Navigating the complexities of student loan repayment can feel overwhelming. Two common strategies, consolidation and refinancing, offer potential paths to simpler, more manageable debt. Understanding the key differences between these approaches is crucial for making informed decisions that align with your individual financial goals and circumstances. This guide will explore the nuances of each option, helping you determine which best suits your needs.

Both consolidation and refinancing aim to streamline your student loan payments, but they operate through different mechanisms and carry distinct advantages and disadvantages. Consolidation typically involves combining multiple federal loans into a single, new federal loan, often resulting in a simplified repayment schedule. Refinancing, on the other hand, replaces your existing loans—federal or private—with a new private loan, potentially offering a lower interest rate but sacrificing federal protections.

Understanding Consolidation

Student loan consolidation simplifies your repayment process by combining multiple federal student loans into a single loan. This can lead to a more manageable repayment schedule and potentially other benefits, though it’s crucial to weigh the pros and cons carefully before proceeding. The process involves applying through the government’s Direct Consolidation Loan program.

The Process of Federal Student Loan Consolidation

The federal student loan consolidation process involves applying for a Direct Consolidation Loan through the Federal Student Aid website. This application combines your eligible federal student loans into one new loan with a single monthly payment. The application requires providing personal information, details of your existing loans, and selecting your repayment plan. After approval, your original loans are paid off, and you begin making payments on your new consolidated loan. The entire process typically takes several weeks.

Types of Federal Student Loans Eligible for Consolidation

Many types of federal student loans are eligible for consolidation. These include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for both parents and graduate students), and Federal Stafford Loans (both subsidized and unsubsidized). However, private student loans cannot be consolidated through the federal program. It is essential to check the eligibility of each individual loan before applying for consolidation.

Applying for Federal Student Loan Consolidation: A Step-by-Step Guide

- Gather your loan information: Collect your loan numbers, lenders, and interest rates for all eligible federal student loans.

- Create or access your Federal Student Aid account: If you don’t already have one, create an account on StudentAid.gov.

- Complete the Direct Consolidation Loan application: This involves providing your personal information and loan details.

- Review and submit your application: Carefully review all information before submitting your application to avoid errors.

- Await approval: The processing time varies, but you’ll typically receive notification within a few weeks.

- Begin making payments: Once approved, your new consolidated loan will be disbursed, and you’ll receive information on your new repayment schedule.

Benefits and Drawbacks of Consolidating Federal Student Loans

Consolidating federal student loans can offer several advantages, such as simplifying repayment by reducing the number of monthly payments and potentially lowering your monthly payment amount by extending the repayment period (though this increases the total interest paid). However, consolidation may also lead to a higher total interest paid over the life of the loan due to a longer repayment term and potentially a higher interest rate (based on a weighted average of your original loans). Careful consideration of these trade-offs is crucial.

Interest Rates Before and After Consolidation

The interest rate on your consolidated loan is a weighted average of the interest rates on your original loans, rounded up to the nearest one-eighth of a percent. This means the rate may be slightly higher than the lowest rate among your original loans, but it will never exceed the highest rate. It is important to note that the interest rate will be fixed for the life of the consolidated loan.

| Loan Type | Original Interest Rate | Consolidated Interest Rate (Example) | Notes |

|---|---|---|---|

| Direct Subsidized Loan | 3.76% | 4.25% | This is an example and can vary. |

| Direct Unsubsidized Loan | 5.04% | 4.25% | This is an example and can vary. |

| Direct PLUS Loan | 7.54% | 4.25% | This is an example and can vary. |

| Federal Stafford Loan | 6.8% | 4.25% | This is an example and can vary. |

Understanding Refinancing

Refinancing your student loans involves replacing your existing loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total amount you pay over the life of the loan. The process offers the potential for significant savings, but it’s crucial to understand the nuances before making a decision.

Refinancing is distinct from consolidation, which combines multiple loans into a single loan with the same lender. While consolidation simplifies repayment, refinancing aims to secure a more favorable interest rate and potentially better loan terms.

The Refinancing Process

The refinancing process typically begins with comparing offers from various lenders. You’ll need to provide information about your existing loans, income, credit score, and desired loan terms. Once you’ve chosen a lender and loan terms, you’ll submit an application. The lender will review your application and, if approved, you’ll receive a loan agreement outlining the terms. After signing the agreement, the lender will pay off your existing student loans and you’ll begin making payments on your new loan. The entire process can take several weeks.

