Navigating the complex world of student loan debt can feel overwhelming, especially when juggling both private and federal loans. The prospect of simplifying this financial burden through consolidation is attractive, promising reduced monthly payments and easier management. However, this path isn’t without potential pitfalls. Understanding the intricacies of consolidation, including eligibility requirements, the application process, and potential long-term financial implications, is crucial for making an informed decision.

This guide delves into the benefits and drawbacks of consolidating private and federal student loans, providing a comprehensive overview of the process and offering insights to help you determine if consolidation aligns with your financial goals. We’ll explore various consolidation programs, alternative debt management strategies, and the potential long-term financial consequences, empowering you to make a choice that best suits your individual circumstances.

The Benefits of Consolidating Student Loans

Consolidating your private and federal student loans can offer several significant advantages, streamlining your repayment process and potentially saving you money. By combining multiple loans into a single, new loan, you simplify your financial life and may unlock opportunities for more favorable repayment terms. However, it’s crucial to carefully weigh the potential benefits against any potential drawbacks before making a decision.

Simplified Repayment

Managing multiple student loans with varying interest rates, due dates, and lenders can be incredibly complex and time-consuming. Consolidation simplifies this by combining all your loans into one monthly payment, eliminating the need to track multiple due dates and logins. This single payment makes budgeting easier and reduces the risk of missed payments, which can negatively impact your credit score. For example, imagine juggling five separate loans – each with a different payment date and login portal. Consolidation streamlines this into a single, manageable payment, freeing up valuable time and mental energy.

Potential for Lower Monthly Payments

One of the most attractive benefits of consolidation is the potential for a lower monthly payment. By extending the repayment term of your consolidated loan, you can reduce the amount you pay each month. However, it’s important to note that extending the repayment term will likely increase the total interest paid over the life of the loan. For instance, consolidating a $50,000 loan with a 10-year repayment term into a 20-year repayment term will significantly lower the monthly payment, but you’ll ultimately pay considerably more in interest over the longer repayment period.

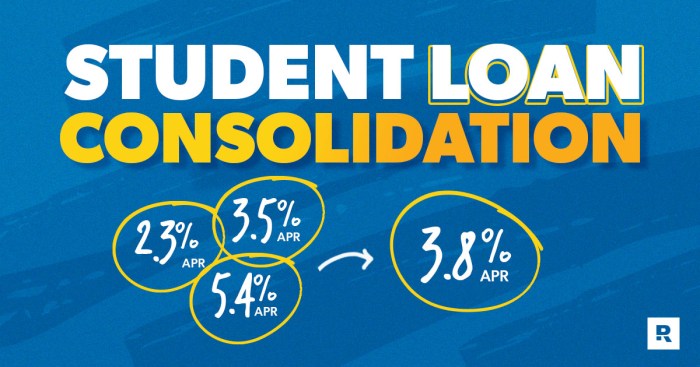

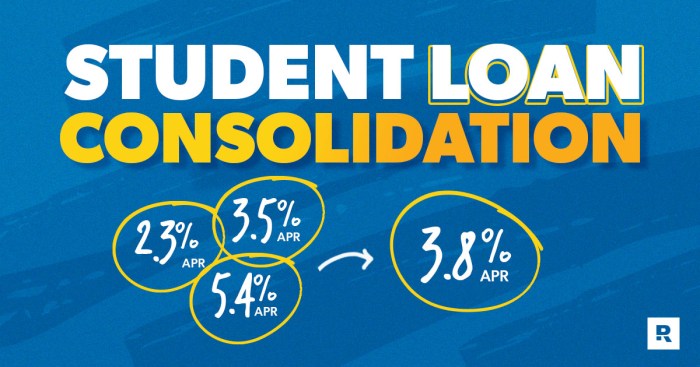

Interest Rate Considerations

Consolidation may offer a lower interest rate, reducing the total interest paid over the life of the loan. This is particularly beneficial if you have high-interest private loans. However, your new interest rate will be a weighted average of your existing loan interest rates. This means that if you have a mix of high and low-interest loans, your new rate might not be significantly lower than your highest existing rate. Furthermore, some consolidation programs may charge fees that could offset any interest savings. It’s vital to compare your current interest rates with the offered consolidated rate, factoring in any associated fees, to determine if consolidation truly offers a financial advantage.

Impact on Credit Score

The impact of loan consolidation on your credit score is complex and not always straightforward. While a single, consistently paid loan can positively impact your credit utilization ratio and payment history, the act of applying for a new loan can temporarily lower your score due to a hard inquiry. Additionally, extending the loan term may negatively affect your credit score due to a longer credit history with the loan. However, if you diligently make your payments on time, your credit score should improve over time as the positive aspects of a simplified payment structure outweigh the temporary negative impact of the hard inquiry. The overall effect depends on several factors, including your existing credit score, payment history, and the terms of the consolidated loan.

