Navigating the complexities of federal student loan debt can feel overwhelming, but understanding the process of consolidation offers a potential pathway to simpler repayment. Consolidating your federal student loans combines multiple loans into a single, new loan, potentially simplifying your monthly payments and offering various repayment plan options. This guide will explore the benefits, drawbacks, and crucial considerations involved in this process.

From eligibility requirements and interest rate calculations to the potential impact on your credit score and the various government assistance programs available, we aim to provide a comprehensive overview. We’ll examine real-world scenarios to illustrate how consolidation can affect your financial picture, helping you make an informed decision about whether this strategy is right for you.

Consolidated Federal Student Loans

Consolidating your federal student loans means combining multiple federal student loans into a single, new loan. This simplifies your repayment process by reducing the number of monthly payments you need to make and potentially offering a more manageable repayment plan. The process itself is relatively straightforward, though understanding the implications beforehand is crucial.

The Process of Consolidating Federal Student Loans

The consolidation process typically begins with applying through the Federal Student Aid website. You’ll need to gather information about your existing loans, including lender information and loan amounts. Once your application is approved, your existing loans are paid off by the new consolidated loan. You’ll then receive a new loan with a single monthly payment, interest rate, and repayment plan. The entire process can take several weeks, so patience is key.

Types of Federal Student Loans Eligible for Consolidation

Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for parents and graduate students), and Federal Stafford Loans (both subsidized and unsubsidized) are all eligible for consolidation into a Direct Consolidation Loan. Other federal education loans, such as Federal Perkins Loans and Federal Consolidation Loans, may also be eligible, but it’s best to check the Federal Student Aid website for the most up-to-date information. Note that private student loans cannot be consolidated into a federal Direct Consolidation Loan.

Interest Rate Comparison: Before and After Consolidation

The interest rate of your Direct Consolidation Loan is a weighted average of the interest rates of your existing loans, rounded up to the nearest one-eighth of a percent. This means your new interest rate will likely be slightly higher than the lowest interest rate among your existing loans but potentially lower than the highest. For example, if you have loans with interest rates of 4%, 5%, and 6%, your consolidated loan rate will likely fall somewhere between these values, rounded up to the nearest one-eighth of a percent. It’s important to carefully compare your current interest rates with the potential consolidated rate to determine if consolidation is financially beneficial.

Benefits and Drawbacks of Consolidating Federal Student Loans

Consolidating federal student loans offers several potential advantages. These include simplified repayment with a single monthly payment, the possibility of qualifying for income-driven repayment plans, and the potential to extend your repayment term (though this will increase the total interest paid). However, drawbacks exist. The weighted average interest rate might be higher than some of your existing rates, potentially leading to a higher total interest paid over the life of the loan. Furthermore, consolidating may eliminate the benefits of specific loan programs, such as loan forgiveness programs tied to certain professions. Careful consideration of these factors is essential before making a decision.

Eligibility Requirements for Consolidation

Consolidating your federal student loans can simplify your repayment process by combining multiple loans into a single one. However, eligibility depends on several factors, and understanding these requirements is crucial before applying. This section details the criteria, necessary documentation, and the role of credit history in the consolidation process.

Eligibility Criteria for Federal Student Loan Consolidation

To be eligible for federal student loan consolidation, you must have at least one eligible federal student loan. These typically include Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans. However, not all loans within these programs are eligible; for instance, some FFEL loans might be ineligible if they’re privately held. It’s essential to check the specific eligibility of each loan before attempting consolidation. Additionally, you must be in repayment, default, or forbearance status on at least one of your loans. You cannot consolidate loans that are still in grace periods. Finally, you must be a U.S. citizen or eligible non-citizen.

Required Documentation for the Application Process

The application process requires specific documentation to verify your identity and loan details. This generally includes your Social Security number, loan information (including loan numbers and amounts), and possibly tax information, depending on your circumstances. Providing accurate and complete information is crucial for a smooth and efficient processing of your application. Inaccurate information can delay the process or even lead to rejection. It is highly recommended to gather all necessary documentation before starting the application.

Impact of Credit History on Loan Consolidation Eligibility

Your credit history does not directly impact your eligibility for federal student loan consolidation. Unlike private loan consolidation, the federal government does not perform a credit check as a condition for eligibility. This is because federal student loan consolidation is primarily a process of administrative simplification, not a new credit extension. However, your credit history might indirectly influence your future repayment options, particularly if you choose to consolidate your loans into a different repayment plan.

