Navigating the complexities of student loan repayment can feel overwhelming. Many borrowers find themselves juggling multiple loans with varying interest rates and repayment schedules. This guide focuses on Nelnet student loan consolidation, exploring its potential benefits and drawbacks to help you determine if it’s the right solution for your financial situation. We’ll delve into the application process, repayment options, and potential pitfalls, equipping you with the knowledge to make informed decisions about your student loan debt.

Understanding the intricacies of Nelnet consolidation is key to effectively managing your student loan debt. This guide provides a detailed breakdown of the process, from eligibility requirements to managing your account post-consolidation. We aim to demystify the process and empower you to take control of your financial future.

Nelnet Student Loan Consolidation Overview

Nelnet is a major servicer of federal student loans, offering consolidation services to borrowers looking to simplify their repayment process. Consolidating your student loans with Nelnet means combining multiple federal student loans into a single, new loan with a potentially simplified payment plan. This can lead to a more manageable monthly payment, although it’s crucial to understand the implications before proceeding.

Nelnet Student Loan Consolidation Process

The Nelnet student loan consolidation process involves several key steps. First, you must determine your eligibility (detailed below). Then, you’ll need to complete a Direct Consolidation Loan application through the Federal Student Aid website, not directly through Nelnet. After applying, your loans will be reviewed, and once approved, Nelnet will become your new loan servicer. You will then receive a new loan agreement outlining the terms of your consolidated loan. Finally, you’ll begin making payments according to your new repayment schedule.

Eligibility Requirements for Nelnet Loan Consolidation

To be eligible for Nelnet student loan consolidation, you must have at least one eligible federal student loan. These generally include Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans. You do not need to be currently in default on your loans, but the consolidation process can’t resolve defaulted loans directly. You will need to be enrolled in an eligible repayment plan, or at least have a plan established before consolidation. You must also be a U.S. citizen or eligible non-citizen.

Comparison of Nelnet Consolidation with Other Loan Consolidation Options

While Nelnet is a significant student loan servicer offering consolidation, it’s important to remember that Nelnet itself doesn’t originate the consolidated loan. The consolidation loan is a Direct Consolidation Loan issued by the Department of Education. Therefore, consolidating through Nelnet is essentially the same as consolidating through any other servicer that handles Direct Consolidation Loans. The key differences lie in customer service, available repayment plans, and online tools provided by each servicer. There is no inherent advantage or disadvantage to choosing Nelnet over another servicer for the consolidation process itself.

Examples of Federal Student Loans Consolidable Through Nelnet

Numerous federal student loan types can be consolidated through Nelnet, as long as the consolidation is processed through the Department of Education’s Direct Consolidation Loan program. Examples include: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for parents or graduate students), FFEL Program Loans (Stafford Loans, SLS Loans, etc.), and Perkins Loans. It’s important to note that some private student loans cannot be included in a federal consolidation loan. The consolidation process is for federal loans only.

