Navigating the complexities of federal student loan debt can feel overwhelming. The sheer volume of loans, varying interest rates, and diverse repayment plans often leave borrowers searching for clarity and a path to manageable repayment. Consolidating your federal student loans presents a potential solution, offering the promise of simplified repayment and potentially lower monthly payments. However, it’s crucial to understand both the advantages and potential drawbacks before making this significant financial decision. This guide provides a comprehensive overview of the process, helping you make an informed choice.

This exploration delves into the intricacies of federal student loan consolidation, examining the step-by-step application process, eligibility requirements, and the impact on repayment plans. We’ll analyze the benefits and potential pitfalls, comparing consolidation to alternative debt management strategies. Through illustrative examples and a frequently asked questions section, we aim to empower you with the knowledge necessary to determine if consolidation is the right path for your financial future.

The Process of Federal Student Loan Consolidation

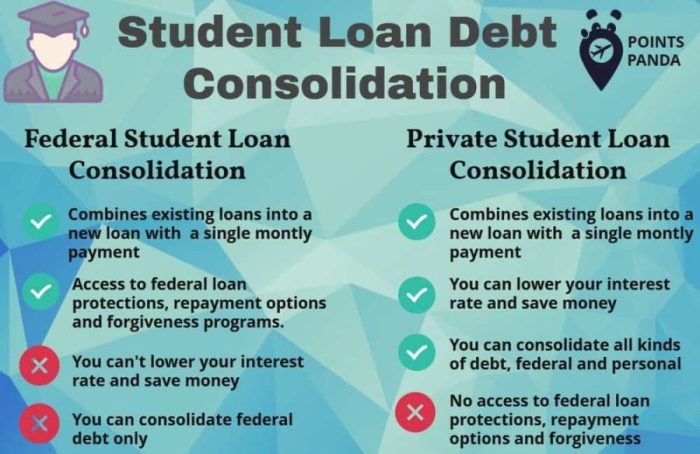

Consolidating your federal student loans can simplify your repayment process by combining multiple loans into a single, new loan. This can lead to a more manageable monthly payment and potentially a more favorable repayment plan, though it’s crucial to understand the implications before proceeding. This section details the process, eligible loan types, and application steps involved in federal student loan consolidation.

Types of Federal Student Loans Eligible for Consolidation

Federal student loan consolidation allows you to combine various federal student loans into one. This includes Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for parents and graduate students), and Federal Stafford Loans (older programs). However, private student loans, Perkins Loans, and certain other federal education loans are generally not eligible for Direct Consolidation Loans. It’s essential to verify the eligibility of each loan before beginning the consolidation process.

Steps Involved in Applying for Federal Student Loan Consolidation

The application process for federal student loan consolidation is relatively straightforward. First, you’ll need to gather all relevant information about your existing federal student loans, including loan numbers, lenders, and outstanding balances. Next, you’ll need to complete the Direct Consolidation Loan application online through the Federal Student Aid website (StudentAid.gov). This involves providing personal information, details about your loans, and choosing your repayment plan. After submitting the application, your loans will be reviewed, and once approved, your new consolidated loan will be disbursed. You will then receive a new loan servicer and a new monthly payment amount based on your chosen repayment plan.

Step-by-Step Guide to Applying for Federal Student Loan Consolidation

- Gather information on all your federal student loans.

- Visit the Federal Student Aid website (StudentAid.gov).

- Complete the Direct Consolidation Loan application online.

- Review and submit your application.

- Await approval and disbursement of your new consolidated loan.

Comparison of Interest Rates and Repayment Terms

The interest rate for a consolidated loan is typically a weighted average of the interest rates on your existing loans, rounded up to the nearest one-eighth of a percent. Repayment terms vary depending on the repayment plan you select. The following table provides a simplified comparison. Note that actual rates and terms can vary depending on factors such as your credit history and loan type. This table is for illustrative purposes only and should not be considered financial advice. Always consult the official Federal Student Aid website for the most up-to-date information.

| Repayment Plan | Interest Rate (Example) | Repayment Term (Example) | Monthly Payment (Example) |

|---|---|---|---|

| Standard Repayment | 6.00% | 10 years | $300 |

| Graduated Repayment | 6.00% | 10 years | Payments start low and increase over time |

| Extended Repayment | 6.00% | 25 years | Lower monthly payments |

| Income-Driven Repayment (IBR, PAYE, REPAYE, ICR) | 6.00% | 20-25 years | Payments based on income |

Benefits and Drawbacks of Consolidation

Consolidating your federal student loans can seem like a straightforward solution to managing multiple loan payments, but it’s crucial to understand both the advantages and disadvantages before making a decision. Weighing the pros and cons carefully will help you determine if consolidation is the right choice for your financial situation.

