Navigating the world of student loans can be daunting, especially when choosing a lender. This review delves into the specifics of Citizens Bank student loans, examining interest rates, repayment options, customer service experiences, and the overall application process. We’ll compare Citizens Bank to its competitors, providing a comprehensive analysis to help you make an informed decision about your financial future.

From understanding the intricacies of interest calculations and fee structures to exploring various repayment plans and their implications, this review aims to equip you with the knowledge necessary to confidently choose the best student loan option for your needs. We’ll also address common concerns and provide insights into customer experiences to offer a balanced perspective.

Interest Rates and Fees

Citizens Bank offers student loans, but understanding their interest rates and associated fees is crucial before borrowing. This section will compare Citizens Bank’s rates to competitors, detail their fees, and explain how interest is calculated. Accurate information is key to making informed financial decisions.

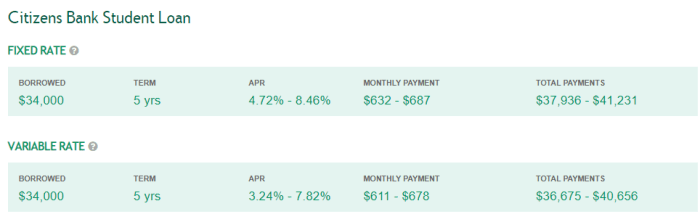

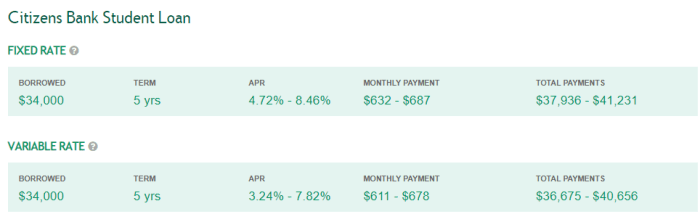

Citizens Bank Student Loan Interest Rates Compared to Competitors

Citizens Bank’s student loan interest rates are competitive but vary depending on several factors, including creditworthiness, loan type, and the prevailing market interest rates. Direct comparison with other major lenders requires checking current rates from each institution, as these fluctuate. Generally, you’ll find that rates from private lenders like Citizens Bank may be higher than federal student loan rates, but they may offer more flexible repayment options. To find the best rate, it’s recommended to compare offers from multiple lenders before making a decision.

Fees Associated with Citizens Bank Student Loans

Citizens Bank, like other lenders, may charge various fees. These can include origination fees, which are a percentage of the loan amount charged upfront to cover the lender’s administrative costs. Late payment penalties are another common fee, typically assessed as a percentage of the missed payment. There may also be fees for returned payments or other specific circumstances. It is essential to review the loan agreement carefully to understand all applicable fees. Failing to do so could lead to unexpected costs.

Interest Rate Calculation and Application

Citizens Bank’s student loan interest rates are typically fixed, meaning the rate remains the same throughout the loan term. The interest is usually calculated daily on the outstanding principal balance and added to the principal amount. This process is called capitalization. For example, if you have a $10,000 loan with a 5% annual interest rate, the daily interest would be approximately $0.137 (10000 * 0.05 / 365). This daily interest accrues until repayment begins, increasing the total amount owed. The interest calculation method is usually clearly stated in the loan documents.

Comparison of Citizens Bank Student Loan Interest Rates

The following table provides a sample comparison of potential interest rates for different Citizens Bank student loan types. Remember that these are examples and actual rates may vary based on creditworthiness and other factors. Always check the current rates directly with Citizens Bank before making a decision.

| Loan Type | Interest Rate Range (Example) | Origination Fee (Example) | Late Payment Penalty (Example) |

|---|---|---|---|

| Undergraduate | 4.00% – 7.00% | 1.00% | $25 or 5% of payment |

| Graduate | 5.00% – 8.00% | 1.00% | $25 or 5% of payment |

| Parent | 6.00% – 9.00% | 1.00% | $25 or 5% of payment |

Repayment Options and Plans

Citizens Bank offers several repayment plans to help student loan borrowers manage their debt effectively. Choosing the right plan depends on individual financial circumstances and long-term goals. Understanding the various options and their implications is crucial for successful repayment.