The Consolidation Process

Consolidating your student loans, whether federal or private, can simplify your repayment process and potentially lower your monthly payments. However, the process differs significantly depending on the type of loans you’re consolidating. Understanding the steps involved is crucial for a smooth and successful consolidation.

Federal Student Loan Consolidation

Consolidating federal student loans involves combining multiple federal student loans into a single new loan with a single monthly payment. This process is managed by the Federal Student Aid (FSA) website.

- Gather Your Information: Before you begin, collect your Federal Student Aid (FSA) ID, Social Security number, loan details (including lender names, loan amounts, and interest rates for each loan), and contact information. Accurate information is essential for a timely processing.

- Complete the Application: Access the Direct Consolidation Loan application through the FSA website (StudentAid.gov). You’ll need to provide all the information gathered in the previous step. The application will guide you through each required field.

- Review and Submit: Carefully review your application for accuracy before submitting it. Errors can delay the process. Once submitted, you’ll receive a confirmation number.

- Loan Disbursement: After your application is approved, your new consolidated loan will be disbursed. This may take several weeks. Your original lenders will be notified, and your payments will be consolidated into a single monthly payment to your new lender (usually the Department of Education).

Potential roadblocks in federal consolidation might include incomplete application information, discrepancies in loan details provided, or issues with your FSA ID. Overcoming these involves double-checking all information for accuracy, contacting your previous lenders to resolve discrepancies, and resetting or verifying your FSA ID if needed.

Private Student Loan Consolidation

Consolidating private student loans is different from federal consolidation. It typically involves working directly with a private lender, often a bank or credit union. The process isn’t managed by a central government agency.

- Research Lenders: Begin by researching private lenders that offer student loan consolidation. Compare interest rates, fees, and repayment terms offered by various lenders to find the most favorable option.

- Check Your Eligibility: Each lender has specific eligibility requirements. These often involve credit score checks and income verification. Ensure you meet the criteria before applying.

- Complete the Application: The application process varies among lenders but generally involves providing personal information, loan details, and financial documentation. This may include pay stubs, tax returns, and bank statements.

- Loan Approval and Disbursement: The lender will review your application and determine your eligibility. If approved, your new consolidated loan will be disbursed, and your previous lenders will be paid off.

Private loan consolidation may present challenges such as higher interest rates compared to federal loans, stricter eligibility requirements based on credit history, and potentially higher fees. Overcoming these requires careful comparison shopping among lenders, improving credit scores if necessary, and ensuring you have sufficient documentation to support your application. It’s also advisable to consider refinancing options, which might offer better interest rates, depending on your creditworthiness.

Types of Consolidation Programs

Consolidating your student loans can simplify repayment, potentially lowering your monthly payments and providing a clearer path to becoming debt-free. However, the best approach depends heavily on whether your loans are federal or private. Understanding the differences between federal and private consolidation programs is crucial for making an informed decision.

Federal and private loan consolidation programs differ significantly in their eligibility requirements, terms, and potential benefits. Federal programs are administered by the government, offering various benefits and protections, while private consolidation loans are offered by banks and other financial institutions, each with its own set of terms and conditions. Choosing the right program depends entirely on your specific loan portfolio and financial situation.

Federal Loan Consolidation Programs

The primary federal student loan consolidation program is the Direct Consolidation Loan. This program allows borrowers to combine multiple federal student loans (Direct Loans, Federal Family Education Loans, and Federal Perkins Loans) into a single, new Direct Consolidation Loan. The interest rate is a weighted average of the interest rates on your existing loans, rounded up to the nearest one-eighth of a percent. This means your new interest rate may be slightly higher than your lowest existing rate, but it simplifies repayment. Importantly, federal consolidation does not change the total amount you owe; it simply streamlines the repayment process.

- Pros: Simplified repayment, fixed interest rate, potential for income-driven repayment plans, government protections against default.

- Cons: May result in a slightly higher interest rate than some existing loans, doesn’t reduce your total debt, potential loss of certain loan benefits associated with specific loan types (e.g., forgiveness programs).

Private Loan Consolidation Programs

Private loan consolidation offers a way to combine multiple private student loans into a single loan with a new lender. Unlike federal consolidation, private consolidation often involves a new interest rate, which could be higher or lower than your current rates depending on your creditworthiness and the lender’s offerings. Several private lenders, including banks, credit unions, and online lenders, offer these programs. Each lender has its own eligibility criteria, interest rates, fees, and repayment terms. It’s crucial to compare offers from multiple lenders before making a decision.

- Pros: Potential for a lower interest rate (depending on credit score), simplified repayment, potentially longer repayment terms.

- Cons: Higher interest rates are possible, may involve fees, less regulatory protection than federal loans, may require a credit check, could lead to increased total interest paid over the life of the loan.