Simplified Repayment

One of the most appealing aspects of federal student loan consolidation is the simplification of repayment. Instead of juggling multiple monthly payments to different lenders with varying interest rates and due dates, consolidation combines all your eligible federal loans into a single loan with one monthly payment. This streamlined approach can make budgeting and repayment significantly easier to manage. This is particularly helpful for individuals who find tracking multiple loans and payments challenging.

Potential for Higher Overall Interest Rate

A significant drawback of consolidation is the potential for a higher overall interest rate. The new interest rate on your consolidated loan is typically a weighted average of the interest rates on your existing loans, rounded up to the nearest one-eighth of a percent. While this may not always result in a higher rate, it’s possible, and this higher rate could lead to paying more in interest over the life of the loan. For example, if you have some loans with low interest rates and some with higher rates, the average could be higher than your lowest rate.

Impact on Credit Score

The impact of consolidation on your credit score is complex and not always negative. While opening a new loan can temporarily lower your score due to a slight increase in your credit utilization ratio, the long-term effect depends on your repayment behavior. Consistent on-time payments on your consolidated loan can improve your credit score over time. Conversely, missed payments can negatively impact your score, potentially more significantly than if you had missed payments on several smaller loans. The positive effects of consistent payments typically outweigh the temporary dip caused by opening a new line of credit.

Comparison with Other Repayment Options

Consolidation is just one of several federal student loan repayment options. It differs from income-driven repayment plans, which base your monthly payment on your income and family size. Income-driven plans may result in lower monthly payments but could lead to higher overall interest payments and a longer repayment period. Consolidation, on the other hand, offers a fixed monthly payment and a set repayment term, providing predictability but without the potential for lower monthly payments based on income. Choosing between consolidation and an income-driven plan depends on your individual financial circumstances and priorities. For instance, someone with a low income might benefit more from an income-driven plan, while someone with a stable income might prefer the predictability of a consolidated loan.

Eligibility Requirements for Consolidation

Federal student loan consolidation allows you to combine multiple federal student loans into a single loan, simplifying repayment. However, eligibility hinges on meeting specific criteria and providing necessary documentation. Understanding these requirements is crucial for a smooth application process.

Eligibility for federal student loan consolidation primarily depends on the type of loans you hold. You must have eligible federal student loans, such as Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans. Private student loans, however, are not eligible for federal consolidation. Additionally, your loans must be in repayment, default, or forbearance. Borrowers who are still in grace periods may not be immediately eligible, but this can vary depending on the specific loan program.

Required Documentation for Consolidation

To apply for federal student loan consolidation, you’ll need to provide certain documentation to verify your identity and loan details. This process helps ensure the accuracy and security of your application. Missing documentation can delay or even prevent the consolidation process.

- Social Security Number (SSN): This is essential for identifying you within the federal student loan system.

- Federal Student Loan Information: You’ll need the loan numbers and details of each loan you wish to consolidate. This information can usually be found on your loan statements or through the National Student Loan Data System (NSLDS).

- Proof of Income (if applicable): Depending on the type of consolidation and your chosen repayment plan, you may need to provide proof of income. This could be a pay stub, tax return, or other documentation verifying your current financial situation.

Verifying Eligibility and the Application Process

The process of verifying your eligibility for federal student loan consolidation begins with submitting your application. The Department of Education will then review your provided information and cross-reference it with the data held in the NSLDS. This process involves checking the types of loans you possess, their current status, and your personal information. Any discrepancies or missing information will result in a request for additional documentation, delaying the process. Once eligibility is confirmed, the consolidation process moves forward, resulting in the creation of a new, single loan.

Consolidation Eligibility Checklist

Before you begin the application process, reviewing this checklist will help ensure you have everything you need:

- Eligible Federal Student Loans (Direct Loans, FFEL, Perkins Loans)

- Loans in repayment, default, or forbearance

- Social Security Number (SSN)

- Federal Student Loan Information (loan numbers and details)

- Proof of Income (if required)

Impact on Repayment Plans

Consolidating your federal student loans can significantly alter your repayment strategy, impacting everything from your monthly payment amount to your eligibility for loan forgiveness programs. Understanding these changes is crucial before making a decision. The effect of consolidation varies depending on your current repayment plan and your individual loan characteristics.

