Navigating the world of student loans can be daunting, and choosing the right lender is crucial. This in-depth analysis of Citizens Bank student loans examines interest rates, repayment options, customer service experiences, and the overall application process. We’ll delve into borrower reviews, compare Citizens Bank to its competitors, and highlight potential challenges to help you make an informed decision.

This comprehensive guide aims to provide a balanced perspective, drawing from various sources to offer a clear understanding of what to expect when considering Citizens Bank for your student loan needs. We’ll explore both the positive and negative aspects, empowering you with the knowledge necessary to navigate this significant financial commitment.

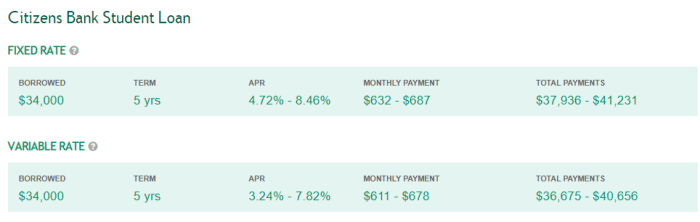

Interest Rates and Fees

Citizens Bank offers student loans, but understanding their interest rates and associated fees is crucial before committing. This section will compare Citizens Bank’s offerings to those of other major lenders, detail the various fees involved, and explain how their interest rate calculations impact borrowers. Accurate information on current rates can be found directly on the Citizens Bank website or by contacting them.

Citizens Bank Student Loan Interest Rates Compared to Competitors

Citizens Bank’s student loan interest rates are competitive within the market, but they fluctuate based on factors like creditworthiness, loan type, and prevailing market conditions. Direct comparison requires checking current rates from multiple lenders, including Sallie Mae, Discover, and private banks. Generally, rates for federal loans tend to be lower than those for private loans. For example, a recent comparison might show Citizens Bank offering a 6.5% fixed rate for undergraduate loans while a competitor like Sallie Mae offers a 6% rate, but these numbers are subject to change. It’s vital to shop around and compare offers from several institutions.

Fees Associated with Citizens Bank Student Loans

Several fees can be associated with Citizens Bank student loans. These commonly include origination fees, which are typically a percentage of the loan amount and are paid upfront. Late payment fees are charged if payments are not made on time, and these fees can significantly impact the total cost of the loan. Other potential fees could include prepayment penalties (though less common now), and potentially fees for specific services like electronic payments or loan consolidation. Borrowers should carefully review the loan documents to understand all applicable fees.

Interest Rate Calculation Methods

Citizens Bank’s interest rate calculation method typically uses a simple interest calculation for the majority of their student loans. This means interest accrues daily on the outstanding principal balance. The exact method will be detailed in the loan agreement. For example, if a borrower has a $10,000 loan with a 7% annual interest rate, the daily interest accrual would be approximately $0.19 (7%/365 days). This daily interest is added to the principal balance, and subsequent interest calculations are based on the increased balance. Understanding this compounding effect is crucial for managing repayment effectively.

Comparison of Citizens Bank Student Loan Interest Rates by Loan Type

| Loan Type | Fixed Rate Range (Example) | Variable Rate Range (Example) | Notes |

|---|---|---|---|

| Undergraduate | 6.0% – 8.0% | 5.0% – 7.0% | Rates vary based on creditworthiness and other factors. |

| Graduate | 6.5% – 8.5% | 5.5% – 7.5% | Generally higher rates than undergraduate loans. |

| Parent | 7.0% – 9.0% | 6.0% – 8.0% | Rates often reflect the parent’s credit history. |

*Please note: These are example ranges and actual rates will vary depending on the applicant’s creditworthiness, loan amount, and the prevailing market conditions. Always check with Citizens Bank for the most current rates.*

Repayment Options and Plans

Citizens Bank offers a variety of repayment plans for student loans, designed to accommodate different financial situations and budgets. Choosing the right plan is crucial for managing your debt effectively and avoiding delinquency. Understanding the terms and conditions of each plan is essential before making a decision. Factors like your income, loan amount, and interest rate will influence which plan best suits your needs.

