Navigating the world of student loans can feel like traversing a complex maze, especially when understanding interest rates is crucial for long-term financial health. This guide delves into the intricacies of College Ave student loan interest rates, providing a clear and concise overview of factors influencing your rate, comparison points to other lenders, and strategies to manage and potentially reduce your costs. We’ll explore the calculation process, the impact of various loan terms and credit scores, and the long-term implications of your interest rate choices.

Understanding College Ave’s interest rate structure is paramount to making informed decisions about your education financing. This in-depth analysis will empower you to navigate the loan application process effectively and make choices that align with your financial goals, leading to a smoother path toward graduation and beyond.

Understanding College Ave Student Loan Interest Rates

College Ave Student Loans offers a range of student loan products with varying interest rates. Understanding these rates is crucial for borrowers to make informed decisions and plan for repayment. Several factors influence the interest rate you’ll receive, and comparing College Ave’s offerings to those of other lenders provides a valuable perspective.

Factors Influencing College Ave Student Loan Interest Rates

Several key factors determine the interest rate a borrower receives from College Ave. These include the borrower’s creditworthiness (credit score and history), the type of loan (e.g., undergraduate, graduate, parent), the loan term length, and the chosen repayment plan. A higher credit score generally qualifies a borrower for a lower interest rate, reflecting a lower perceived risk to the lender. Similarly, shorter loan terms often correlate with lower interest rates. The type of loan also plays a role; graduate loans may carry higher rates than undergraduate loans due to factors such as higher loan amounts and potentially higher risk. Finally, the chosen repayment plan can indirectly affect the interest rate through its influence on the total interest paid over the life of the loan.

College Ave Student Loan Types and Interest Rates

College Ave offers several types of student loans, each with its own interest rate structure. These typically include undergraduate student loans, graduate student loans, and parent PLUS loans. Undergraduate loans are designed for students pursuing undergraduate degrees, while graduate loans cater to those in graduate programs. Parent PLUS loans allow parents to borrow money to help finance their children’s education. Precise interest rates vary depending on the factors mentioned previously and are subject to change based on market conditions. It’s essential to check College Ave’s website for the most up-to-date information on current interest rates for each loan type. The rates are typically presented as an interest rate range, reflecting the variability based on individual borrower profiles.

