The pursuit of higher education is often lauded as a pathway to success, yet the financial landscape of student loans casts a long shadow. This exploration delves into the often-overlooked drawbacks of student loan debt, examining its profound impact on financial stability, career choices, mental well-being, and future financial planning. We’ll dissect the realities of repayment, explore alternative funding options, and ultimately, empower readers to make informed decisions about their educational journey.

From the crippling weight of high interest rates to the subtle yet significant pressure on career paths, the consequences of student loan debt extend far beyond the initial cost of tuition. This discussion aims to provide a comprehensive understanding of these challenges, offering practical strategies and resources to navigate the complexities of student loan repayment and mitigate its potential long-term effects.

Financial Burden of Student Loans

The weight of student loan debt can significantly impact a borrower’s financial well-being, extending far beyond the immediate repayment period. Understanding the intricacies of interest rates, repayment plans, and the long-term consequences is crucial for responsible financial planning.

High Interest Rates and Loan Repayment

High interest rates dramatically increase the total cost of a student loan. Interest accrues on the principal balance, meaning that borrowers pay not only the initial loan amount but also a substantial sum in interest over the life of the loan. For example, a $30,000 loan with a 7% interest rate will cost significantly more than the same loan with a 4% interest rate, potentially adding tens of thousands of dollars to the total repayment amount. This added cost can severely restrict a borrower’s ability to save, invest, or pursue other financial goals.

Long-Term Debt and Financial Instability

Student loan debt can create long-term financial instability. The persistent monthly payments can strain a budget, limiting the ability to save for retirement, emergencies, or other important financial priorities. The burden of this debt can extend for decades, hindering financial freedom and creating a sense of perpetual financial obligation. This long-term commitment can negatively affect credit scores, making it harder to secure loans for housing or other large purchases.

Impact on Major Life Milestones

Student loan debt frequently delays major life milestones. The financial strain of loan repayments can postpone homeownership, making it difficult to save for a down payment and meet mortgage requirements. Similarly, starting a family may be delayed due to the financial constraints imposed by student loans. The need to prioritize loan payments over savings for a down payment or childcare expenses can significantly impact life choices and create considerable stress. For instance, a young couple might delay having children for several years to prioritize loan repayment.

Strategies for Budgeting and Managing Student Loan Payments

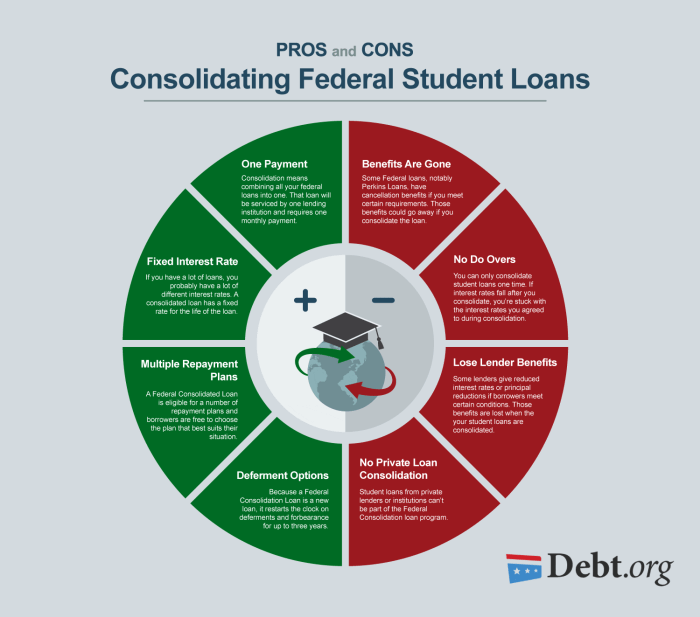

Effective budgeting and loan management strategies are crucial for navigating the challenges of student loan debt. Creating a detailed budget that accounts for all income and expenses is the first step. This allows borrowers to identify areas where spending can be reduced to allocate more funds toward loan repayment. Exploring different repayment options, such as income-driven repayment plans, can help tailor payments to a borrower’s financial situation. Consolidating multiple loans into a single loan can simplify repayment and potentially lower the interest rate. Finally, seeking financial counseling can provide personalized guidance and support in managing student loan debt effectively.