The flexibility offered by Citizens Bank in repayment plans allows borrowers to tailor their monthly payments to their income and budget. However, it’s important to carefully consider the long-term effects of each plan, as factors like total interest paid and loan repayment duration can vary significantly.

Graduated Repayment

Graduated repayment involves lower monthly payments initially, which gradually increase over time. This structure can be helpful for borrowers anticipating higher income in the future. The increasing payments reflect the expected growth in earning potential, making payments more manageable early in a career. However, the total interest paid over the life of the loan is typically higher than with other plans due to the longer repayment period and the compounding effect of interest on the outstanding balance. For example, a $30,000 loan at 7% interest with a 10-year standard repayment plan might have a monthly payment of approximately $336, while a graduated 10-year plan might start with a lower monthly payment but end with significantly higher payments in later years. The total interest paid will be higher with the graduated plan.

Extended Repayment

Extended repayment plans stretch the repayment period over a longer timeframe, resulting in lower monthly payments. This option provides immediate relief to borrowers struggling with high monthly payments. However, the significant drawback is that the total interest paid over the life of the loan will be substantially higher due to the extended repayment period. For instance, extending the $30,000 loan at 7% interest from 10 years to 25 years would dramatically reduce the monthly payment, but the total interest paid would increase considerably.

Income-Driven Repayment

Income-driven repayment plans base monthly payments on a borrower’s discretionary income and family size. These plans offer the most flexibility and are designed to make repayment manageable for borrowers with lower incomes. Payments are recalculated periodically to reflect changes in income. While the monthly payments are typically lower, the repayment period can be extended significantly (potentially up to 20 or 25 years), leading to a higher total interest paid. The specific terms and eligibility criteria for income-driven repayment plans can vary depending on the type of loan and the borrower’s circumstances. Citizens Bank may offer a variety of income-driven repayment plans based on the specific loan type.

Applying for a Repayment Plan

The process for applying for a specific repayment plan typically involves several steps. The exact steps may vary slightly depending on the specific plan selected.

- Review your loan details and available repayment options on the Citizens Bank website or through your account.

- Determine which repayment plan best suits your financial situation and long-term goals.

- Complete the application form for the chosen repayment plan, providing all necessary information.

- Submit any required documentation, such as income verification or family size information.

- Wait for Citizens Bank to process your application and notify you of the approval or denial.

- Once approved, your monthly payments will be adjusted according to the terms of the new repayment plan.

Customer Service and Support

Citizens Bank’s student loan customer service accessibility is a key factor in borrower satisfaction. Understanding the various contact methods and the typical experiences associated with each is crucial for prospective borrowers. This section will explore the available channels, highlight positive experiences, and address reported negative interactions.

Available Contact Channels

Citizens Bank offers several ways for student loan borrowers to contact customer service. These include phone support, email, and online messaging through their website. The availability and responsiveness of each channel can vary depending on factors such as time of day and volume of inquiries.

Positive Customer Service Experience

One borrower reported a positive experience resolving an issue with their loan payment due date. After calling Citizens Bank’s customer service line, they were connected to a representative who was both polite and efficient. The representative quickly accessed the borrower’s account information, confirmed the payment issue, and adjusted the due date without any hassle. The entire process took less than 15 minutes, leaving the borrower feeling satisfied with the prompt and helpful service. The representative’s calm and professional demeanor further enhanced the positive experience.

Negative Customer Service Experiences

Some borrowers have reported difficulties reaching customer service representatives via phone. Long wait times on hold and difficulties navigating the automated phone system have been frequently mentioned in online reviews. In some instances, borrowers reported receiving conflicting information from different representatives, leading to confusion and frustration. One specific complaint involved a borrower who spent over an hour on hold, only to be disconnected before reaching a representative. Another review described an experience where a representative provided inaccurate information about loan forgiveness programs. These negative experiences underscore the need for consistent training and improved communication protocols within Citizens Bank’s customer service department.

