Navigating the world of student loans can feel overwhelming, especially when faced with the complexities of interest rates. Understanding the nuances of different loan types, lender offerings, and repayment plans is crucial for making informed financial decisions that minimize long-term debt. This guide will equip you with the knowledge to effectively compare student loan rates and choose the best option for your unique circumstances.

From federal to private loans, fixed to variable rates, the landscape of student loan financing is diverse. This guide will break down the key factors that influence interest rates, such as credit score, income, and loan amount. We’ll also explore various repayment options and their impact on your overall cost, helping you make a well-informed choice that aligns with your financial goals and repayment capabilities.

Understanding Student Loan Rate Types

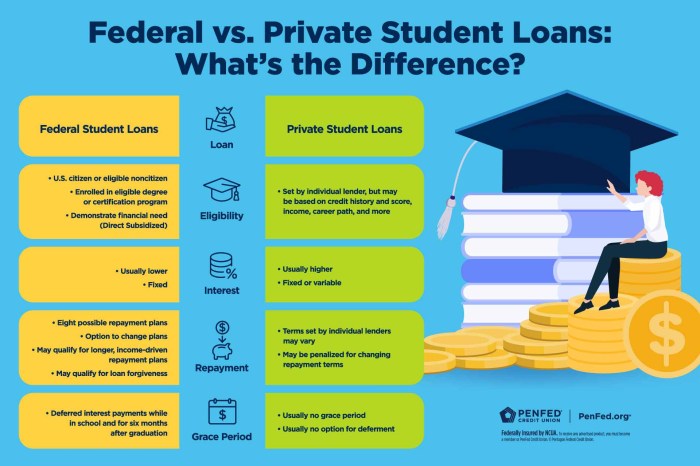

Choosing the right student loan involves understanding the different interest rates available. The interest rate significantly impacts the total cost of your loan, so careful consideration is crucial. This section will clarify the distinctions between federal and private student loan rates, focusing on fixed versus variable rates.

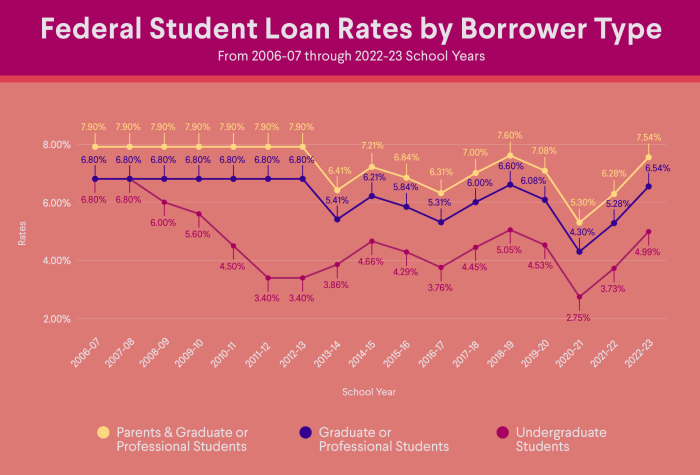

Federal Student Loan Rates

Federal student loans offer several advantages, including government-backed protection and various repayment plans. However, the interest rates are set by the government and can change yearly. There are primarily two types of federal student loan rates: fixed and variable. Fixed rates remain constant throughout the loan’s life, providing predictable monthly payments. Variable rates fluctuate based on an index, like the 91-day Treasury bill rate, potentially leading to fluctuating monthly payments.

Private Student Loan Rates

Private student loans are offered by banks, credit unions, and other financial institutions. These loans are not backed by the government, meaning the lender sets the interest rate. The rates are typically based on your creditworthiness, making them potentially higher than federal loan rates for borrowers with less-than-stellar credit. Similar to federal loans, private student loans can have fixed or variable interest rates. A fixed rate offers predictability, while a variable rate presents the risk of higher payments if the index increases.