Flowchart Illustrating the Application Process

The application process can be visualized as follows:

[Imagine a flowchart here. The flowchart would begin with a “Start” box. The next box would be “Gather Necessary Documentation” which would branch to “Meet Eligibility Requirements?” with a “Yes” branch leading to “Complete Application” and a “No” branch leading to “Ineligible”. “Complete Application” would branch to “Submit Application” which would lead to “Application Processing” and then finally to “Consolidated Loan”. The “Application Processing” box might have a small sub-branch showing a potential “Request for Additional Information”. The “Ineligible” box would have a concluding “End” box, while the “Consolidated Loan” box also leads to an “End” box.]

The flowchart illustrates the straightforward nature of the application process, provided the applicant meets the necessary eligibility requirements. The process primarily involves gathering the required documentation, completing the application, and submitting it for processing. The federal government then processes the application and, upon successful verification, consolidates the eligible loans.

Interest Rates and Repayment Plans

Consolidating your federal student loans can simplify your repayment process, but understanding the interest rates and available repayment plans is crucial for making informed financial decisions. Choosing the right plan significantly impacts your monthly payments and the total amount you pay over the life of the loan.

The interest rate on a consolidated loan is a weighted average of the interest rates on your existing loans. This means the rate isn’t simply the highest or lowest rate, but a calculation factoring in the principal balance of each loan. This weighted average is then rounded up to the nearest one-eighth of a percent. The result is a fixed interest rate for the life of the consolidated loan, meaning it won’t change.

Repayment Plan Options and Payment Examples

Several repayment plans are available after consolidation, each with varying monthly payments and loan terms. The best option depends on your individual financial circumstances and repayment goals. Below is a comparison of some common plans, using a hypothetical loan amount of $30,000 and a consolidated interest rate of 6%. Keep in mind that these are examples, and your actual payments will vary depending on your loan amount and interest rate.

| Repayment Plan | Monthly Payment | Total Interest Paid | Loan Term (Years) |

|---|---|---|---|

| Standard Repayment Plan | $300 (approx.) | $10,800 (approx.) | 10 |

| Extended Repayment Plan | $200 (approx.) | $18,000 (approx.) | 20 |

| Graduated Repayment Plan | $200 (approx.) increasing over time | $18,000 (approx.) | 10 |

| Income-Driven Repayment Plan (Example: ICR) | Variable (based on income) | Variable (can be significantly higher or lower than other plans) | 25 |

Note: These figures are approximate and for illustrative purposes only. Actual payments will vary based on the specific loan amount, interest rate, and chosen repayment plan. Income-driven repayment plans require annual income recertification.

Interest Rate Calculation and Impact of Repayment Plans

The interest rate for a consolidated loan is calculated as a weighted average of the interest rates on your individual loans. The formula is complex and involves the principal balance of each loan and its interest rate. For example, if you have two loans – one with a $10,000 balance at 5% and another with a $20,000 balance at 7% – the weighted average would favor the larger loan. The resulting rate is then rounded up to the nearest one-eighth of a percent.

Choosing a longer repayment plan, like the Extended Repayment Plan, reduces your monthly payment. However, this comes at a cost – you’ll pay significantly more in interest over the life of the loan. Conversely, shorter repayment plans like the Standard Repayment Plan result in lower total interest paid but require higher monthly payments. Income-driven repayment plans offer lower monthly payments based on income, but potentially result in a longer repayment period and higher total interest.

The Impact of Consolidation on Credit Score

Consolidating your federal student loans can have a multifaceted impact on your credit score. While it doesn’t automatically boost your score, it can indirectly influence it in both positive and negative ways, depending on your pre-consolidation habits and post-consolidation management. Understanding these potential effects is crucial for making informed decisions and maintaining a healthy credit profile.

The primary effect of consolidation on your credit score is often related to the age of your credit accounts. When you consolidate multiple loans into one, you essentially close the individual accounts. This can shorten your credit history, potentially lowering your score, especially if those individual accounts had a long history of on-time payments. Conversely, if you had accounts with late payments or defaults, consolidating can help improve your credit score over time by removing those negative marks from your credit report as long as you maintain timely payments on the consolidated loan.

Credit Score Changes After Consolidation

The impact of consolidation on your credit score is not immediate and depends on several interacting factors. A significant drop is unlikely unless you already have a poor credit history. However, a slight, temporary dip is possible due to the closing of older accounts. Over time, responsible management of the consolidated loan will rebuild any lost ground and likely lead to gradual improvement as long as payments are made on time. The length of time it takes to see a positive effect varies from person to person, and it is typically dependent on the individual’s credit behavior after consolidation. For instance, someone with a history of missed payments might see a slower improvement than someone with a consistent record of on-time payments.

Factors Influencing Credit Score After Consolidation

Understanding the factors that influence your credit score after consolidation is key to proactive management. Several elements play a significant role. These include the length of your credit history (which may temporarily decrease immediately after consolidation), your payment history (the most important factor, with on-time payments boosting your score), your credit utilization ratio (keeping your credit utilization low is crucial), and the types of credit you use (a diverse credit mix is generally beneficial). Additionally, the presence of any negative marks on your credit report, such as bankruptcies or collections, can significantly impact your score regardless of consolidation.

