Navigating the complexities of student loan debt can feel overwhelming, but refinancing offers a potential path to lower monthly payments and faster debt repayment. Citizens Bank presents itself as a viable option for those seeking to streamline their student loan obligations. This exploration delves into the intricacies of Citizens Bank’s student loan refinance program, examining eligibility criteria, rates and fees, the application process, customer experiences, and comparisons with competing lenders. We aim to provide a comprehensive overview to help you determine if refinancing with Citizens Bank aligns with your financial goals.

Understanding the nuances of refinancing is crucial. Factors such as credit score, income, and the type of student loan significantly influence eligibility and the interest rate offered. This analysis will dissect these factors, providing a clear picture of what to expect throughout the process, from application to approval and beyond. We’ll also compare Citizens Bank’s offerings against those of other major lenders, enabling you to make an informed decision.

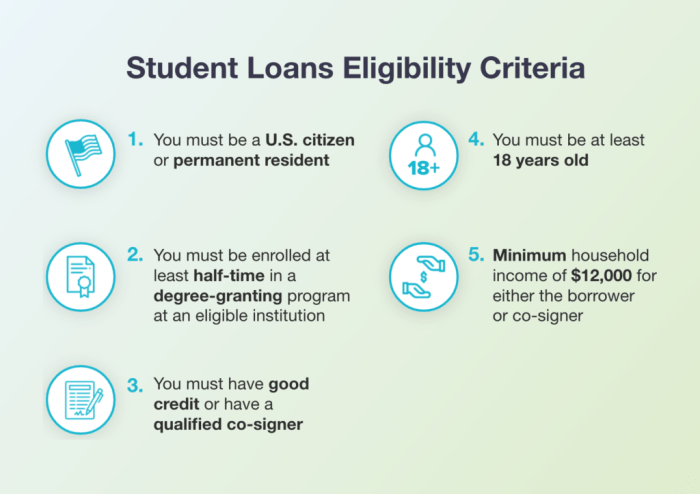

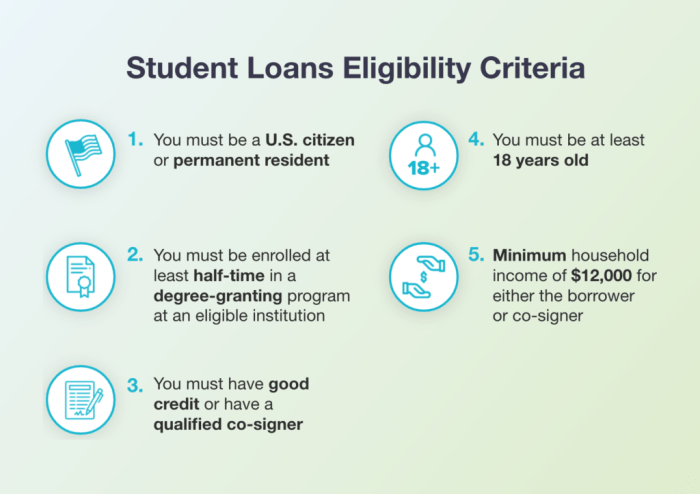

Citizens Bank Student Loan Refinance Eligibility Requirements

Refinancing your student loans with Citizens Bank can offer benefits like lower interest rates and potentially lower monthly payments. However, eligibility depends on several factors. Understanding these requirements will help you determine if refinancing with Citizens Bank is a suitable option for you.

Income Requirements

Citizens Bank considers your income when evaluating your application for student loan refinancing. While they don’t publicly state a minimum income threshold, a stable and sufficient income demonstrates your ability to repay the refinanced loan. This typically involves providing proof of income through pay stubs, tax returns, or employment verification. A higher income generally improves your chances of approval and may qualify you for more favorable loan terms.

Credit Score Thresholds

A good credit score is crucial for approval. Citizens Bank, like most lenders, uses credit scores to assess risk. While the exact minimum credit score isn’t publicly advertised, a higher credit score significantly increases your likelihood of approval and often results in better interest rates. Generally, a credit score above 670 is considered good, and a score above 700 is excellent, substantially improving your chances.

