The student loan crisis is a dominant force in the American economy, and CNBC, a prominent financial news network, has dedicated significant airtime to covering this pervasive issue. Their reporting offers valuable insights into the complexities of student debt, from the personal struggles of borrowers to the broader policy implications. This analysis examines CNBC’s coverage, exploring its impact on public perception, policy debates, and the behavior of those grappling with student loan repayment.

We delve into the recurring themes highlighted by CNBC, analyzing their presentation of statistics, interviews with key experts, and comparisons with other major news outlets. The goal is to understand not only what CNBC reports but also how their reporting shapes the national conversation and influences both individual decisions and broader policy discussions surrounding student loan debt.

CNBC’s Coverage of Student Loan Issues

CNBC, a prominent business news network, provides consistent coverage of the student loan crisis, focusing primarily on the economic and financial implications for borrowers and the broader economy. Their reporting often blends macroeconomic analysis with personal stories, offering a multifaceted view of the issue.

Summary of CNBC’s Recent Reporting on Student Loan Debt and Repayment

CNBC’s recent reporting has highlighted the ongoing challenges faced by student loan borrowers, particularly in the context of rising interest rates and the expiration of pandemic-era payment pauses. Their coverage frequently features interviews with financial experts, policymakers, and borrowers themselves, offering diverse perspectives on the best strategies for managing student loan debt and navigating the complexities of repayment plans. Articles often delve into the potential economic consequences of widespread loan forgiveness or the impact of various repayment options on individual borrowers’ financial well-being. Specific examples of recent reporting would include articles analyzing the impact of interest rate hikes on monthly payments, exploring the effectiveness of income-driven repayment plans, and profiling borrowers struggling to manage their debt.

Three Recurring Themes in CNBC’s Student Loan Coverage

Three prominent themes consistently emerge in CNBC’s student loan coverage over the past year: the economic burden of student loan debt on individuals and the economy as a whole; the efficacy and accessibility of different repayment plans; and the ongoing political debate surrounding student loan forgiveness. The economic burden is often illustrated through data showing the increasing levels of student loan debt and its impact on homeownership, savings, and other major financial milestones. The discussion of repayment plans explores the complexities of various programs and their suitability for different borrowers, often highlighting the need for greater transparency and simpler application processes. Finally, the political debate surrounding forgiveness is presented by examining the arguments for and against the policy, its potential economic impact, and the various legislative proposals put forward.

Comparison of CNBC’s Student Loan Forgiveness Reporting with Other Major News Outlets

While CNBC, like other major news outlets such as the New York Times and the Wall Street Journal, covers the political and economic aspects of student loan forgiveness, CNBC’s focus tends to lean more heavily towards the financial implications for both borrowers and the government. For example, CNBC might analyze the potential impact on the national debt or the effect on the banking sector more extensively than other outlets. The New York Times, in contrast, might place greater emphasis on the social and political dimensions, focusing on the impact on different demographic groups and the broader political implications. The Wall Street Journal’s coverage, similar to CNBC’s, emphasizes the economic ramifications but may also include more detailed analysis of the legal challenges surrounding forgiveness programs.

Timeline of Significant Student Loan-Related Events Covered by CNBC

A timeline of significant student loan-related events covered by CNBC would include: the various extensions of the pandemic-era payment pause; the Supreme Court’s decision on the Biden administration’s forgiveness plan; the subsequent announcements regarding alternative repayment plans and strategies; and the ongoing Congressional debates on future legislative action concerning student loan debt. Each of these events would have been analyzed by CNBC through the lens of its economic impact, the effects on borrowers, and the political maneuvering surrounding the issue.

Impact of CNBC’s Reporting on Student Loan Borrowers

CNBC’s extensive coverage of student loan debt significantly influences the behavior and perceptions of borrowers and the broader public. Its reporting, given its reach and perceived authority, shapes individual financial decisions, public discourse on student loan policies, and ultimately, the national conversation surrounding this critical issue. The network’s impact is multifaceted, encompassing both positive and potentially negative consequences.

CNBC’s reporting may influence borrower behavior in several ways. For example, detailed reports on refinancing options could empower borrowers to actively seek lower interest rates, potentially saving them thousands of dollars over the life of their loans. Conversely, coverage emphasizing the severity of the debt crisis might lead to increased anxiety and feelings of helplessness among borrowers, potentially delaying their efforts to address their debt. The framing of the information – highlighting solutions versus problems – plays a crucial role in shaping borrower responses.