Comparison of Federal and Private Student Loan Rates

The table below summarizes the key differences between federal and private student loan rates:

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Rate Type | Fixed or Variable | Fixed or Variable |

| Interest Rate Calculation | Set by the government; may vary yearly for variable rates. Based on market indices for variable rates. | Set by the lender; based on creditworthiness, market conditions, and the loan type. Based on market indices for variable rates. |

| Repayment Options | Various income-driven repayment plans, standard repayment, extended repayment, and graduated repayment options are available. | Repayment options vary by lender; typically standard repayment plans. Income-driven repayment plans are less common. |

| Potential Benefits | Government backing, income-driven repayment plans, potential for loan forgiveness programs. | Potentially lower interest rates for borrowers with excellent credit. More flexible loan terms in some cases. |

| Potential Drawbacks | Higher interest rates compared to private loans for borrowers with excellent credit. Loan limits may apply. | Higher interest rates for borrowers with poor credit. Lack of government protection. Fewer repayment options. |

Factors Influencing Student Loan Rates

Securing a student loan involves more than just applying; understanding the factors that determine your interest rate is crucial for securing the best possible terms. Lenders use a variety of factors to assess your risk and determine how much interest you’ll pay over the life of your loan. These factors directly impact the monthly payments and the overall cost of your education.

Several key elements influence the interest rate you’ll receive on your student loans. These factors are carefully weighed by lenders to assess your creditworthiness and determine the level of risk associated with lending you money. A higher risk profile typically translates to a higher interest rate, while a lower risk profile usually leads to a lower rate.

Credit Score’s Influence on Interest Rates

Your credit score is a significant factor in determining your student loan interest rate, especially for private loans. A higher credit score demonstrates a history of responsible borrowing and repayment, signaling lower risk to the lender. Conversely, a lower credit score indicates a higher risk of default, leading to a higher interest rate to compensate the lender for that increased risk. Federal student loans typically don’t require a credit check for undergraduates, relying instead on other factors. However, graduate students and parents taking out PLUS loans may be subject to credit checks, and a poor credit history can result in higher rates or loan denial.

- Good Credit Score (700+): For private loans, a good credit score can result in interest rates several percentage points lower than those offered to borrowers with poor credit. Federal loans, while not directly impacted by credit score for undergraduates, might still benefit indirectly through eligibility for lower repayment plans or other benefits.

- Poor Credit Score (below 600): For private loans, a poor credit score often leads to significantly higher interest rates, sometimes exceeding the rates offered to those with good credit by 5% or more. For federal PLUS loans, a poor credit score can result in higher interest rates or even loan denial. The borrower might need a co-signer with good credit to qualify.

Income’s Impact on Interest Rates

While not always a direct factor in determining interest rates for federal loans, income can play a role in assessing eligibility for certain programs and repayment plans. For private loans, income can indirectly influence your interest rate. Lenders might consider your income in relation to your loan amount to assess your debt-to-income ratio. A high debt-to-income ratio could suggest a higher risk of default, potentially leading to a higher interest rate. Conversely, a stable, higher income could indicate lower risk and potentially lead to a more favorable interest rate.

Co-Signer’s Role in Securing Lower Rates

A co-signer with good credit can significantly improve your chances of securing a lower interest rate, particularly for private loans. The co-signer essentially guarantees the loan, reducing the lender’s risk. This assurance allows the lender to offer a lower interest rate, as the risk of default is mitigated by the co-signer’s financial responsibility. It’s important to note that if the primary borrower defaults, the co-signer becomes responsible for the loan repayment.

Loan Amount and Interest Rate Relationship

The loan amount itself can indirectly influence interest rates, especially with private lenders. Larger loan amounts represent a greater financial risk for the lender. While not always a direct correlation, lenders might offer slightly higher rates for larger loan amounts to offset the increased risk. This is more pronounced in the private loan market.

Comparing Rates from Different Lenders

Choosing a student loan involves careful consideration of various factors, and understanding the interest rates offered by different lenders is crucial for securing the best financial terms. Different lenders have varying lending criteria and risk assessments, resulting in a diverse range of interest rates. This section will explore how to compare rates from different lenders to make an informed decision.

Private student loan lenders operate differently from federal student loan programs. While federal loans typically offer fixed interest rates and consistent terms, private lenders’ rates fluctuate based on market conditions and the borrower’s creditworthiness. It’s vital to compare offers from multiple lenders to find the most favorable terms.

