Navigating the complex world of student loan debt can feel overwhelming. The sheer volume of information, coupled with the significant financial implications, often leaves borrowers unsure of their best course of action. This guide explores two key strategies for managing student loan debt: consolidation and refinancing. We’ll delve into the nuances of each approach, helping you understand the benefits, drawbacks, and crucial factors to consider before making a decision that could impact your financial future for years to come.

Whether you’re grappling with multiple loans, high interest rates, or simply seeking a more manageable repayment plan, understanding the differences between consolidation and refinancing is paramount. This guide provides a clear and concise comparison, equipping you with the knowledge to make an informed choice tailored to your specific circumstances. We’ll cover everything from eligibility requirements and interest rate comparisons to the long-term financial consequences of each option.

Understanding Student Loan Consolidation

Consolidating your federal student loans can simplify your repayment process by combining multiple loans into a single, new loan. This can lead to a more manageable monthly payment, but it’s crucial to understand the implications before making a decision. This section will Artikel the process, benefits, drawbacks, and application steps involved in federal student loan consolidation, and compare it to refinancing.

Federal Student Loan Consolidation Process

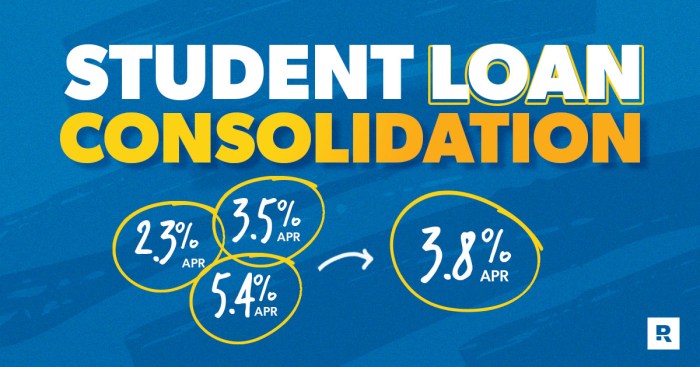

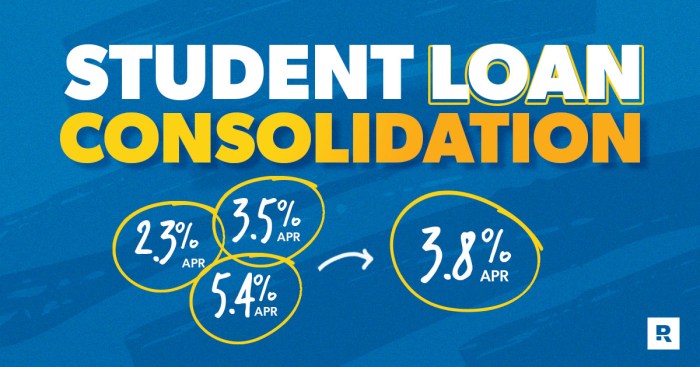

The process of consolidating federal student loans involves applying through the Federal Student Aid website. You’ll need to gather information about your existing loans, including lender names, loan amounts, and interest rates. The application will require you to provide this information, and once approved, your eligible loans will be combined into a new Direct Consolidation Loan. The new loan will have a single monthly payment, interest rate, and repayment plan. The interest rate will be a weighted average of your existing loans’ rates, rounded up to the nearest one-eighth of a percent.

Benefits and Drawbacks of Federal Student Loan Consolidation

Consolidating federal student loans offers several potential advantages. A single monthly payment simplifies budgeting and reduces the administrative burden of managing multiple loans. It may also qualify you for different repayment plans, such as income-driven repayment, which can lower your monthly payments based on your income and family size. However, consolidation may not always be beneficial. Consolidating can extend your repayment period, leading to potentially paying more interest over the life of the loan. Furthermore, consolidating federal loans into a new Direct Consolidation Loan might mean losing access to certain benefits associated with your original loans, such as forgiveness programs specific to certain loan types.