CNBC’s Influence on Public Opinion Regarding Student Loan Policies

CNBC’s reporting significantly impacts public opinion by framing the debate surrounding student loan policies. By presenting diverse perspectives from economists, policymakers, and borrowers themselves, CNBC can contribute to a more nuanced understanding of the complexities involved. However, the selection of interviewees and the emphasis placed on certain aspects of the issue can subtly shape public perception. For instance, focusing heavily on the economic burden of student loan debt might sway public opinion toward supporting debt forgiveness or reform initiatives, while emphasizing the responsibility of borrowers might lead to a different outcome. The network’s choice of narratives and the tone of its reporting directly impacts how viewers understand and react to the student loan crisis.

Examples of CNBC’s Impact on the National Conversation

CNBC’s coverage has frequently featured prominent figures in the student loan debate, including government officials, economists, and representatives from student advocacy groups. These interviews and analyses have helped to bring critical issues, such as the rising cost of higher education and the effectiveness of existing repayment plans, to the forefront of the national conversation. For example, CNBC’s reporting on the pause of student loan payments during the COVID-19 pandemic played a significant role in shaping public discourse around the need for government intervention in this area. The network’s coverage of specific legislative proposals and their potential impact on borrowers has also influenced the political debate surrounding student loan reform.

Potential Biases in CNBC’s Student Loan Reporting

While CNBC strives for objectivity, inherent biases can subtly influence its reporting. As a business news network, its focus often centers on the economic aspects of the student loan crisis, potentially overlooking the social and equity implications. The selection of experts and the framing of stories might inadvertently favor certain viewpoints, such as those emphasizing market-based solutions over government intervention. Furthermore, the network’s reliance on data and statistics can sometimes overshadow the lived experiences of individual borrowers, potentially minimizing the human cost of student loan debt. A critical analysis of CNBC’s reporting requires careful consideration of these potential biases.

CNBC’s Interviews and Expert Opinions on Student Loans

CNBC’s coverage of the student loan crisis frequently incorporates interviews with leading experts in the field of economics, finance, and higher education. These interviews provide diverse perspectives on the causes, consequences, and potential solutions to the growing student debt burden. Analyzing these expert opinions offers valuable insights into the complexities of the issue and helps viewers form a more comprehensive understanding.

Analysis of CNBC’s Featured Student Loan Experts

CNBC regularly features a range of experts to provide insightful commentary on student loan issues. Analyzing their viewpoints reveals a spectrum of opinions on the efficacy of various proposed solutions and the overall impact of student debt on the economy. Three key experts frequently featured are:

| Expert Name | Key Argument | Supporting Evidence | Counterarguments/Alternative Viewpoints |

|---|---|---|---|

| (Expert 1 Name – e.g., Mark Zandi, Chief Economist of Moody’s Analytics) | (Argument Summary – e.g., The current student loan system is unsustainable and requires significant reform, focusing on affordability and debt relief measures. He often emphasizes the macroeconomic consequences of high student loan debt.) | (Evidence – e.g., He frequently cites Moody’s Analytics economic models demonstrating the negative impact of student debt on economic growth and consumer spending. He might point to data on delinquency rates and loan defaults.) | (Counterarguments – e.g., Some might argue that his focus on macroeconomic effects overshadows the individual borrowers’ experiences, or that his proposed solutions might have unintended consequences.) |

| (Expert 2 Name – e.g., Beth Akers, Senior Fellow at the Manhattan Institute) | (Argument Summary – e.g., Akers often advocates for market-based solutions, emphasizing the need for increased competition and transparency in higher education to reduce costs. She might highlight the role of government subsidies in driving up tuition.) | (Evidence – e.g., She might present data on tuition increases relative to inflation, analyze the impact of government subsidies on college costs, or cite research on the effectiveness of different higher education models.) | (Counterarguments – e.g., Critics might argue that market-based solutions don’t address the underlying inequalities in access to higher education or that they could exacerbate existing disparities.) |

| (Expert 3 Name – e.g., Jason Furman, Professor of the Practice of Economic Policy at Harvard Kennedy School) | (Argument Summary – e.g., Furman often focuses on the distributional effects of student debt, highlighting the disproportionate burden it places on low- and middle-income families. He might advocate for targeted relief programs.) | (Evidence – e.g., He might present data on student loan debt burdens across different income brackets, analyze the impact of student debt on wealth accumulation, or discuss the long-term consequences of high debt levels for various demographic groups.) | (Counterarguments – e.g., Some might argue that targeted relief programs are inefficient or that they create moral hazard, discouraging responsible borrowing behavior.) |

