Navigating the complexities of federal student loan repayment can feel overwhelming. The sheer volume of loans, varying interest rates, and diverse repayment plans often leave borrowers seeking clarity. Consolidating your federal student loans presents a potential solution, offering the possibility of simplified repayment and potentially lower monthly payments. However, this strategy isn’t a one-size-fits-all answer; understanding the nuances is crucial before making a decision that impacts your long-term financial health.

This guide provides a comprehensive overview of federal student loan consolidation, exploring eligibility criteria, the consolidation process, and the long-term implications. We’ll delve into the advantages and disadvantages, examine different consolidation programs, and offer practical advice to help you make an informed choice. Whether you’re facing mounting debt or simply seeking a more manageable repayment strategy, this resource will empower you to navigate the path toward financial freedom.

Eligibility Requirements for Federal Student Loan Consolidation

Consolidating your federal student loans can simplify your repayment process by combining multiple loans into a single one. However, understanding the eligibility requirements is crucial before proceeding. This section Artikels the key aspects of eligibility, including income requirements, eligible loan types, and a step-by-step process to determine your eligibility. We will also discuss situations where consolidation might not be the most advantageous option.

Income Requirements for Federal Student Loan Consolidation

There are no specific income requirements to consolidate federal student loans. Eligibility for consolidation is primarily based on the types of loans you hold and your loan status, not your income level. The consolidation process itself does not involve an income-based assessment.

Eligible Federal Student Loan Types for Consolidation

Several types of federal student loans are eligible for consolidation. These generally include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for graduate or professional students and parents), Federal Stafford Loans, Federal Consolidation Loans, and Federal Perkins Loans. It’s important to note that some older loan programs might not be eligible; checking with the Federal Student Aid website is recommended to verify which loans you hold can be consolidated.

Step-by-Step Process for Determining Eligibility

Determining your eligibility for federal student loan consolidation is straightforward. Follow these steps:

1. Gather your loan information: Collect your loan documents, including the lender, loan type, and loan amounts.

2. Check your loan servicer’s website: Most servicers provide online tools to check consolidation eligibility.

3. Visit the Federal Student Aid website: The official website (StudentAid.gov) provides comprehensive information and tools to determine eligibility and initiate the consolidation process.

4. Review your loan details: Confirm that all your eligible loans are listed correctly.

5. Complete the consolidation application: Once you’ve confirmed your eligibility, you can proceed with the application.

Situations Where Consolidation Might Not Be Beneficial

While consolidation simplifies repayment, it’s not always the best option. For example, if you have loans with significantly different interest rates, consolidating might result in a higher overall interest rate for your new loan, increasing your total repayment cost over time. Similarly, if you’re already on an income-driven repayment plan that offers lower monthly payments based on your income, consolidation might cause you to lose that benefit and face higher monthly payments. Consolidating loans with different repayment terms may also affect your credit score, though the effect is generally small. Carefully weigh the pros and cons before proceeding with consolidation.

The Consolidation Process

Consolidating your federal student loans simplifies your repayment by combining multiple loans into a single one. This process can streamline your finances and potentially offer benefits like a lower monthly payment or a fixed interest rate. Understanding the steps involved and necessary documentation is crucial for a smooth consolidation.

The consolidation process involves several key steps, from application submission to loan disbursement. Careful preparation and accurate documentation are vital for a timely and successful outcome. The entire process, while straightforward, requires attention to detail to ensure accuracy and avoid delays.

Consolidation Process Flowchart

The following flowchart visually represents the steps involved in the federal student loan consolidation process:

[Flowchart Description] The flowchart would begin with a box labeled “Gather Required Documents.” This would lead to a box labeled “Complete the Consolidation Application.” Next would be a box representing “Submit the Application.” This would branch to two boxes: “Application Approved” leading to “Loan Disbursement” and “Application Denied” leading to “Review Denial Reasons and Resubmit (if applicable).” The final box would be “Consolidated Loan Repayment Begins.”