Eligible Loan Types

Citizens Bank typically refinances federal and private student loans. This includes both undergraduate and graduate student loans. However, it’s important to check their current guidelines, as specific eligible loan types might vary. Loans from multiple lenders can often be consolidated into a single refinance loan with Citizens Bank, simplifying your repayment process.

Required Documentation

To complete your application, you’ll need to provide several documents. This typically includes proof of identity (such as a driver’s license or passport), proof of income (pay stubs, tax returns, W-2 forms), and details of your existing student loans (loan servicing information, statements, etc.). You may also be asked to provide information about your employment history and assets.

Comparison of Loan Programs and Eligibility Criteria

| Loan Program | Minimum Credit Score (Estimate) | Income Requirements | Eligible Loan Types |

|---|---|---|---|

| Citizens Bank Student Loan Refinance | 670-700+ (Generally, higher scores result in better rates) | Stable income sufficient to repay the loan; documentation required (pay stubs, tax returns) | Federal and Private Student Loans (Undergraduate and Graduate) |

| (Example Competitor 1) | 680+ (Illustrative) | Sufficient income to cover monthly payments; verification required | Federal and Private Student Loans |

| (Example Competitor 2) | 700+ (Illustrative) | Stable employment history and income; documentation needed | Federal and Private Student Loans (Specific loan types may vary) |

Refinance Rates and Fees

Understanding the rates and fees associated with refinancing your student loans with Citizens Bank is crucial for making an informed decision. This section will detail Citizens Bank’s refinance rates, compare them to competitors, and explain the associated fees and how interest rates are calculated.

Citizens Bank offers competitive student loan refinance rates, but the exact rate you receive will depend on several factors, as discussed below. It’s important to compare their offerings with other major lenders to ensure you’re getting the best possible deal. While Citizens Bank may not always have the absolute lowest rate, their overall package of services and customer support could make them a worthwhile choice.

Citizens Bank Refinance Rates Compared to Competitors

Citizens Bank’s refinance rates fluctuate based on market conditions and your individual creditworthiness. To get an accurate comparison, you should obtain personalized quotes from several lenders, including Citizens Bank, and compare the annual percentage rate (APR), which includes interest and fees. Major competitors include lenders like SoFi, Earnest, and Sallie Mae. Each lender uses different underwriting criteria, leading to variations in offered rates. For example, a borrower with excellent credit and a high income might receive a significantly lower rate than someone with a lower credit score and income, regardless of the lender chosen.

Associated Fees

Citizens Bank, like many other lenders, may charge origination fees. These fees cover the administrative costs of processing your loan application. The exact percentage will vary based on the loan amount and your credit profile. It’s crucial to understand that origination fees increase the overall cost of borrowing. Furthermore, prepayment penalties are generally not applied to Citizens Bank student loan refinancing, meaning you can pay off your loan early without incurring additional charges. Always clarify all fees upfront with the lender to avoid unexpected costs.

Interest Rate Calculation Methods

Citizens Bank uses a standard method for calculating interest on refinanced student loans. The interest is typically calculated daily on the outstanding principal balance and added to the principal, resulting in compound interest. The specific calculation method is usually detailed in the loan agreement. It is important to understand that a higher interest rate will lead to higher total interest paid over the life of the loan. The formula for simple interest calculation is: Interest = Principal x Rate x Time. However, for student loan refinancing, compound interest is generally applied.

Factors Influencing Interest Rate Determination

Several factors determine the interest rate you’ll receive from Citizens Bank. These include your credit score, credit history, debt-to-income ratio, loan amount, the type of loan being refinanced (federal or private), and the chosen repayment term. A higher credit score and a lower debt-to-income ratio generally lead to lower interest rates. Similarly, a shorter repayment term might result in a slightly lower interest rate, although your monthly payments will be higher.

