and are Artikeld in the loan agreement. Contact Chipper directly for specific details.

Does Chipper offer loan forgiveness programs?

Chipper’s participation in any loan forgiveness programs depends on government initiatives. Check their website or contact them for current information.

Can I refinance my Chipper student loan with another lender?

Yes, you may be able to refinance with another lender once your Chipper loan is established. This will depend on your creditworthiness and the other lender’s requirements.

What types of documentation are required for a Chipper loan application?

Typical documentation includes proof of enrollment, financial aid award letters, and tax returns. Specific requirements are detailed on Chipper’s application portal.