Best Practices for Managing Debt After Consolidation

Careful management of your consolidated loan is crucial for maintaining or improving your credit score. Here are some best practices:

- Make on-time payments consistently: This is the single most important factor affecting your credit score.

- Keep your credit utilization low: Aim to use less than 30% of your available credit.

- Monitor your credit report regularly: Check for errors and track your progress.

- Consider a higher credit limit: If feasible, request a higher credit limit to reduce your credit utilization ratio. This can improve your credit score, assuming you do not increase your spending.

- Budget effectively: Create a realistic budget to ensure you can comfortably afford your monthly payments.

Potential Pitfalls of Consolidation

Consolidating your federal student loans can seem like a straightforward solution to managing multiple payments, but it’s crucial to understand the potential drawbacks before making a decision. While consolidation simplifies your repayment process, it can also lead to unforeseen consequences if not carefully considered. This section Artikels key risks and situations where consolidation may not be the best course of action.

Consolidation isn’t always the optimal strategy, and several factors can negate its benefits. Understanding these pitfalls is vital to making an informed choice that aligns with your individual financial circumstances.

Higher Overall Interest Payments

Consolidation typically results in a weighted average interest rate based on your existing loans. While this might seem beneficial, it can actually lead to paying more interest overall if you have loans with significantly lower interest rates. For example, if you have several loans with rates below 5% and consolidate them into a loan with a rate of 7%, you’ll end up paying more in interest over the life of the loan, even though you’re making only one payment. This is because the higher rate applies to the entire consolidated loan balance. The longer the repayment period, the more pronounced this effect becomes.

Loss of Certain Loan Benefits

Consolidating federal student loans means losing access to certain repayment plans or forgiveness programs associated with your original loans. For instance, you might forfeit eligibility for income-driven repayment plans, public service loan forgiveness, or other programs designed to help borrowers in specific circumstances. Carefully evaluate the benefits of your current loans before consolidating, ensuring you won’t be sacrificing crucial features. This could significantly impact your long-term repayment strategy and overall cost.

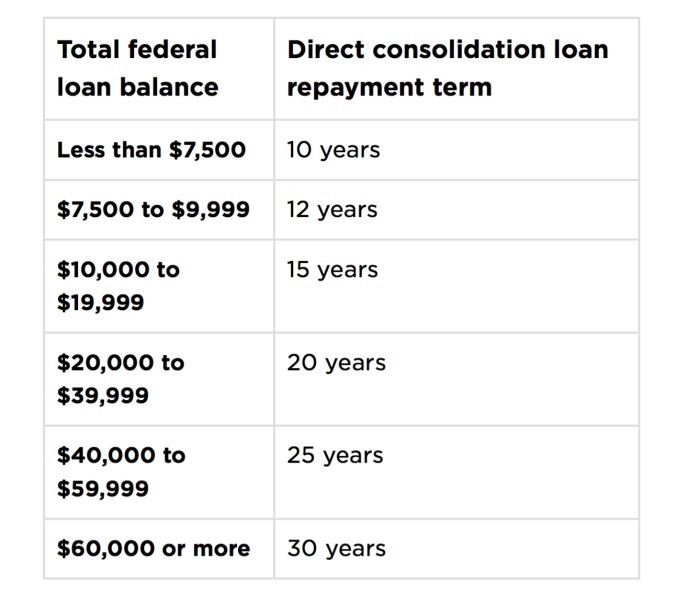

Extended Repayment Period

While a single monthly payment might seem appealing, consolidating your loans could lead to a longer repayment period, ultimately increasing the total interest paid. While a longer repayment period reduces your monthly payment, it significantly increases the total amount you repay over time. This is because you’re paying interest on the principal for a much longer duration. Consider the trade-off between lower monthly payments and the increased overall cost before making a decision.

Consequences of Default

Defaulting on a consolidated federal student loan has severe consequences. Your credit score will be severely damaged, impacting your ability to obtain loans, rent an apartment, or even secure employment. The government can garnish your wages, tax refunds, and Social Security benefits to recover the debt. Furthermore, defaulting can lead to additional fees and penalties, making the debt even more difficult to manage. The ramifications of default are far-reaching and should be carefully considered before consolidating.

Government Resources and Assistance Programs

Navigating the complexities of federal student loan consolidation and repayment can be challenging. Fortunately, the government provides numerous resources and assistance programs designed to help borrowers manage their debt effectively and avoid default. Understanding these resources is crucial for borrowers seeking to alleviate financial strain and achieve long-term financial stability. This section will Artikel key government websites, assistance programs, and the process of applying for income-driven repayment plans.