Comparison of College Ave Interest Rates with Other Major Student Loan Providers

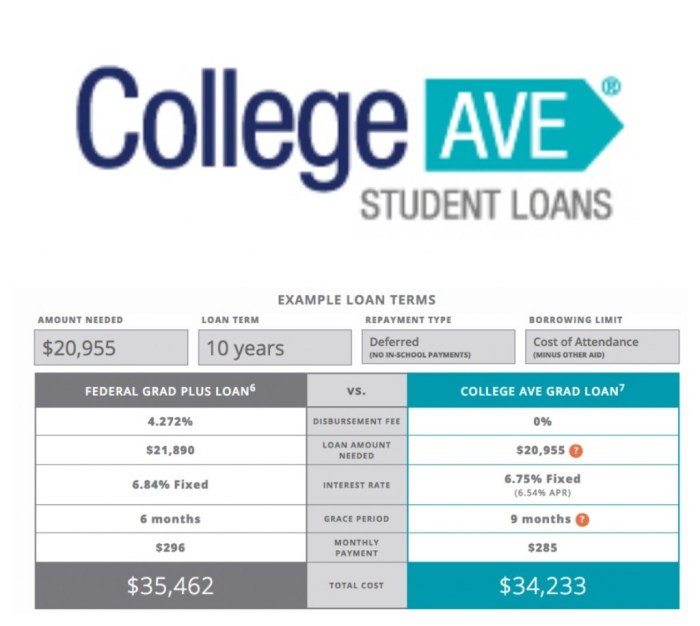

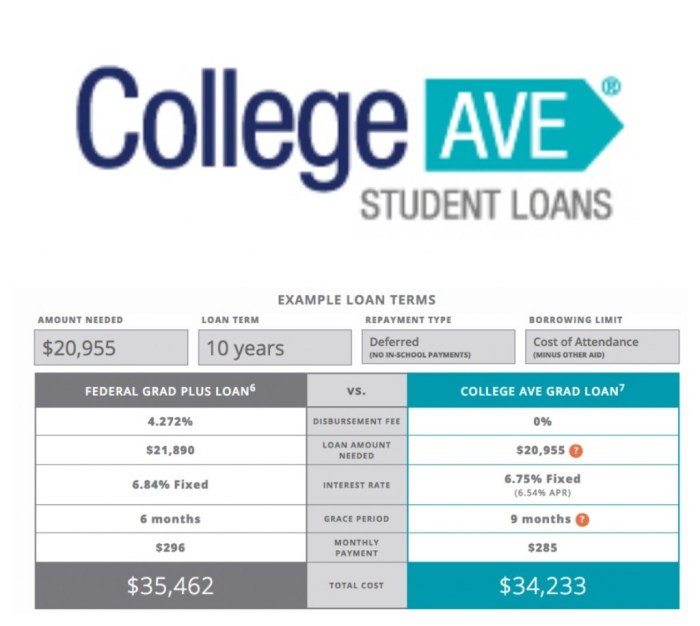

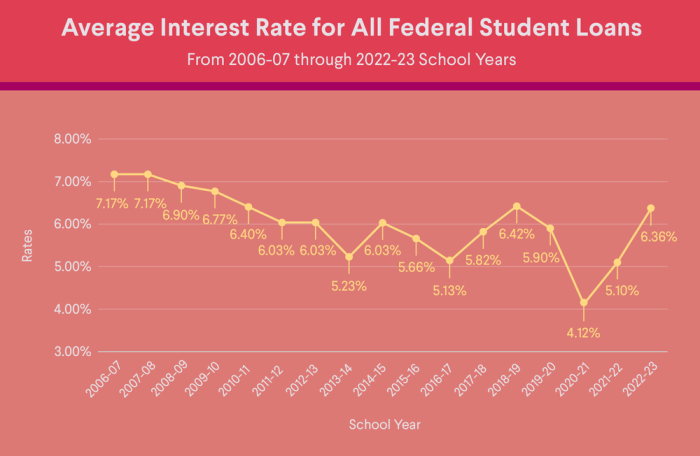

Direct comparison of College Ave interest rates with other major student loan providers like Sallie Mae, Discover, and federal student loans requires accessing the current rates offered by each lender. These rates fluctuate based on market conditions and individual borrower profiles. Generally, it’s advisable to compare offers from multiple lenders to find the most favorable interest rate. Factors beyond the interest rate, such as repayment options, fees, and customer service, should also be considered when comparing lenders. A thorough comparison allows borrowers to choose the loan option that best aligns with their financial circumstances and repayment capabilities.

Comparison of Fixed vs. Variable Interest Rates Offered by College Ave

| Feature | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Rate Type | Stays the same for the life of the loan. | Changes periodically based on market index. |

| Predictability | Highly predictable monthly payments. | Monthly payments can fluctuate. |

| Risk | Lower risk of unexpected payment increases. | Higher risk of increased payments if interest rates rise. |

| Potential Savings | May not offer the lowest initial rate. | Potentially lower initial rate if market rates are low. |

Interest Rate Calculation and Application

Understanding how College Ave calculates student loan interest rates is crucial for prospective borrowers. The process isn’t a simple formula; rather, it involves a complex assessment of several factors related to your creditworthiness and the loan terms you select. This ensures that the interest rate accurately reflects the perceived risk associated with lending to you.

College Ave uses a proprietary model to determine individual interest rates. This model considers various factors, weighting them according to their relative importance in assessing risk. While the exact algorithm remains confidential, publicly available information allows us to understand the key components influencing the final rate. These factors are primarily your credit history, the loan amount, the loan term length, and the type of loan (e.g., undergraduate, graduate, parent).

Credit Score’s Influence on Interest Rates

Your credit score is a significant factor. A higher credit score generally indicates lower risk to the lender, resulting in a lower interest rate. Conversely, a lower credit score suggests a higher risk, leading to a higher interest rate. For example, a borrower with an excellent credit score (750 or above) might qualify for an interest rate around 5%, while a borrower with a fair credit score (650-699) might receive a rate closer to 8%. These are illustrative examples and actual rates can vary based on other factors.

Loan Term and Amount’s Impact

The length of your loan term also plays a role. Longer loan terms generally result in higher interest rates because the lender is exposed to risk for a longer period. Similarly, larger loan amounts might lead to slightly higher rates, reflecting the increased risk for the lender. For instance, a 10-year loan might have a higher interest rate than a 5-year loan, even if all other factors remain the same. Likewise, borrowing $50,000 might result in a slightly higher rate than borrowing $25,000, assuming all other factors are constant.

