Navigating the complexities of student loan repayment can feel daunting, especially when grappling with the often-misunderstood concept of compound interest. This seemingly innocuous financial mechanism can significantly inflate the total cost of your education over time, potentially impacting your long-term financial well-being. Understanding how compound interest affects your student loans is crucial for making informed decisions about repayment strategies and ultimately achieving financial freedom.

This guide will demystify compound interest in the context of student loans, providing practical strategies to manage and minimize its impact. We’ll explore various factors influencing interest accumulation, compare different loan types and repayment plans, and highlight the long-term financial consequences of neglecting this critical aspect of loan repayment. By the end, you’ll be equipped with the knowledge to effectively navigate your student loan journey.

Understanding Compound Interest on Student Loans

Student loans, a significant financial commitment for many, often accrue interest using the compound interest method. Understanding how compound interest works is crucial for responsible borrowing and effective repayment planning. This section will detail the mechanics of compound interest as it applies to student loans, illustrating its impact on the overall cost of borrowing.

Compound Interest Explained

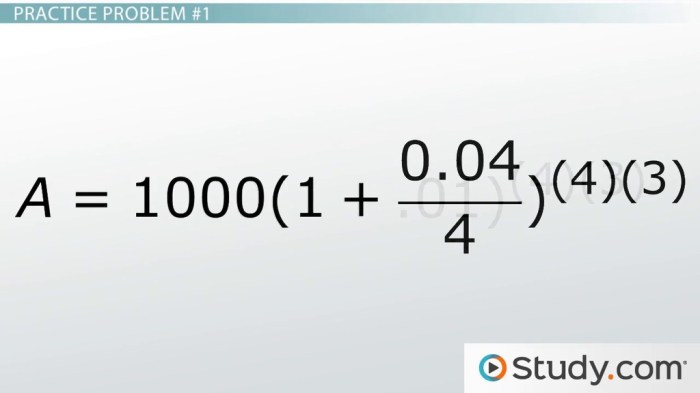

Compound interest calculates interest not only on the principal loan amount but also on the accumulated interest from previous periods. This means that your interest grows exponentially over time. Unlike simple interest, where interest is calculated only on the principal, compound interest adds previously accrued interest to the principal, leading to a larger interest payment in subsequent periods. The more frequently interest is compounded (e.g., daily, monthly, annually), the faster your loan balance grows. The formula for compound interest is: A = P (1 + r/n)^(nt), where A is the future value of the loan, P is the principal amount, r is the annual interest rate (as a decimal), n is the number of times interest is compounded per year, and t is the number of years.

Impact of Different Interest Rates

The interest rate significantly influences the total repayment amount. A higher interest rate leads to substantially more interest accruing over the loan’s life, resulting in a much larger total repayment amount. For instance, a 5% interest rate on a $10,000 loan will result in a smaller total repayment than a 7% interest rate on the same loan over the same repayment period. Even a seemingly small difference in interest rates can lead to thousands of dollars in additional interest charges over the loan’s term.

Effects of Various Repayment Plans

Different repayment plans influence the total interest paid. A shorter repayment plan, such as a 10-year plan compared to a 20-year plan, will result in higher monthly payments but significantly lower total interest paid due to less time for interest to accumulate. Conversely, a longer repayment plan will result in lower monthly payments but substantially higher total interest paid over the loan’s lifetime. Choosing a repayment plan should carefully consider your financial capacity and the long-term implications of interest accumulation. For example, a $20,000 loan at 6% interest compounded annually could cost significantly more in interest over 20 years compared to a 10-year repayment plan.