Federal Student Loan Consolidation vs. Refinancing

Federal student loan consolidation and refinancing are similar in that they both combine multiple loans into one, but there are key differences. Consolidation combines federal loans into a new federal loan, while refinancing replaces your existing federal or private loans with a new private loan from a lender. Refinancing often offers lower interest rates than consolidation, but comes with the risk of losing federal loan benefits, such as income-driven repayment plans and public service loan forgiveness. Refinancing also typically requires a credit check and a good credit score.

Applying for Federal Student Loan Consolidation: A Step-by-Step Guide

1. Gather your loan information: Collect details about all your federal student loans.

2. Complete the application: Access the application through the Federal Student Aid website (StudentAid.gov).

3. Review and submit: Carefully review your application for accuracy before submitting.

4. Await approval: The processing time varies, but you’ll receive notification once your application is approved.

5. Begin repayment: Once approved, your new Direct Consolidation Loan will be disbursed, and you’ll begin making your new monthly payments.

Comparison of Federal Consolidation Programs

| Program | Loan Type | Interest Rate | Repayment Plans |

|---|---|---|---|

| Direct Consolidation Loan | Federal Student Loans | Weighted average of existing loans, rounded up | Various income-driven and standard plans |

| (No other federal consolidation programs exist beyond the Direct Consolidation Loan. Other options, like refinancing, are offered by private lenders.) |

Refinancing Student Loans

Refinancing your student loans can be a strategic move to potentially lower your monthly payments and save money over the life of your loan. However, it’s crucial to understand the process and its implications before making a decision. This section will explore the key aspects of refinancing student loans, helping you determine if it’s the right choice for your financial situation.

Eligibility Requirements for Refinancing Student Loans

Lenders assess several factors to determine your eligibility for student loan refinancing. These typically include your credit score, debt-to-income ratio, income level, and the type and amount of student loan debt you possess. A higher credit score and lower debt-to-income ratio generally improve your chances of approval and securing a favorable interest rate. Lenders often require a minimum credit score, typically around 660 or higher, although this can vary. Furthermore, they may prefer borrowers with a consistent history of on-time payments on other debts. Your employment history and income stability also play a significant role in the lender’s assessment of your ability to repay the refinanced loan.

Types of Refinancing Options

There are two primary types of student loan refinancing: private and federal. Private refinancing involves consolidating your federal and/or private student loans into a new private loan with a private lender. This often results in a lower interest rate, but it comes with the loss of federal student loan benefits, such as income-driven repayment plans and potential loan forgiveness programs. Federal student loan consolidation, on the other hand, involves combining your federal student loans into a single federal loan with the Department of Education. This maintains the benefits of federal loans but may not always result in a lower interest rate.

Scenarios Where Refinancing is Beneficial and Not Beneficial

Refinancing can be advantageous when you have a good credit score, a stable income, and can secure a significantly lower interest rate than your current loans. For example, a borrower with multiple federal loans at high interest rates (7-10%) might benefit from refinancing to a private loan with a significantly lower rate (3-5%), potentially saving thousands of dollars over the loan’s life. Conversely, refinancing is generally not advisable if you have a low credit score, unstable income, or are relying on federal loan forgiveness programs. Refinancing federal loans eliminates eligibility for these programs, potentially costing you significant savings in the long run. For instance, a borrower in a public service job relying on the Public Service Loan Forgiveness (PSLF) program should avoid refinancing their federal loans.

Potential Risks Associated with Refinancing Student Loans

Several risks are associated with refinancing student loans. The most significant risk is losing access to federal loan benefits, such as income-driven repayment plans and loan forgiveness programs. Additionally, refinancing can lock you into a longer repayment term, potentially increasing the total interest paid over the life of the loan, even if the interest rate is lower. Furthermore, if your financial situation deteriorates after refinancing, you may struggle to make payments on your new, larger loan. Finally, private lenders may not offer the same flexibility and forbearance options as federal lenders, making it harder to manage financial hardship.