Hypothetical Scenario: Interest Rate Impact on Repayment

Let’s consider two hypothetical borrowers, both borrowing $20,000 for a 10-year loan. Borrower A has an excellent credit score and secures a 6% interest rate. Borrower B has a fair credit score and receives a 9% interest rate. Using a standard amortization calculator (easily found online), we can estimate the total interest paid over the life of the loan. Borrower A would pay approximately $6,000 in interest, while Borrower B would pay approximately $9,000. This illustrates the significant impact even a small difference in interest rates can have on the total cost of the loan. This difference underscores the importance of maintaining a good credit score before applying for student loans.

Managing and Reducing Interest Rates

Securing a manageable student loan interest rate is crucial for long-term financial health. Lowering your interest rate can significantly reduce the total amount you repay over the life of your loan. This section explores strategies to achieve this with your College Ave student loan.

Understanding that interest rates are influenced by several factors, including credit score, co-signer availability, and loan terms, proactive steps can help you optimize your repayment journey.

Strategies for Securing a Lower Interest Rate from College Ave

Before taking out a loan, improving your creditworthiness is paramount. A higher credit score typically qualifies you for a lower interest rate. This involves paying bills on time, maintaining low credit utilization, and avoiding new credit applications. Furthermore, exploring the possibility of a co-signer with excellent credit can significantly enhance your chances of securing a favorable interest rate. College Ave may offer autopay discounts; enrolling in this feature can result in a small but valuable reduction in your interest rate. Finally, consider the loan term; choosing a shorter repayment period might lead to a slightly lower interest rate, although it will increase your monthly payments.

Refinancing a College Ave Student Loan

Refinancing your College Ave student loan with another lender offers the potential to secure a lower interest rate, particularly if your credit score has improved since you initially took out the loan. The process involves applying to a new lender, providing necessary documentation, and undergoing a credit check. However, it’s essential to compare offers carefully, considering fees and other terms before refinancing. Be aware that refinancing might extend the repayment period, potentially increasing the total interest paid despite a lower interest rate. For example, someone with a 750 credit score might find refinancing advantageous, while someone with a 600 score might not see significant improvements and could face higher fees.

Income-Driven Repayment Plans and Interest Accumulation

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. While this can make payments more manageable, it’s important to understand the implications for interest accumulation. IDR plans often extend the repayment period, leading to a higher total interest paid over the life of the loan. For instance, an IDR plan might reduce monthly payments significantly but increase the repayment timeline by several years, resulting in a substantial increase in overall interest costs. Carefully weigh the short-term benefits of lower monthly payments against the long-term costs of increased interest accumulation before opting for an IDR plan.

Appealing a High Interest Rate Assigned by College Ave

If you believe the interest rate assigned by College Ave is unfairly high, you can appeal the decision. This typically involves gathering supporting documentation, such as evidence of improved credit score or extenuating circumstances that might justify a lower rate. Clearly articulate your case in writing to College Ave’s customer service department, outlining your reasons for appealing the interest rate. Be prepared to provide thorough documentation and be persistent in your communication. While success isn’t guaranteed, a well-supported appeal can sometimes lead to a reconsideration of your interest rate. Remember to maintain a professional and respectful tone throughout the process.

Long-Term Implications of Interest Rates

Understanding the long-term effects of interest rates on your student loans is crucial for responsible financial planning. The seemingly small differences in interest rates can significantly impact your overall repayment costs and your long-term financial health. Choosing a repayment plan and understanding the implications of your interest rate will directly influence your financial well-being for years to come.

The cumulative effect of interest over the life of a loan can dramatically increase the total amount you repay. A seemingly small difference in the annual interest rate can translate into thousands of dollars in extra interest paid over the loan’s lifespan. This difference is amplified by longer repayment periods. Careful consideration of these long-term implications is essential for making informed borrowing decisions.

Total Interest Paid Over Various Loan Terms

The following table illustrates the significant difference in total interest paid on a $30,000 loan with different interest rates and repayment terms. This example highlights the substantial savings achievable by securing a lower interest rate and choosing a shorter repayment period.

| Loan Amount | Interest Rate | Loan Term (Years) | Total Interest Paid |

|---|---|---|---|

| $30,000 | 5% | 10 | $5,782 |

| $30,000 | 5% | 20 | $16,157 |

| $30,000 | 7% | 10 | $8,882 |

| $30,000 | 7% | 20 | $27,157 |

Impact of High Interest Rates on Credit Score and Future Financial Stability

High interest rates on student loans can negatively impact your credit score and future financial stability in several ways. Consistent late or missed payments, a common consequence of struggling with high interest payments, will severely damage your credit rating. This can make it harder to secure loans, rent an apartment, or even get a job in the future, as many employers conduct credit checks. Furthermore, the burden of high monthly payments can limit your ability to save for other important financial goals, such as a down payment on a house or retirement savings. The long-term financial strain of high interest payments can significantly restrict future opportunities.