CNBC’s Presentation of Student Loan Statistics and Data

CNBC’s coverage of the student loan crisis often incorporates significant statistical data to illustrate the scale and impact of the problem. This data, presented in various formats, aims to inform viewers about the severity of the situation and the potential consequences for individuals and the economy. The network’s selection and presentation of these statistics, however, can significantly influence how viewers perceive the issue.

CNBC utilizes a variety of methods to present student loan statistics, often combining graphical representations with on-air commentary from financial experts and affected individuals. This multi-faceted approach attempts to provide context and make complex data more accessible to a wider audience. However, the chosen statistics and their visual representation can subtly shape the narrative, highlighting certain aspects while potentially downplaying others.

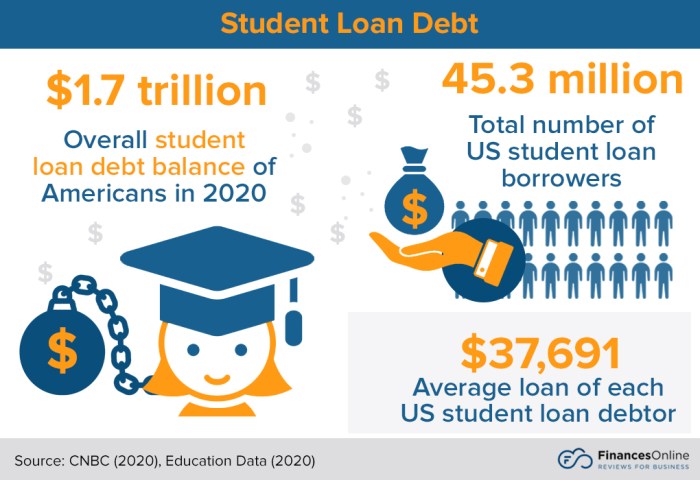

Three Significant Student Loan Debt Statistics Presented by CNBC

Three significant statistics frequently highlighted by CNBC include the total amount of student loan debt outstanding, the average student loan debt per borrower, and the delinquency and default rates on student loans. These statistics provide a broad overview of the problem, allowing viewers to grasp the magnitude of the financial burden placed on borrowers and the potential implications for the broader economy. While precise figures fluctuate, CNBC consistently emphasizes the massive scale of the debt and its persistent growth.

Methodology Used by CNBC to Present Statistics

CNBC generally sources its data from reputable organizations such as the Federal Reserve, the Department of Education, and the Bureau of Economic Analysis. The network typically presents these statistics using charts, graphs, and on-screen text overlays during news segments and financial analysis programs. Visual aids such as bar charts comparing debt levels across different years or demographics, and pie charts illustrating the proportion of debt held by various borrowers, are frequently employed. Narration often contextualizes these figures, emphasizing trends and comparing current data to historical figures. However, the selection of specific statistics and the chosen visual representations can influence viewer interpretation.

Visual Representation of a Key Student Loan Statistic

A compelling visual representation of a key statistic could be an interactive bar chart showing the growth of total student loan debt over time. The horizontal axis would represent the years, perhaps from 2000 to the present, while the vertical axis would represent the total debt in trillions of dollars. Each bar would represent a year, with its height corresponding to the total student loan debt for that year. The chart could be color-coded, with progressively darker shades of red indicating increasing debt levels, visually emphasizing the exponential growth of the problem. A small inset could display the average annual growth rate as a percentage, further highlighting the rate of increase.