Private Lender Rate Comparison

Several major private lenders offer student loans, each with its own rate structure. The following table compares the interest rate ranges, loan terms, and additional fees for three prominent lenders. Remember that these rates are subject to change and are based on typical offerings. It’s essential to check the current rates directly with each lender before making a decision.

| Lender Name | Interest Rate Range (Variable) | Loan Terms (Years) | Additional Fees |

|---|---|---|---|

| Discover Student Loans | 6.00% – 14.00% | 5 – 15 | Origination fee (typically 1-4% of the loan amount) may apply. Late payment fees may also apply. |

| Sallie Mae | 6.50% – 13.50% | 5 – 10 | Origination fee (varies depending on loan type and creditworthiness). Late payment fees and returned payment fees may apply. |

| Wells Fargo Student Loans | 6.25% – 14.50% | 5 – 15 | Origination fee (may apply). Late payment fees may apply. |

Disclaimer: The interest rate ranges provided are examples and may not reflect current rates. These rates are subject to change based on market conditions and individual borrower qualifications. Always check with the respective lenders for the most up-to-date information.

Repayment Options and Their Impact on Total Cost

Choosing the right repayment plan for your student loans is crucial, as it significantly impacts the total amount you’ll pay back. Different plans offer varying monthly payments and repayment timelines, leading to substantial differences in the total interest accrued over the life of the loan. Understanding these options is key to making informed financial decisions.

Understanding the various repayment plans available helps borrowers manage their debt effectively and minimize overall costs. The best plan depends on individual financial circumstances and long-term goals.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It typically involves fixed monthly payments over a 10-year period. While this plan offers the shortest repayment timeline, leading to less interest paid overall, the monthly payments can be higher than other plans. This plan is ideal for borrowers who can comfortably afford higher monthly payments and want to pay off their loans quickly.

Graduated Repayment Plan

A graduated repayment plan starts with lower monthly payments that gradually increase over time. This can be beneficial for borrowers who anticipate an increase in income during the repayment period. However, while the initial payments are manageable, they eventually become higher than standard plan payments, potentially extending the repayment period and increasing total interest paid. This plan is suitable for borrowers whose income is expected to grow significantly in the coming years.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) base monthly payments on your discretionary income and family size. Several types of IDR plans exist, each with its own specific formula for calculating payments. These plans generally result in lower monthly payments than standard or graduated plans, but they often extend the repayment period to 20 or 25 years, leading to significantly higher total interest paid. This is a suitable option for borrowers with lower incomes or unpredictable financial situations.

Comparison Scenario: $20,000 Loan

The following table illustrates the differences in total cost for a $20,000 student loan under three different repayment plans, assuming a 5% annual interest rate. These figures are for illustrative purposes and actual costs may vary based on individual loan terms and interest rates.

| Repayment Plan | Approximate Monthly Payment | Total Interest Paid (Approximate) | Total Repayment Amount (Approximate) |

|---|---|---|---|

| Standard (10-year) | $212 | $5,000 | $25,000 |

| Graduated (10-year) | Starts at ~$150, increases gradually | ~$5,500 | ~$25,500 |

| Income-Driven (20-year) | Varies based on income, but generally lower than standard | ~$10,000 | ~$30,000 |

The Role of a Co-signer

Securing a student loan can be challenging, especially for students with limited or no credit history. A co-signer can significantly improve a borrower’s chances of approval and obtaining a favorable interest rate. This individual, typically a parent or other trusted adult, agrees to be equally responsible for repaying the loan if the borrower defaults.

A co-signer essentially acts as a guarantor, lending their established creditworthiness to the borrower’s application. Lenders view co-signed loans as less risky because they have a second individual committed to repayment. This reduced risk translates to better loan terms for the borrower, including lower interest rates and potentially more favorable repayment options. The co-signer’s credit score and financial stability are crucial factors in determining the loan’s terms.

Co-signer Responsibilities and Risks

Becoming a co-signer is a significant commitment with both responsibilities and potential risks. The co-signer is legally obligated to repay the loan if the primary borrower fails to do so. This means that any missed payments or defaults will negatively impact the co-signer’s credit score, potentially affecting their ability to obtain credit in the future (e.g., mortgages, car loans). Furthermore, the co-signer is responsible for the full amount of the loan, even if the loan amount exceeds their personal financial capacity. This can have serious financial consequences for the co-signer. It is therefore vital that both the borrower and the co-signer thoroughly understand the terms and conditions of the loan before signing the agreement.