The specific repayment plans available and their details might vary depending on the type of student loan (federal or private) and the terms of your loan agreement. It’s always advisable to check directly with Citizens Bank for the most up-to-date information on your loan.

Standard Repayment Plan

This is typically the default repayment plan. Borrowers make fixed monthly payments over a standard 10-year period. The monthly payment amount is calculated based on the loan’s principal balance, interest rate, and loan term. A longer repayment period generally results in lower monthly payments but leads to paying significantly more in interest over the life of the loan.

Example: A $30,000 loan with a 7% interest rate would have an estimated monthly payment of approximately $350 under a standard 10-year plan. The total interest paid would be approximately $12,000. A $10,000 loan with a 5% interest rate would have an estimated monthly payment of approximately $106.

Extended Repayment Plan

This plan allows borrowers to extend the repayment period beyond the standard 10 years, resulting in lower monthly payments. However, the trade-off is that you’ll pay substantially more in interest over the life of the loan. Citizens Bank may offer extended repayment plans up to 25 years depending on the loan type and amount.

Example: The same $30,000 loan with a 7% interest rate, extended to a 25-year repayment period, might result in a monthly payment of around $200. However, the total interest paid would likely exceed $25,000.

Graduated Repayment Plan

With this plan, monthly payments start low and gradually increase over time. This can be helpful for borrowers who anticipate their income will rise over the repayment period. While the initial payments are manageable, they become progressively larger, potentially becoming burdensome later on.

Example: A graduated repayment plan for a $20,000 loan at 6% interest might start with monthly payments around $150 and increase to approximately $300 by the end of the repayment period. The exact increase schedule would be defined in the loan agreement.

Income-Driven Repayment Plan (if applicable)

Some student loans may qualify for income-driven repayment plans. These plans tie your monthly payments to your income and family size. If your income is low, your monthly payments may be significantly reduced or even $0. However, the remaining loan balance may be forgiven after a specific period (typically 20 or 25 years), but this forgiveness is considered taxable income. The availability of income-driven repayment plans depends on the type of loan and Citizens Bank’s specific offerings. This plan is usually not available for private loans.

Example: A borrower with a low income and a $40,000 loan might have a monthly payment significantly lower than the standard repayment plan, possibly even $0 in some months, depending on income and family size. However, they would need to consult Citizens Bank for specific plan eligibility and details.

Repayment Plan Summary

The following is a summary of the key features of each repayment plan. Remember to consult Citizens Bank directly for the most accurate and up-to-date information regarding your specific loan.

- Standard Repayment: Fixed monthly payments over 10 years. Lowest total interest paid but highest monthly payments.

- Extended Repayment: Fixed monthly payments over a longer period (up to 25 years). Lower monthly payments but significantly higher total interest paid.

- Graduated Repayment: Payments start low and gradually increase. May be suitable for those expecting income growth, but payments increase substantially over time.

- Income-Driven Repayment (if applicable): Payments based on income and family size. Lower monthly payments, but potential for loan forgiveness (taxable) after a set period.

Customer Service and Support

Citizens Bank offers various channels for student loan borrowers to access customer service and support. Understanding these options and the typical response times is crucial for a positive borrowing experience. Effective communication with the lender can prevent misunderstandings and ensure timely resolution of any issues.

Citizens Bank provides customer support through several channels, each with its own advantages and disadvantages. The effectiveness of each channel can vary depending on the complexity of the issue and the time of day.

Available Customer Service Channels

Citizens Bank aims to provide comprehensive support through phone, email, and an online portal. The phone line offers immediate assistance for urgent matters, while email allows for detailed inquiries that may require documentation. The online portal provides 24/7 access to account information and allows for secure messaging.

Response Times and Effectiveness of Customer Support

Response times can vary significantly depending on the chosen method and the volume of inquiries. Phone calls typically receive immediate attention, although wait times may increase during peak hours. Email responses usually take a few business days, while the online portal messaging system provides a relatively quick response time, often within 24-48 hours. The effectiveness of the support is generally considered good, with many borrowers reporting positive experiences resolving their queries. However, anecdotal evidence suggests that complex issues may require multiple interactions.