Decision-Making Process for Refinancing

The following flowchart illustrates the key steps in deciding whether to refinance student loans:

[Diagram Description: A flowchart would be placed here. It would start with a “Start” box. The next box would ask: “Do you have good credit (660+) and stable income?” A “Yes” branch would lead to: “Can you secure a significantly lower interest rate?” A “Yes” branch would lead to “Consider refinancing.” A “No” branch would lead to “Do not refinance.” A “No” branch from the initial question would also lead to “Do not refinance.” Finally, there’s an “End” box.]

Comparing Consolidation and Refinancing

Choosing between consolidating and refinancing your student loans depends heavily on your individual financial situation and goals. Both options aim to simplify your repayment process, but they achieve this through different mechanisms and carry distinct advantages and disadvantages. Understanding these nuances is crucial for making an informed decision.

Interest Rates in Consolidation and Refinancing

Federal student loan consolidation programs typically offer a fixed interest rate that’s a weighted average of your existing loans’ interest rates. This means your new interest rate won’t be lower than your highest existing rate, but it might be slightly lower if you have a mix of high and low-interest loans. In contrast, private refinancing lenders offer variable or fixed interest rates that are competitive with current market rates. These rates are often based on your credit score, income, and debt-to-income ratio. A borrower with excellent credit might secure a significantly lower interest rate through refinancing than through federal consolidation. For example, a borrower with a weighted average of 7% on their federal loans might find a private refinance option at 5% or even lower, depending on their creditworthiness. Conversely, a borrower with a lower credit score might find a private refinance rate higher than their current federal loan rate.

Repayment Plans and Total Loan Cost

Different repayment plans directly influence the total cost of your loans. Federal consolidation offers various repayment plans, including income-driven repayment options, which can lower monthly payments but extend the repayment period, ultimately increasing the total interest paid. Refinancing, on the other hand, typically offers a fixed-term repayment plan with a set monthly payment amount. While this provides predictability, it might not be as flexible as federal repayment options. For instance, a 10-year repayment plan will result in significantly less interest paid over the life of the loan compared to a 20-year plan, even if the interest rate is the same. However, the shorter-term plan will necessitate higher monthly payments.

Key Differences Between Consolidation and Refinancing

The following points highlight the core distinctions between consolidating and refinancing student loans:

- Loan Type: Consolidation uses federal programs to combine existing federal loans. Refinancing replaces existing federal or private loans with a new private loan.

- Interest Rates: Consolidation uses a weighted average of existing rates; refinancing offers market-based rates dependent on creditworthiness.

- Repayment Plans: Consolidation provides various federal repayment options, including income-driven plans; refinancing typically offers a fixed-term plan.

- Loan Forgiveness Programs: Federal consolidation maintains eligibility for income-driven repayment and potential loan forgiveness programs; refinancing eliminates this eligibility.

- Lender: Consolidation is done through the federal government; refinancing is done through a private lender.

Impact on Credit Scores

Both consolidation and refinancing can impact your credit score, although the effects vary. Consolidation generally has a minimal impact, as it doesn’t significantly alter your debt-to-credit ratio. However, refinancing can temporarily lower your score due to a hard credit inquiry and the closing of older accounts. Over time, however, responsible repayment of a refinanced loan can positively influence your credit score by demonstrating consistent payment history and potentially lowering your debt utilization ratio. For example, if a borrower has multiple loans with late payments, consolidating them and making on-time payments will show improvement on their credit report. Refinancing can improve a credit score if the borrower is able to obtain a lower interest rate and pay off the loan faster.

Pros and Cons of Consolidation vs. Refinancing

| Feature | Consolidation (Federal) | Refinancing (Private) |

|---|---|---|

| Interest Rate | Weighted average of existing rates (may not be lower) | Potentially lower rate based on credit score |

| Repayment Plans | Various options, including income-driven plans | Typically fixed-term |

| Loan Forgiveness | Eligible for certain programs | Not eligible |

| Credit Score Impact | Minimal impact | Temporary dip, potential long-term improvement |

Factors to Consider Before Consolidating or Refinancing

Consolidating or refinancing your student loans can significantly impact your finances, both positively and negatively. Before making a decision, it’s crucial to thoroughly assess your current financial situation and understand the potential consequences of each option. A careful evaluation of several key factors will help you make an informed choice that aligns with your long-term financial goals.

