Navigating the world of student loans can be daunting, but understanding your options is crucial for a successful financial future. Collage Ave offers a range of student loan products designed to meet diverse needs and financial situations. This guide provides a detailed overview of Collage Ave student loans, exploring their various features, repayment options, and potential financial implications. We’ll also compare them to other lenders to help you make informed decisions.

From eligibility requirements and the application process to managing repayments and exploring alternative options, we aim to demystify the complexities of Collage Ave student loans. We’ll delve into customer experiences, addressing both positive and negative feedback, and offer strategies for responsible loan management to ensure a smoother journey toward financial independence.

Understanding Collage Ave Student Loans

Collage Ave is a relatively new player in the student loan refinancing market, offering a streamlined process and potentially competitive rates for borrowers looking to consolidate or refinance their existing student loan debt. Understanding their offerings and how they compare to other lenders is crucial for making informed financial decisions.

Types of Student Loans Offered by Collage Ave

Collage Ave primarily focuses on refinancing existing federal and private student loans. They do not offer new student loans directly to students currently enrolled in college. Their refinancing options typically consolidate multiple loans into a single, simpler monthly payment with a potentially lower interest rate. This consolidation can simplify repayment and potentially save borrowers money over the life of the loan. They offer both fixed and variable interest rate options, allowing borrowers to choose the option that best suits their risk tolerance and financial goals.

Eligibility Criteria for Collage Ave Student Loans

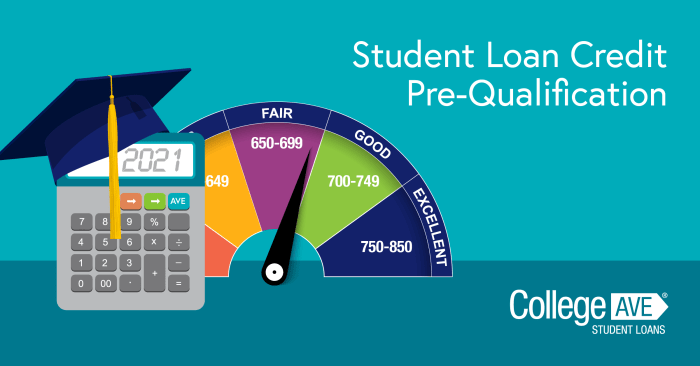

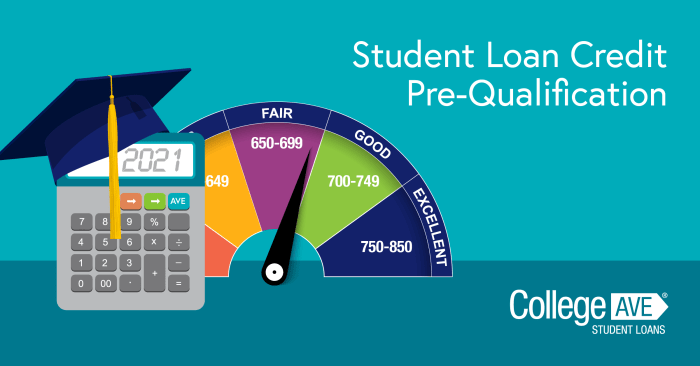

To be eligible for Collage Ave student loan refinancing, borrowers generally need to meet certain criteria. These typically include having a credit score above a certain threshold (this varies depending on the loan type and other factors), a stable income, and a demonstrated ability to repay the loan. Specific requirements may include a minimum credit score, a certain level of income, and the type and amount of existing student loan debt. The exact requirements are subject to change and should be verified directly on the Collage Ave website.

The Application Process for Obtaining a Collage Ave Student Loan

The application process for a Collage Ave student loan is generally straightforward. Borrowers typically begin by completing an online application, providing information about their existing student loans, income, and credit history. After submitting the application, Collage Ave will review the information and provide a pre-qualification or approval decision. If approved, borrowers will receive a loan offer outlining the terms and conditions, including the interest rate, repayment schedule, and fees. Final approval is contingent upon providing additional documentation, such as verification of income and employment.

