Navigating the complexities of student loan debt can be challenging, especially for couples. Jointly consolidating student loans with your spouse offers a potential path towards simplification and potential financial benefits, but it’s crucial to understand the implications before taking the plunge. This guide will explore the advantages and disadvantages of consolidating student loans as a couple, providing a clear picture of the process, legal considerations, and long-term financial planning implications.

From eligibility requirements and financial benefits to the application process and alternative strategies, we will delve into the intricacies of joint student loan consolidation. We’ll also address common concerns and provide practical advice to help you make an informed decision that aligns with your shared financial goals. Understanding the nuances of joint responsibility, potential interest rate savings, and the impact on individual credit scores is paramount to making a well-considered choice.

Eligibility Requirements for Joint Consolidation

Consolidating student loans with a spouse can offer several benefits, such as simplifying repayment and potentially securing a lower interest rate. However, eligibility depends on several factors related to both applicants’ financial situations. Understanding these requirements before applying is crucial for a smooth process.

Income Requirements for Joint Student Loan Consolidation

Lenders generally consider the combined income of both spouses when assessing the eligibility for joint student loan consolidation. While there isn’t a specific minimum income threshold universally applied, a higher combined income typically improves the chances of approval. This is because a higher income demonstrates a greater ability to manage and repay the consolidated loan. Lenders assess the debt-to-income ratio (DTI), which compares your total monthly debt payments to your gross monthly income. A lower DTI indicates a lower risk for the lender. For example, a couple with a combined annual income of $100,000 and relatively low existing debt would likely have a better chance of approval than a couple with a combined income of $50,000 and high existing debt.

Credit Score Considerations for Joint Applications

Credit scores play a significant role in the approval process for joint student loan consolidation. Lenders will review the credit history of both applicants. A higher credit score generally indicates responsible financial management, making applicants appear less risky to lenders. While there’s no single magic number, a good credit score (generally considered 670 or above) for at least one applicant, or a strong average between both applicants, significantly increases the likelihood of approval. A low credit score for either applicant could result in rejection or higher interest rates. If one spouse has significantly better credit than the other, the lender might base their decision more heavily on the stronger credit score.

Required Documentation for Joint Consolidation

Before applying for joint consolidation, gather all necessary documentation. This typically includes: Social Security numbers for both applicants, proof of income (pay stubs, tax returns), current student loan statements for all loans to be consolidated, and proof of residency (utility bills, driver’s license). Depending on the lender, additional documentation such as bank statements or proof of employment may also be required. Providing complete and accurate documentation expedites the application process.