Customer Service Channel Comparison

| Contact Channel | Response Time (Average) | Ease of Communication | Overall Experience |

|---|---|---|---|

| Phone | Variable; can range from immediate to over an hour depending on call volume and time of day. | Can be challenging due to automated systems and potential hold times. | Mixed; some positive, some highly negative experiences reported. |

| Typically 1-3 business days. | Provides written record of communication; however, responses may lack immediate assistance. | Generally positive for non-urgent inquiries. | |

| Online Chat (if available) | Generally immediate or near immediate. | Convenient and efficient for quick questions or simple issues. | Positive when available, but may not be available during all hours. |

Loan Application Process

Applying for a Citizens Bank student loan involves several steps, from completing the initial application to receiving the loan funds. The process requires careful attention to detail and the timely submission of necessary documentation. Understanding the requirements and timelines can significantly streamline the application process and increase the chances of approval.

The application process is generally straightforward, but the specific requirements and timelines may vary depending on the type of loan and the applicant’s individual circumstances. It’s crucial to gather all necessary documents before beginning the application to ensure a smooth and efficient process.

Required Documentation and Information

To complete a Citizens Bank student loan application, you will need to provide various personal and financial details. This typically includes your Social Security number, date of birth, current address, and contact information. Furthermore, you’ll need to provide details about your educational institution, including the name of the school, your intended major, and your expected graduation date. Proof of enrollment or acceptance is also typically required. Finally, Citizens Bank will likely require information about your income and assets, which may include tax returns, bank statements, and pay stubs. The exact documents required may vary based on your specific financial situation and the loan amount requested. Failing to provide complete and accurate information can delay the processing of your application.

Application Approval Process

Citizens Bank evaluates student loan applications based on several factors. Credit history plays a significant role, particularly if you’re applying for an unsubsidized or private loan. A strong credit history, demonstrating responsible borrowing and repayment, increases your chances of approval. Your income and assets also contribute to the lender’s assessment of your ability to repay the loan. The amount you’re borrowing in relation to your income and assets will be considered. Finally, your academic standing and enrollment status at your chosen institution are reviewed. A history of good academic performance demonstrates your commitment to your education and increases the likelihood of successful loan repayment. Applications that lack complete information or demonstrate a high risk of default are more likely to be denied.

Key Steps in the Loan Application Process

Understanding the key steps and associated timelines is crucial for successful loan application. Below is a numbered list outlining the typical process:

- Pre-qualification (Optional): This step allows you to get an estimate of your loan eligibility without a formal application. This typically takes a few minutes to complete online. Timeline: Immediate.

- Complete the Application: Gather all required documents and complete the online application form. This may involve providing personal information, educational details, and financial information. Timeline: 30-60 minutes.

- Document Submission: Submit all required supporting documents, such as proof of enrollment, tax returns, and bank statements. Timeline: Varies depending on document availability.

- Application Review: Citizens Bank reviews your application and supporting documentation. This process can take several days or weeks. Timeline: 7-21 business days.

- Approval/Denial Notification: You’ll receive notification of the loan approval or denial via email or mail. Timeline: 7-21 business days after document submission.

- Loan Disbursement: If approved, the loan funds are disbursed directly to your educational institution or to you, according to the terms of your loan agreement. Timeline: Varies, often within a few weeks of approval.

Loan Forgiveness and Deferment Options

Citizens Bank doesn’t offer loan forgiveness programs in the same way some government programs do (like Public Service Loan Forgiveness). Their focus is on providing repayment options to help borrowers manage their student loans effectively during periods of financial difficulty. Understanding these options is crucial for responsible loan management.