Example Loan Amounts, Interest Rates, and Monthly Payments

The following table provides examples of monthly payments based on various loan amounts and interest rates. These are illustrative examples only and should not be considered a guaranteed offer. Actual rates and payments may vary.

| Loan Amount | Interest Rate (%) | Loan Term (Years) | Estimated Monthly Payment |

|---|---|---|---|

| $20,000 | 6.0 | 10 | $211 |

| $30,000 | 7.0 | 10 | $317 |

| $40,000 | 8.0 | 15 | $360 |

| $50,000 | 9.0 | 15 | $450 |

Application and Approval Process

Applying for a Citizens Bank student loan refinance involves a straightforward process designed for ease and efficiency. The entire application, from submission to a potential funding decision, is handled primarily online, minimizing paperwork and maximizing convenience. This section details the steps involved and provides information on what to expect throughout the process.

Application Steps

The application process is designed to be user-friendly and efficient. To ensure a smooth application, gather all necessary documentation beforehand. The following steps Artikel the typical application flow:

- Complete the Online Application: Begin by visiting the Citizens Bank website and navigating to their student loan refinance application. You’ll be asked to provide personal information, details about your student loans, and your desired refinance terms.

- Provide Required Documentation: Citizens Bank will request supporting documentation to verify your identity and the details provided in your application. This typically includes proof of income (such as pay stubs or tax returns), your Social Security number, and details of your existing student loans (including loan servicer information and account numbers).

- Review and Submit: Carefully review your application to ensure accuracy before submitting it. Double-check all information, especially financial details and contact information, to avoid delays.

- Credit Check and Verification: After submission, Citizens Bank will conduct a credit check and verify the information provided in your application. This process helps determine your eligibility for refinancing and your potential interest rate.

- Receive Communication: You’ll receive updates throughout the application process via email and/or phone. These communications may include requests for additional documentation, updates on the status of your application, or notification of a final decision.

- Approval or Denial Notification: Citizens Bank will notify you of their decision. If approved, you will receive details about your new loan terms, including the interest rate, monthly payment, and repayment schedule. If denied, you will receive an explanation of the reasons for denial.

- Loan Closing (if approved): Once approved, you’ll need to complete the final loan documents electronically. After signing, your existing student loans will be paid off, and you’ll begin making payments on your new refinanced loan with Citizens Bank.

Required Documentation

Gathering the necessary documentation beforehand streamlines the application process. The specific documents requested may vary slightly, but generally include:

- Government-issued photo ID: Such as a driver’s license or passport.

- Proof of income: Pay stubs, W-2 forms, or tax returns.

- Social Security number: Needed for verification purposes.

- Details of existing student loans: Loan servicer information, account numbers, and outstanding balances.

- Diploma or degree verification (may be required): This might be requested depending on the loan program and your educational history.

Application Processing Time

The typical processing time for a Citizens Bank student loan refinance application is approximately 2-4 weeks. However, this timeframe can vary depending on several factors, including the completeness of your application, the verification of your information, and the current volume of applications being processed. In some cases, the process may take longer.

Communication During Application

Citizens Bank will communicate with you primarily through email and potentially phone calls. You can expect emails confirming receipt of your application, requests for additional documents, updates on the status of your application, and ultimately, notification of approval or denial. Phone calls may be used to clarify information or address specific questions. Maintain regular check of your email inbox and be prepared to answer any inquiries from Citizens Bank promptly.

Customer Reviews and Experiences

Citizens Bank’s student loan refinancing program receives a mixed bag of reviews, reflecting the diverse experiences of borrowers. Understanding these reviews provides valuable insight into the strengths and weaknesses of the program, allowing prospective borrowers to make informed decisions. This section summarizes both positive and negative feedback to present a balanced overview.

Analyzing online reviews from various platforms reveals recurring themes in customer feedback. Positive reviews frequently highlight the competitive interest rates offered by Citizens Bank, the streamlined application process, and the generally responsive customer service. Negative reviews, however, often cite difficulties in reaching customer service representatives, lengthy processing times for certain applications, and occasional discrepancies in communication regarding loan terms and conditions. These contrasting experiences suggest a need for further refinement in certain aspects of the program to ensure consistent customer satisfaction.