Simple Interest vs. Compound Interest: A Comparison

The table below illustrates the stark difference between simple and compound interest over various loan terms. Note that these figures assume a fixed interest rate and consistent monthly payments. Real-world scenarios may vary.

| Loan Term (Years) | Simple Interest (Total Cost, $20,000 loan at 6%) | Compound Interest (Total Cost, $20,000 loan at 6%) | Interest Paid Difference ($) |

|---|---|---|---|

| 10 | $26,000 | $28,730 | $2,730 |

| 15 | $32,000 | $36,790 | $4,790 |

| 20 | $38,000 | $47,540 | $9,540 |

Factors Influencing Compound Interest Accumulation

Understanding how compound interest affects your student loan repayment is crucial for effective financial planning. Several key factors influence the rate at which this interest accumulates, ultimately determining the total amount you’ll repay. These factors interact in complex ways, so it’s important to be aware of each one’s impact.

Interest Rate

The interest rate is the most significant factor determining the amount of compound interest accrued on your student loan. A higher interest rate leads to significantly faster interest accumulation. For example, a loan with a 7% interest rate will accrue interest much faster than a loan with a 3% interest rate, even if the principal amounts are the same. This is because compound interest calculates interest not only on the principal but also on the accumulated interest from previous periods. The higher the starting rate, the larger the base for subsequent interest calculations.

Loan Principal

The principal loan amount directly impacts the total interest paid. A larger loan balance means more interest is calculated each period. For instance, a $50,000 loan will accrue substantially more interest than a $20,000 loan, assuming the interest rate and repayment schedule are identical. This is simply because there’s more money upon which interest is being calculated.

Loan Repayment Frequency

The frequency of loan repayments significantly affects the total interest paid. More frequent payments, such as monthly payments, reduce the principal balance more quickly. This, in turn, lowers the amount of interest calculated in subsequent periods. Conversely, less frequent payments, such as quarterly payments, allow the interest to compound on a larger principal balance for a longer period, resulting in higher overall interest payments. A monthly payment plan will always lead to less total interest paid compared to a quarterly plan, assuming all other factors remain constant.

Loan Deferment or Forbearance Periods

Periods of deferment or forbearance, where loan payments are temporarily suspended or reduced, lead to increased total interest paid. During these periods, interest continues to accrue on the outstanding principal balance, adding to the total loan amount. The longer the deferment or forbearance period, the more interest will accumulate, increasing the final loan repayment amount. For example, a one-year deferment on a $30,000 loan with a 6% interest rate will add a substantial amount to the total interest paid over the life of the loan.

Calculating Compound Interest: A Flowchart

The following steps illustrate the calculation of compound interest on a student loan. Note that this is a simplified representation and doesn’t account for all possible scenarios (such as variable interest rates or graduated repayment plans).

Step 1: Determine the principal loan amount (P).

Step 2: Identify the annual interest rate (r) and convert it to a decimal (divide by 100).

Step 3: Determine the number of compounding periods per year (n). (e.g., 12 for monthly, 4 for quarterly).

Step 4: Determine the total number of compounding periods (t) (loan term in years multiplied by n).

Step 5: Calculate the future value (A) using the formula: A = P (1 + r/n)^(nt)

Step 6: Subtract the principal (P) from the future value (A) to find the total interest paid.

Strategies for Minimizing Compound Interest

Minimizing the impact of compound interest on your student loans requires a proactive approach. By understanding the mechanics of compound interest and employing strategic repayment methods, you can significantly reduce the total amount you pay over the life of your loans and accelerate your path to becoming debt-free. This involves careful planning and consistent effort, but the long-term rewards are substantial.

Effective strategies focus on reducing the principal balance as quickly as possible, thereby limiting the amount of interest that accrues. This can be achieved through various methods, including making extra principal payments, strategically choosing a repayment plan, and maintaining good financial habits to avoid accruing further debt.

Extra Principal Payments

Making extra principal payments is one of the most effective ways to reduce the total interest paid on your student loans. Every dollar you pay above your minimum monthly payment directly reduces the principal balance, lowering the base upon which future interest is calculated. Even small, consistent extra payments can make a considerable difference over time. For example, let’s say you have a $30,000 loan at a 5% interest rate with a 10-year repayment plan. Paying an extra $100 per month would significantly shorten the repayment period and reduce the total interest paid. This reduction in repayment time directly translates to less interest accrued overall. The earlier you start making these extra payments, the greater the impact.