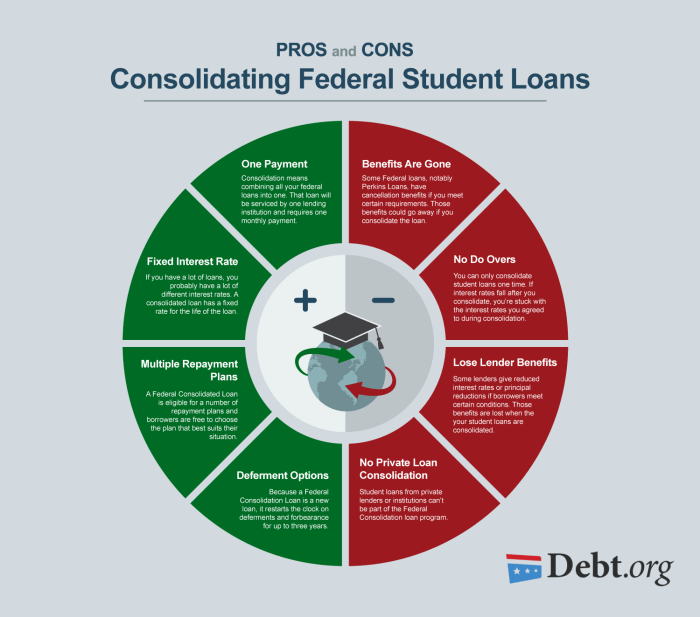

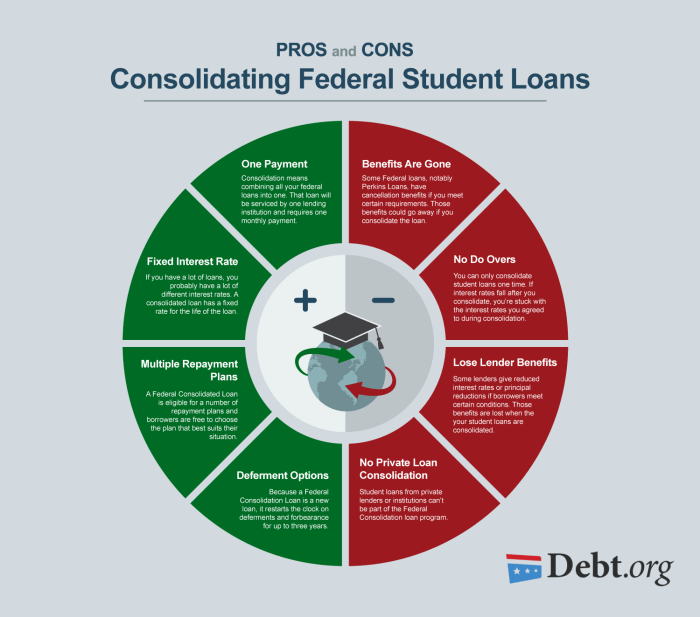

Benefits and Drawbacks of Nelnet Consolidation

Consolidating your student loans with Nelnet can offer several advantages, but it’s crucial to understand the potential downsides before making a decision. This section will explore the benefits and drawbacks, focusing on the impact on interest rates and repayment terms. Careful consideration of these factors is essential for making an informed choice.

Interest Rate Impact of Nelnet Consolidation

Nelnet calculates your new interest rate based on a weighted average of your existing loans’ interest rates. This means your new rate might be lower, higher, or the same as your highest existing rate, depending on the interest rates of your individual loans. For example, if you have several high-interest loans and a few low-interest ones, your consolidated rate might still be relatively high. Conversely, if most of your loans have lower interest rates, consolidation could result in a lower overall rate. It’s vital to compare your current weighted average interest rate to the offered consolidated rate before proceeding. Remember, the weighted average calculation considers both the interest rate and the principal balance of each loan.

Repayment Term Changes with Nelnet Consolidation

Consolidating your loans with Nelnet can affect your repayment term. You may be able to extend your repayment period, leading to lower monthly payments. However, this usually means you’ll pay more interest overall because you’re paying off the loan over a longer period. For instance, if you currently have a 10-year repayment plan and consolidate to a 20-year plan, your monthly payment will be significantly lower, but the total interest paid will be considerably higher. Shorter repayment terms, conversely, will lead to higher monthly payments but less total interest paid. The choice depends on your financial priorities and circumstances.

Benefits of Nelnet Loan Consolidation

Simplifying your repayment process is a key benefit. Instead of managing multiple loans with different due dates and interest rates, you’ll have a single monthly payment to Nelnet. This can significantly reduce administrative hassle and improve your financial organization. Another advantage might be the potential for a lower monthly payment (though this often comes at the cost of paying more interest overall, as explained above). Finally, Nelnet may offer various repayment plans to help borrowers manage their debt more effectively.

Drawbacks of Nelnet Loan Consolidation

A potential drawback is the possibility of a higher total interest paid over the life of the loan, especially if you extend your repayment term. You might also lose benefits associated with specific federal loan programs, such as income-driven repayment plans or loan forgiveness programs. For example, if you consolidate federal loans into a private loan, you might lose access to federal loan forgiveness programs applicable to public service employees. Additionally, if you have federal loans with subsidized interest, consolidation could convert them to unsubsidized loans, meaning you will accrue interest even while in school or during grace periods.

Comparison of Pros and Cons

| Pros | Cons |

|---|---|

| Simplified repayment process (single monthly payment) | Potentially higher total interest paid |

| Potentially lower monthly payment (longer repayment term) | Potential loss of federal loan benefits |

| Improved financial organization | Possible conversion of subsidized to unsubsidized loans |

| Access to various repayment plans | Increased repayment time |

The Application and Approval Process

Consolidating your student loans with Nelnet involves a straightforward application process, but understanding the steps and required documentation is crucial for a smooth experience. This section details the application process, necessary paperwork, tracking your application, and potential delays.