Common Complaints and Issues Regarding Customer Service

While many borrowers express satisfaction with Citizens Bank’s customer service, some common complaints include long wait times on the phone, difficulties navigating the online portal, and occasional delays in email responses. Some borrowers also report inconsistent experiences across different customer service representatives. These issues highlight the importance of clear communication and efficient processes for improved customer satisfaction.

Hypothetical Scenarios Illustrating Customer Service Interactions

Positive Interaction

Imagine Sarah, a Citizens Bank student loan borrower, experiencing difficulty understanding her repayment options. She contacts customer service via the online portal. Within 24 hours, a representative responds, providing a clear explanation of her repayment plans and answering all her questions thoroughly. The representative even proactively suggests a plan that aligns with her current financial situation. Sarah feels heard and supported, leaving her satisfied with the interaction.

Negative Interaction

Consider David, another borrower, who attempts to resolve a billing discrepancy via phone. He experiences a lengthy wait time, only to be connected to a representative who is unable to fully address his concern. The representative provides limited information and offers no concrete solution, leaving David frustrated and unresolved. This negative interaction underscores the importance of efficient call routing and well-trained customer service representatives.

Loan Application and Approval Process

Applying for a Citizens Bank student loan involves a straightforward process, but understanding the steps and required documentation is crucial for a smooth application. This section details the application process, required information, evaluation factors, and provides a visual representation of the process flow.

Applying for a Citizens Bank student loan typically begins online through their website. The application process requires providing accurate and complete information to ensure timely processing. Citizens Bank, like other lenders, uses a multi-step process to assess creditworthiness and determine loan eligibility.

Required Documentation and Information

Applicants will need to provide personal information, including their Social Security number, date of birth, and contact details. Academic information is also necessary, such as the name of the school, enrollment status, and expected graduation date. Finally, financial information, including income details (if applicable), and existing debt obligations, may be requested to assess the applicant’s ability to repay the loan. Citizens Bank may also require tax returns or proof of income for verification purposes.

Factors Considered in Loan Application Evaluation

Citizens Bank considers several key factors when evaluating student loan applications. These factors include credit history (if applicable), debt-to-income ratio, academic performance, and the applicant’s ability to repay the loan. A strong academic record and a low debt-to-income ratio typically improve the chances of loan approval. The type of loan applied for (e.g., federal vs. private) and the loan amount requested also play a role in the decision-making process. Applicants with a history of missed payments or defaults on other loans may face difficulties in securing a loan.

Loan Application and Approval Process Flowchart

Imagine a flowchart with the following steps:

1. Application Submission: The applicant completes the online application form and submits it along with the required documents.

2. Application Review: Citizens Bank reviews the submitted application and supporting documentation for completeness and accuracy.

3. Credit Check (if applicable): A credit check may be performed to assess the applicant’s creditworthiness.

4. Verification: Citizens Bank may contact the applicant or their school to verify information provided in the application.

5. Loan Approval/Denial: Based on the review, Citizens Bank approves or denies the loan application.

6. Loan Agreement: If approved, the applicant receives a loan agreement outlining the terms and conditions of the loan.

7. Loan Disbursement: Once the agreement is signed, Citizens Bank disburses the loan funds directly to the educational institution.

This flowchart illustrates the typical process; however, individual experiences may vary slightly. The time it takes to process an application can also vary depending on several factors.

Borrower Reviews and Experiences

Understanding borrower experiences is crucial for prospective students considering Citizens Bank student loans. Online reviews offer a valuable, albeit subjective, insight into the overall borrower satisfaction and potential challenges associated with the loan process and repayment. Analyzing these reviews provides a more comprehensive picture than relying solely on official bank information.

Online reviews of Citizens Bank student loans reveal a mixed bag of experiences. While many borrowers report positive interactions and smooth loan processes, others express frustration with specific aspects of the service. The common themes emerging from these reviews offer a nuanced perspective that prospective borrowers should consider.