Loan Repayment Plans After Consolidation

Once your loans are consolidated, you’ll choose a repayment plan. Different plans offer varying monthly payments and repayment periods. Choosing the right plan depends on your financial situation and repayment goals.

| Repayment Plan | Monthly Payment | Repayment Period | Interest Rate |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payment, typically 10 years | 10 years | Fixed, based on weighted average of original loans |

| Graduated Repayment Plan | Payments start low and gradually increase | 10 years | Fixed, based on weighted average of original loans |

| Extended Repayment Plan | Lower monthly payments, longer repayment period | Up to 25 years | Fixed, based on weighted average of original loans |

| Income-Driven Repayment Plan (IDR) | Monthly payment based on income and family size | 20-25 years | Fixed, based on weighted average of original loans |

Required Documents for Consolidation

Preparing the necessary documents beforehand streamlines the application process. Missing documentation can lead to delays.

- Completed Consolidation Application

- Social Security Number

- Federal Student Aid PIN

- Information on all federal student loans to be consolidated (loan numbers, lenders, balances)

Timeline for the Consolidation Process

The timeline for loan consolidation varies, but generally, it takes several weeks. Factors such as application completeness and processing times can influence the duration.

A typical timeline might involve:

- Application Submission: This is the starting point.

- Processing Time: This typically takes several weeks, sometimes longer depending on the volume of applications.

- Loan Disbursement: Once approved, the consolidated loan is disbursed to the borrower.

- Repayment Begins: Repayment of the consolidated loan commences after disbursement.

Impact on Interest Rates and Repayment Terms

Consolidating your federal student loans can significantly alter your repayment plan, primarily by affecting your interest rate and loan term. Understanding these changes is crucial for making an informed decision. While consolidation simplifies repayment by combining multiple loans into one, it’s essential to carefully weigh the potential benefits against any drawbacks.

The weighted average interest rate of your existing loans determines the new interest rate for your consolidated loan. This rate is fixed, meaning it won’t change over the life of the loan, unlike some variable-rate loans. However, this fixed rate might be higher than the lowest rate among your original loans, potentially increasing the total interest paid over the life of the loan. Conversely, if you have loans with high interest rates, consolidation could lower your overall average rate, resulting in savings.

Interest Rate Calculation and Comparison

The new interest rate on your consolidated loan is a weighted average of the interest rates on your individual loans. This means loans with larger balances will have a greater impact on the final rate. For example, let’s consider two scenarios:

Scenario 1: You have two loans: Loan A ($10,000 at 5% interest) and Loan B ($20,000 at 7% interest). The weighted average interest rate would be approximately 6.33%. (Calculation: [(10,000 * 0.05) + (20,000 * 0.07)] / 30,000 = 0.0633 or 6.33%). Consolidating these loans would result in a fixed interest rate of approximately 6.33%.

Scenario 2: You have three loans: Loan C ($5,000 at 4%), Loan D ($10,000 at 6%), and Loan E ($15,000 at 8%). The weighted average would be approximately 6.7% [(5000 * 0.04) + (10000 * 0.06) + (15000 * 0.08)] / 30000 = 0.067 or 6.7%.

In both scenarios, the consolidated loan’s interest rate falls between the highest and lowest rates of the original loans. However, it’s crucial to compare this new rate to the rates of your individual loans before deciding to consolidate.

Impact on Repayment Period

Consolidation can affect your repayment term, potentially lengthening or shortening it depending on your chosen repayment plan. While you may have the option to maintain your original repayment schedule, opting for a longer repayment term can lower your monthly payments, but it will ultimately increase the total interest paid over the life of the loan. Conversely, choosing a shorter repayment term will result in higher monthly payments but less total interest paid.

Factors Influencing the New Interest Rate

Several factors determine the new interest rate after consolidation. The most significant factor is the weighted average of the interest rates of your existing federal student loans. The type of consolidation loan (Direct Consolidation Loan or Federal Family Education Loan Program (FFEL) consolidation loan) can also play a minor role, although Direct Consolidation Loans are generally preferred due to their broader benefits and access to income-driven repayment plans.

Calculating Total Interest Paid

Calculating the total interest paid under different consolidation scenarios requires considering the new interest rate and the chosen repayment term. Several online loan calculators are available to assist with this calculation. These calculators typically require inputting the loan amount, interest rate, and repayment term to estimate the total interest paid over the life of the loan. By comparing the total interest paid under different scenarios (e.g., different repayment terms), you can make a more informed decision about your consolidation strategy. For example, a longer repayment term will decrease monthly payments but increase total interest paid; a shorter term increases monthly payments but reduces total interest.

