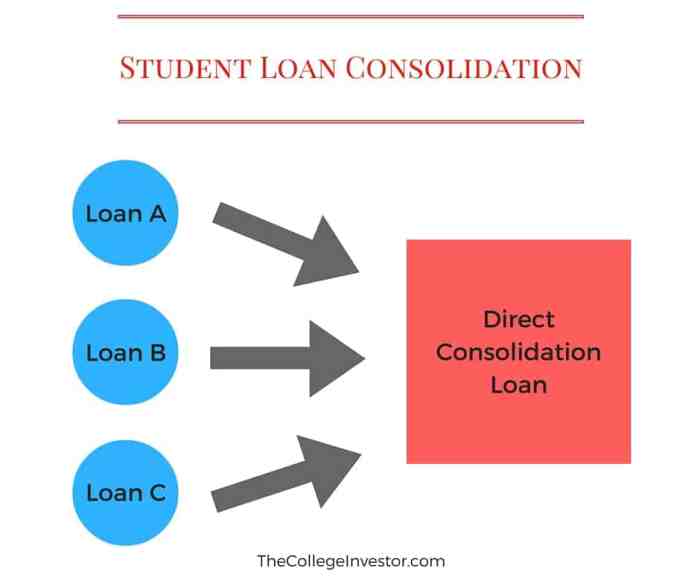

Navigating the complex world of student loan debt can feel overwhelming. Many borrowers find themselves juggling multiple loans with varying interest rates and repayment schedules. Student loan consolidation offers a potential solution, simplifying repayment by combining multiple loans into a single, manageable payment. This guide explores the process, benefits, and potential drawbacks of consolidating your student loans, empowering you to make informed decisions about your financial future.

Understanding the nuances of federal versus private loan consolidation is crucial. Eligibility criteria, interest rate calculations, and the potential impact on your credit score all play significant roles in determining the best approach for your individual circumstances. We will delve into each of these aspects, providing clear explanations and practical examples to help you navigate this important financial step.

Eligibility Requirements for Consolidation

Consolidating your student loans, whether federal or private, can simplify your repayment process by combining multiple loans into a single one. However, eligibility requirements vary depending on the type of loan and the lender. Understanding these requirements is crucial before you begin the consolidation process. This section will Artikel the key eligibility criteria for both federal and private student loan consolidation, highlighting the differences and the impact of your credit score.

Federal Student Loan Consolidation Eligibility

To be eligible for federal student loan consolidation, you must have eligible federal student loans. This generally includes Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans. However, some loans, such as defaulted loans, may require rehabilitation before they can be consolidated. The specific types of federal loans eligible for consolidation can change, so it’s always advisable to check the current guidelines on the Federal Student Aid website. You will also need to complete a Direct Consolidation Loan application.

Private Student Loan Consolidation Eligibility

Eligibility for private student loan consolidation is significantly different from federal consolidation. Private lenders establish their own criteria, which often focus heavily on your creditworthiness. Generally, you’ll need a good or excellent credit score, a stable income, and a demonstrable ability to repay the consolidated loan. Unlike federal consolidation, there isn’t a single set of requirements across all private lenders.

Comparison of Eligibility Requirements Across Lenders

Private lenders’ eligibility requirements vary considerably. Some may offer consolidation options to borrowers with lower credit scores but may charge higher interest rates to offset the increased risk. Others may require a minimum credit score, a certain level of income, or a specific debt-to-income ratio. For example, Lender A might require a minimum credit score of 660 and a debt-to-income ratio under 40%, while Lender B might accept borrowers with scores as low as 620 but with a significantly higher interest rate. It’s essential to compare offers from multiple lenders to find the most suitable option based on your individual financial situation.

Impact of Credit Score on Eligibility

Your credit score plays a crucial role in your eligibility for private student loan consolidation, and it can even influence the terms you receive. A higher credit score generally leads to better interest rates and more favorable loan terms. A lower credit score might result in rejection of your application or significantly less favorable terms, including higher interest rates and potentially higher fees. For example, a borrower with a credit score of 750 might qualify for a lower interest rate than a borrower with a credit score of 600, even if both have similar incomes and debt levels. Improving your credit score before applying for consolidation can significantly improve your chances of approval and securing better loan terms.

The Consolidation Process

Consolidating your student loans, whether federal or private, can simplify your repayment process by combining multiple loans into a single, manageable payment. Understanding the steps involved is crucial for a smooth and successful consolidation. This section details the process for both federal and private loan consolidation.