Comparison of Student Loan Repayment Plans

The choice of repayment plan significantly impacts the monthly payment amount, repayment period, and total interest paid. Understanding the differences between these plans is crucial for making informed decisions.

| Plan Name | Monthly Payment Example (Based on $30,000 Loan) | Repayment Period | Interest Accrual |

|---|---|---|---|

| Standard Repayment Plan | $600 – $800 (depending on interest rate and loan term) | 10 years | Significant, depending on interest rate |

| Extended Repayment Plan | Lower than Standard Plan | Up to 25 years | Higher than Standard Plan due to longer repayment period |

| Income-Driven Repayment Plan (e.g., ICR, PAYE, REPAYE) | Based on income and family size | 20-25 years | Potentially high due to longer repayment period; potential for loan forgiveness after 20-25 years |

Impact on Career Choices

The weight of student loan debt can significantly alter the trajectory of a young adult’s career path, often forcing compromises and limiting opportunities that might otherwise be available. The pressure to secure a high-paying job to manage repayment quickly can overshadow passions and potentially lead to career choices driven primarily by financial necessity rather than personal fulfillment.

Student loan debt can subtly, yet powerfully, shape career decisions. Individuals burdened with substantial debt may be less inclined to pursue careers with lower starting salaries, even if those careers align more closely with their interests and long-term goals. The fear of accumulating further debt through postgraduate studies or pursuing less lucrative but personally rewarding fields can be a significant deterrent. This often leads to a focus on immediate financial stability over long-term career satisfaction.

Career Choices with and Without Significant Student Loan Debt

Individuals without significant student loan debt often have greater flexibility in their career choices. They may be more willing to accept lower-paying jobs in fields they are passionate about, pursue further education without the added financial strain, or even take time off to travel or volunteer. In contrast, those with substantial student loan debt may feel compelled to prioritize high-paying jobs, even if those jobs are not fulfilling, to expedite loan repayment. This can lead to feelings of job dissatisfaction and a sense that their career path is dictated by financial constraints rather than personal aspirations. For example, someone with significant debt might choose a high-paying but unfulfilling corporate job over a lower-paying position as a teacher, despite a lifelong passion for education.

Examples of Successful Debt Management and Career Navigation

While the pressure of student loan debt can be immense, many individuals successfully navigate career choices while managing their repayments. One example might be a recent graduate who secures a job in a field they are passionate about, even if the salary is not exceptionally high. They meticulously budget their income, prioritize loan repayment, and seek out resources like income-driven repayment plans to manage their debt effectively. Another example could be someone who chooses to work in a non-profit sector, accepting a lower salary but finding fulfillment in their work, and strategically using budgeting and repayment plans to address their student loans over time. These individuals often demonstrate careful financial planning, prioritizing loan repayment while simultaneously pursuing career goals that align with their values and interests. Their success highlights the importance of proactive financial management and a clear understanding of personal priorities.

Mental Health and Stress

The crushing weight of student loan debt extends far beyond the financial realm, significantly impacting the mental health and overall well-being of borrowers. The constant worry about repayment, coupled with the pressure to secure a well-paying job to manage the debt, can lead to chronic stress and anxiety, affecting various aspects of daily life.

The link between student loan debt and increased stress and anxiety is well-documented. Studies consistently show a correlation between higher levels of debt and increased rates of depression, anxiety disorders, and other mental health challenges. The persistent financial burden creates a pervasive sense of uncertainty and fear, hindering individuals’ ability to focus on other important life aspects, such as career development, personal relationships, and self-care. This constant pressure can lead to sleep disturbances, difficulty concentrating, and even physical health problems. The inability to meet minimum monthly payments can trigger a cascade of negative emotions, further exacerbating mental health issues.