Understanding Current Loan Terms

Before considering consolidation or refinancing, meticulously review your existing student loan agreements. Note the interest rates, repayment terms, loan balances, and any associated fees for each loan. This detailed understanding forms the basis for comparing your current situation with potential outcomes after consolidation or refinancing. For instance, you might have some loans with subsidized interest rates (where the government pays the interest while you are in school) and others with unsubsidized rates. Understanding these differences is crucial for evaluating the overall impact of a consolidation or refinancing plan. Failing to do so could lead to unexpected higher payments or longer repayment periods.

Credit Score’s Impact on Loan Approval and Interest Rates

Your credit score plays a pivotal role in determining your eligibility for loan consolidation or refinancing and the interest rates you’ll receive. Lenders use your credit score to assess your creditworthiness – essentially, your ability to repay the loan. A higher credit score generally translates to more favorable loan terms, including lower interest rates and potentially more favorable repayment options. Conversely, a lower credit score may result in loan denial or higher interest rates, negating the potential benefits of consolidation or refinancing. For example, someone with a credit score of 750 might qualify for a significantly lower interest rate than someone with a score of 600.

Income and Debt-to-Income Ratio’s Influence on Eligibility

Your income and debt-to-income (DTI) ratio are critical factors in determining your eligibility for loan consolidation or refinancing. Lenders assess your ability to manage additional debt by considering your income relative to your existing debt obligations. A higher income and a lower DTI ratio generally improve your chances of approval and may lead to better loan terms. A low DTI ratio shows lenders you have sufficient disposable income to comfortably manage your existing debt and the new consolidated or refinanced loan. For example, if your monthly income is $5,000 and your monthly debt payments are $1,000, your DTI is 20%. A lower DTI ratio increases your likelihood of approval and could potentially lead to better interest rates.

Strategies for Improving Credit Score

Improving your credit score before applying for loan consolidation or refinancing can significantly enhance your chances of securing favorable terms. Strategies include paying all bills on time, maintaining low credit utilization (the amount of credit you use compared to your total available credit), and avoiding opening multiple new credit accounts within a short period. Monitoring your credit report regularly for errors and disputing any inaccuracies can also positively impact your score. Consistent and responsible credit management over several months can demonstrably improve your credit score, potentially resulting in thousands of dollars in savings over the life of your loan.

Long-Term Financial Implications

The long-term financial implications of consolidating or refinancing student loans should be carefully considered. While lower monthly payments might seem attractive, extending the repayment period often leads to paying more interest overall. Conversely, securing a lower interest rate through refinancing can save significant money in the long run, despite potentially higher monthly payments. A thorough comparison of total interest paid over the life of the loan under different scenarios is crucial for making an informed decision. For example, a longer repayment term with a lower monthly payment could result in paying significantly more interest than a shorter term with a higher monthly payment, even if the interest rate is the same.

Finding the Right Lender or Program

Choosing the right lender for student loan refinancing or consolidation is crucial for securing favorable terms and minimizing costs. A thorough comparison of lenders and their offerings is essential to making an informed decision. This involves understanding their reputations, fees, and the specific terms of their loan programs.

Finding a reputable lender involves careful research and due diligence. Several well-known financial institutions and online lenders specialize in student loan refinancing. It’s important to note that not all lenders offer the same products or services, and the best option will depend on individual circumstances.

Reputable Lenders and Their Offerings

Many reputable banks, credit unions, and online lenders offer student loan refinancing programs. Some well-known examples include national banks like Wells Fargo and Bank of America (though availability and terms may vary by location), as well as online lenders like SoFi and Earnest. Credit unions often offer competitive rates and personalized service, but their loan offerings may be less diverse than those of larger institutions. It is important to independently verify the legitimacy and reputation of any lender before applying. Checking reviews from independent sources, like the Better Business Bureau, can provide valuable insights into customer experiences.