Illustrative Example of Co-signer Impact

Imagine Sarah, a recent high school graduate with no credit history, is applying for a $20,000 student loan. Due to her lack of credit history, lenders offer her a high interest rate of 10%, resulting in a significantly higher total repayment cost. However, with her mother, Jane, as a co-signer (Jane has an excellent credit score and stable income), Sarah’s application is viewed much more favorably. Lenders are willing to offer her a significantly lower interest rate of 6%, reducing her total repayment cost by thousands of dollars over the life of the loan. This lower interest rate allows Sarah to graduate with less debt and gives her more financial flexibility after college. However, Jane takes on the risk of being responsible for the entire loan amount should Sarah default. While this scenario improves Sarah’s financial prospects, Jane needs to carefully consider the potential financial implications for herself. This example highlights the crucial role a co-signer plays in helping students access more affordable education financing, but underscores the substantial responsibility and risk the co-signer undertakes.

Understanding Loan Fees and Charges

Student loan fees can significantly impact the overall cost of your education. Understanding these fees upfront is crucial for budgeting and choosing the most cost-effective loan option. Failing to account for these charges can lead to unexpected expenses and a higher total repayment amount.

Several common fees are associated with student loans. Origination fees are charges levied by the lender when the loan is disbursed. Late payment fees are penalties incurred for missed or late payments. Prepayment penalties, while less common with federal student loans, are charges for paying off the loan early. Other fees might include returned payment fees (if a payment is rejected by the bank) and administrative fees for certain loan services. It’s essential to carefully review the loan terms and conditions to understand all applicable fees.

Common Student Loan Fees

The following provides a breakdown of common student loan fees and their potential impact.

- Origination Fees: These are usually a percentage of the loan amount and are deducted from the disbursed funds. For example, a 1% origination fee on a $10,000 loan would reduce the amount you receive to $9,900.

- Late Payment Fees: These fees vary by lender but are typically a fixed dollar amount or a percentage of the missed payment. Consistent late payments can quickly add up, increasing your total debt substantially.

- Prepayment Penalties: While uncommon with federal student loans, some private lenders may charge a penalty for paying off your loan before the scheduled term. This penalty could be a percentage of the remaining loan balance or a fixed fee.

- Returned Payment Fees: If your payment is returned due to insufficient funds, you’ll likely face a fee, adding to your already overdue balance.

- Administrative Fees: Some lenders may charge administrative fees for services like loan modifications or deferments.

Fee Structure Comparison: Two Lenders

Let’s compare the fee structures of two hypothetical lenders, Lender A and Lender B, to illustrate how fees can differ.

- Lender A: Charges a 1% origination fee, a $25 late payment fee, and no prepayment penalty. They also charge a $30 returned payment fee.

- Lender B: Charges a 0.5% origination fee, a $30 late payment fee, a 2% prepayment penalty if paid within the first three years, and a $25 returned payment fee.

Hypothetical Scenario: Fee Accumulation

Imagine a student takes out a $20,000 student loan from Lender A. If they miss one payment resulting in a $25 late fee and have one payment returned due to insufficient funds resulting in a $30 returned payment fee, their total additional fees would be $55. Over the life of the loan, several missed or late payments and returned payments could add hundreds or even thousands of dollars to the total cost. If the same student had chosen Lender B and paid off the loan early, they could incur a substantial prepayment penalty, negating some of the benefits of early repayment.

Outcome Summary

Choosing the right student loan involves careful consideration of various factors beyond just the initial interest rate. By understanding the different loan types, lender offerings, and repayment plans, you can make an informed decision that minimizes your long-term financial burden. Remember to carefully compare rates, fees, and repayment terms from multiple lenders before committing to a loan. Proactive planning and informed decision-making are key to successfully managing your student loan debt.

Essential Questionnaire

What is the difference between a fixed and variable interest rate?

A fixed interest rate remains constant throughout the loan term, while a variable rate fluctuates based on market conditions. Fixed rates offer predictability, while variable rates may offer lower initial rates but carry more risk.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing may be an option if you qualify. This involves obtaining a new loan to pay off your existing loans, potentially with a lower interest rate. Eligibility depends on your credit score and income.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default, which has serious financial consequences.

How do I choose the best repayment plan for my student loans?

Consider your income, budget, and long-term financial goals. Several repayment plans exist, each with different monthly payment amounts and total interest paid over the life of the loan. Carefully evaluate each plan’s implications before making a choice.