Comparison of Federal and Private Consolidation Programs

The table below summarizes the key differences between federal and private student loan consolidation programs.

| Feature | Federal Consolidation (Direct Consolidation Loan) | Private Consolidation |

|---|---|---|

| Eligibility | Federal student loans only | Private student loans; may require good credit |

| Interest Rate | Weighted average of existing loan rates (rounded up) | Variable or fixed; depends on creditworthiness and lender |

| Repayment Plans | Various income-driven repayment plans available | Typically standard repayment plans; some lenders may offer other options |

| Fees | Generally no fees | May involve origination fees or other charges |

| Borrower Protections | Strong borrower protections under federal law | Fewer borrower protections; subject to lender’s terms |

Potential Drawbacks of Consolidation

Consolidating your student loans can seem appealing, but it’s crucial to understand the potential downsides before making a decision. While consolidation simplifies repayment by combining multiple loans into one, it’s not always the best financial move. Several factors can negatively impact your long-term financial health.

Increased Repayment Period and Long-Term Financial Implications

Consolidating your loans often results in a longer repayment period. This extension, while seemingly beneficial in lowering monthly payments, ultimately leads to paying significantly more interest over the life of the loan. For example, a $50,000 loan with a 10-year repayment plan at 6% interest will accrue less interest than the same loan spread over 20 years. The longer repayment period means you’ll be paying interest for a much longer time, potentially delaying other financial goals like buying a home or investing. This can have substantial long-term financial implications, potentially costing tens of thousands of dollars more in interest.

Loss of Certain Loan Benefits

Consolidating your federal student loans into a single federal loan might mean losing access to certain repayment plans, particularly income-driven repayment (IDR) plans. IDR plans adjust your monthly payments based on your income and family size, offering lower payments for those struggling financially. If your individual loans had different IDR plans, consolidating might lock you into a standard repayment plan with potentially higher monthly payments. For example, someone on a PAYE plan (Pay As You Earn) with a low monthly payment might find their payment significantly increases after consolidation.

Higher Total Interest Paid

While a lower monthly payment may seem attractive, extending the repayment period invariably increases the total interest paid over the life of the loan. This is because you’re paying interest on the principal balance for a longer duration. This increased interest cost can significantly outweigh any short-term benefits of lower monthly payments. A simple example illustrates this: A $30,000 loan at 5% interest over 10 years will accrue considerably less interest than the same loan spread over 25 years, even with lower monthly payments.

Situations Where Consolidation Might Not Be Beneficial

Consolidation may not be advantageous if you have federal loans with different interest rates, particularly if some have significantly lower rates. If you qualify for an income-driven repayment plan that offers substantial benefits, consolidation might eliminate this advantage. Similarly, if you’re close to paying off your loans, the added interest accrued from a longer repayment period due to consolidation could negate any perceived benefits. Finally, if you have private loans with high interest rates, consolidating these into a federal loan might not lower your overall interest rate, rendering the process ineffective.

Alternatives to Consolidation

Consolidating your student loans isn’t the only path to managing your debt. Several alternative strategies can be more beneficial depending on your individual financial situation and goals. Understanding these options allows you to make a well-informed decision about the best approach for your circumstances. Let’s explore some viable alternatives and compare them to loan consolidation.

Refinancing and debt management plans offer distinct approaches to tackling student loan debt, each with its own set of advantages and disadvantages. Careful consideration of your financial profile, including your credit score, income, and the interest rates on your existing loans, is crucial in determining the most suitable strategy.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a private lender, typically at a lower interest rate. This can significantly reduce your monthly payments and the total amount you pay over the life of the loan. However, refinancing often requires a good credit score and stable income. It also typically eliminates federal loan benefits such as income-driven repayment plans and loan forgiveness programs.

Debt Management Plans

Debt management plans (DMPs) are offered by credit counseling agencies. They involve negotiating with your lenders to lower your interest rates and consolidate your payments into a single monthly payment. DMPs can help you manage your debt more effectively, but they may impact your credit score and often involve fees. This option is generally better suited for individuals struggling with multiple types of debt, not just student loans.

Comparison of Alternatives

The following table summarizes the key differences between loan consolidation, refinancing, and debt management plans:

| Feature | Consolidation | Refinancing | Debt Management Plan |

|---|---|---|---|

| Interest Rate | Weighted average of existing rates | Potentially lower, depending on creditworthiness | Potentially lower, negotiated with creditors |

| Loan Type | Federal and/or private | Typically private | Multiple loan types |

| Federal Benefits | Retained (if federal loans are involved) | Lost (if refinancing federal loans) | Not directly impacted |

| Credit Score Impact | Minimal | Potentially positive (if a lower rate is secured) | Potentially negative (due to account management changes) |

| Fees | Typically none | Potentially closing costs | Fees charged by credit counseling agency |

Examples of Suitable Scenarios

Consolidation: A borrower with a mix of federal and private loans at varying interest rates might benefit from consolidation to simplify payments and potentially lower their overall interest burden. This is particularly useful if the weighted average interest rate after consolidation is lower than the highest interest rate among their existing loans.