Fee and Term Comparisons Among Lenders

Direct comparison of fees and terms requires careful examination of loan offers from multiple lenders. This includes comparing the interest rate (both fixed and variable options if available), origination fees, prepayment penalties (if any), and the loan repayment term. Some lenders may offer promotional periods with reduced interest rates, while others might prioritize features like flexible repayment plans or income-based repayment options. Creating a spreadsheet to organize this information from different lenders can significantly aid the comparison process. For example, one lender might offer a lower interest rate but a higher origination fee, making another lender ultimately more cost-effective in the long run.

Checklist of Questions for Potential Lenders

Before committing to a lender, a prospective borrower should have a clear understanding of the loan terms and the lender’s practices. This involves asking specific questions to ensure transparency and avoid potential pitfalls.

- What is the current interest rate and what type of rate is it (fixed or variable)?

- What are the origination fees and any other associated fees?

- What is the loan repayment term and what are the monthly payment amounts?

- What are the lender’s policies on late payments and default?

- What are the options for repayment, such as deferment or forbearance?

- What is the lender’s customer service track record and how can I contact them for support?

- What is the lender’s process for handling complaints or disputes?

Shopping Around for the Best Rates and Terms

The process of finding the best rates and terms involves actively seeking out offers from multiple lenders. This requires obtaining personalized quotes from several institutions, comparing their offerings side-by-side, and considering factors beyond just the interest rate. It’s advisable to pre-qualify with several lenders, as this process doesn’t affect your credit score and allows you to see what offers you are eligible for before submitting a formal application. This comparative shopping approach ensures that you secure the most favorable loan terms for your specific financial situation. Remember, the lowest interest rate isn’t always the best deal; consider the overall cost, including fees and the repayment schedule.

Factors to Consider When Selecting a Lender or Program

Selecting a lender requires careful consideration of various factors that extend beyond the interest rate and fees.

- Interest Rate: The annual percentage rate (APR) reflects the total cost of borrowing. A lower APR is generally preferable.

- Fees: Origination fees, prepayment penalties, and other fees can significantly impact the overall cost.

- Repayment Terms: Consider the loan’s length and the resulting monthly payments. Longer terms mean lower monthly payments but higher overall interest paid.

- Customer Service: A lender with responsive and helpful customer service can make a significant difference during the loan process and beyond.

- Reputation and Financial Stability: Choose a reputable lender with a proven track record and strong financial standing.

- Eligibility Requirements: Ensure you meet the lender’s eligibility criteria before applying.

Summary

Ultimately, the decision to consolidate or refinance student loans is a deeply personal one, heavily dependent on your individual financial situation and long-term goals. By carefully weighing the pros and cons of each approach, understanding your eligibility, and thoroughly researching lenders and programs, you can confidently navigate this crucial financial step. Remember to prioritize responsible borrowing practices and seek professional financial advice when needed to ensure you’re making the best choice for your future.

FAQ Compilation

What is the difference between federal consolidation and private refinancing?

Federal consolidation combines multiple federal loans into one, typically with a fixed interest rate. Private refinancing replaces existing federal or private loans with a new private loan, potentially offering a lower interest rate but losing federal benefits.

Will refinancing affect my credit score?

A hard credit inquiry during the refinancing process will temporarily lower your score. However, if the new loan terms are favorable and you manage payments responsibly, your score may improve over time.

Can I consolidate private student loans?

You cannot consolidate private student loans through the federal government. You can only refinance them with a private lender.

What if I miss payments after consolidating or refinancing?

Missing payments will negatively impact your credit score and may lead to penalties and collection actions from your lender.

How long does the consolidation or refinancing process take?

Processing times vary depending on the lender and the complexity of your application. It can take several weeks or even months.