Student Loan Repayment Plan Comparisons

Different repayment plans offer varying approaches to managing student loan debt. The standard repayment plan involves fixed monthly payments over a 10-year period. Graduated repayment plans start with lower payments that gradually increase over time. Income-driven repayment plans (IDR) tie your monthly payment to your income and family size, resulting in potentially lower payments but potentially extending the repayment period. Each plan has its advantages and disadvantages. Standard plans offer the quickest repayment but require higher initial payments. Graduated plans ease the burden initially but lead to higher payments later. IDR plans provide affordability but may lead to a larger overall repayment amount due to the longer repayment period. The best choice depends on your individual financial circumstances and long-term goals. Careful consideration of the trade-offs between payment amount and repayment duration is crucial.

Steps to Reduce Student Loan Interest Burden

A multi-pronged approach is often most effective. This involves not only managing existing debt but also preventing further debt accumulation.

Here are some key steps:

- Prioritize high-interest loans: Focus extra payments on loans with the highest interest rates to maximize savings.

- Automate payments: Set up automatic payments to ensure consistent, on-time payments and avoid late fees.

- Refinance if beneficial: Explore refinancing options to potentially secure a lower interest rate, but carefully compare offers and fees.

- Budget effectively: Create and stick to a budget to ensure you can afford your loan payments and avoid accumulating new debt.

- Consider loan consolidation: Consolidating multiple loans into one may simplify payments and potentially lower your interest rate, though this is not always the case.

The Long-Term Financial Implications of Compound Interest on Student Loans

Understanding the long-term effects of compound interest on student loan debt is crucial for responsible financial planning. Ignoring or misunderstanding this powerful force can lead to significant financial hardship and limit future opportunities. The seemingly small amounts accruing daily can snowball into substantial sums over the life of the loan, drastically altering your financial trajectory.

The relentless accumulation of compound interest significantly impacts your overall financial health. High interest rates dramatically inflate the total cost of your education, extending repayment periods and reducing the amount of disposable income available for other life goals. This isn’t simply about the initial loan amount; it’s about the added cost of borrowing that compounds over time.

High Interest Rates and Increased Educational Costs

High interest rates exponentially increase the total amount repaid on student loans. For instance, a $50,000 loan with a 7% interest rate will cost considerably more than the same loan with a 4% interest rate over the same repayment period. The difference can amount to tens of thousands of dollars, representing a significant increase in the effective cost of education. This added expense could be the difference between being able to comfortably afford a down payment on a house or struggling to save for retirement.

Compound Interest’s Impact on Major Life Decisions

The weight of student loan debt, compounded over time, can profoundly influence major life decisions. For example, a large monthly payment on student loans might limit the size of a mortgage a person can qualify for, forcing them into a smaller house or a less desirable neighborhood. Similarly, the need to prioritize loan repayment could delay significant investments, such as starting a retirement savings plan or investing in a business. The opportunity cost of carrying high student loan debt can be substantial, potentially hindering career advancement and financial security.

Visual Representation of Student Loan Debt Growth

Imagine a graph depicting the growth of a $30,000 student loan over 10 years. One line represents a scenario with a 5% interest rate, showing a steady, but manageable, increase in the total debt. Another line illustrates a 10% interest rate, showcasing a much steeper and faster growth of the debt. A third line might depict a scenario where aggressive repayment strategies reduce the principal faster than interest accrues, resulting in a less steep curve. This visual comparison would clearly illustrate how interest rates directly impact the final amount owed, highlighting the importance of understanding and managing compound interest. The difference between the 5% and 10% scenarios could easily represent tens of thousands of dollars in additional debt, dramatically altering long-term financial plans. This illustrates how even small differences in interest rates can have enormous consequences over time.