To estimate total interest paid, use the following formula (though online calculators are recommended for precise calculations): Total Interest = (Monthly Payment * Number of Months) – Principal Loan Amount

Advantages and Disadvantages of Consolidating Federal Student Loans

Consolidating your federal student loans can seem like a straightforward solution to managing multiple loan payments, but it’s crucial to weigh the potential benefits against the drawbacks before making a decision. Understanding the long-term financial implications is key to making an informed choice that aligns with your individual circumstances.

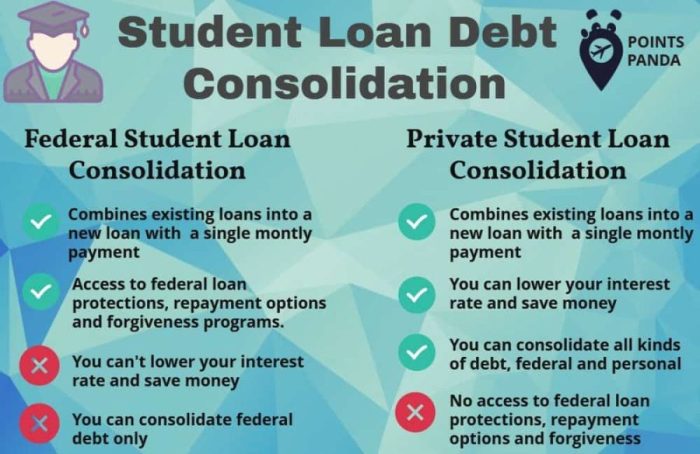

Consolidation simplifies your repayment by combining multiple federal student loans into a single loan with one monthly payment. This can make budgeting easier and potentially reduce administrative hassle. However, it’s important to carefully consider the impact on your interest rate and overall repayment cost before proceeding.

Advantages of Consolidating Federal Student Loans

Several advantages can make consolidation an attractive option for some borrowers. These benefits primarily center around simplification and potential access to income-driven repayment plans.

- Simplified Repayment: Managing one monthly payment instead of several is significantly less complex and reduces the risk of missed payments.

- Potential for Lower Monthly Payments: Consolidation can lower your monthly payment amount, though this often comes at the cost of a longer repayment period and increased overall interest paid.

- Eligibility for Income-Driven Repayment Plans: Consolidation can make you eligible for income-driven repayment plans, which base your monthly payments on your income and family size. This can be particularly beneficial for borrowers facing financial hardship.

- Streamlined Communication: Dealing with a single loan servicer simplifies communication and makes it easier to track your loan progress and repayment.

Disadvantages of Consolidating Federal Student Loans

While consolidation offers benefits, it’s essential to acknowledge the potential drawbacks. These often involve long-term financial implications that can significantly impact your overall repayment costs.

- Potential Increase in Total Interest Paid: While monthly payments might decrease, extending the repayment term often leads to a higher total interest paid over the life of the loan. This is because you’re paying interest for a longer period.

- Loss of Certain Loan Benefits: Consolidating certain types of federal loans, such as subsidized loans, may result in the loss of benefits associated with those specific loan programs. For example, you might lose the benefit of subsidized interest.

- Longer Repayment Period: Lower monthly payments typically come with a longer repayment term, meaning you’ll be paying off your debt for a longer period. This extends the time it takes to become debt-free.

- Impact on Credit Score (Potentially): While consolidation itself doesn’t directly harm your credit score, missing payments on your consolidated loan certainly will. Consistent on-time payments are crucial for maintaining a good credit score.

Long-Term Financial Implications of Consolidation

The long-term financial impact of consolidation hinges on the trade-off between lower monthly payments and increased total interest paid. It’s crucial to perform a thorough cost-benefit analysis using loan amortization calculators to compare the total cost of repayment under different scenarios (consolidated vs. non-consolidated).

For example, let’s say you have $30,000 in student loans with an average interest rate of 6%. Consolidating these loans might lower your monthly payment, but if it extends your repayment period from 10 years to 20 years, you could end up paying significantly more in interest over the life of the loan, potentially tens of thousands of dollars more. This increase in total interest paid is a substantial long-term cost that must be carefully weighed against the benefit of lower monthly payments.

Comparison of Consolidation with Other Student Loan Repayment Strategies

Consolidation is just one of several student loan repayment strategies. Other options include income-driven repayment plans (IDR), which adjust payments based on income, and refinancing, which involves replacing your federal loans with private loans. Each strategy has its own set of advantages and disadvantages.