Eligibility Criteria for Federal vs. Private Loans

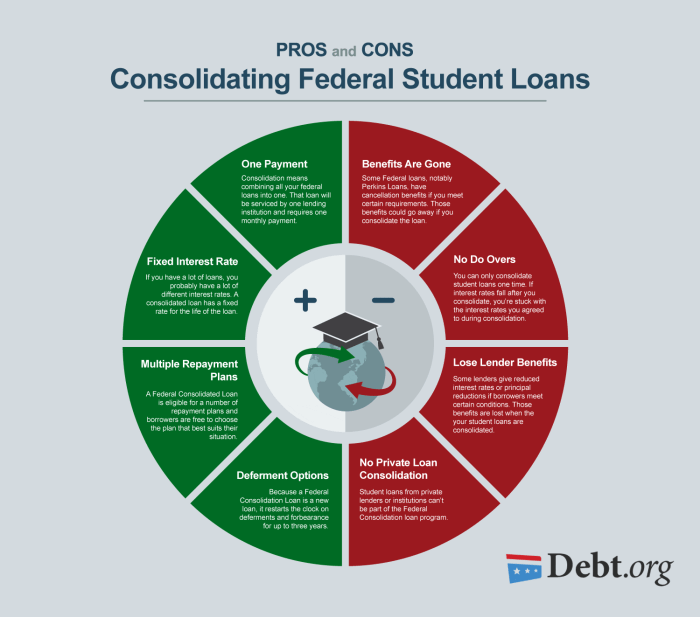

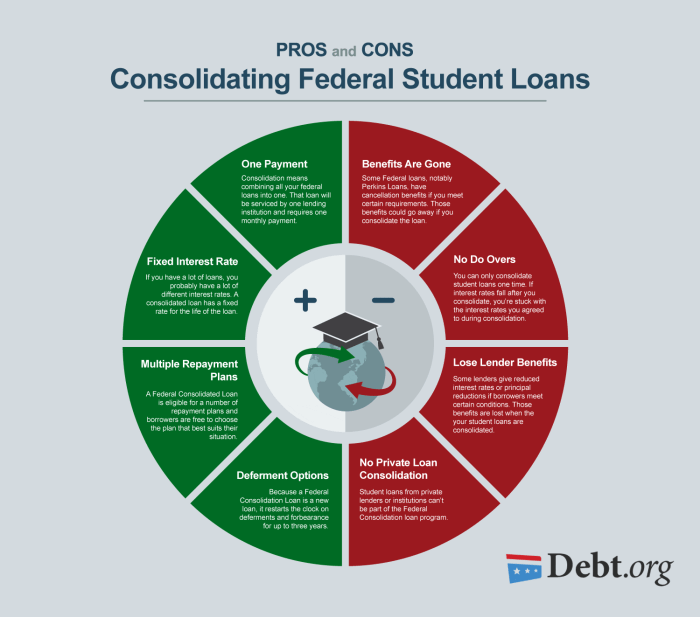

Eligibility criteria differ between federal and private student loan consolidation. Federal loans often have more lenient eligibility requirements, primarily focusing on the borrower’s ability to repay. Private lenders, on the other hand, typically have stricter criteria, often requiring higher credit scores and lower debt-to-income ratios. Joint consolidation is more readily available for federal loans, with the possibility of combining both federal and private loans under certain circumstances. However, the terms and conditions of consolidation will vary depending on the lender and the type of loans involved.

Financial Benefits and Drawbacks

Consolidating student loans with a spouse can offer significant financial advantages, but it also presents potential drawbacks. Understanding both sides is crucial before making a decision. This section will explore the potential benefits related to interest rates and credit scores, as well as the risks associated with combining financial responsibilities.

Potential Interest Rate Savings

Joint consolidation may result in a lower interest rate on your combined loans compared to your individual rates. Lenders often offer better terms to borrowers with stronger combined credit scores and higher incomes. For example, if one spouse has a high credit score and the other has a lower score, combining their loans might lead to a weighted average interest rate that is lower than the higher individual rate. This translates to lower monthly payments and less interest paid over the life of the loan. The extent of the savings depends on several factors, including the individual credit scores, the types of loans being consolidated, and the lender’s current interest rate offerings. A significant reduction in interest rates can lead to substantial long-term savings.

Impact on Individual Credit Scores

The effect of joint consolidation on individual credit scores is complex. While a joint loan will appear on both credit reports, its impact depends on the existing credit history and responsible repayment habits of both individuals. If both spouses consistently make on-time payments, the joint loan can potentially boost credit scores over time, especially if one spouse had a previously weaker credit history. However, a missed payment or delinquency on the joint loan negatively impacts both credit scores, potentially more severely than if the loans were separate.

Potential Downsides of Combining Loan Responsibilities

Combining loans means sharing the responsibility for repayment. This can be beneficial if both spouses are committed to responsible financial management. However, if one spouse experiences financial hardship, the other spouse is fully responsible for the entire loan amount. This shared responsibility can create significant financial strain and even damage the relationship if not handled carefully. Furthermore, it can complicate divorce proceedings, as the loan becomes a shared asset subject to division.

Scenarios Illustrating Benefits and Detriments

Scenario 1: A couple, one with excellent credit and the other with fair credit, consolidates their student loans. The excellent credit score helps secure a lower interest rate for both, resulting in significant long-term savings. This is a beneficial scenario.

Scenario 2: A couple with strong individual credit scores consolidates their loans, but one spouse loses their job and is unable to contribute to the repayment. The other spouse is now solely responsible for the entire loan amount, potentially leading to financial hardship and impacting their credit score. This illustrates a detrimental scenario.

The Application Process

Consolidating your student loans with your spouse can simplify your repayment process and potentially lower your monthly payments. However, the application process requires careful planning and attention to detail. This section Artikels the steps involved in a joint student loan consolidation.