Positive Borrower Experiences

Many positive reviews highlight Citizens Bank’s competitive interest rates and flexible repayment options as key advantages. Borrowers frequently praise the straightforward application process, reporting a relatively quick and easy approval process compared to other lenders. Several reviews mention the helpfulness and responsiveness of customer service representatives in addressing questions and resolving issues. For example, one borrower described their experience as “seamless from application to repayment,” emphasizing the ease of managing their loan online. Another praised the bank’s proactive communication regarding payment deadlines and upcoming changes to their loan terms.

Negative Borrower Experiences

Conversely, some negative reviews cite difficulties in contacting customer service, experiencing long wait times or receiving unhelpful responses. There are also reports of unexpected fees or changes in loan terms that caused financial strain for some borrowers. A recurring complaint concerns the lack of transparency regarding certain fees or the complexities of understanding specific repayment plan options. One review detailed a frustrating experience trying to understand the implications of deferment, while another mentioned hidden fees that weren’t clearly explained during the application process.

Comparison of Experiences Across Loan Types and Repayment Plans

While reviews don’t consistently categorize experiences by specific loan type or repayment plan, a general trend suggests that borrowers with federal loans often report smoother experiences due to established regulatory protections and established repayment guidelines. Those with private loans, which are offered by Citizens Bank, sometimes report more difficulties navigating the repayment process and dealing with potential interest rate fluctuations. The complexity of income-driven repayment plans also appears to contribute to negative reviews, highlighting the need for clear and concise communication from the bank regarding these options.

Influence of Borrower Reviews on Applicant Decisions

Borrower reviews significantly influence prospective applicants’ decisions. Negative reviews, particularly those highlighting poor customer service or unexpected fees, can deter potential borrowers from choosing Citizens Bank. Conversely, positive reviews emphasizing competitive rates, easy application processes, and helpful customer support can encourage applicants. The weight given to online reviews varies, of course, but they represent a valuable source of information that complements official bank materials and allows prospective borrowers to make informed decisions based on real-world experiences. For example, a prospective student might be swayed away from Citizens Bank if numerous reviews describe difficulties in reaching customer service, especially if prompt communication is a high priority for them.

Comparison with Competitors

Choosing a student loan lender requires careful consideration of various factors. This section compares Citizens Bank’s student loan offerings with those of two other major lenders: Sallie Mae and Discover. While specific rates and fees are subject to change, this comparison highlights key differences to aid in your decision-making process.

Key Differences in Student Loan Offerings

This comparison focuses on interest rates, fees, and repayment options, three crucial aspects for borrowers. The information presented here is based on publicly available data and may not reflect all possible scenarios or individual experiences.

| Feature | Citizens Bank | Sallie Mae | Discover |

|---|---|---|---|

| Interest Rates (Variable) | Rates vary based on creditworthiness and loan type. Expect a range, for example, from 4% to 10% for undergraduate loans. Specific rates are available on their website. | Rates are competitive and vary based on creditworthiness and loan type. Expect a similar range to Citizens Bank. | Discover typically offers competitive variable rates, also influenced by creditworthiness and loan type, similar to the other lenders. |

| Origination Fees | Citizens Bank may charge origination fees, the percentage of which will depend on the loan type and borrower’s profile. Check their website for the most current information. | Sallie Mae may also charge origination fees, the exact amount varying by loan type and borrower qualifications. | Discover may charge origination fees, similar to the other lenders, with the amount determined by factors such as the loan amount and the borrower’s credit history. |

| Repayment Options | Citizens Bank offers standard repayment plans, including graduated and extended repayment options. Specific plans available will depend on the loan type and amount. | Sallie Mae provides a variety of repayment plans, such as graduated, extended, and income-driven repayment, to suit different financial situations. | Discover offers a range of repayment options, potentially including income-driven plans and options for borrowers with various financial circumstances. |

Customer Service and Support Variations

Each lender provides customer support through various channels, such as phone, email, and online resources. However, the responsiveness and helpfulness of customer service can vary significantly based on individual experiences. Citizens Bank, Sallie Mae, and Discover each have online help centers and customer service phone numbers. While all aim for high levels of customer satisfaction, the actual experience may differ. For example, one lender might have shorter wait times on the phone, or a more intuitive online help center than another. Checking online reviews can provide insight into the customer service experiences of previous borrowers with each lender.