Federal Student Loan Consolidation Steps

The process for consolidating federal student loans is relatively straightforward and can be completed online. It’s important to gather all necessary information beforehand to streamline the application.

- Gather your loan information: Collect your Federal Student Aid (FSA) ID, loan numbers, and details about each loan (lender, interest rate, balance). This information is essential for accurate consolidation.

- Choose your consolidation loan program: The most common federal loan consolidation program is the Direct Consolidation Loan. This program allows you to combine most federal student loans into a single Direct Consolidation Loan.

- Complete the application: The application process is typically completed online through the Federal Student Aid website (StudentAid.gov). You’ll need to provide your personal information, loan details, and agree to the terms and conditions.

- Review and submit your application: Carefully review all the information you’ve provided before submitting. Any errors could delay the process.

- Monitor your application status: After submitting your application, you can track its progress online. This will allow you to stay informed about the status of your consolidation.

- Receive your new loan: Once approved, your new consolidated loan will be disbursed, and your old loans will be paid off.

Private Student Loan Consolidation Steps

Consolidating private student loans is slightly more complex than federal consolidation, as it typically involves working directly with a private lender.

- Research lenders: Begin by researching different private lenders who offer student loan consolidation. Compare interest rates, fees, and repayment terms to find the best option for your financial situation. Consider factors like credit score requirements and loan amounts offered.

- Check your eligibility: Each lender has its own eligibility requirements. Before applying, ensure you meet the criteria, which often include credit history and income verification.

- Gather your loan information: Similar to federal consolidation, gather all relevant information about your private student loans, including loan numbers, balances, and interest rates.

- Complete the application: The application process will vary depending on the lender, but generally involves completing an online application form and providing supporting documentation.

- Provide supporting documentation: Lenders may request documentation such as proof of income, tax returns, or employment verification to verify your eligibility and assess your creditworthiness.

- Review and submit your application: Carefully review your application before submission to ensure accuracy. Inaccuracies can lead to delays or rejection.

- Monitor your application status: Keep track of your application’s progress. Contact the lender if you have any questions or concerns.

- Receive your new loan: Once approved, your new consolidated loan will be disbursed, and your old loans will be paid off.

Tips for a Smooth Consolidation Process

Careful planning and preparation can significantly ease the consolidation process.

- Compare lenders and interest rates: Don’t settle for the first offer you receive. Shop around and compare options from multiple lenders to find the best terms.

- Understand the terms and conditions: Read the loan agreement carefully before signing. Understand the interest rate, fees, and repayment terms.

- Organize your documents: Gather all necessary documents beforehand to avoid delays in the application process. This includes loan information, income verification, and other supporting documentation.

- Maintain good communication: Stay in contact with your lender throughout the process to address any questions or concerns promptly.

- Check your credit report: Review your credit report for any errors before applying for consolidation. Errors can negatively impact your approval chances.

Interest Rates and Loan Terms After Consolidation

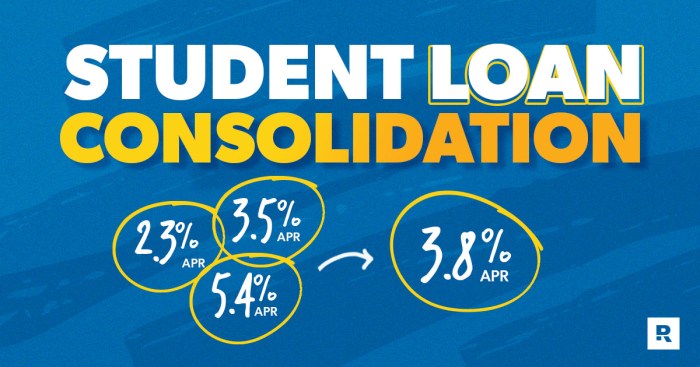

Consolidating your student loans can simplify your repayment process, but understanding how interest rates and loan terms are affected is crucial for making informed decisions. The new interest rate on your consolidated loan isn’t simply an average of your existing rates; it’s a weighted average based on the outstanding balances of your individual loans. This means loans with larger balances will have a greater influence on the final rate. Furthermore, the type of repayment plan you choose significantly impacts the total interest paid over the life of the loan.