Eligibility Criteria for Refinancing

Lenders have specific eligibility criteria for student loan refinancing. Generally, applicants need a good credit score (typically above 670), a stable income, and a demonstrable ability to repay the loan. Some lenders may also require a certain level of education or a specific type of student loan. The exact requirements vary among lenders. Pre-qualification can help you understand your eligibility without impacting your credit score.

Examples of Lenders Offering Student Loan Refinancing

Several companies specialize in student loan refinancing. Examples include SoFi, Earnest, and CommonBond. These lenders often offer competitive interest rates and flexible repayment options. It’s crucial to compare offers from multiple lenders to find the best fit for your financial situation. Other banks and credit unions may also offer refinancing options, though their terms and conditions might differ.

Comparison of Interest Rates Offered by Various Lenders

Interest rates for student loan refinancing vary depending on several factors, including your credit score, income, loan amount, and the lender. It’s impossible to provide exact, up-to-the-minute rates here as they fluctuate constantly. However, a hypothetical comparison illustrates the potential differences:

| Lender | Interest Rate (Fixed) | Interest Rate (Variable) | Repayment Term Options |

|---|---|---|---|

| SoFi | 5.5% – 10% | 4.5% – 9% | 5, 7, 10 years |

| Earnest | 6% – 11% | 5% – 10% | 5, 10, 15 years |

| CommonBond | 6.5% – 12% | 5.5% – 11% | 5, 10 years |

| Example Bank | 7% – 13% | 6% – 12% | 10 years |

*Note: These are hypothetical examples and do not represent actual rates. Always check with individual lenders for current rates.*

Potential Impact of Refinancing on Your Credit Score

Applying for a new loan will result in a hard inquiry on your credit report, which can temporarily lower your credit score by a few points. However, if refinancing lowers your monthly payments and you consistently make on-time payments on your new loan, your credit score should improve over time. The positive impact of improved credit utilization and payment history often outweighs the minor, temporary dip from the hard inquiry. A higher credit score can lead to better financial opportunities in the future.

Consolidation vs. Refinancing

Choosing between consolidating and refinancing your student loans depends heavily on your individual financial situation and goals. Both options aim to simplify or improve your repayment process, but they achieve this through different mechanisms and with varying implications. Understanding these differences is crucial for making an informed decision.

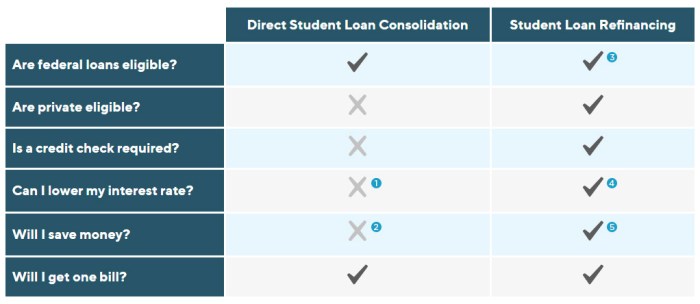

Key Differences Between Consolidation and Refinancing

Consolidation and refinancing, while both involving your student loans, operate differently. Consolidation combines multiple federal student loans into a single loan with a new repayment plan, managed by the federal government. Refinancing, on the other hand, replaces your existing loans—federal or private—with a new private loan from a lender. This new loan often offers a lower interest rate or a more favorable repayment term, but you lose the benefits of federal loan programs.

Situations Favoring Consolidation

Consolidation is generally a better option when you primarily have federal student loans and are struggling to manage multiple payments or repayment plans. It simplifies your repayment process by combining all your loans into one, potentially offering a fixed monthly payment and a standardized interest rate. This can improve organization and reduce administrative burdens. Furthermore, if you qualify for income-driven repayment plans, consolidation can provide access to these options, offering more manageable monthly payments based on your income and family size.

Situations Favoring Refinancing

Refinancing is often preferable when you have a strong credit score, a stable income, and aim to lower your interest rate significantly. This is particularly beneficial for borrowers with private student loans or a mix of federal and private loans who may not qualify for federal consolidation benefits. Refinancing can lead to substantial savings over the life of the loan, especially if you can secure a significantly lower interest rate. Additionally, it might offer the opportunity to switch to a shorter repayment term, enabling you to pay off your debt faster, though this will increase your monthly payment.