The Nelnet student loan consolidation application is primarily completed online through their secure website. Applicants will need to create an account or log in to an existing one. The application itself involves providing personal information, details about your current student loans (including lender names, loan amounts, and interest rates), and selecting your desired repayment plan. Accurate and complete information is vital for a timely processing.

Required Documentation

Submitting the correct documentation is essential for a swift application review. Incomplete applications often lead to delays. Generally, Nelnet will request verification of your identity and income. This may include providing a copy of your driver’s license or state-issued ID, Social Security number, and recent pay stubs or tax returns. They may also request copies of your student loan promissory notes or statements to verify the loan details you’ve provided. Failure to provide this documentation promptly can significantly delay the consolidation process.

Tracking Application Status

Once you submit your application, you can track its progress online through your Nelnet account. The website usually provides updates on the application’s status, indicating whether it’s been received, under review, or approved. You can also contact Nelnet’s customer service directly for status updates via phone or email. Regularly checking your account and actively communicating with Nelnet will keep you informed and allow you to address any issues promptly.

Potential Delays and Issues

Several factors can cause delays in the Nelnet consolidation process. Incomplete applications, missing documentation, or discrepancies in the information provided are common reasons for delays. For example, a mismatch between the information on your application and your provided documentation can trigger a review process, potentially adding weeks to the timeline. Furthermore, technical issues with the Nelnet website or internal processing delays within Nelnet itself can occasionally contribute to extended processing times. In cases of significant discrepancies or missing information, Nelnet may contact the applicant directly to request clarification or additional documentation. Proactive communication and careful attention to detail during the application process can help minimize the risk of such delays.

Repayment Plans and Options After Consolidation

Consolidating your student loans with Nelnet offers several repayment plan options, each with its own implications for your monthly payments and total interest paid. Choosing the right plan depends on your financial situation and long-term goals. Understanding the differences between these plans is crucial for effective debt management.

Available Repayment Plan Options

Nelnet typically offers a range of standard repayment plans, including but not limited to, Standard, Extended, Graduated, and Income-Driven Repayment (IDR) plans. The specifics of these plans, including eligibility criteria, may vary slightly depending on the type of federal loans included in your consolidation. It’s essential to check the Nelnet website or contact their customer service for the most up-to-date information on available plans.

Comparison of Repayment Plans

The primary differences between these plans lie in the length of repayment and the resulting monthly payment amount. A Standard plan typically involves a shorter repayment period, leading to higher monthly payments but lower total interest paid over the life of the loan. Conversely, an Extended plan stretches the repayment period, resulting in lower monthly payments but significantly higher total interest paid. Graduated plans start with lower monthly payments that increase over time, offering a balance between immediate affordability and long-term interest costs. Income-Driven Repayment (IDR) plans base your monthly payments on your income and family size, making them more manageable for those with fluctuating incomes but potentially leading to a longer repayment period and higher overall interest.

Sample Repayment Schedule

Let’s consider a hypothetical scenario: a consolidated loan of $30,000 with a 6% interest rate.

| Repayment Plan | Repayment Term (Years) | Approximate Monthly Payment | Approximate Total Interest Paid |

|---|---|---|---|

| Standard (10 years) | 10 | $330 | $9,600 |

| Extended (25 years) | 25 | $160 | $24,000 |

| Graduated (10 years) | 10 | (Starts lower, increases gradually) | (Between Standard and Extended) |

| IDR (Plan-Specific) | (Variable) | (Income-based) | (Potentially High) |

*Note: These are estimations. Actual payments and interest may vary based on individual circumstances and the specific terms of the loan.*

Calculating Total Loan Cost

The total cost of a loan is calculated by adding the principal loan amount to the total interest paid over the repayment period. For example:

Total Loan Cost = Principal Loan Amount + Total Interest Paid

Using the sample data above:

* Standard Plan: $30,000 (Principal) + $9,600 (Interest) = $39,600 (Total Cost)

* Extended Plan: $30,000 (Principal) + $24,000 (Interest) = $54,000 (Total Cost)

This demonstrates how significantly the choice of repayment plan impacts the overall cost of the loan. While a longer repayment term offers lower monthly payments, it ultimately results in paying substantially more interest over the life of the loan. Careful consideration of your financial capabilities and long-term goals is crucial in making this decision.

