The intersection of Congress and student loans forms a critical juncture in American economic and social policy. Millions grapple with the burden of student loan debt, impacting their financial futures and the nation’s overall economic health. This exploration delves into the historical evolution of federal student loan programs, analyzing legislative changes, the influence of various interest groups, and the ongoing debate surrounding debt relief. We will examine the economic consequences of current policies and explore potential future directions for more sustainable and equitable solutions.

From the landmark legislation of the 1970s to contemporary proposals for widespread debt forgiveness, the trajectory of student loan policy reflects evolving societal priorities and political landscapes. Understanding this complex interplay is crucial for both policymakers and individuals navigating the challenges of higher education financing.

Historical Overview of Congressional Action on Student Loans

The landscape of federal student loan programs in the United States has undergone significant transformation since the 1970s, shaped by evolving economic conditions, shifting political priorities, and fluctuating public opinion. This evolution reflects a complex interplay between legislative action, administrative interpretations, and the ever-changing needs of students and borrowers.

Timeline of Major Legislative Changes

The federal government’s involvement in student lending began modestly, expanding dramatically over several decades. Key legislative changes have significantly altered the accessibility, affordability, and repayment terms of student loans. Understanding this timeline is crucial to comprehending the current state of student debt.

| Year Enacted | Legislation Name | Key Provisions | Impact on Borrowers |

|---|---|---|---|

| 1972 | Higher Education Act Amendments | Expanded federal student loan programs; introduced subsidized loans. | Increased access to federal student loans, particularly for low-income students. |

| 1992 | Higher Education Amendments | Introduced the Direct Loan Program, shifting away from bank-based lending. | Streamlined the loan process, reducing administrative costs and potentially lowering interest rates for borrowers. |

| 2007 | College Cost Reduction and Access Act | Increased Pell Grant funding, expanded loan limits, and introduced income-driven repayment plans. | Made college more affordable for some students, but also contributed to the rise in overall student loan debt. |

| 2010 | Health Care and Education Reconciliation Act | Further expanded income-driven repayment plans and consolidated federal student loan programs under the Department of Education. | Simplified the loan repayment process for some borrowers and offered more flexible repayment options. |

Evolution of Federal Student Loan Programs

The shift from a primarily bank-based system to a direct lending model under the Department of Education significantly altered the federal student loan landscape. This change aimed to improve efficiency, reduce costs, and enhance borrower protections. Eligibility criteria have also evolved, with expansions in Pell Grant eligibility and increased loan limits aiming to improve access to higher education. Repayment plans have become more diverse, with income-driven repayment options offering more flexibility to borrowers facing financial hardship. Interest rates have fluctuated based on market conditions and legislative decisions, impacting the overall cost of borrowing.

Presidential Approaches to Student Loan Debt

Different presidential administrations have adopted varying approaches to student loan debt. For example, the Obama administration significantly expanded income-driven repayment plans and implemented initiatives to address the rising cost of college. Subsequent administrations have focused on varying aspects of student loan policy, including reforms to repayment plans and efforts to control the growth of student loan debt. These differing priorities highlight the ongoing political debate surrounding the role of the federal government in higher education financing.

Current State of Student Loan Debt and Congressional Involvement

The student loan crisis in the United States is a significant economic and social issue, impacting millions of borrowers and influencing national policy debates. The sheer volume of outstanding debt, coupled with the diverse demographics of those burdened by it, creates a complex landscape requiring careful consideration by Congress. Understanding the current state of student loan debt and the ongoing congressional involvement is crucial to formulating effective solutions.

The total amount of student loan debt in the US is staggering. As of late 2023, the total outstanding student loan debt exceeded $1.7 trillion, surpassing both auto loan and credit card debt. This represents a massive burden on the national economy and individual borrowers alike. This figure reflects the cumulative debt across all borrowers, highlighting the pervasive nature of the issue.

Demographics of Student Loan Borrowers

Student loan debt disproportionately affects certain demographic groups. Borrowers from lower-income families often take on larger loans relative to their income to finance their education. Similarly, minority groups, particularly Black and Hispanic borrowers, often carry higher debt burdens compared to their white counterparts, even when controlling for educational attainment. This disparity is often attributed to factors such as limited access to financial aid and higher rates of borrowing from private lenders with less favorable terms. Additionally, borrowers with only a bachelor’s degree, despite having invested in higher education, can still struggle under the weight of student loan debt, suggesting that the cost of education may not always translate directly into increased earning potential.