Coping Mechanisms and Resources for Managing Student Loan Debt Stress

Effective coping strategies are crucial for managing the stress associated with student loan debt. These strategies can help individuals regain a sense of control and reduce the overwhelming feelings of anxiety and helplessness. A multi-pronged approach, encompassing both practical financial management and mental health support, is often the most effective.

Available Mental Health Resources for Students

Access to mental health support is vital for students grappling with the pressures of loan repayment. Many institutions offer resources specifically designed to address the unique challenges faced by students. These resources can provide crucial support and guidance in navigating both the financial and emotional aspects of student loan debt.

- University Counseling Centers: Most universities and colleges provide counseling services to students, often at no or low cost. These services can offer therapy, stress management techniques, and support groups.

- National Alliance on Mental Illness (NAMI): NAMI offers various resources, including support groups, educational materials, and a helpline for individuals struggling with mental health challenges. They provide information and support specifically tailored to managing stress related to financial difficulties.

- The Jed Foundation: The Jed Foundation focuses on protecting emotional health and preventing suicide for teens and young adults. Their resources address the impact of stress and anxiety, offering practical strategies and support for navigating challenging life circumstances, including financial difficulties.

- Student Loan Repayment Assistance Programs: Many government and non-profit organizations offer programs to help students manage their loan repayments. These programs can provide guidance on income-driven repayment plans, loan forgiveness programs, and other options to reduce the financial burden and associated stress.

- Financial Counseling Services: Numerous organizations provide free or low-cost financial counseling services. These services can help students create a budget, develop a repayment plan, and explore options for debt consolidation or management.

Impact on Future Financial Decisions

Student loan debt casts a long shadow over an individual’s financial future, significantly impacting their ability to achieve crucial long-term goals and navigate major life decisions. The weight of these loans extends far beyond the monthly payment, influencing saving habits, creditworthiness, and access to further financial opportunities.

The persistent pressure of student loan repayments often leaves little room for saving for retirement or other significant long-term objectives. This financial constraint can lead to delayed homeownership, reduced investment opportunities, and a potentially less secure financial future in retirement. The impact is particularly pronounced for individuals with high debt loads relative to their income.

Retirement Savings Challenges

The considerable monthly payments required for student loans often divert funds that would otherwise be allocated to retirement savings plans. This can severely impact the accumulation of retirement assets, potentially leading to a less comfortable retirement or necessitating a longer working life. For example, someone with a $50,000 student loan balance and a 6% interest rate might find their monthly payment significantly impacting their ability to contribute even a modest amount to a 401(k) or IRA. This reduction in contributions, compounded over decades, can result in a substantial difference in retirement savings.

Credit Building Difficulties

Building a strong credit history is crucial for securing loans and favorable interest rates in the future. However, managing substantial student loan payments can negatively impact credit scores, especially if borrowers struggle to make timely payments. The consistent burden of student loan debt can make it challenging to obtain other types of credit, such as credit cards or personal loans, which are necessary to build a comprehensive credit profile. A lower credit score can lead to higher interest rates on future loans, exacerbating the long-term financial strain.

Securing Loans for Major Purchases

The presence of significant student loan debt often makes it more difficult to secure loans for major purchases such as a house or car. Lenders assess an applicant’s debt-to-income ratio when considering loan applications, and a high student loan balance can significantly reduce the likelihood of approval or result in less favorable loan terms, such as higher interest rates or a larger down payment. This can delay major life milestones, such as homeownership or purchasing a reliable vehicle. A hypothetical scenario might involve a young professional with substantial student loan debt applying for a mortgage. Their debt-to-income ratio may be too high to qualify for a loan, even with a good income, delaying their ability to purchase a home.

Hypothetical Scenario: The Long-Term Impact of High Student Loan Debt

Consider Sarah, a recent graduate with $100,000 in student loan debt at a 7% interest rate. Her monthly payment is substantial, leaving limited funds for retirement savings and other investments. She struggles to build a strong credit history due to the loan payments, leading to higher interest rates on future loans. When she attempts to buy a house, she finds it difficult to qualify for a mortgage due to her high debt-to-income ratio. Over time, the high interest payments on her student loans significantly reduce her disposable income, impacting her ability to save for her children’s education and ultimately leading to a less secure financial future. This scenario illustrates how high student loan debt can create a ripple effect, impacting various aspects of her financial life for decades.