Potential Challenges and Risks

Taking out student loans, even from a reputable institution like Citizens Bank, involves inherent risks and potential challenges. Borrowers should carefully consider these factors before committing to a loan to avoid unforeseen financial difficulties. Understanding these potential pitfalls allows for proactive mitigation strategies, ensuring a smoother repayment journey.

Borrowers may encounter several difficulties throughout the life cycle of their Citizens Bank student loan. These challenges can stem from various factors, including interest rates, repayment options, and personal circumstances.

High Interest Rates and Increasing Loan Balances

Citizens Bank student loan interest rates, like those of other lenders, can fluctuate depending on market conditions and the borrower’s creditworthiness. High interest rates can significantly increase the total cost of the loan over time, leading to a larger overall debt burden. For example, a borrower with a high interest rate might find their loan balance increasing substantially even with consistent monthly payments, potentially delaying their ability to pay off the loan completely. This is especially true if the interest rate is variable, meaning it can change over the life of the loan, leading to unpredictable monthly payments.

Difficulty Managing Repayment

Repayment plans offered by Citizens Bank, while potentially flexible, may not always align perfectly with a borrower’s financial situation. Unexpected life events, such as job loss or illness, can severely impact a borrower’s ability to meet their monthly payment obligations. For instance, a recent graduate might find themselves struggling to manage their student loan payments alongside the costs of living and unexpected expenses. Failure to manage repayments effectively can lead to delinquency, negatively impacting credit scores and potentially leading to default.

Loan Default and its Consequences

Defaulting on a Citizens Bank student loan can have severe consequences. Default occurs when a borrower fails to make payments for an extended period. This can result in damaged credit scores, wage garnishment, and even legal action. The impact of default extends beyond immediate financial repercussions; it can also hinder future opportunities, such as obtaining new loans or securing favorable employment. For example, a borrower who defaults on their student loans may struggle to qualify for a mortgage or car loan in the future.

Strategies for Mitigating Risks

To mitigate the risks associated with Citizens Bank student loans, borrowers should carefully budget and plan for repayment. Creating a realistic budget that accounts for all expenses, including student loan payments, is crucial. Exploring various repayment options offered by Citizens Bank, such as income-driven repayment plans, can help manage monthly payments based on income levels. Furthermore, maintaining open communication with Citizens Bank regarding any financial difficulties is vital to potentially negotiate alternative repayment arrangements and avoid default. Finally, proactively seeking financial counseling can provide valuable guidance in managing student loan debt effectively.

Conclusion

Ultimately, the decision of whether or not to choose Citizens Bank for your student loans rests on your individual circumstances and priorities. Carefully weigh the pros and cons presented in this review, considering factors such as interest rates, repayment flexibility, and the quality of customer service. Remember to thoroughly research all available options and compare them before making a final commitment. By doing so, you can confidently select a student loan lender that best aligns with your financial goals and long-term well-being.

General Inquiries

What is the Citizens Bank student loan pre-approval process like?

The pre-approval process typically involves providing basic personal and financial information. This allows you to get an estimate of your potential loan amount and interest rate without a formal application.

Does Citizens Bank offer loan forgiveness programs?

Citizens Bank does not directly offer loan forgiveness programs. However, borrowers may be eligible for federal loan forgiveness programs depending on their employment and other factors.

Can I refinance my existing student loans with Citizens Bank?

Citizens Bank may offer student loan refinancing options. Check their website or contact them directly for current offerings and eligibility requirements.

What happens if I miss a student loan payment with Citizens Bank?

Missing a payment will likely result in late fees and negatively impact your credit score. Contact Citizens Bank immediately if you anticipate difficulty making a payment to explore possible solutions.