Political Discourse Surrounding Student Loan Forgiveness

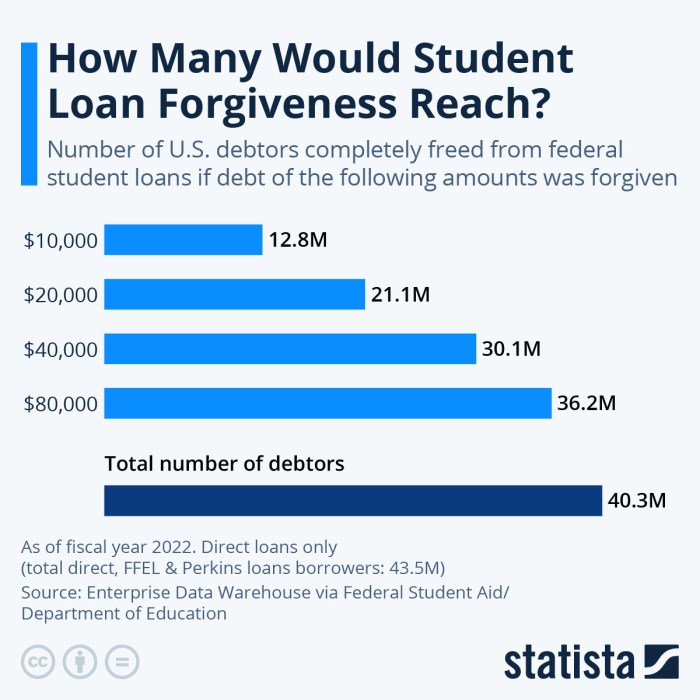

The debate surrounding student loan forgiveness is highly polarized. Proponents argue that widespread forgiveness would stimulate the economy by freeing up borrowers’ disposable income, leading to increased consumer spending and economic growth. They also emphasize the social justice aspect, addressing the disproportionate impact of student loan debt on minority groups and low-income families. Conversely, opponents express concerns about the potential cost to taxpayers, the fairness of forgiving debt for some while others diligently repaid their loans, and the potential for encouraging future over-borrowing. They often propose alternative solutions, such as targeted debt relief for specific groups or reforms to the student loan system itself.

Congressional Proposals Regarding Student Loan Policy

Several proposals are currently being debated in Congress aimed at addressing the student loan crisis. These include various forms of debt relief, ranging from targeted forgiveness for specific groups (e.g., borrowers with disabilities or those who attended for-profit colleges) to broader, income-based repayment plans. There are also proposals focused on reforming the existing student loan system, such as lowering interest rates, increasing access to affordable education, and improving financial literacy among students. These proposals reflect the diverse perspectives within Congress and the ongoing struggle to find a comprehensive and equitable solution to the student loan debt crisis. The debate often centers on the balance between providing relief to struggling borrowers and managing the fiscal implications for the government.

Economic Impacts of Student Loan Policies

The burgeoning student loan debt crisis in the United States has profound and multifaceted economic consequences, impacting both individual borrowers and the national economy. Understanding these impacts is crucial for developing effective and equitable policy solutions. This section will explore the effects of student loan debt on personal finances and economic mobility, analyze the macroeconomic consequences of high student loan debt levels, and examine the potential economic effects of various student loan forgiveness plans.

Student Loan Debt’s Impact on Personal Finances and Economic Mobility

High levels of student loan debt significantly constrain personal finances. Borrowers often face difficulties in saving for retirement, purchasing homes, starting families, and even meeting basic living expenses. This financial strain can delay major life milestones and limit opportunities for wealth accumulation, hindering economic mobility. The weight of loan repayments can also force individuals to postpone or forgo pursuing further education or training, limiting their career advancement prospects. For example, studies have shown a correlation between high student loan debt and lower rates of homeownership among young adults. The inability to accumulate savings also restricts entrepreneurship, as many aspiring business owners lack the capital to start their ventures.

Macroeconomic Consequences of High Student Loan Debt

The accumulation of substantial student loan debt has broader macroeconomic implications. High levels of debt can suppress consumer spending, a key driver of economic growth. When a significant portion of disposable income is allocated to loan repayments, less money is available for other expenditures, potentially slowing overall economic activity. Furthermore, high student loan debt can negatively impact aggregate demand and investment, as individuals prioritize debt repayment over investment in education, business ventures, or other forms of capital accumulation. This reduced investment can hinder long-term economic growth and productivity. The potential for widespread loan defaults also poses a systemic risk to the financial system.

Economic Impacts of Student Loan Forgiveness Plans

Student loan forgiveness plans, while potentially offering immediate relief to borrowers, also carry significant economic implications. One potential benefit is a boost to consumer spending, as forgiven debt frees up disposable income. This increased spending could stimulate economic growth. However, loan forgiveness also raises concerns about the cost to taxpayers and the potential for inflationary pressures. The distribution of benefits could also be uneven, with higher earners potentially benefiting disproportionately. Furthermore, the impact on future borrowing behavior is uncertain. For example, some argue that forgiveness could incentivize future borrowing, potentially exacerbating the problem in the long run. Others argue that it could encourage more people to pursue higher education.