Consolidation simplifies your repayment by combining multiple loans into a single loan with one monthly payment. However, this simplification doesn’t necessarily translate to a lower overall cost or easier repayment. The new loan’s interest rate is a weighted average of your existing loans’ rates, which may be higher or lower than your current highest rate. This impacts your total interest paid over the life of the loan. Furthermore, your eligibility for certain repayment plans and forgiveness programs can be affected.

Impact on Income-Driven Repayment Plans

Switching to a consolidated loan can affect your eligibility for income-driven repayment (IDR) plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). While consolidation itself doesn’t automatically disqualify you, the process can reset the clock on your repayment timeline. For example, if you were nearing loan forgiveness under an IDR plan, consolidation might extend the repayment period, delaying forgiveness. This is because the consolidated loan’s repayment term is often longer, and the IDR calculation is based on the new loan’s terms. The new loan’s payment amount might also change, depending on your income and the new loan’s terms.

Implications for Loan Forgiveness Programs

Consolidation can have a profound impact on your eligibility for loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness. Consolidating loans under the Direct Loan program is generally required for PSLF, but consolidating federal family education loans (FFEL) or Perkins loans into a Direct Consolidation Loan can affect your progress towards forgiveness. Any payments made before consolidation might not count towards the required 120 qualifying monthly payments for PSLF. Similarly, consolidating loans could reset the clock for other forgiveness programs, potentially delaying the forgiveness timeline.

Changes in Monthly Payment Amount

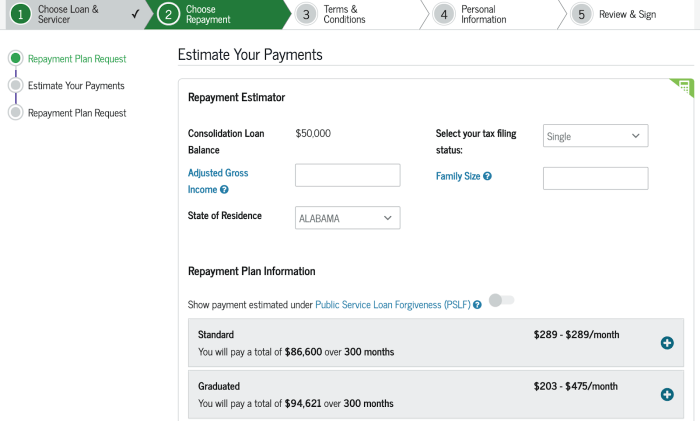

The monthly payment amount after consolidation depends on several factors, including the new interest rate, the loan balance, and the repayment term. A longer repayment term will result in a lower monthly payment, but you’ll pay significantly more in interest over the life of the loan. Conversely, a shorter repayment term will result in a higher monthly payment, but you’ll pay less in interest overall. For example, a $50,000 loan with a 6% interest rate over 10 years might have a monthly payment of approximately $530, while the same loan over 20 years might have a monthly payment of approximately $350. However, the total interest paid would be considerably higher over the longer repayment period.

Potential Changes in Repayment Schedules

Before consolidating, carefully consider the following potential changes to your repayment schedule:

- Change in Interest Rate: The new interest rate will be a weighted average of your existing loan rates, potentially resulting in a higher or lower rate.

- Change in Monthly Payment Amount: Your monthly payment could increase or decrease, depending on the new interest rate and the chosen repayment term.

- Change in Repayment Term: The repayment term of your consolidated loan will likely be longer than the shortest term of your existing loans.

- Resetting of Progress Toward Forgiveness: Progress towards loan forgiveness programs might be reset, extending the time to forgiveness.

- Loss of Certain Repayment Plan Eligibility: You might lose eligibility for certain repayment plans, depending on the terms of the consolidated loan.

Potential Pitfalls to Avoid

Consolidating federal student loans can be a beneficial process, but navigating it without awareness of potential pitfalls can lead to unexpected consequences. Understanding common mistakes and making informed decisions is crucial for maximizing the advantages of consolidation while minimizing potential drawbacks. Careful planning and a thorough understanding of the terms are key to a successful consolidation experience.

Common Mistakes to Avoid During Consolidation

Failing to compare loan terms before consolidating is a frequent error. Borrowers should meticulously review interest rates, repayment terms, and any associated fees across different consolidation programs to identify the most advantageous option. Another common oversight is neglecting to understand the impact of consolidation on loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF). Consolidating loans can alter eligibility criteria, potentially delaying or jeopardizing forgiveness. Finally, some borrowers rush into consolidation without fully considering their long-term financial goals and repayment capacity. This can lead to unforeseen difficulties in managing monthly payments.