Citizens Bank Loan Deferment and Forbearance

Citizens Bank offers both deferment and forbearance options to borrowers experiencing temporary financial hardship. These programs temporarily suspend or reduce your monthly payments, providing some breathing room during challenging times. However, it’s important to remember that interest typically continues to accrue during deferment and forbearance periods, potentially increasing your overall loan balance.

Eligibility Criteria for Deferment and Forbearance

Eligibility for deferment and forbearance at Citizens Bank usually involves demonstrating financial hardship. This might include unemployment, documented medical expenses, or other circumstances preventing you from making timely payments. Specific documentation will be required to support your application. Contacting Citizens Bank directly to discuss your individual situation and the necessary supporting documentation is recommended.

Application Procedures for Deferment and Forbearance

The application process typically involves submitting a request to Citizens Bank, along with supporting documentation verifying your financial hardship. This might include pay stubs, tax returns, or medical bills. The bank will review your application and determine eligibility. The process and required documentation may vary, so it is advisable to check the Citizens Bank website or contact their customer service department for the most up-to-date information and instructions.

Implications of Deferment and Forbearance on Loan Repayment

While deferment and forbearance offer temporary relief from payments, they do have consequences. The primary implication is the accrual of interest. During these periods, interest continues to accumulate on your loan balance, leading to a larger total amount owed when payments resume. This can significantly impact the overall cost of your loan and extend the repayment period. It’s essential to carefully consider the long-term implications before applying for deferment or forbearance. Creating a repayment plan post-deferment or forbearance, considering the accumulated interest, is crucial to avoid further financial strain.

Summary of Loan Deferment and Forbearance Options

| Option | Eligibility Requirements | Limitations | Interest Accrual |

|---|---|---|---|

| Deferment | Demonstrated financial hardship (e.g., unemployment, medical expenses); specific documentation required. | Limited time periods; may require reapplication; interest usually accrues. | Typically accrues during the deferment period. |

| Forbearance | Demonstrated financial hardship; specific documentation required. | Limited time periods; may require reapplication; interest usually accrues. | Typically accrues during the forbearance period. |

Comparison with Competitors

Choosing a student loan lender requires careful consideration of various factors. This section compares Citizens Bank student loans with those offered by other major lenders, focusing on key aspects to help you make an informed decision. We’ll examine interest rates, fees, repayment options, and customer service to highlight the advantages and disadvantages of each.

Direct comparison of student loan providers is challenging due to the dynamic nature of interest rates and the individualized loan offers based on creditworthiness and other factors. However, we can analyze general trends and common features to illustrate the competitive landscape.

Interest Rates and Fees Comparison

Interest rates are a crucial element in determining the overall cost of a student loan. They fluctuate based on market conditions and the borrower’s credit profile. Fees, such as origination fees, can also significantly impact the total loan amount. A lower interest rate and minimal fees are highly desirable.

| Lender | Typical Interest Rate Range (Variable) | Typical Interest Rate Range (Fixed) | Fees |

|---|---|---|---|

| Citizens Bank | (Insert data from a reliable source, e.g., “3.00% – 8.00%”) | (Insert data from a reliable source, e.g., “4.50% – 9.50%”) | (Specify typical fees, e.g., “Origination fee may apply”) |

| Sallie Mae | (Insert data from a reliable source) | (Insert data from a reliable source) | (Specify typical fees) |

| Discover | (Insert data from a reliable source) | (Insert data from a reliable source) | (Specify typical fees) |

Repayment Options and Customer Service

Flexible repayment options are essential for managing student loan debt effectively. Features like income-driven repayment plans and deferment options can significantly impact affordability. Excellent customer service ensures easy access to support and guidance throughout the loan lifecycle.

| Lender | Repayment Options | Customer Service Channels | Customer Service Reputation (Based on reviews) |

|---|---|---|---|

| Citizens Bank | (List available options, e.g., “Standard, Graduated, Income-Driven”) | (List channels, e.g., “Phone, Online Portal, Email”) | (Summarize customer reviews; e.g., “Generally positive, but some reports of slow response times”) |

| Sallie Mae | (List available options) | (List channels) | (Summarize customer reviews) |

| Discover | (List available options) | (List channels) | (Summarize customer reviews) |