Influence of CNBC’s Data Presentation on Viewer Understanding

CNBC’s presentation of data, while aiming for objectivity, inevitably shapes viewers’ understanding of the student loan crisis. The choice of statistics, their visual representation, and the accompanying commentary can emphasize specific aspects of the issue. For example, focusing on the total amount of outstanding debt might highlight the systemic nature of the problem, while emphasizing default rates could focus attention on the individual struggles of borrowers. The visual presentation, particularly the use of color and scale, can also evoke specific emotional responses, potentially influencing viewers’ perceptions of the urgency and severity of the situation. The network’s influence is therefore significant, impacting public discourse and potentially shaping policy discussions.

CNBC’s Role in Shaping Policy Discussions on Student Loans

CNBC, as a prominent business news network, holds significant influence over public perception and, consequently, policy debates surrounding student loan debt. Its coverage, reaching a broad audience of investors, policymakers, and the general public, can significantly shape the narrative around student loan forgiveness and related issues. The network’s access to influential figures and its focus on economic analysis provides a unique platform to impact the conversation.

CNBC’s reporting on student loan issues can influence policy debates through its framing of the issue, the experts it features, and the data it presents. By highlighting the economic consequences of student debt, for example, CNBC can sway public opinion towards supporting policies aimed at alleviating the burden. Conversely, emphasizing the potential costs of large-scale forgiveness programs can influence a more cautious approach from policymakers.

CNBC’s Reporting Impact on Student Loan Policy Conversations

CNBC’s influence is often indirect, operating through shaping public discourse rather than direct lobbying. For instance, extensive coverage of the rising cost of college tuition and the subsequent increase in student loan debt could indirectly pressure lawmakers to consider legislative solutions. Similarly, interviews with economists who analyze the economic impact of different student loan forgiveness proposals can directly inform the debate, offering quantitative analyses that policymakers can use to evaluate potential outcomes. While specific instances of direct policy changes solely attributable to CNBC’s reporting are difficult to definitively isolate, the network’s contribution to the overall conversation is undeniable.

Potential Implications of CNBC’s Influence on Student Loan Policy

The potential implications of CNBC’s influence are multifaceted. Positive implications include increased awareness of the issue among the public and policymakers, leading to more informed policy decisions. This could translate into policies that are more effective and equitable in addressing the student loan crisis. However, there are also potential negative implications. For instance, a focus on the economic costs of forgiveness, without adequately addressing the social and individual hardships faced by borrowers, could lead to policies that fail to provide sufficient relief. Furthermore, the network’s emphasis on market-based solutions might overshadow the need for broader systemic reforms in higher education financing.

Comparison of CNBC’s Role with Other Media Outlets

Compared to other media outlets, CNBC’s role in shaping student loan policy discussions is characterized by its economic focus. While other news organizations might emphasize the social and political aspects of the issue, CNBC’s analysis tends to prioritize the economic implications, such as the impact on the national debt or the potential effects on the financial markets. This economic lens, while valuable, can sometimes overshadow the human stories and broader societal impacts of the student loan crisis. News outlets with a stronger focus on social justice might provide a more comprehensive and nuanced perspective, balancing economic considerations with the human cost of student debt. This difference in approach leads to a diverse range of narratives shaping the overall public discourse on student loan policy.

Final Conclusion

CNBC’s extensive coverage of the student loan crisis provides a multifaceted view of this complex issue, influencing public understanding and potentially shaping policy. While their reporting offers valuable data and expert opinions, a critical examination reveals potential biases and the importance of considering diverse perspectives. Ultimately, understanding CNBC’s role in framing the student loan narrative is crucial for informed engagement with this pressing economic and social challenge. The ongoing conversation surrounding student loan debt requires a nuanced understanding of the information landscape, and CNBC’s contribution is a significant piece of that puzzle.

Quick FAQs

What is CNBC’s typical approach to presenting student loan statistics?

CNBC generally uses charts, graphs, and on-screen text to visually represent student loan statistics, often focusing on large-scale national figures.

Does CNBC offer solutions or advice for individuals struggling with student loan debt?

While CNBC primarily focuses on news and analysis, their reporting often includes discussions of potential solutions and repayment strategies, often referencing government programs or financial advisors.

How does CNBC’s coverage compare to that of other financial news outlets like Bloomberg or the Wall Street Journal?

Each outlet has its own focus and style. Comparisons would require a detailed content analysis, but generally, differences may arise in the emphasis on specific aspects of the student loan crisis, the types of experts interviewed, and the overall tone of the reporting.