Potential Economic Benefits and Drawbacks of Proposed Student Loan Policies

| Policy | Benefit 1 | Benefit 2 | Drawback |

|---|---|---|---|

| Targeted Loan Forgiveness (e.g., for low-income borrowers) | Increased consumer spending among low-income households | Improved economic mobility for disadvantaged groups | Potential for higher taxes or increased government debt |

| Income-Driven Repayment Reform | More affordable monthly payments for borrowers | Reduced risk of default | Lower overall revenue for the government |

| Increased Funding for Pell Grants | Improved access to higher education for low-income students | Reduced reliance on student loans | Increased government spending |

| Interest Rate Caps | Lower monthly payments for borrowers | Reduced total interest paid over the life of the loan | Potential for reduced lender participation in the student loan market |

Potential Future Directions of Student Loan Policy

The current student loan crisis demands innovative and comprehensive solutions. Addressing the challenges requires a multifaceted approach encompassing legislative changes, alternative financing models, and technological advancements to improve efficiency and accessibility. This section explores several potential pathways for reforming student loan policies and mitigating the burden of student debt.

Legislative Solutions to Address Student Loan Debt

Several legislative avenues could significantly impact student loan debt. One approach involves expanding eligibility for loan forgiveness programs, targeting specific professions or demographics facing disproportionate debt burdens. Another is implementing a more robust system of loan repayment based on income, potentially incorporating adjustments for inflation and regional cost of living differences. Finally, legislation could incentivize institutions to better manage tuition costs, thereby reducing the overall need for borrowing. For example, a tiered system of federal funding could reward institutions demonstrating commitment to affordability and accessibility. This could involve direct funding allocations based on metrics such as graduation rates, student debt levels, and the proportion of low-income students enrolled.

Analysis of Income-Driven Repayment Plans

Income-driven repayment (IDR) plans offer a pathway to more manageable monthly payments, basing them on a borrower’s income and family size. However, current IDR plans suffer from complexities and inconsistencies, leading to confusion and, in some cases, longer repayment periods. Improved transparency and simplification are crucial. For example, a standardized calculation method, clearly communicated across all participating lenders, would reduce ambiguity and improve borrower understanding. Furthermore, addressing the issue of negative amortization – where interest accrues faster than payments – is vital. This could be achieved by implementing interest caps or adjustments based on income fluctuations. The long-term feasibility of IDR plans depends on maintaining a balance between borrower affordability and the long-term solvency of the loan program. The experience of programs like PAYE (Pay As You Earn) and REPAYE (Revised Pay As You Earn) in the US can inform the design of more effective and sustainable IDR models.

Alternative Approaches to Financing Higher Education

Increased grant aid and tuition reform offer promising alternatives to the current reliance on student loans. Expanding Pell Grants, for instance, could significantly reduce the need for borrowing among low-income students. Targeted increases based on demonstrated financial need, combined with simplified application processes, would improve accessibility. Tuition reform could involve various strategies, including state-level tuition caps, incentivizing institutions to reduce costs, and promoting greater transparency in tuition pricing. For example, states could implement performance-based funding models that reward institutions for graduating students with lower debt levels. Moreover, fostering greater collaboration between institutions and employers to create apprenticeship programs and alternative credentialing pathways could reduce the reliance on traditional four-year degrees and the associated debt.

The Role of Technology in Streamlining Student Loan Management and Repayment

Technology offers significant potential to improve the student loan experience. User-friendly online portals could provide borrowers with real-time access to their loan information, simplifying repayment tracking and management. Automated systems could streamline communication between borrowers and lenders, reducing administrative burdens and improving customer service. Furthermore, sophisticated algorithms could personalize repayment plans, adapting to individual circumstances and ensuring affordability. Artificial intelligence could also be used to identify and address potential issues proactively, such as early signs of delinquency, helping borrowers avoid default. The successful integration of technology requires robust data security measures and safeguards against potential misuse. Examples of successful applications of technology in other financial sectors can inform the development of secure and effective systems for student loan management.

Conclusion

The issue of student loan debt and Congressional action remains a dynamic and multifaceted challenge. While significant progress has been made in expanding access to higher education, the current system still presents considerable hurdles for many borrowers. A comprehensive approach, considering economic impacts, the influence of lobbying efforts, and the needs of diverse student populations, is vital to crafting effective and equitable solutions for the future. Ultimately, finding a balance between promoting access to higher education and ensuring the long-term fiscal stability of the nation will require ongoing dialogue and innovative policy solutions.

Detailed FAQs

What are income-driven repayment (IDR) plans?

IDR plans adjust your monthly student loan payments based on your income and family size. Several plans exist, each with different eligibility requirements and repayment periods.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or during periods of deferment. Unsubsidized loans accrue interest from the time they’re disbursed.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple federal student loans into a single loan with a new interest rate and repayment plan. This can simplify repayment but may not always lower your overall interest paid.

What happens if I default on my student loans?

Defaulting on your student loans has severe consequences, including wage garnishment, tax refund offset, and damage to your credit score. It also impacts your ability to obtain future federal loans.