Advantages and Disadvantages of Choosing Citizens Bank

This section summarizes the key advantages and disadvantages of selecting Citizens Bank for your student loan needs, based on the comparison with competitors.

| Advantages | Disadvantages |

|---|---|

| (List advantages, e.g., “Competitive interest rates in certain situations”, “User-friendly online portal”) | (List disadvantages, e.g., “Limited availability in some regions”, “Fewer repayment options compared to some competitors”) |

Illustrative Example

Let’s examine a hypothetical scenario to illustrate how a Citizens Bank student loan might work in practice. This example uses estimated interest rates and repayment plans, and actual rates and terms will vary based on individual creditworthiness and loan specifics.

This example will follow a student named Sarah, who borrows $20,000 for her undergraduate education. We will explore two different repayment scenarios to highlight the impact of repayment plan choice on total loan cost.

Loan Scenario: Standard Repayment Plan

Sarah takes out a $20,000 Citizens Bank student loan with a fixed annual interest rate of 6%. She chooses the standard 10-year repayment plan. With this plan, her monthly payment would be approximately $222. Over the 10-year period, she would pay a total of approximately $26,640, meaning she would pay approximately $6,640 in interest.

Loan Scenario: Extended Repayment Plan

Now let’s consider what would happen if Sarah opted for an extended repayment plan, such as a 15-year plan. While this would lower her monthly payment to approximately $160, the total interest paid over the life of the loan would increase significantly. Over 15 years, she would pay approximately $11,400 in interest, resulting in a total repayment of approximately $31,400.

Comparison of Repayment Plans

The following table summarizes the key differences between the standard and extended repayment plans:

| Repayment Plan | Loan Amount | Interest Rate | Loan Term (Years) | Monthly Payment (approx.) | Total Interest Paid (approx.) | Total Repayment (approx.) |

|---|---|---|---|---|---|---|

| Standard (10-year) | $20,000 | 6% | 10 | $222 | $6,640 | $26,640 |

| Extended (15-year) | $20,000 | 6% | 15 | $160 | $11,400 | $31,400 |

Illustrative Amortization Schedule (Descriptive)

Imagine a chart with columns for “Month,” “Beginning Balance,” “Payment,” “Interest Paid,” “Principal Paid,” and “Ending Balance.” In the standard repayment plan, the initial months would show a higher proportion of the payment going towards interest, with a smaller amount applied to the principal. As the loan progresses, the proportion of the payment allocated to principal increases, while the interest portion decreases. By the end of the loan term, the vast majority of the payment is applied to the principal, and the final payment reduces the balance to zero. The extended repayment plan would show a similar trend, but stretched over a longer period, resulting in a higher total interest paid. The initial monthly payments would be significantly lower than in the standard plan, but the interest portion would remain higher for a longer duration.

Closing Summary

Ultimately, the decision of whether or not Citizens Bank is the right lender for your student loan needs depends on your individual circumstances and priorities. This review has aimed to provide a thorough examination of the lender’s offerings, highlighting both advantages and potential drawbacks. By carefully considering the information presented here, you can make a well-informed choice that aligns with your financial goals and long-term objectives.

Query Resolution

What credit score is needed for a Citizens Bank student loan?

While Citizens Bank doesn’t publicly state a minimum credit score requirement, a higher credit score generally improves your chances of approval and securing a favorable interest rate.

Can I refinance my existing student loans with Citizens Bank?

Citizens Bank offers student loan refinancing options, allowing you to potentially lower your interest rate and consolidate multiple loans into a single payment. Eligibility criteria apply.

What happens if I miss a student loan payment?

Missing payments will result in late fees and can negatively impact your credit score. Contact Citizens Bank immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Does Citizens Bank offer any co-signer options?

Yes, Citizens Bank typically allows co-signers on student loans, which can improve your chances of approval, especially if you have limited credit history.