Positive Customer Feedback

Positive customer experiences with Citizens Bank student loan refinancing frequently center around attractive interest rates and a relatively straightforward application process. Many borrowers report feeling satisfied with the overall speed of approval and the clarity of the provided information. Some reviewers specifically praise the ease of online account management and the helpfulness of certain customer service representatives encountered during the process. These positive experiences contribute to the overall perception of the program as a viable option for those seeking to refinance their student loans.

Negative Customer Feedback

Conversely, negative feedback often focuses on the challenges encountered during the application and approval process. Some borrowers report experiencing long wait times when attempting to contact customer service, with some indicating difficulties reaching a representative who could adequately address their concerns. Others cite inconsistencies in communication, noting discrepancies between initial promises and the final loan terms. Furthermore, a small percentage of reviewers mention experiencing delays in the processing of their applications, leading to frustration and uncertainty. These negative experiences highlight areas where Citizens Bank could improve its services to better meet customer expectations.

Customer Service Experience

The customer service experience with Citizens Bank’s student loan refinancing program appears to be inconsistent, based on available reviews. While some borrowers report positive interactions with helpful and knowledgeable representatives, others describe difficulties in reaching someone or receiving adequate assistance. The reported wait times vary significantly, suggesting potential issues with staffing or call routing. The overall experience seems to be dependent on individual circumstances and the specific representative contacted. A more consistent and efficient customer service system could significantly improve overall satisfaction.

Comparison with Competitor Banks

Compared to other major banks offering student loan refinancing, Citizens Bank generally falls within the average range for interest rates and application processes. Some competitors may offer slightly lower interest rates in specific situations, while others might boast more streamlined application systems. However, Citizens Bank’s overall package is considered competitive, with its strengths and weaknesses balancing out against the offerings of its competitors. A direct comparison requires examining individual borrower profiles and specific loan circumstances, as the ideal lender will vary based on individual needs.

Key Findings from Review Platforms

- Interest Rates: Generally competitive, but not always the lowest available.

- Application Process: Mostly straightforward, but can be slow for some applicants.

- Customer Service: Inconsistent experiences reported; some positive, some negative, with significant variability in wait times.

- Communication: Occasional discrepancies reported between initial information and final loan terms.

- Overall Satisfaction: Mixed reviews, with a significant portion of positive feedback balanced by concerns regarding customer service and processing times.

Comparison with Other Lenders

Choosing the right student loan refinance lender involves careful consideration of various factors beyond just the interest rate. This section compares Citizens Bank’s refinance options with those offered by other major lenders, highlighting key differences to aid in your decision-making process. We’ll examine terms, conditions, and overall value propositions to help you determine the best fit for your financial situation.

Key Differences in Terms and Conditions

Different lenders offer varying terms and conditions for student loan refinancing. These variations can significantly impact the overall cost and manageability of your loan. For example, some lenders may offer longer repayment terms, leading to lower monthly payments but potentially higher overall interest paid. Others might have stricter eligibility requirements, such as minimum credit scores or debt-to-income ratios. Furthermore, fees associated with refinancing, such as application fees or prepayment penalties, can vary considerably. Understanding these nuances is crucial for making an informed choice.

Advantages and Disadvantages of Choosing Citizens Bank

Citizens Bank, like other lenders, presents both advantages and disadvantages for student loan refinancing. A potential advantage might be its established reputation and extensive branch network, offering in-person support for borrowers who prefer that option. However, a disadvantage could be its interest rates, which may not always be the most competitive compared to online-only lenders who often have lower overhead costs. Another factor to consider is the specific terms and conditions Citizens Bank offers, such as repayment options and flexibility in handling potential financial hardships. Thorough research and comparison with competing offers are essential.