IDR plans can offer lower monthly payments but may result in a higher total amount paid over the life of the loan and potential tax implications on forgiven amounts. Refinancing with private loans might offer lower interest rates but could eliminate federal loan protections and benefits. The best strategy depends on your individual financial situation, risk tolerance, and long-term goals.

Understanding the Different Consolidation Programs

Federal student loan consolidation simplifies repayment by combining multiple federal loans into a single loan. However, it’s crucial to understand that while there’s only one type of federal student loan consolidation program, the resulting loan’s terms and features can vary depending on the types of loans being consolidated and the borrower’s circumstances. This means the “program” isn’t a choice, but the resulting loan characteristics are.

Direct Consolidation Loan Program Features

The Direct Consolidation Loan Program is the only federal student loan consolidation program currently available. It allows borrowers to combine various federal student loans, including Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans, into a single Direct Consolidation Loan. The features of this consolidated loan are determined by several factors, including the interest rates of the original loans and the repayment plan chosen.

Criteria for Choosing a Repayment Plan (within the Direct Consolidation Loan)

The choice of repayment plan significantly impacts the monthly payment amount and the total interest paid over the life of the loan. Borrowers should carefully consider their financial situation and long-term goals when selecting a repayment plan. Factors such as income, expenses, and desired repayment timeline should all be considered.

Benefits and Drawbacks of the Direct Consolidation Loan

| Feature | Benefit | Drawback |

|---|---|---|

| Simplified Repayment | One monthly payment instead of multiple payments. | May not lower the overall interest paid if a longer repayment term is chosen. |

| Potential for Lower Monthly Payments | Extending the repayment term can reduce monthly payments. | Leads to paying more interest over the life of the loan. |

| Access to Income-Driven Repayment Plans | Eligibility for income-driven plans can significantly reduce monthly payments based on income and family size. | May result in a longer repayment period and higher overall interest paid. |

| Streamlined Loan Management | Easier to track payments and manage the loan. | No significant drawback beyond the potential increase in overall interest. |

Post-Consolidation Management and Financial Planning

Consolidating your federal student loans can simplify repayment, but effective management afterward is crucial for long-term financial health. This section Artikels strategies for budgeting, utilizing available resources, and planning for a financially secure future after consolidation. Careful planning now will significantly impact your ability to manage debt and achieve your financial goals.

Sample Budget Incorporating Consolidated Loan Payments

A realistic budget is essential for successful loan repayment. The following example demonstrates how a consolidated loan payment might integrate into monthly expenses. Remember to adjust these figures to reflect your specific circumstances.

| Category | Amount |

|---|---|

| Housing (Rent/Mortgage) | $1200 |

| Consolidated Student Loan Payment | $500 |

| Food | $400 |

| Transportation | $200 |

| Utilities | $150 |

| Healthcare | $100 |

| Savings | $150 |

| Other Expenses (Entertainment, etc.) | $100 |

| Total Monthly Expenses | $2800 |

This sample budget shows a scenario where a $500 monthly consolidated loan payment fits within a $2800 monthly budget. Prioritizing essential expenses and building a realistic savings plan are key components. This budget illustrates the importance of creating a detailed plan before consolidation to ensure manageable payments.

Available Resources for Borrowers Post-Consolidation

Numerous resources are available to assist borrowers after consolidating their federal student loans. These resources can provide guidance on repayment strategies, financial planning, and managing debt effectively.

The Federal Student Aid website (studentaid.gov) offers comprehensive information on repayment plans, loan forgiveness programs, and other relevant resources. Additionally, many non-profit credit counseling agencies provide free or low-cost guidance on debt management and financial literacy. These agencies can help borrowers develop personalized repayment plans and navigate complex financial situations.

Strategies for Effective Repayment and Avoiding Delinquency

Successful repayment hinges on proactive strategies. Establishing a consistent budget, prioritizing loan payments, and exploring different repayment options are crucial.

Automating loan payments ensures timely payments and avoids late fees. Consider exploring income-driven repayment plans if your income is low relative to your debt. These plans adjust your monthly payments based on your income and family size. Regularly reviewing your budget and making adjustments as needed is vital to stay on track and avoid delinquency. Finally, open communication with your loan servicer can help resolve issues before they escalate.

Tips for Long-Term Financial Planning After Consolidating Student Loans

Consolidating student loans is a significant step, but it’s only one piece of long-term financial planning.