Comparing Different Loan Types and Interest Rates

Understanding the nuances of student loan interest rates is crucial for effective financial planning. Different loan types carry varying interest rates and repayment terms, significantly impacting the total cost of your education. This section will compare federal and private loans, explore fixed versus variable rates, and illustrate the long-term consequences of interest rate choices.

Federal and Private Student Loan Differences

Federal student loans, offered by the U.S. government, generally have lower interest rates than private loans, which are provided by banks and other financial institutions. Federal loans often come with more borrower protections, such as income-driven repayment plans and loan forgiveness programs. Private loans, however, may offer more flexible repayment options in certain circumstances. The eligibility criteria also differ; federal loans are based on financial need and enrollment status, while private loan eligibility depends on creditworthiness and co-signer availability.

Fixed versus Variable Interest Rates

Fixed interest rates remain constant throughout the loan’s life, providing predictability in monthly payments. Variable interest rates fluctuate based on market indices, leading to potentially lower initial payments but with the risk of higher payments in the future if interest rates rise. Choosing between a fixed and variable rate depends on individual risk tolerance and predictions about future interest rate trends. For instance, if you anticipate interest rates staying low or decreasing, a variable rate might initially seem appealing. However, if rates rise significantly, your monthly payments could increase substantially, potentially leading to difficulty in repayment. A fixed rate offers stability and protection against such fluctuations.

Implications of Interest Rate Choice

The interest rate significantly impacts the total cost of a student loan. A higher interest rate results in a larger total amount repaid over the loan’s lifetime. For example, a $50,000 loan with a 5% fixed interest rate will accumulate significantly less interest over 10 years than the same loan with a 7% fixed interest rate. Conversely, a lower interest rate translates to lower monthly payments and less overall interest paid. This difference can amount to thousands of dollars over the repayment period. Careful consideration of the interest rate is essential to minimize long-term financial burden.

Average Interest Rates for Student Loans (Past Five Years)

The following table presents average interest rates for various student loan types over the past five years (2019-2023). Note that these are averages and actual rates can vary depending on the lender, creditworthiness, and other factors. Data is approximated based on publicly available information and may not reflect the precise average for every lender.

| Loan Type | 2019 (approx.) | 2020 (approx.) | 2021 (approx.) | 2022-2023 (approx.) |

|---|---|---|---|---|

| Federal Direct Subsidized Loan (Undergraduate) | 4.5% | 4.0% | 3.7% | 4.99% |

| Federal Direct Unsubsidized Loan (Undergraduate) | 5.0% | 4.5% | 4.2% | 5.5% |

| Federal Direct Graduate PLUS Loan | 6.0% | 5.5% | 5.2% | 6.5% |

| Private Student Loan (Variable) | 6.5%-10% | 5.5%-9% | 4%-8% | 7%-11% |

| Private Student Loan (Fixed) | 7%-11% | 6%-10% | 5%-9% | 8%-12% |

Epilogue

Successfully managing student loan debt requires a proactive approach, and understanding compound interest is a cornerstone of that strategy. By employing the strategies discussed—from making extra principal payments to choosing the right repayment plan—you can significantly reduce the overall cost of your loans and pave the way for a more secure financial future. Remember, informed decision-making is key to minimizing the long-term impact of compound interest on your financial health.

Q&A

What is the difference between fixed and variable interest rates on student loans?

Fixed interest rates remain constant throughout the loan’s life, making repayment predictable. Variable rates fluctuate with market conditions, potentially leading to higher or lower payments over time.

Can I refinance my student loans to a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but it’s crucial to compare offers carefully and consider the terms and conditions before refinancing.

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage your credit score, and potentially lead to loan default, with serious financial consequences.

Are there any tax benefits associated with student loan interest?

In some cases, you may be able to deduct student loan interest from your taxes, but eligibility requirements vary depending on your income and filing status. Consult a tax professional for guidance.