Interest rates on consolidated student loans are typically fixed, meaning they remain constant throughout the loan term. This contrasts with variable-rate loans, where the interest rate fluctuates based on market conditions. A fixed rate provides predictability, allowing you to accurately budget for your monthly payments. The specific interest rate you receive depends on several factors, including your credit history, the type of loan being consolidated (federal or private), and the lender you choose. It’s important to shop around and compare offers from different lenders to secure the most favorable rate.

Interest Rate Calculation After Consolidation

The interest rate for a consolidated loan is calculated as a weighted average of the interest rates of the individual loans being consolidated. The weight assigned to each loan’s interest rate is proportional to its outstanding balance. For example, if you have two loans – one with a $10,000 balance at 5% interest and another with a $20,000 balance at 7% interest – the weighted average interest rate would be calculated as follows: [(0.05 * $10,000) + (0.07 * $20,000)] / ($10,000 + $20,000) = 0.06 or 6%. This calculation demonstrates how larger loan balances significantly impact the final interest rate. Keep in mind that some lenders may add a small margin to this weighted average.

Impact of Repayment Plans on Total Interest Paid

The choice of repayment plan significantly influences the total interest paid. Shorter repayment terms, such as a 10-year plan, result in higher monthly payments but lower total interest paid due to the shorter loan duration. Conversely, longer repayment terms, like a 20-year or 25-year plan, lead to lower monthly payments but significantly higher total interest paid over the extended repayment period. The optimal plan balances affordability with minimizing overall interest costs.

Comparison of Interest Rates Offered by Different Lenders

Interest rates vary among lenders. Federal student loan consolidation programs typically offer lower interest rates than private lenders. Private lenders may offer more flexible repayment options but often charge higher interest rates. Before consolidating, it’s essential to compare interest rates and terms from several lenders to find the best deal. Factors such as your credit score and the type of loans being consolidated will influence the interest rate offered. For example, a borrower with excellent credit might secure a lower rate than someone with a less-than-perfect credit history.

Repayment Plan Options and Associated Interest Rates

The following table illustrates examples of various repayment plans and their associated interest rates (these are examples and may vary depending on the lender and borrower profile). Remember, these are hypothetical examples and actual rates will differ based on individual circumstances.

| Repayment Plan | Loan Term (Years) | Example Interest Rate (%) | Approximate Monthly Payment (on a $30,000 loan) |

|---|---|---|---|

| Standard | 10 | 6.0 | $330 |

| Extended | 20 | 6.0 | $200 |

| Graduated | 10 | 6.0 | (Starts low, increases over time) |

| Income-Driven | 20-25 | 6.0 | (Based on income; varies) |

Potential Risks and Considerations

Student loan consolidation, while offering the potential for simplified repayment, also presents several risks and considerations that borrowers should carefully evaluate before proceeding. Understanding these potential downsides is crucial to making an informed decision and avoiding negative consequences. Failing to do so could lead to unforeseen financial difficulties.

While consolidation simplifies your repayment process by combining multiple loans into one, it doesn’t magically erase your debt. In fact, certain aspects of consolidation might even worsen your financial situation if not carefully considered. Therefore, a thorough understanding of the terms and conditions is paramount.

Understanding Loan Terms and Conditions

Before consolidating your student loans, meticulously review the terms and conditions of the new consolidated loan. Pay close attention to the interest rate, repayment period, and any associated fees. A seemingly minor difference in the interest rate can significantly impact the total amount you pay over the life of the loan. For example, a seemingly small increase of even 0.5% on a $50,000 loan could add thousands of dollars to your total repayment cost over ten years. Compare these terms to your current loan terms to ensure consolidation truly benefits you. Don’t hesitate to seek clarification from your lender if anything is unclear.

Consequences of Defaulting on a Consolidated Loan

Defaulting on a consolidated student loan carries severe consequences, similar to defaulting on individual loans. These consequences can significantly damage your credit score, making it harder to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, tax refund offset, and difficulty securing federal financial aid are also potential outcomes. In extreme cases, it can lead to legal action. The impact of a default can be long-lasting and significantly hinder your financial well-being.

Potential Pitfalls to Avoid

It’s essential to understand potential pitfalls to avoid during the consolidation process. Careful planning and thorough research are vital to ensure a smooth and beneficial consolidation experience.

- Higher Interest Rate: Consolidation might result in a higher interest rate than your lowest existing loan rate, increasing your total repayment cost.