Comparison of Key Features from Three Lenders

The following table compares key features of student loan refinance options from Citizens Bank, SoFi, and Earnest. Remember that rates and terms are subject to change, and individual eligibility will vary based on creditworthiness and other factors. This information is for illustrative purposes and should not be considered financial advice.

| Feature | Citizens Bank | SoFi | Earnest |

|---|---|---|---|

| Minimum Credit Score | (Check Citizens Bank website for current requirements) | (Check SoFi website for current requirements) | (Check Earnest website for current requirements) |

| Interest Rates | Variable and Fixed rates available (Check Citizens Bank website for current rates) | Variable and Fixed rates available (Check SoFi website for current rates) | Variable and Fixed rates available (Check Earnest website for current rates) |

| Repayment Terms | (Check Citizens Bank website for available terms) | (Check SoFi website for available terms) | (Check Earnest website for available terms) |

| Fees | (Check Citizens Bank website for current fees) | (Check SoFi website for current fees) | (Check Earnest website for current fees) |

| Co-signer Release Option | (Check Citizens Bank website for details) | (Check SoFi website for details) | (Check Earnest website for details) |

Illustrative Example of Refinancing

This example demonstrates how refinancing a student loan with Citizens Bank could potentially save you money. It uses hypothetical figures for illustrative purposes and should not be considered financial advice. Always consult with a financial advisor before making any major financial decisions.

This scenario involves a borrower with a significant remaining balance on their student loans. We will compare their current loan terms with a potential refinanced loan from Citizens Bank, highlighting the differences in interest rates, monthly payments, and total interest paid.

Original Loan Details

The borrower initially had a federal student loan with a principal balance of $50,000, an interest rate of 7%, and a remaining balance of $40,000 after several years of repayment. Their monthly payment was approximately $400, and the loan’s original term was 10 years. Due to the high interest rate, the total interest paid over the life of the loan would be substantial.

Refinanced Loan Details

The borrower decides to refinance their loan with Citizens Bank. After applying and being approved, they secure a new loan with a principal balance of $40,000 (their remaining balance), a lower interest rate of 5%, and a new loan term of 8 years. Their new monthly payment is approximately $500.

Comparison of Loan Costs

The lower interest rate offered by Citizens Bank, while resulting in a higher monthly payment, significantly reduces the total interest paid over the life of the loan. In this example, the original loan would have resulted in approximately $18,000 in total interest paid. With the refinanced loan, the total interest paid is estimated to be around $8,000. This represents a considerable savings of $10,000.

Visual Representation of Payment Schedules

A visual comparison would show two line graphs. The first graph, representing the original loan, would show a relatively flat line initially, gradually increasing as the principal decreases and the interest portion of the payment increases. The second graph, for the refinanced loan, would demonstrate a steeper initial decline, showing a quicker reduction of the principal due to the higher monthly payment. Both graphs would eventually reach zero, representing the full repayment of the loan, but the refinanced loan’s graph would reach zero sooner, illustrating the shorter repayment period. The area under each graph represents the total amount paid (principal plus interest), clearly showing the significant reduction in total interest paid with the refinanced loan.

Last Point

Refinancing your student loans with Citizens Bank, or any lender for that matter, requires careful consideration. This analysis has highlighted the key aspects to evaluate, from eligibility requirements and interest rates to the application process and customer reviews. By weighing the pros and cons, comparing options across different lenders, and understanding the potential long-term financial implications, you can make a decision that best suits your individual circumstances and financial aspirations. Remember to thoroughly research and compare all available options before committing to a refinance plan.

Quick FAQs

What happens if my application is denied?

Citizens Bank will typically provide a reason for denial. You can review your application, address any shortcomings, and reapply at a later date, potentially after improving your credit score or income.

Can I refinance both federal and private student loans with Citizens Bank?

The ability to refinance both federal and private loans depends on Citizens Bank’s current offerings. Check their website for the most up-to-date information on eligible loan types.

What is the typical processing time for a refinance application?

Processing times vary but generally range from a few weeks to a couple of months. Factors like application completeness and credit check processing can influence the timeline.

What are the consequences of prepayment?

Citizens Bank may or may not charge prepayment penalties. Review your loan agreement carefully to determine if there are any associated fees for paying off your loan early.