Impact on Repayment Period

The impact on the repayment period differs considerably. Consolidation might extend the repayment period, potentially lowering your monthly payments but increasing the total interest paid over the loan’s life. Conversely, refinancing can shorten the repayment period, leading to faster debt payoff but higher monthly payments. The optimal choice depends on your priorities: lower monthly payments versus faster debt elimination. For example, a borrower might consolidate to reduce monthly payments, even if it means paying more interest over time, while another might refinance to shorten the loan term, accepting higher monthly payments for quicker payoff.

Decision-Making Flowchart

A simple flowchart illustrating the decision process could look like this:

Start –> Do you primarily have federal student loans? –> Yes: Consider Consolidation –> No: Consider Refinancing –> Assess your credit score and income –> Strong credit and income? –> Yes: Refinancing likely beneficial –> No: Carefully weigh benefits and drawbacks of refinancing –> Choose best option based on individual circumstances –> End

Financial Implications

Understanding the long-term financial implications of consolidating or refinancing your student loans is crucial for making an informed decision. Both options can significantly impact your total interest paid, your repayment schedule, and your eligibility for certain loan forgiveness programs. Carefully weighing these factors is essential to determine which strategy aligns best with your individual financial goals.

Both consolidation and refinancing alter your student loan repayment landscape, potentially leading to either savings or increased costs over the life of your loans. The choice hinges on several factors, including your current interest rates, loan types, and financial goals. For instance, if you have a mix of high-interest and low-interest loans, refinancing might lower your overall interest rate, resulting in significant long-term savings. Conversely, consolidating federal loans might streamline payments but could potentially lead to a higher overall interest rate if the new consolidated rate is higher than your lowest existing rate.

Total Interest Paid Over Loan Lifetime

Consolidation combines multiple loans into a single loan, typically with a new weighted average interest rate. This rate might be lower, the same, or higher than your current average, depending on the consolidation terms and your creditworthiness. Refinancing, on the other hand, involves replacing your existing loans with a new loan from a private lender. This often offers the opportunity for a lower interest rate, but it depends on your credit score and the lender’s current rates.

Example: Let’s say you have three federal student loans totaling $50,000 with interest rates of 4%, 5%, and 6%. Consolidating these loans might result in a weighted average interest rate of 5%. Refinancing with a private lender, assuming you qualify for a 3% interest rate, would significantly reduce your total interest paid over the life of the loan. The exact amount saved depends on the loan term and the difference in interest rates. A longer repayment period will increase the total interest paid regardless of the interest rate.

Impact on Loan Forgiveness Programs

The impact of consolidation and refinancing on loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) or Income-Driven Repayment (IDR) plans, is a significant consideration. Consolidating federal loans generally preserves eligibility for federal loan forgiveness programs, although the repayment terms might change. However, refinancing federal loans with a private lender almost always eliminates eligibility for these programs. This is because private loans are not subject to the same rules and regulations as federal loans.

For example, someone enrolled in PSLF who consolidates their federal loans into a Direct Consolidation Loan will maintain their eligibility, provided they continue to meet the program’s requirements. However, refinancing those same loans with a private lender would immediately disqualify them from PSLF.

Tax Implications

The tax implications of consolidating and refinancing student loans are relatively minimal for most borrowers. However, understanding the potential nuances is important.

Understanding the tax implications is crucial for accurate financial planning. While the interest paid on most student loans is not tax-deductible, there are exceptions and considerations that might apply to your situation. Consulting a tax professional is advisable for personalized guidance.

- Consolidation: Generally, no significant tax implications. Interest paid remains non-deductible unless other criteria are met.

- Refinancing: Generally, no significant tax implications. Interest paid remains non-deductible unless other criteria are met.

Calculating Total Cost Over Different Repayment Periods

Calculating the total cost of each option requires considering the principal loan amount, the interest rate, and the repayment period. A longer repayment period will result in lower monthly payments but higher overall interest costs. A shorter repayment period will result in higher monthly payments but lower overall interest costs.

To calculate the total cost, you can use an online loan amortization calculator. These calculators allow you to input the loan amount, interest rate, and repayment period to determine the total interest paid and the total cost of the loan over its lifetime. For example, a $30,000 loan with a 5% interest rate over 10 years will have a significantly higher total cost than the same loan repaid over 5 years, even though the monthly payment is lower over 10 years.