Managing Your Consolidated Loans with Nelnet

Successfully consolidating your student loans with Nelnet is only half the battle; effectively managing your repayment is equally crucial. This section details how to navigate your Nelnet account, make payments, update your information, and access customer support. Understanding these processes will ensure a smooth and stress-free repayment journey.

Making Payments on Your Consolidated Loans

Several convenient methods exist for making payments on your consolidated Nelnet loans. You can choose the option that best fits your lifestyle and financial preferences. Options generally include online payments through your Nelnet account, automatic payments (recurring debit or bank transfer), payments by mail (check or money order), and phone payments. It’s advisable to enroll in automatic payments to avoid late fees and ensure timely payments. Remember to always keep track of your payment due date and payment confirmation number.

Accessing Your Account Online and Managing Loan Information

Accessing your Nelnet account online provides a centralized location to manage all aspects of your consolidated loans. Through the Nelnet website, you can view your loan balance, payment history, upcoming payments, and repayment schedule. You can also update your contact information, enroll in autopay, and explore different repayment options. The online portal is designed for user-friendly navigation, offering a comprehensive overview of your loan status. Remember to bookmark the Nelnet website for easy access.

Contacting Nelnet Customer Service

Nelnet offers various channels for contacting their customer service team. You can reach them via phone, email, or through their online help center. The phone number and email address are readily available on the Nelnet website. The online help center provides FAQs and troubleshooting guides for common issues. For complex issues or urgent matters, contacting them via phone is often the most efficient method. Keep your Nelnet account number handy when contacting customer service to expedite the process.

Updating Personal Information

Keeping your personal information up-to-date is crucial for receiving important communications from Nelnet regarding your loans. This includes your address, phone number, and email address. You can easily update this information through your online Nelnet account. Logging into your account, navigating to the “Profile” or “Personal Information” section, and making the necessary changes is generally straightforward. It’s recommended to update your information promptly whenever there’s a change to ensure you receive timely notifications and avoid any potential issues with your loan payments.

Potential Issues and Solutions

While Nelnet loan consolidation offers significant benefits, borrowers should be aware of potential challenges that may arise. Understanding these issues and having strategies in place for resolution can significantly improve the consolidation experience. This section addresses common problems, dispute resolution, and solutions for borrowers facing financial hardship.

Several issues can occur during or after the Nelnet loan consolidation process. These range from administrative errors in the consolidation process itself, such as incorrect loan balances or missing payments being reflected, to difficulties managing the consolidated loan, including unexpected payment increases or challenges with accessing customer support. Disputes may arise from discrepancies in account information, disagreements regarding interest rates or fees, or difficulties in modifying repayment plans. Financial hardship, such as job loss or unexpected medical expenses, can make loan repayments challenging even after consolidation.

Resolving Disputes with Nelnet

Effective communication is crucial when addressing disagreements with Nelnet. Begin by gathering all relevant documentation, including loan agreements, payment history, and any correspondence with Nelnet. Contact Nelnet’s customer service department directly via phone or their online portal. Clearly explain the issue, referencing specific dates and account numbers. If the initial contact doesn’t resolve the problem, escalate the issue to a supervisor or consider submitting a formal written complaint. Keeping detailed records of all communication, including dates, times, and the names of individuals contacted, is vital for future reference. In some cases, mediation services or contacting a consumer protection agency may be necessary to resolve more complex disputes.

Solutions for Borrowers Facing Financial Hardship

Borrowers facing financial difficulties after consolidating their loans may be eligible for several hardship programs offered by Nelnet or the federal government. These programs often involve temporarily reduced payments, forbearance (a temporary suspension of payments), or deferment (postponement of payments). It’s crucial to contact Nelnet immediately to discuss your situation and explore available options. Proactive communication is key to avoiding delinquency and potential negative impacts on your credit score. Depending on the severity of the hardship, exploring options such as income-driven repayment plans may be beneficial. These plans base your monthly payments on your income and family size.