Building an emergency fund is crucial to handle unexpected expenses without jeopardizing loan payments. Regularly saving for retirement through a 401(k) or IRA is essential for long-term financial security. Investing in your education and career development can increase your earning potential, enabling faster debt repayment and greater financial freedom. Finally, seeking professional financial advice can provide personalized guidance for navigating your financial future.

Illustrative Scenarios

Consolidating federal student loans can significantly impact borrowers’ financial situations, depending on their individual circumstances. The benefits of consolidation are not universal, and careful consideration is crucial before proceeding. The following scenarios illustrate how consolidation can be either highly beneficial or potentially detrimental.

Scenario: Consolidation is Highly Beneficial

Consider Sarah, a recent graduate with three federal student loans: a subsidized Stafford loan at 4.5%, an unsubsidized Stafford loan at 6%, and a Perkins loan at 5%. Her monthly payments are spread across three different loan servicers, creating a logistical nightmare. She’s struggling to keep track of her due dates and feels overwhelmed by the complexity of her repayment plan. By consolidating her loans into a single Direct Consolidation Loan, Sarah achieves a lower, fixed interest rate (assuming a weighted average of her current rates or a slightly higher rate offered by the consolidation program). This reduces her overall interest payments over the life of the loan. The simplification of her repayment schedule, with a single monthly payment to one servicer, significantly reduces her administrative burden and stress. The financial outcome is a lower total repayment amount and improved financial management. Her weighted average interest rate might be around 5%, but consolidation could offer her a fixed rate as low as 4.75%, resulting in substantial savings over the long term. This positive outcome is further amplified by the reduction in administrative hassle.

Scenario: Consolidation is Not the Best Option

In contrast, consider David, who has a single federal student loan with a low interest rate of 2.5%. He’s diligently making his payments on time and is on track to pay off his loan early. Consolidating his loan would likely result in a higher interest rate, potentially increasing his overall repayment costs. Furthermore, he might lose access to certain repayment plans, such as income-driven repayment options, that are specifically designed for his low interest rate loan. The financial outcome would be an increase in total interest paid and a longer repayment period. The administrative simplification wouldn’t outweigh the increased cost.

Factors Determining Consolidation Effectiveness

Several factors influence the effectiveness of student loan consolidation for individual borrowers. These include the current interest rates on individual loans, the availability of income-driven repayment plans, the borrower’s repayment history, and their financial goals. A borrower with high-interest loans and multiple servicers will likely benefit from consolidation. Conversely, a borrower with a single low-interest loan and a good repayment track record might find consolidation to be detrimental. The availability of favorable income-driven repayment plans associated with specific loan types should also be carefully weighed against the potential benefits of a consolidated loan.

Financial Outcomes in Each Scenario

In Sarah’s scenario (beneficial consolidation), the financial outcome is a lower total interest paid and simplified repayment management. The exact savings depend on the difference between her weighted average interest rate and the consolidated loan interest rate, and the length of her repayment period. In David’s scenario (unbeneficial consolidation), the financial outcome is a higher total interest paid and potentially a longer repayment period. The increase in interest costs might offset any benefits of administrative simplification. Careful analysis of the interest rate offered for consolidation versus the weighted average of the individual loans is crucial for informed decision-making. Borrowers should consider using loan calculators to model the financial outcomes of both scenarios before deciding.

Final Conclusion

Ultimately, the decision to consolidate federal student loans requires careful consideration of your individual financial circumstances. While consolidation can simplify repayment and potentially lower monthly payments, it’s essential to weigh the potential long-term impact on interest rates and the overall repayment period. By thoroughly understanding the process, exploring different programs, and planning for post-consolidation management, you can make an informed decision that aligns with your financial goals. Remember to leverage available resources and seek professional financial advice if needed to ensure a smooth and successful consolidation experience.

FAQ Overview

What happens to my loan forgiveness programs after consolidation?

Consolidation may affect your eligibility for certain loan forgiveness programs. It’s crucial to research the implications for your specific program before consolidating.

Can I consolidate private student loans with federal loans?

No, the federal consolidation program only applies to federal student loans. Private loans must be addressed separately.

What if I default on my consolidated loan?

Defaulting on a consolidated loan has serious consequences, including damage to your credit score and potential wage garnishment. It’s vital to maintain consistent payments.

How long does the consolidation process take?

The timeline varies, but it generally takes several weeks to complete the consolidation process after applying.