Comparison of Collage Ave Student Loan Interest Rates with Other Lenders

Collage Ave’s interest rates are competitive within the student loan refinancing market, but they are not necessarily the lowest available. The actual interest rate offered to a borrower depends on several factors, including their credit score, income, loan amount, and the type of loan being refinanced. To compare Collage Ave’s rates with other lenders, it’s crucial to obtain personalized quotes from multiple lenders and compare the total cost of the loan, including interest and fees, over the life of the loan. Interest rates fluctuate based on market conditions, so the rates shown on any given day are only a snapshot in time. Always compare current rates from various lenders before making a decision.

Repayment Options and Features

Collage Ave offers a range of repayment options designed to accommodate various financial situations and allow borrowers to manage their student loan debt effectively. Understanding these options and features is crucial for successful repayment and minimizing long-term costs. This section details the available plans, payment processes, and additional features such as deferment and forbearance.

Available Repayment Plans

Collage Ave provides several repayment plans to suit different borrower needs and financial situations. The specific plans offered may vary depending on the loan type and individual circumstances. Common options typically include standard repayment, graduated repayment, and extended repayment plans. Each plan differs in its monthly payment amount and overall repayment timeline. Choosing the right plan depends on factors like income, expenses, and personal financial goals.

Managing and Making Payments

Managing and making payments on Collage Ave loans is generally straightforward. Borrowers typically access their accounts online through the Collage Ave website or mobile app. This platform allows for viewing loan balances, payment due dates, and making payments via various methods such as electronic transfers, debit cards, or potentially through automatic payments. The online portal also provides tools for managing payment schedules and tracking repayment progress. Contacting customer support is an option for assistance with payment inquiries or difficulties.

Deferment and Forbearance Options

Collage Ave may offer deferment and forbearance options to borrowers experiencing temporary financial hardship. Deferment temporarily suspends loan payments, often requiring specific qualifying circumstances such as unemployment or enrollment in school. Forbearance also postpones or reduces payments, but typically doesn’t require specific qualifying events, and may involve accumulating interest. It’s important to understand the terms and conditions of each option, as they can impact the total repayment amount and interest accrued over time. Applying for deferment or forbearance usually involves submitting documentation to Collage Ave to support the borrower’s request.

Comparison of Repayment Plans

The following table compares the pros and cons of different repayment plans. Note that the specific details, including interest rates and eligibility requirements, can vary based on the loan terms and individual borrower circumstances. This is a general comparison and should not be considered exhaustive.

| Plan Name | Interest Rate Impact | Payment Amount | Eligibility Requirements |

|---|---|---|---|

| Standard Repayment | Fixed interest rate; may lead to lower total interest paid over time due to shorter repayment period | Higher monthly payments | Generally available to all borrowers |

| Graduated Repayment | Fixed interest rate; potentially higher total interest paid due to longer repayment period | Lower initial payments, gradually increasing over time | Generally available to all borrowers |

| Extended Repayment | Fixed interest rate; potentially highest total interest paid due to significantly longer repayment period | Lowest monthly payments | Generally available to all borrowers; may require meeting specific loan amount thresholds |

Customer Experiences and Reviews

Understanding customer experiences is crucial for evaluating the overall quality of Collage Ave student loans. This section summarizes customer reviews and testimonials to provide a balanced perspective on borrowers’ experiences. Analysis focuses on common themes, both positive and negative, and examines the effectiveness of Collage Ave’s customer service.

Collage Ave student loan reviews are readily available online through various platforms such as Trustpilot, the Better Business Bureau, and independent review sites. While the specific number and weighting of positive versus negative reviews can fluctuate, several consistent themes emerge from the aggregated feedback.

Positive Customer Feedback Themes

Many positive reviews highlight Collage Ave’s user-friendly online platform and straightforward application process. Borrowers frequently praise the transparency of loan terms and the ease of managing their accounts online. The availability of various repayment options, including income-driven repayment plans, is also frequently cited as a significant positive aspect.

- Simple and intuitive online platform.

- Transparent loan terms and conditions.

- Variety of repayment plan options.

- Responsive and helpful customer service (in many cases).

Negative Customer Feedback Themes

Negative reviews often center on issues related to customer service responsiveness and the complexity of navigating certain aspects of the loan process. Some borrowers report difficulties in reaching customer service representatives or experiencing long wait times for resolution of their inquiries. Challenges with loan disbursement or unexpected fees are also occasionally mentioned.