Total Cost = Principal + Total Interest Paid

Impact on Credit Score

Consolidating or refinancing your student loans can have a noticeable impact on your credit score, both positive and negative. The effects depend on several factors, including your current credit history, the terms of your new loan, and how responsibly you manage your debt afterward. Understanding these potential impacts is crucial before making a decision.

Consolidation’s Effect on Credit Score

Consolidation typically involves combining multiple student loans into a single loan. While this simplifies repayment, the immediate impact on your credit score is often minimal. The process itself doesn’t directly improve or damage your score, unless it involves opening a new credit account, which could slightly lower your average credit age. However, a well-managed consolidated loan can indirectly improve your score over time by reducing your debt-to-credit ratio and demonstrating consistent on-time payments. The key is responsible repayment.

Refinancing’s Effect on Credit Score

Refinancing involves replacing your existing student loans with a new loan, often at a lower interest rate. Unlike consolidation, refinancing usually requires a credit check, which can lead to a temporary dip in your score due to the hard inquiry. However, if you qualify for a better interest rate and successfully manage the new loan, your score can improve in the long run due to a lower debt burden and improved credit utilization. The initial dip is often temporary, but securing a lower interest rate and improved repayment terms usually outweighs the short-term negative impact.

Impact of Poor Credit Score on Loan Options

A poor credit score significantly limits your options for both consolidation and refinancing. Lenders view individuals with poor credit as higher risk, leading to higher interest rates, stricter qualification requirements, and potentially even loan denials. For example, someone with a credit score below 670 might only qualify for consolidation through a federal program, which may not offer the best interest rates. Refinancing options may be limited or nonexistent, forcing them to continue with their current, potentially higher-interest loans. They may also encounter higher fees and stricter terms.

Steps to Improve Credit Score Before Applying

Improving your credit score before applying for consolidation or refinancing is highly recommended. This involves several key steps:

- Pay down existing debt: Reducing your credit utilization ratio (the amount of credit you use compared to your total available credit) is crucial. Aim for under 30% utilization.

- Pay bills on time: Consistent on-time payments are a major factor in your credit score. Set up automatic payments to avoid late fees and negative marks on your report.

- Monitor your credit report: Regularly check your credit report for errors and inaccuracies. Dispute any errors you find with the relevant credit bureau.

- Consider a secured credit card: A secured credit card can help rebuild credit if you have limited or damaged credit history. Responsible use can improve your score over time.

Visual Representation of Credit Score Impact Over Time

Imagine a graph with time on the x-axis and credit score on the y-axis. For consolidation, the line would show a slight, almost imperceptible dip initially, followed by a gradual, steady increase as consistent on-time payments improve the debt-to-credit ratio. For refinancing, the line would show a small, temporary dip immediately after the credit check. This dip would be followed by a steeper, more significant increase as the lower interest rate and improved repayment terms positively affect the credit score. The magnitude of the increase for both options depends on the individual’s starting credit score and responsible debt management. The refinancing line would generally show a more dramatic upward trend due to the potential for a significantly lower interest rate and monthly payment. However, this assumes successful qualification for refinancing at a lower rate.

Closure

Ultimately, the choice between consolidating and refinancing student loans hinges on your specific financial situation, loan types, and long-term objectives. Carefully weighing the pros and cons of each option, considering your credit score, and exploring available resources will empower you to make the most strategic decision for your financial well-being. Remember to thoroughly research lenders and compare interest rates before committing to either path. A well-informed choice can significantly impact your repayment journey and overall financial health.

FAQ Insights

What is the impact of consolidation on loan forgiveness programs?

Consolidating federal loans may affect your eligibility for certain income-driven repayment plans and loan forgiveness programs. It’s crucial to understand how consolidation will impact your specific program before proceeding.

Can I refinance my federal student loans with a private lender?

Yes, you can refinance federal student loans with a private lender. However, this means you’ll lose federal protections like income-driven repayment plans and potential forgiveness programs.

How long does the consolidation or refinancing process take?

The timeframe varies depending on the lender and your individual circumstances. Federal consolidation typically takes several weeks, while private refinancing can be faster, sometimes taking only a few weeks.

What is the minimum credit score required for refinancing?

Credit score requirements for refinancing vary widely among lenders. Generally, a higher credit score will qualify you for better interest rates and terms. Some lenders may offer options for borrowers with less-than-perfect credit, but at potentially higher interest rates.