The federal government offers a wealth of information and support through various websites and agencies. The primary source of information is the official website of the U.S. Department of Education, specifically the Federal Student Aid website (studentaid.gov). This website provides comprehensive information on all aspects of federal student loans, including consolidation, repayment plans, and available assistance programs. It also offers tools and calculators to help borrowers estimate their monthly payments and explore different repayment options. Beyond the main website, many other government resources offer guidance and support.

Income-Driven Repayment Plan Application

Applying for an income-driven repayment (IDR) plan involves completing a detailed application process through the Federal Student Aid website. Borrowers will need to provide their income and family size information, which will be used to calculate their monthly payment. The specific requirements and forms vary depending on the chosen IDR plan (such as Income-Based Repayment, Pay As You Earn, Revised Pay As You Earn, or Income-Contingent Repayment). Generally, the process involves logging into your student loan account on studentaid.gov, selecting the desired IDR plan, and providing the necessary documentation. The application will require verification of income through tax returns or pay stubs. Once submitted and approved, your monthly payment will be adjusted based on your income and family size. It is important to recertify your income annually to ensure your payments remain accurate.

Government Agencies Providing Student Loan Debt Assistance

Understanding which government agencies offer assistance is vital for effective debt management. The following agencies play significant roles in supporting borrowers:

- U.S. Department of Education: The primary federal agency responsible for administering federal student loan programs. They oversee loan consolidation, repayment plans, and various assistance programs.

- Federal Student Aid (FSA): A part of the U.S. Department of Education, FSA provides direct support to borrowers through its website, online tools, and customer service channels.

- The Consumer Financial Protection Bureau (CFPB): While not directly involved in loan administration, the CFPB protects consumers from unfair, deceptive, or abusive practices by lenders and servicers. They offer resources and guidance to borrowers facing difficulties.

Visual Representation

Understanding the benefits of federal student loan consolidation often requires visualizing the impact on your overall debt. Let’s consider a hypothetical scenario to illustrate how consolidation can simplify repayment and potentially save money.

This example demonstrates the before-and-after effects of consolidating several federal student loans with varying interest rates into a single loan with a weighted average interest rate. The result is a potentially lower monthly payment and a reduction in total interest paid over the life of the loan.

Loan Consolidation: A Before-and-After Comparison

Imagine a borrower with three federal student loans:

| Loan | Original Balance | Interest Rate | Monthly Payment |

|---|---|---|---|

| Loan A | $10,000 | 7% | $100 |

| Loan B | $15,000 | 5% | $150 |

| Loan C | $5,000 | 9% | $60 |

Before consolidation, the borrower manages three separate loans, each with a different interest rate and monthly payment. This requires tracking multiple due dates and payments, making the repayment process more complex. The total monthly payment is $310.

After consolidating these loans, the borrower now has a single loan with a new weighted average interest rate (let’s assume this is 6%). The total loan balance remains the same ($30,000), but the monthly payment may be lower due to the extended repayment period offered by the consolidated loan. For instance, the monthly payment might be reduced to approximately $280. This reduction in the monthly payment is because the weighted average interest rate is lower than the highest interest rate of the original loans. Furthermore, the total interest paid over the life of the loan is likely to be less than the sum of the interest paid on the individual loans, representing a potential cost saving.

| Consolidated Loan | New Balance | Weighted Average Interest Rate | New Monthly Payment (Example) |

|---|---|---|---|

| Consolidated Loan | $30,000 | 6% | $280 |

Note: The specific interest rate and monthly payment after consolidation will depend on several factors, including the borrower’s credit history, chosen repayment plan, and the terms offered by the lender. This example serves as a simplified illustration of the potential benefits.

Closing Notes

Consolidating federal student loans presents a significant financial decision requiring careful consideration of individual circumstances. While the simplification of payments and access to flexible repayment plans are attractive benefits, potential drawbacks such as extended repayment periods and higher overall interest costs must be weighed against your personal financial goals. By understanding the intricacies of the process and utilizing available resources, borrowers can make informed choices leading to more manageable student loan repayment.

Popular Questions

What happens to my original loans after consolidation?

Your original loans are paid off with the proceeds from your new consolidated loan. They no longer exist as separate debts.

Can I consolidate private student loans with federal loans?

No, consolidation is only for federal student loans. Private loans must be managed separately.

Will consolidating my loans affect my credit score immediately?

The immediate impact is usually minimal, but responsible repayment of the consolidated loan will positively affect your credit score over time.

What if I default on my consolidated loan?

Defaulting on a consolidated loan has serious consequences, including damage to your credit score, wage garnishment, and potential tax refund offset.

How long does the consolidation process take?

The processing time varies, but it generally takes several weeks. Expect delays if additional documentation is required.