- Customer service response times can be slow or inconsistent.

- Difficulty reaching customer service representatives by phone.

- Occasional issues with loan disbursement timelines.

- Some complaints regarding unclear or unexpected fees.

Customer Service Experience

The customer service experience with Collage Ave appears to be a mixed bag, with some borrowers reporting positive interactions and others expressing frustration. Response times seem to vary significantly depending on the nature of the inquiry and the method of contact (phone versus email). While many users report helpful and knowledgeable representatives, others describe difficulties in getting their issues resolved efficiently.

Visual Representation of Review Distribution

A hypothetical representation of review distribution (assuming a sample of 100 reviews) might look like this:

Positive Reviews: 70 (70%) * Negative Reviews: 30 (30%) *

Note: This is a hypothetical example and does not reflect any specific data on Collage Ave’s actual review distribution. Actual percentages may vary based on the source and time of data collection.

Financial Implications and Considerations

Taking out a student loan, even one with favorable terms like those offered by Collage Ave, represents a significant financial commitment with long-term consequences. Understanding these implications is crucial for responsible borrowing and avoiding potential future hardship. Careful consideration of loan amounts, interest rates, and repayment strategies is essential to navigate the complexities of student loan debt effectively.

The total cost of borrowing extends far beyond the initial loan amount. Interest accrues over the life of the loan, significantly increasing the total repayment amount. For example, a $10,000 loan with a 5% interest rate over 10 years will cost considerably more than the same loan with a 3% interest rate over the same period. The longer the repayment period, the more interest you will pay. Choosing a shorter repayment plan, while demanding higher monthly payments, ultimately reduces the total interest paid.

Long-Term Financial Implications of Student Loans

Borrowing for education can impact future financial decisions for years to come. High student loan debt can delay major life milestones such as homeownership, starting a family, or investing for retirement. It can also limit career choices, as individuals may prioritize jobs with higher salaries to manage debt repayment, potentially foregoing career paths they find more fulfilling. Careful budgeting and financial planning are essential to mitigate these potential long-term effects. A realistic budget that accounts for loan repayments alongside living expenses is vital.

Comparison of Total Borrowing Costs

The total cost of a student loan is heavily influenced by both the principal amount borrowed and the interest rate. A higher loan amount necessitates a larger repayment sum, while a higher interest rate increases the overall cost over the life of the loan. To illustrate, let’s consider two scenarios: Scenario A: a $20,000 loan at 4% interest over 10 years; Scenario B: a $30,000 loan at 6% interest over 10 years. Scenario B will clearly result in a significantly higher total repayment amount due to both the increased principal and higher interest rate. Using a student loan calculator readily available online allows for personalized estimations based on individual loan terms.

Strategies for Responsible Student Loan Management and Budgeting

Effective student loan management begins with a well-defined budget. Tracking income and expenses is crucial to identify areas where savings can be maximized. Creating a realistic repayment plan, aligned with your post-graduation income expectations, is essential. Exploring options such as income-driven repayment plans, offered by Collage Ave or the government, can provide flexibility if your income is lower than anticipated. Furthermore, prioritizing early loan repayments, even small extra payments, can significantly reduce the total interest paid and shorten the repayment period.

Potential Financial Hardships and Mitigation Strategies

Unforeseen circumstances such as job loss, illness, or unexpected expenses can create financial strain for borrowers. These hardships can make it challenging to meet monthly loan repayments, potentially leading to delinquency and damage to credit scores. Mitigating these risks involves building an emergency fund to cover unexpected expenses. Open communication with Collage Ave regarding financial difficulties can facilitate exploring options such as forbearance or deferment, temporarily suspending or reducing payments. It is crucial to proactively address any financial difficulties to prevent severe negative consequences.

Alternatives to Collage Ave Student Loans

Choosing a student loan provider is a significant decision impacting your financial future. While Collage Ave offers certain advantages, it’s crucial to explore alternative options to ensure you secure the best possible loan terms and conditions. This section compares Collage Ave to other federal and private loan providers, highlighting their strengths and weaknesses to help you make an informed choice.