- Longer Repayment Period: While a longer repayment period lowers your monthly payments, it also increases the total interest paid over the loan’s life.

- Loss of Benefits: Consolidating federal loans into a private loan might cause you to lose benefits such as income-driven repayment plans or loan forgiveness programs.

- Ignoring Fees: Be aware of any fees associated with the consolidation process. These fees can add to your overall debt burden.

- Failing to Compare Offers: Don’t settle for the first consolidation offer you receive. Compare offers from multiple lenders to find the most favorable terms.

Comparing Consolidation Options

Choosing between federal and private student loan consolidation involves careful consideration of your individual financial situation and long-term goals. Both options offer the convenience of combining multiple loans into a single monthly payment, but they differ significantly in terms of benefits, risks, and eligibility. Understanding these differences is crucial for making an informed decision.

Federal and private student loan consolidation options present distinct advantages and disadvantages. Federal consolidation, offered through the Department of Education, generally provides greater borrower protections and more flexible repayment options. Private consolidation, on the other hand, might offer lower interest rates in certain circumstances, but often lacks the same level of consumer safeguards.

Federal Student Loan Consolidation Advantages and Disadvantages

Federal student loan consolidation simplifies repayment by combining multiple federal loans into one manageable monthly payment. This streamlined approach can improve organization and reduce the risk of missed payments. Furthermore, federal consolidation programs often offer income-driven repayment plans, which can significantly lower monthly payments based on your income and family size. However, it’s important to note that federal consolidation may not always result in a lower overall interest rate. In some cases, the weighted average interest rate of your existing loans may be slightly higher than the new rate offered. Additionally, you lose access to certain repayment plans or forgiveness programs available for specific loan types once they are consolidated.

Private Student Loan Consolidation Advantages and Disadvantages

Private student loan consolidation, offered by banks and other private lenders, can potentially lead to a lower interest rate than your current weighted average, especially if you have a strong credit score. This can translate to substantial savings over the life of the loan. However, private consolidation lacks the robust borrower protections afforded by federal programs. For instance, you may not be eligible for income-driven repayment plans or loan forgiveness programs. Furthermore, the terms and conditions of private consolidation loans can be less flexible, and you may be subject to stricter eligibility requirements.

Scenarios Favoring Federal or Private Consolidation

A borrower with a mix of federal subsidized and unsubsidized loans, along with high-interest private loans, might benefit from federal consolidation to simplify repayment and potentially access income-driven repayment plans. This strategy streamlines payments and offers flexibility in managing monthly expenses. Conversely, a borrower with excellent credit and primarily high-interest private loans might find a lower interest rate through private consolidation, resulting in significant long-term savings. This approach prioritizes minimizing interest costs, but sacrifices the protections offered by federal programs.

Choosing the Best Consolidation Option

The optimal consolidation option depends on several factors. Consider your credit score, the types of loans you have (federal vs. private), your income, and your long-term financial goals. If borrower protections and flexible repayment options are paramount, federal consolidation is generally preferable. If minimizing interest costs is the primary concern and you have excellent credit, private consolidation might be a more suitable choice. Before making a decision, carefully compare interest rates, fees, repayment terms, and the availability of income-driven repayment plans and other benefits from both federal and private lenders. Seeking advice from a financial advisor can also be beneficial.

Last Recap

Consolidating your student loans can significantly simplify your repayment process, potentially lowering your monthly payments and providing a clearer path to becoming debt-free. However, careful consideration of the potential risks and a thorough understanding of the terms and conditions are paramount. By weighing the benefits and drawbacks, and by carefully comparing federal and private options, you can make an informed decision that best aligns with your financial goals and long-term well-being. Remember to explore all available resources and seek professional advice when needed to ensure a smooth and successful consolidation process.

FAQ Insights

What happens to my loan forgiveness programs after consolidation?

Consolidation may affect your eligibility for certain income-driven repayment plans or loan forgiveness programs. Review the specifics of your current programs before consolidating.

Can I consolidate loans with different co-signers?

Generally, no. Consolidation typically involves combining loans under a single borrower name, though some exceptions may exist depending on the lender and loan type.

How long does the consolidation process take?

The timeframe varies depending on the lender and the complexity of your loans. It can range from a few weeks to several months.

Will consolidating my loans improve my credit score immediately?

Not necessarily. While simplification can indirectly benefit your credit over time, the immediate impact depends on various factors. Check your credit report regularly.