Comparison of Total Borrowing Costs with Different Repayment Plans and Interest Rates

Choosing a repayment plan significantly influences the total cost of borrowing. For instance, an income-driven repayment plan might lower your monthly payments initially, but it could extend the loan’s repayment period, ultimately leading to higher total interest paid over the life of the loan. Conversely, a standard repayment plan with a shorter term will result in higher monthly payments but lower overall interest costs. The optimal choice depends on your individual financial circumstances and priorities. A detailed comparison of different repayment plans, including their monthly payment amounts and total interest costs, is essential for making an informed decision. This careful analysis ensures you choose the plan that best aligns with your long-term financial goals.

Important Disclosures and Considerations

Choosing a student loan requires careful consideration of various factors beyond just the interest rate. Understanding the complete financial picture, including potential fees and the loan terms, is crucial for responsible borrowing. Transparency and a thorough understanding of the agreement are paramount to avoid unexpected costs and financial strain.

Hidden Fees and Charges

College Ave student loans, like many other lenders, may include fees beyond the interest rate. These fees can significantly impact the overall cost of the loan. It’s essential to review the loan agreement meticulously for details on origination fees, late payment fees, and any other potential charges. Origination fees, for instance, are typically a percentage of the loan amount and are deducted upfront. Late payment fees can add up substantially over time if payments are missed. Borrowers should inquire directly with College Ave for the most up-to-date information on all applicable fees. Failure to understand these fees can lead to unexpected expenses and increased debt burden.

Importance of Understanding Loan Terms and Conditions

Before signing any loan agreement, thoroughly review all terms and conditions. This includes the repayment schedule, interest rate calculation method, grace period, and any prepayment penalties. Understanding the repayment schedule will help you budget effectively and avoid missed payments. The interest rate calculation method determines how much interest you accrue over the life of the loan. The grace period provides a timeframe after graduation before repayment begins. Prepayment penalties, if applicable, could discourage early repayment, which can save you money on interest. Failing to understand these aspects can result in financial difficulties.

Factors to Consider Before Choosing a College Ave Student Loan

Several factors should be carefully weighed before selecting a College Ave student loan. These include: the interest rate offered, repayment options, loan amount, and the lender’s reputation and customer service. Comparing College Ave’s offerings to other lenders is also highly recommended. Consider the flexibility of repayment options; some lenders may offer income-driven repayment plans, which can be beneficial during periods of low income. The loan amount should align with your educational expenses and your ability to repay the loan. Researching the lender’s reputation for customer service can help ensure a positive borrowing experience.

Potential Risks and Benefits of Borrowing from College Ave

Borrowing from College Ave, like any student loan, carries both risks and benefits. Weigh these carefully before proceeding.

A key benefit is the potential for securing funding for higher education. However, a significant risk is accumulating substantial debt, potentially impacting your financial future.

Responsible borrowing practices, such as careful budgeting and timely repayments, are essential to mitigate the risks. Thoroughly understanding the loan terms and conditions before signing the agreement is also crucial.

Wrap-Up

Securing a student loan requires careful consideration of various factors, and interest rates are at the forefront. By understanding how College Ave calculates interest rates, exploring strategies for securing a lower rate, and recognizing the long-term financial implications of your choices, you can make informed decisions that minimize your borrowing costs and maximize your financial well-being. Remember to thoroughly review all terms and conditions before signing any loan agreement and seek further guidance from financial professionals if needed. A well-informed approach to student loan financing paves the way for a brighter financial future.

General Inquiries

What factors besides credit score influence my College Ave student loan interest rate?

Several factors influence your rate, including your loan type (e.g., undergraduate, graduate), loan amount, repayment term, and co-signer (if applicable). Your chosen repayment plan can also indirectly affect your total interest paid.

Can I change my repayment plan after I’ve accepted a College Ave loan?

Yes, you may be able to change your repayment plan, but this may affect your monthly payment amount and total interest paid over the life of the loan. Contact College Ave directly to explore your options.

What happens if I miss a payment on my College Ave student loan?

Missing payments can negatively impact your credit score and may result in late fees. Contact College Ave immediately if you anticipate difficulty making a payment to explore options such as forbearance or deferment.

Does College Ave offer any hardship programs?

College Ave may offer hardship programs for borrowers experiencing financial difficulties. Check their website or contact their customer service for details on available options and eligibility requirements.