Choosing the Best Consolidation Plan

Selecting the optimal consolidation plan hinges on individual financial circumstances and long-term objectives. Borrowers should prioritize a plan that aligns with their repayment capabilities and financial goals. Factors to consider include the interest rate offered, the length of the repayment term, and the potential impact on credit score. For example, a borrower with a high debt load and limited income might benefit from an extended repayment plan, even if it results in paying slightly more interest overall. Conversely, a borrower with a higher income and shorter-term financial goals might prefer a shorter repayment period with higher monthly payments. A thorough analysis of various options is crucial before making a final decision.

Understanding Terms and Conditions Before Consolidation

Before proceeding with consolidation, it is paramount to thoroughly understand all terms and conditions associated with the chosen plan. This includes carefully reviewing the interest rate, repayment schedule, fees, and any other associated charges. Borrowers should pay close attention to the details of the loan agreement, ensuring complete comprehension before signing any documents. Overlooking crucial details can lead to unexpected financial burdens and difficulties in managing the consolidated loan. For instance, hidden fees or unfavorable interest rate adjustments can significantly impact the overall cost of repayment. Therefore, taking the time to fully understand the terms is an essential step in the consolidation process.

Decision-Making Flowchart for Consolidation

The following flowchart illustrates the key decision points involved in the federal student loan consolidation process:

[Imagine a flowchart here. The flowchart would start with a “Start” box. It would then branch to a box asking “Do you have multiple federal student loans?”. A “Yes” branch would lead to a box asking “Have you compared interest rates and repayment terms of different consolidation options?”. A “No” branch would loop back to the comparison box. A “Yes” branch would lead to a box asking “Do you understand the terms and conditions of your chosen plan?”. A “No” branch would loop back to the review terms box. A “Yes” branch would lead to a box asking “Does the plan align with your financial goals and repayment capacity?”. A “No” branch would loop back to the plan comparison box. A “Yes” branch would lead to a “Consolidate Loans” box. A “No” branch would lead to a “Re-evaluate Options” box. Finally, both the “Consolidate Loans” and “Re-evaluate Options” boxes would lead to an “End” box.]

Alternatives to Consolidation

Before diving into alternative strategies for managing federal student loan debt, it’s important to understand that consolidation isn’t always the best solution. Several other approaches might be more beneficial depending on your individual financial situation and loan characteristics. These alternatives offer different advantages and disadvantages compared to consolidation, and careful consideration is crucial to selecting the most appropriate path.

Exploring alternatives to federal student loan consolidation involves examining strategies that address debt management without combining loans into a single payment. These approaches often focus on optimizing repayment terms, minimizing interest accrual, or leveraging specific government programs designed to assist borrowers.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payment based on your income and family size. These plans, such as ICR, PAYE, REPAYE, and IBR, can significantly lower your monthly payments, potentially making them more manageable. However, IDR plans typically extend the repayment period, leading to higher overall interest paid over the life of the loan. This trade-off between lower monthly payments and increased total interest is a key consideration. For example, a borrower with a high debt load and low income might find an IDR plan more manageable than consolidation, even if it means paying more interest in the long run.

Deferment and Forbearance

Deferment and forbearance offer temporary pauses or reductions in your monthly loan payments. Deferment is usually granted for specific reasons, such as returning to school or experiencing unemployment. Forbearance is generally granted when you face temporary financial hardship. While these options provide short-term relief, they don’t reduce your overall debt and often lead to accumulating interest, increasing your total loan amount. This approach is best suited for borrowers facing temporary financial setbacks who anticipate being able to resume payments soon. It’s not a long-term solution and shouldn’t be used repeatedly.

Student Loan Rehabilitation

If your federal student loans are in default, rehabilitation might be an option. This involves making nine on-time payments within a specific timeframe, after which your loans are reinstated to good standing. Rehabilitation can remove the default status from your credit report and restore your eligibility for certain repayment plans and benefits. However, it doesn’t reduce your loan amount or interest accrued during the default period. This is a viable alternative for borrowers facing default, offering a path back to responsible loan management.

Public Service Loan Forgiveness (PSLF)

PSLF is a program that forgives the remaining balance on your federal student loans after you’ve made 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit organization. Meeting the stringent requirements for PSLF can be challenging, but the potential for complete loan forgiveness is a significant benefit for eligible borrowers. This is preferable to consolidation if you meet the eligibility criteria, as it leads to debt elimination rather than just restructuring.