Steps to Take When Experiencing Difficulties with Nelnet

Taking proactive steps is essential when facing challenges with your Nelnet consolidated loans. A structured approach can help ensure the issue is addressed efficiently and effectively.

- Gather Documentation: Collect all relevant documents, including loan agreements, payment history, and any communication with Nelnet.

- Contact Nelnet: Reach out to Nelnet’s customer service department via phone or their online portal, clearly explaining the issue.

- Keep Detailed Records: Maintain meticulous records of all communication, including dates, times, and the names of individuals contacted.

- Escalate if Necessary: If the initial contact doesn’t resolve the issue, escalate it to a supervisor or manager.

- Explore Hardship Options: If facing financial hardship, contact Nelnet immediately to explore available forbearance, deferment, or income-driven repayment plans.

- Seek External Assistance: If the dispute remains unresolved, consider seeking assistance from a consumer protection agency or a student loan counselor.

Illustrative Examples

Understanding the benefits and drawbacks of Nelnet student loan consolidation requires considering various scenarios. The optimal choice depends heavily on individual circumstances, such as the types of loans held, interest rates, and financial goals. The following examples illustrate situations where consolidation is advantageous and where it might not be the best course of action.

Scenario: Consolidation is Beneficial

Imagine Sarah, a recent graduate with three federal student loans: a subsidized loan at 4.5%, an unsubsidized loan at 6%, and a PLUS loan at 7%. Her monthly payments are spread across three separate lenders, making budgeting challenging. Consolidating these loans with Nelnet could simplify her payments into a single monthly payment, potentially lowering her overall interest rate if she qualifies for a lower rate. The simplification of payment management and the potential for interest rate reduction significantly outweigh the small administrative fee associated with consolidation. This scenario demonstrates a clear benefit: improved financial organization and potential cost savings.

Scenario: Consolidation is Not the Best Option

Consider Mark, who has a low-interest federal loan and a high-interest private loan. While consolidating with Nelnet might simplify his payments, his overall interest rate could increase if the new consolidated rate is weighted more heavily towards the higher private loan rate. Furthermore, consolidating federal loans into a private loan might cause him to lose access to federal repayment plans and benefits, such as income-driven repayment options. In this instance, a strategic approach might involve focusing on repaying the high-interest private loan aggressively while maintaining the low-interest federal loan. Consolidation would not be the best approach given the potential loss of benefits and the risk of a higher interest rate.

Hypothetical Borrower’s Experience

Let’s examine the experience of David, who consolidated several federal student loans with Nelnet. Initially, David appreciated the convenience of a single monthly payment and the streamlined online account management. Nelnet’s customer service was responsive when he had questions about his repayment plan. However, David later discovered that his consolidated loan’s interest rate was slightly higher than he anticipated, negating some of the initial cost savings. Moreover, due to the consolidation, he lost access to a federal income-driven repayment plan that would have lowered his monthly payments based on his income. While the simplification of his loan management was a positive aspect, the slightly increased interest rate and loss of access to a beneficial repayment plan ultimately made the overall experience somewhat disappointing. This highlights the importance of carefully weighing the potential benefits against the potential drawbacks before consolidating.

Epilogue

Consolidating your student loans through Nelnet can offer significant advantages, simplifying your repayment and potentially lowering your monthly payments. However, it’s crucial to carefully weigh the pros and cons before proceeding. By understanding the process, exploring available repayment options, and proactively addressing potential challenges, you can make an informed decision that aligns with your financial goals. Remember to thoroughly review your options and seek professional financial advice if needed.

Questions and Answers

What types of federal student loans can be consolidated with Nelnet?

Nelnet can consolidate various federal student loans, including Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans. However, eligibility may vary depending on your loan type and servicer.

What happens to my loan forgiveness programs after consolidation?

Consolidation may affect your eligibility for certain loan forgiveness programs. It’s crucial to carefully consider the implications for programs like Public Service Loan Forgiveness (PSLF) before consolidating.

Can I consolidate private student loans with Nelnet?

No, Nelnet primarily consolidates federal student loans. Private student loans require separate refinancing options.

What if I have trouble making payments after consolidation?

Nelnet offers various repayment plans to accommodate different financial situations. Contacting Nelnet customer service to discuss your options is crucial if you’re facing difficulties.