Joint Consolidation Application Steps

The application process for joint student loan consolidation typically involves several key steps. Careful adherence to these steps ensures a smooth and efficient application.

| Step | Action | Documents Needed | Timeline |

|---|---|---|---|

| 1 | Check Eligibility | Social Security numbers, current addresses, student loan details (loan amounts, interest rates, lenders) for both spouses. | Immediately; this determines if you can proceed. |

| 2 | Choose a Lender or Servicer | Compare interest rates, fees, and repayment options from different lenders offering federal or private loan consolidation. | 1-2 weeks (research and comparison). |

| 3 | Complete the Application | Completed application form (this may vary depending on the lender), proof of income for both spouses (pay stubs, tax returns), and potentially other financial documentation as requested by the lender. | 1-2 weeks (filling out forms and gathering documents). |

| 4 | Submit the Application | All completed forms and supporting documents, usually submitted electronically. | 1 day (submission). |

| 5 | Review and Approval | Lender reviews the application; you may be contacted for additional information. | 2-6 weeks (processing and approval). |

| 6 | Loan Disbursement | Once approved, the lender disburses the consolidated loan, paying off the individual loans. | 1-2 weeks after approval. |

Completing the Required Forms Accurately

Accuracy is paramount when completing the application forms. Inaccurate information can lead to delays or rejection of the application. Each lender has its own forms, but common elements include personal information for both spouses, details of all existing student loans (including lender names, account numbers, and balances), and income verification. Double-check all entries for accuracy before submission. Many lenders offer online applications, allowing for immediate error correction. If applying through mail, carefully review the completed forms before mailing. Consider having a second person review the completed forms before submission to catch any potential errors.

Selecting a Loan Servicer

Choosing the right loan servicer is a critical decision. Different servicers offer varying interest rates, fees, and repayment options. Before selecting a servicer, compare offers from multiple lenders, paying close attention to the annual percentage rate (APR), any origination fees, and the terms of the repayment plan. Consider factors such as customer service reputation and available online tools for managing the loan. A lower APR can significantly reduce the total interest paid over the life of the loan. For example, a difference of even 0.5% in the APR on a $50,000 loan can save thousands of dollars over the repayment period.

Legal and Tax Implications

Consolidating student loans with a spouse has significant legal and tax implications that couples should carefully consider before proceeding. Understanding these implications can help prevent future disagreements and financial hardship. This section will Artikel the key aspects of joint liability and the tax consequences of this financial decision.

Tax Implications of Joint Loan Consolidation

The tax implications of joint student loan consolidation are generally minimal. Interest paid on student loans is typically not tax-deductible unless certain conditions are met, and these conditions remain unchanged whether the loan is in one name or jointly held. However, it’s crucial to consult a tax professional for personalized advice, as individual circumstances and tax laws can vary. For example, the deductibility might depend on your modified adjusted gross income (MAGI) and whether you’re claiming the student loan interest deduction. A tax advisor can help determine your eligibility for any relevant deductions or credits.

Legal Ramifications of Joint Responsibility

Jointly consolidating student loans means both spouses become legally responsible for the entire debt. This means that if one spouse defaults on the loan, the lender can pursue the other spouse for the full amount. This joint liability continues even after divorce or separation, unless specific legal arrangements are made. It is essential to understand that this shared responsibility extends beyond the repayment period and may impact credit scores for both individuals. A default by either party will negatively affect the credit history of both.

Handling Potential Disputes Between Spouses

Disputes regarding student loan repayment can arise between spouses, especially if financial situations change or one spouse feels unfairly burdened. Open communication and a clear understanding of financial responsibilities before consolidation are vital to prevent conflicts. Creating a detailed repayment plan that both spouses agree upon can mitigate potential disputes. In cases where disagreements persist, seeking mediation or financial counseling can help facilitate a resolution. Legal separation or divorce may necessitate renegotiating the loan terms or establishing separate financial responsibilities through a legal agreement.

Flowchart Illustrating Legal Aspects of Joint Consolidation

The following description details a flowchart illustrating the legal aspects of joint consolidation. The flowchart would begin with the decision to jointly consolidate student loans. This would branch into two paths: one for proceeding with joint consolidation and one for not proceeding. The “proceeding” path would lead to a box detailing the legal implications of joint liability, including shared responsibility for the debt and potential consequences of default. This would then branch to a box detailing the process of handling potential disputes, including communication strategies, mediation, and legal action if necessary. The “not proceeding” path would lead to a box highlighting the alternative options available, such as individual loan consolidation or other debt management strategies. Finally, both paths would converge at a box representing the final outcome, whether it be successful joint consolidation, a different debt management strategy, or a legal resolution of a dispute.

Alternative Strategies to Joint Consolidation

Joint consolidation isn’t the only path to managing student loan debt as a couple. Several alternative strategies offer unique advantages and disadvantages, and the best choice depends on individual financial circumstances and risk tolerance. Understanding these alternatives allows for a more informed decision-making process.