Exploring alternative student loan options allows borrowers to compare interest rates, repayment plans, and other crucial factors to find the best fit for their individual financial circumstances. Understanding the nuances of each loan type – federal versus private – is essential for making a well-informed decision. This comparison focuses on key differences to help you determine which lender best suits your needs.

Comparison of Collage Ave with Federal Student Loans

Federal student loans, offered through the government, generally come with more borrower protections and flexible repayment options compared to private loans. They often have lower interest rates and are not tied to your credit score. However, the application process can be more complex, and loan amounts may be limited. In contrast, Collage Ave, as a private lender, may offer faster processing times and potentially higher loan amounts, but at the risk of higher interest rates and less borrower protection. A borrower with excellent credit might secure better terms from Collage Ave, while a borrower with limited credit history might find federal loans more accessible.

Comparison of Collage Ave with Other Private Student Loan Providers

Several private lenders compete with Collage Ave, each offering unique features and benefits. For example, lenders like Sallie Mae and Discover Student Loans often offer competitive interest rates and various repayment options, potentially including income-driven repayment plans. These options may be more favorable than Collage Ave’s offerings depending on individual financial situations and creditworthiness. Other lenders might specialize in specific areas, such as loans for medical students or graduate students, providing tailored solutions. Careful comparison of interest rates, fees, and repayment terms across different lenders is essential.

Situations Where Alternative Loan Options Might Be More Suitable

Alternative loan options might be more suitable than Collage Ave in several scenarios. Borrowers with limited credit history may find federal loans more accessible, as they don’t require a strong credit score for approval. Individuals needing a larger loan amount than Collage Ave offers might consider consolidating multiple loans from different lenders or exploring federal loan programs that provide higher loan limits. Those seeking specific repayment options, such as income-driven repayment plans, which are generally available through federal loans, might find those more beneficial than what Collage Ave provides. Finally, borrowers who prioritize borrower protections and government-backed loan forgiveness programs will likely find federal loans a better fit.

Key Differences Between Collage Ave and Other Prominent Student Loan Providers

Before making a decision, it’s vital to compare key aspects across different lenders. The following table summarizes the key differences between Collage Ave and three other prominent providers: Sallie Mae, Discover Student Loans, and Ascent. Note that these are general comparisons, and specific terms can vary based on individual circumstances and the current market conditions.

| Feature | Collage Ave | Sallie Mae | Discover Student Loans | Ascent |

|---|---|---|---|---|

| Interest Rates | Variable, potentially higher for borrowers with lower credit scores | Variable, competitive rates available | Variable, competitive rates available, potential discounts for good grades | Variable, potential discounts for co-signers |

| Repayment Options | Standard repayment plans, potential for deferment or forbearance | Variety of repayment plans, including income-driven options | Various repayment options, including income-based plans | Flexible repayment options, including income-driven plans |

| Borrower Protections | Standard private loan protections | Various protections and resources for borrowers | Customer support and resources available | Strong customer support and resources |

| Loan Amounts | Potentially high loan amounts, dependent on creditworthiness | High loan amounts, dependent on creditworthiness | High loan amounts, dependent on creditworthiness | High loan amounts, dependent on creditworthiness |

Final Thoughts

Ultimately, choosing the right student loan provider requires careful consideration of your individual circumstances and financial goals. This guide has provided a thorough exploration of Collage Ave student loans, highlighting their features, benefits, and potential drawbacks. By understanding the various repayment options, comparing interest rates, and considering alternative lenders, you can make an informed decision that aligns with your long-term financial well-being. Remember to always budget responsibly and explore all available resources to manage your student loan debt effectively.

FAQ Section

What credit score is needed for a Collage Ave student loan?

Collage Ave’s credit score requirements vary depending on the loan type and co-signer availability. Generally, a higher credit score improves your chances of approval and securing a favorable interest rate.

Can I refinance my existing student loans with Collage Ave?

Yes, Collage Ave offers student loan refinancing options. This allows you to potentially lower your interest rate and consolidate multiple loans into a single payment.

What happens if I miss a payment on my Collage Ave student loan?

Missing payments can negatively impact your credit score and may lead to late fees. Contact Collage Ave immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Does Collage Ave offer any grace periods after graduation?

Grace periods are typically offered, but the specific length varies depending on the loan type. Check your loan agreement for details.