Alternatives to Student Loans

The crippling weight of student loan debt is a significant concern for many, but thankfully, viable alternatives exist. Exploring these options proactively can significantly reduce reliance on loans and pave the way for a more financially secure future. This section will examine several alternatives, comparing their benefits, drawbacks, and application processes.

Comparison of Funding Options

Choosing the right funding source for higher education requires careful consideration of various factors, including the amount of funding needed, eligibility requirements, and the time commitment involved in securing the funds. Scholarships, grants, and part-time jobs represent distinct pathways to finance education, each with its unique advantages and disadvantages. Scholarships are typically merit-based awards that don’t need to be repaid. Grants, on the other hand, are often need-based and also do not require repayment. Part-time jobs offer a reliable income stream but require a time commitment that could potentially affect academic performance.

Scholarships and Grants: Application and Award Processes

Securing scholarships and grants involves diligent research and a proactive application strategy. The application process generally requires completing an application form, providing academic transcripts, and sometimes submitting essays or letters of recommendation. Many scholarships and grants are offered by universities, colleges, private organizations, and even corporations. Finding suitable opportunities requires thorough research through online databases, university financial aid offices, and professional organizations relevant to the student’s field of study. Successful applicants typically demonstrate strong academic performance, community involvement, and a clear articulation of their educational goals. The award amounts vary significantly depending on the source and the applicant’s qualifications.

Potential Savings and Benefits of Alternative Funding Sources

The financial benefits of exploring alternative funding sources are substantial. By successfully securing scholarships and grants, students can significantly reduce or even eliminate their reliance on student loans. This translates to considerable long-term savings, avoiding the burden of monthly loan repayments and the accumulation of interest over time. For instance, a student who secures a $10,000 scholarship avoids taking out a loan for that amount, saving potentially thousands of dollars in interest over the loan repayment period. Furthermore, minimizing loan debt can positively impact credit scores and overall financial well-being, allowing graduates to pursue their desired career paths without the constraint of significant debt repayment. Working part-time allows students to contribute directly to their education costs, building financial responsibility and reducing reliance on external funding.

Visual Representation of Cost Comparison

Imagine a bar graph. One bar represents the total cost of education financed primarily through student loans, showing a high bar representing the total cost including principal and accumulated interest over time. A second, significantly shorter bar represents the total cost of education funded through a combination of scholarships, grants, and part-time work. This visual comparison clearly illustrates the potential savings and reduced financial burden achieved by utilizing alternative funding sources. The difference between the heights of the bars visually represents the substantial amount saved by avoiding excessive student loan debt. For example, if the student loan bar shows $100,000, and the alternative funding bar shows $60,000, the difference of $40,000 visually emphasizes the significant financial benefit.

Closing Notes

Navigating the complexities of student loan debt requires careful planning, proactive decision-making, and a realistic understanding of its potential long-term implications. While higher education is undeniably valuable, a thorough assessment of funding options and a realistic approach to repayment are crucial to ensuring that the pursuit of knowledge doesn’t lead to overwhelming financial burdens. By understanding the potential downsides and exploring alternatives, individuals can embark on their educational journey with a clearer vision and a more secure financial future.

Questions and Answers

What happens if I can’t make my student loan payments?

Failure to make payments can result in delinquency, negatively impacting your credit score and potentially leading to wage garnishment or legal action. Explore options like deferment or forbearance programs to avoid default.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payment. However, carefully compare offers and consider the terms before refinancing, as it might extend your repayment period.

How do student loans affect my credit score?

Your student loan payment history significantly impacts your credit score. Consistent on-time payments build positive credit, while missed payments can severely damage your creditworthiness.

Are there any government programs to help with student loan repayment?

Yes, several government programs offer income-driven repayment plans, loan forgiveness programs (depending on your occupation), and other assistance options. Research these programs to see if you qualify.