Individual Refinancing

Individual refinancing involves each spouse refinancing their student loans separately. This allows for personalized loan terms based on individual credit scores and income. A spouse with a higher credit score may qualify for a lower interest rate, resulting in potential savings. However, this approach may not offer the same benefits as joint consolidation, particularly if one spouse has significantly higher debt or a lower credit score.

Advantages and Disadvantages of Individual Refinancing

Advantages include potentially securing lower interest rates for individuals with strong credit and tailoring repayment plans to individual financial situations. Disadvantages include the administrative burden of managing two separate loans and potentially missing out on the benefits of joint application, such as lower interest rates or more favorable terms achievable through joint application.

Debt Allocation

Debt allocation focuses on strategically prioritizing which loans to pay down first. This approach doesn’t involve refinancing or consolidation but instead utilizes various debt repayment methods, such as the avalanche method (prioritizing loans with the highest interest rates) or the snowball method (prioritizing loans with the smallest balances). This strategy is particularly beneficial when dealing with a mix of federal and private loans, as it allows for targeted repayment efforts.

Advantages and Disadvantages of Debt Allocation

Advantages include the ability to strategically target high-interest debt, potentially leading to faster overall debt reduction. Disadvantages include the potential for slower overall debt reduction if a less efficient repayment method is chosen, and the need for strong self-discipline and consistent effort.

Comparison of Strategies

The following table summarizes the key features of joint consolidation and the alternative strategies discussed above. It’s important to note that the actual outcomes can vary depending on individual circumstances.

| Feature | Joint Consolidation | Individual Refinancing | Debt Allocation |

|---|---|---|---|

| Loan Terms | Single loan with unified terms | Separate loans with individual terms | Existing loan terms remain unchanged |

| Interest Rates | Potentially lower rate if both spouses have good credit | Varies based on individual credit scores | No change to interest rates |

| Administrative Burden | Simplified to one loan payment | Requires managing multiple loans | Requires careful tracking and planning |

| Federal Loan Benefits | May lose federal loan benefits | May lose federal loan benefits | Retains federal loan benefits |

| Credit Score Impact | Can positively or negatively impact credit depending on application and existing credit history | Can positively or negatively impact credit depending on application and existing credit history | No direct impact on credit score |

Long-Term Financial Planning After Consolidation

Consolidating your student loans with your spouse is a significant step toward a more manageable debt burden. However, the real victory lies in leveraging this consolidation to build a strong financial future together. Careful planning after consolidation is crucial to ensure you not only pay off your debt efficiently but also achieve your long-term financial goals. This includes creating a realistic budget, developing a comprehensive debt repayment plan, and tracking your progress diligently.

Sample Budget for a Couple After Loan Consolidation

A successful budget reflects your income, expenses, and debt repayment strategy. The following is a sample budget, and you’ll need to adjust it to reflect your specific income and expenses. Remember that this is a simplified example; more detailed budgeting tools and software are readily available.

| Income | Amount |

|---|---|

| Spouse 1 Salary | $4,000 |

| Spouse 2 Salary | $3,500 |

| Total Income | $7,500 |

| Expenses | Amount |

| Housing (Mortgage/Rent) | $1,800 |

| Utilities | $300 |

| Groceries | $600 |

| Transportation | $400 |

| Student Loan Payment | $1,200 |

| Other Expenses (Entertainment, Savings, etc.) | $1,200 |

| Total Expenses | $7,500 |

This example shows a balanced budget, where income equals expenses. It’s vital to allocate sufficient funds for loan repayment while still maintaining a comfortable lifestyle and saving for the future.

Debt Repayment Plan After Consolidation

A well-defined repayment strategy is critical for achieving debt freedom. Consider these strategies:

Prioritizing the repayment of high-interest debt is generally recommended. This approach minimizes the total interest paid over the life of the loans. Accelerated repayment methods, such as making extra payments or bi-weekly payments, can significantly reduce the loan’s lifespan and overall interest costs. For example, making an extra $100 payment each month can substantially shorten the repayment period and save thousands of dollars in interest over the life of the loan. The snowball method, where you focus on paying off the smallest debt first for motivation, can also be effective. The avalanche method focuses on paying the highest interest debt first. Both strategies can be useful, depending on personal preference and financial circumstances.

Tracking Progress Towards Debt Freedom

Regularly monitoring your progress is crucial to staying motivated and on track. Several methods exist:

Using a spreadsheet or budgeting app to track your loan balance, payments made, and interest accrued provides a clear picture of your progress. Visualizing your debt reduction through charts or graphs can be highly motivating. Many online tools and apps offer personalized dashboards that track your debt repayment and project your debt-free date.