Refinancing: An individual with a strong credit score and high income, who has mostly private student loans with high interest rates, could significantly reduce their monthly payments and overall interest costs through refinancing. For instance, someone with $50,000 in private loans at 8% interest could save thousands of dollars by refinancing to a lower rate of 5%.

Debt Management Plan: A borrower struggling to manage multiple types of debt, including student loans, credit card debt, and medical bills, might find a DMP helpful in organizing their finances and negotiating lower interest rates and payments with creditors. For example, someone overwhelmed by multiple minimum payments could benefit from the simplified single monthly payment offered by a DMP.

Financial Implications of Consolidation

Consolidating your student loans can significantly impact your financial future, both positively and negatively. Understanding these potential impacts is crucial before making a decision. The long-term effects depend heavily on factors like your current interest rates, the new interest rate after consolidation, and the repayment plan you choose.

Long-Term Financial Impact: Hypothetical Scenarios

Let’s consider two hypothetical borrowers, Alex and Ben. Both owe $50,000 in student loans. Alex has a mix of federal loans with varying interest rates averaging 6%, while Ben’s loans are all private, averaging 8%. If Alex consolidates his loans into a Direct Consolidation Loan, he might receive a fixed interest rate of 5%. This could save him thousands of dollars over the life of the loan. However, if Ben consolidates his private loans, his new rate might be higher than his average current rate, potentially increasing his overall cost. This highlights the importance of comparing rates before and after consolidation. Another factor is the loan term. If Alex opts for a longer repayment term to lower his monthly payments, he will pay more interest overall. Conversely, a shorter term will lead to higher monthly payments but lower total interest.

Interest Rate Changes and Total Loan Cost

Changes in interest rates directly affect the total cost of your loan. A lower interest rate after consolidation will reduce the total amount you pay over the loan’s lifetime. Conversely, a higher interest rate will increase the total cost. For example, a 1% difference in interest rate on a $50,000 loan over 10 years could translate to thousands of dollars in additional interest paid. This is because interest is calculated on the remaining principal balance each month, meaning even small interest rate differences accumulate significantly over time. It’s essential to carefully consider the potential impact of even minor rate fluctuations.

Repayment Plans and Total Interest Paid

Different repayment plans significantly influence both the total interest paid and the loan repayment duration. A standard repayment plan typically involves fixed monthly payments over 10 years. However, longer repayment plans, such as extended repayment or graduated repayment, may result in lower monthly payments but significantly higher total interest paid due to the extended period of accruing interest. Conversely, income-driven repayment plans adjust monthly payments based on income, potentially lowering monthly payments but extending the repayment period. For example, a 15-year repayment plan might have lower monthly payments than a 10-year plan but result in a considerably higher total interest payment.

Visual Representation of Interest Rates and Repayment Plans

Imagine a graph with the x-axis representing different interest rates (e.g., 4%, 5%, 6%, 7%) and the y-axis representing the total loan cost. For each interest rate, multiple lines would represent different repayment plans (e.g., standard 10-year, extended 15-year, income-driven). The lines would show how the total cost increases with higher interest rates and longer repayment periods. A line representing a 5% interest rate with a 10-year plan would be lower than a line representing the same interest rate with a 15-year plan. Similarly, a line representing a 7% interest rate with any repayment plan would be higher than lines representing lower interest rates. This visual representation would clearly illustrate the interplay between interest rates and repayment plans on the overall cost of the loan.

Conclusive Thoughts

Consolidating private and federal student loans presents a compelling opportunity to streamline debt management and potentially reduce monthly payments. However, careful consideration of eligibility criteria, the application process, and potential long-term financial impacts is paramount. By weighing the benefits against the potential drawbacks, and exploring alternative strategies, you can make an informed decision that best positions you for long-term financial success. Remember to thoroughly research all options and, if necessary, seek professional financial advice before proceeding.

Top FAQs

Can I consolidate loans with different interest rates?

Yes, consolidation typically combines loans with varying interest rates into a single loan with a weighted average interest rate.

What happens to my loan forgiveness programs after consolidation?

Consolidating federal loans may affect eligibility for certain income-driven repayment plans or loan forgiveness programs. Review the implications carefully before consolidating.

How long does the consolidation process take?

The timeframe varies depending on the lender and type of loan. Federal consolidation typically takes several weeks, while private loan consolidation can be faster or slower.

Will consolidating my loans affect my credit score?

The impact on your credit score is complex and depends on several factors. While a new account inquiry might temporarily lower your score, responsible repayment of the consolidated loan can positively impact your credit over time.