Comparison Table

| Feature | Consolidation | IDR Plans | Deferment/Forbearance | PSLF |

|---|---|---|---|---|

| Monthly Payment | Potentially lower, depending on the chosen repayment plan | Lower, based on income | Reduced or paused | Lower under IDR, eventual forgiveness |

| Total Interest Paid | Potentially lower with a shorter repayment term, potentially higher with a longer term | Generally higher due to longer repayment periods | Increases during deferment/forbearance | Potentially high initially, but eventually zero |

| Loan Term | Variable, often longer | Typically longer | Extended by the deferment/forbearance period | Extended until 120 qualifying payments |

| Eligibility | Most federal loan borrowers | Most federal loan borrowers | Most federal loan borrowers | Specific employment and repayment plan requirements |

Illustrative Examples of Consolidation Scenarios

Consolidating federal student loans can significantly alter a borrower’s repayment journey. The optimal approach depends heavily on individual circumstances, including loan types, interest rates, and financial goals. The following scenarios illustrate how consolidation might impact different borrowers.

Scenario 1: High-Interest Loans, Seeking Lower Monthly Payments

This scenario involves Sarah, who holds $60,000 in federal student loans: $20,000 in subsidized loans at 4.5% interest, $20,000 in unsubsidized loans at 6%, and $20,000 in graduate PLUS loans at 7.5%. Sarah is struggling to manage her high monthly payments. Consolidation would allow her to combine these loans into a single loan with a weighted average interest rate, likely lower than her highest rate (7.5%), resulting in a potentially lower monthly payment. However, this lower payment may come at the cost of a slightly longer repayment period, leading to potentially higher overall interest paid over the life of the loan. The benefit for Sarah is immediate financial relief, while the drawback is a potential increase in total interest paid.

Scenario 2: Mixed Loan Types, Aiming for Income-Driven Repayment

John owes $45,000, comprising $20,000 in subsidized undergraduate loans and $25,000 in unsubsidized graduate loans. His current repayment plan is proving difficult to maintain. Consolidating his loans makes him eligible for an income-driven repayment (IDR) plan. This plan bases his monthly payments on his income and family size. While his weighted average interest rate might increase slightly after consolidation, the significant reduction in monthly payments through the IDR plan outweighs this increase for John, offering long-term financial stability. The risk is that he may end up paying more interest over time if his income remains low throughout the repayment period.

Scenario 3: Low-Interest Loans, No Immediate Financial Distress

Maria holds $30,000 in federal student loans with a low average interest rate of 3.5%. She is currently managing her payments comfortably. For Maria, consolidation offers little benefit. Consolidating her loans wouldn’t significantly reduce her monthly payment, and any slight increase in interest rate could outweigh any perceived advantages. In her case, maintaining her existing loans is the financially wiser choice. The weighted average interest rate post-consolidation is unlikely to be significantly lower, and the potential for extending the repayment period negates any potential benefits.

Scenario 4: Default Imminent, Seeking Rehabilitation

David is facing default on his $50,000 in federal student loans due to financial hardship. Consolidation, in this situation, offers a pathway to rehabilitation. By consolidating his loans and agreeing to a new repayment plan, he can avoid default and prevent severe damage to his credit score. While he may still face a longer repayment period and potentially higher overall interest costs, the immediate benefit of avoiding default is substantial. This scenario highlights the non-monetary benefits of consolidation. The negative impact on his credit history is mitigated, offering better future financial opportunities.

Epilogue

Consolidating federal student loans can be a powerful tool for simplifying debt management, but it’s not a one-size-fits-all solution. Careful consideration of your individual circumstances, including your current loan portfolio, financial goals, and understanding of the potential long-term implications, is paramount. By weighing the advantages against the potential disadvantages and exploring alternative strategies, you can make an informed decision that aligns with your financial well-being. Remember to thoroughly research and understand the terms and conditions before proceeding with consolidation. This proactive approach will help you navigate the complexities of student loan repayment and pave the way towards a more secure financial future.

FAQ Section

What happens to my loan forgiveness eligibility after consolidation?

Consolidation may affect your eligibility for certain loan forgiveness programs. The specific impact depends on the program and your loan type. Research the implications for your specific program before consolidating.

Can I consolidate private student loans with federal student loans?

No, federal student loan consolidation programs only apply to federal student loans. Private loans must be addressed separately.

Will my credit score improve after consolidation?

Consolidation itself won’t directly improve your credit score. However, consistent on-time payments after consolidation can positively impact your credit over time.

What if I default on my consolidated loan?

Defaulting on a consolidated loan has serious consequences, including damage to your credit score, wage garnishment, and potential tax refund offset.