Financial Planning for Future Goals After Debt Consolidation

Once you’ve established a solid debt repayment plan, it’s time to focus on your long-term financial goals. This includes:

Saving for retirement is a crucial long-term goal. Contributing to retirement accounts like 401(k)s and IRAs provides tax advantages and helps build wealth for your future. Emergency fund creation is vital for unexpected expenses. Aim for 3-6 months of living expenses in a readily accessible account. Investing in assets such as stocks, bonds, or real estate can help grow your wealth over the long term. Finally, planning for major life events, such as buying a house, having children, or further education, requires careful budgeting and saving. A detailed financial plan encompassing all these elements is essential for securing a financially stable future.

Illustrative Scenarios

Understanding the practical implications of joint student loan consolidation requires examining various scenarios. The benefits and drawbacks can vary significantly depending on individual circumstances, financial situations, and future plans. The following examples illustrate key considerations.

Joint Consolidation Highly Beneficial

Imagine Sarah and Mark, both graduating with significant student loan debt. Sarah owes $40,000 at a 7% interest rate, and Mark owes $30,000 at a 6% interest rate. By jointly consolidating their loans, they qualify for a lower interest rate of 5%, saving them thousands of dollars in interest over the life of the loan. Furthermore, consolidating simplifies their repayment process to a single monthly payment, improving their budgeting and reducing the administrative burden of managing separate loans. Their combined income allows for a larger monthly payment, enabling them to pay off the debt faster. This scenario highlights the significant financial advantage of joint consolidation when both borrowers have good credit and a stable combined income.

Joint Consolidation Not Advisable

Consider the case of Lisa and David. Lisa has excellent credit and a high income, while David has a lower credit score and a history of missed payments. While consolidating their loans might offer a slightly lower interest rate, David’s credit history could negatively impact Lisa’s credit score. Furthermore, if David experiences financial hardship and defaults on the loan, Lisa’s credit could also be severely damaged. In this scenario, separate loan management might be a more prudent strategy, protecting Lisa’s financial well-being. This example emphasizes the importance of individual creditworthiness and the potential risks associated with joint consolidation when one borrower has a significantly weaker financial profile.

Impact of Marital Status Change on Consolidated Loans

Suppose Emily and Tom consolidate their student loans during their marriage. They choose a joint repayment plan, leveraging their combined income. However, they later divorce. The loan remains in both their names, but its management and repayment responsibility need to be legally defined through their divorce settlement. This could involve one spouse assuming full responsibility, refinancing the loan individually, or establishing a shared repayment plan. This scenario demonstrates the critical need to consider the long-term implications of joint consolidation, especially the potential legal and financial ramifications of a marital dissolution.

Importance of Open Communication Regarding Debt Management

Anna and Ben are both burdened with student loan debt. Before considering consolidation, they have an open and honest discussion about their individual financial situations, spending habits, and long-term financial goals. This conversation reveals that Ben has a tendency to overspend, while Anna is more financially disciplined. This realization prompts them to create a detailed budget and financial plan before making any decisions about consolidating their loans. They also agree on a shared responsibility for repayment and regular monitoring of their progress. This scenario illustrates how effective communication is essential for successful debt management, preventing future conflicts and promoting a shared understanding of their financial responsibilities.

End of Discussion

Consolidating student loans with your spouse can be a powerful tool for streamlining debt management and potentially achieving significant financial gains. However, it’s essential to carefully weigh the advantages and disadvantages based on your unique circumstances. By thoroughly understanding the eligibility criteria, financial implications, and legal aspects, couples can make an informed decision that best serves their long-term financial well-being. Remember, open communication and a shared financial plan are key to success in this endeavor. Don’t hesitate to seek professional financial advice to ensure you’re making the best choice for your future.

Question & Answer Hub

What happens if one spouse’s credit score is significantly lower than the other’s?

A lower credit score can impact the interest rate offered. Lenders often base the interest rate on the lower score. Consider improving credit scores individually before applying jointly.

Can we consolidate federal and private student loans together?

This depends on the lender. Some lenders allow consolidation of both, while others may only consolidate federal or private loans separately. Check with potential lenders for their specific policies.

What if we divorce after consolidating our loans?

Both spouses remain legally responsible for the debt, even after divorce. A clear agreement on repayment responsibility should be established before consolidation and ideally documented legally.

How does joint consolidation affect our individual credit reports?

The consolidated loan will appear on both credit reports. Consistent on-time payments will benefit both credit scores. Late payments will negatively affect both.