Navigating the complexities of student loan debt often feels like traversing a financial maze. Understanding consolidated student loan interest rates is crucial for borrowers seeking to manage their debt effectively and minimize long-term costs. This guide unravels the intricacies of consolidation, exploring how different factors influence your final interest rate and ultimately, your repayment journey.

From the mechanics of consolidation itself to the impact of credit history and income, we’ll examine the various elements that shape your interest rate. We’ll also delve into the differences between federal and private loan consolidation, highlighting the nuances of interest rate calculations for each. Ultimately, this guide empowers you to make informed decisions about your student loan debt and pave the way towards a more financially secure future.

Understanding Consolidated Student Loan Interest Rates

Consolidating your student loans can simplify repayment by combining multiple loans into a single, new loan. However, understanding how this consolidation impacts your interest rate is crucial to making an informed decision. This section will detail the mechanics of consolidation and the factors that influence the resulting interest rate.

Consolidation involves taking out a new loan to pay off your existing student loans. The new loan’s interest rate is typically a weighted average of the rates on your previous loans, although this isn’t always the case. The process simplifies payments, but the interest rate calculation can be complex and potentially increase your total interest paid over the life of the loan, depending on several factors.

Factors Influencing Consolidated Loan Interest Rates

Several factors contribute to the final interest rate on your consolidated student loan. These factors interact to determine the rate offered, making it essential to understand their influence.

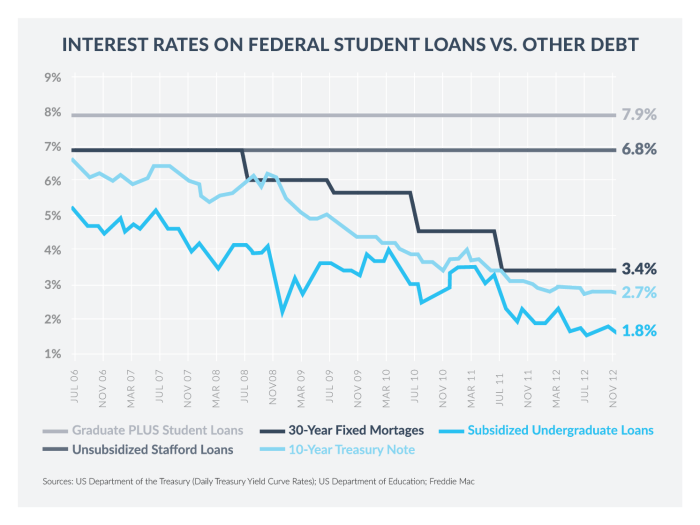

The most significant factor is the interest rates of your existing loans. A weighted average is typically calculated, meaning loans with larger balances carry more weight in determining the final rate. The types of loans being consolidated also play a role. Federal loans generally have lower interest rates than private loans, so consolidating primarily federal loans will likely result in a lower consolidated rate than consolidating a mix of federal and private loans. Your credit history is another crucial factor; a strong credit history may help secure a more favorable interest rate. Finally, prevailing market interest rates at the time of consolidation significantly influence the final rate offered. These rates fluctuate, so the rate you get today might be different tomorrow.

Weighted Average Interest Rates versus Fixed Interest Rates

After consolidation, your loan may have either a weighted average interest rate or a fixed interest rate. A weighted average interest rate reflects the average of your previous loan interest rates, weighted by the outstanding balance of each loan. A fixed interest rate, on the other hand, remains constant throughout the loan’s term, regardless of market fluctuations. The type of consolidation program you choose will determine whether you receive a weighted average or a fixed rate. While a fixed rate offers predictability, it might not always be the lowest possible rate, and a weighted average might result in a slightly lower initial rate but could be subject to fluctuations depending on the market conditions.

Hypothetical Scenario: Interest Rate Impact on Repayment

Let’s consider a hypothetical scenario to illustrate the impact of different interest rate calculations. Suppose a student has three federal student loans:

| Loan | Balance | Interest Rate |

|---|---|---|

| Loan A | $10,000 | 4% |

| Loan B | $20,000 | 5% |

| Loan C | $5,000 | 6% |

The weighted average interest rate would be calculated as follows: ((10000 * 0.04) + (20000 * 0.05) + (5000 * 0.06)) / 35000 = 0.0486 or 4.86%. If consolidated at a fixed rate of 5%, the total interest paid over a ten-year repayment period would differ significantly. Using a standard amortization calculator (easily found online), a 4.86% interest rate on a $35,000 loan over 10 years results in approximately $6,640 in total interest. A 5% fixed rate on the same loan would result in approximately $7,100 in total interest. This difference, though seemingly small, highlights the importance of understanding the interest rate calculation and its impact on long-term repayment costs. The difference is even more pronounced over longer repayment periods.

Impact of Credit History and Income on Interest Rates

Consolidating your student loans can offer significant benefits, but the interest rate you receive isn’t solely determined by the loan amounts. Your credit history and income play a crucial role in shaping the final interest rate offered by lenders. Understanding this relationship is essential for making informed decisions about your loan consolidation strategy.

Your credit history acts as a significant indicator of your creditworthiness to lenders. A strong credit history, characterized by consistent on-time payments and low credit utilization, typically results in more favorable interest rates. Conversely, a poor credit history, marked by missed payments, defaults, or high credit utilization, often leads to higher interest rates, making loan repayment more expensive. This is because lenders perceive a higher risk of default with borrowers who have demonstrated poor financial responsibility in the past.

Credit Score and Interest Rate Relationship

Lenders use credit scores to assess risk. Borrowers with excellent credit scores (generally 750 or higher) are considered low-risk and are typically offered lower interest rates. Conversely, those with poor credit scores (below 670) face significantly higher interest rates, reflecting the increased risk of default. The interest rate difference between these two groups can be substantial, potentially adding thousands of dollars to the total cost of the loan over its lifetime. For example, a borrower with an excellent credit score might secure a consolidated loan with an interest rate of 4%, while a borrower with a poor credit score might receive an interest rate of 8% or higher.

Income Verification’s Influence on Interest Rates

Income verification is another key factor influencing interest rates. Lenders review your income to determine your ability to repay the loan. Higher income levels often translate to lower interest rates because lenders perceive less risk. The income verification process typically involves providing documentation such as pay stubs, tax returns, or employment verification letters. Lenders use this information to assess your debt-to-income ratio (DTI), a key metric indicating your ability to manage existing debt while taking on additional debt. A lower DTI generally leads to better interest rates.

Interest Rate Comparison Table

The following table illustrates the potential impact of credit score and income level on consolidated student loan interest rates. These are examples and actual rates may vary depending on the lender and other factors.

| Credit Score | Income Level | Interest Rate (Approximate) | Repayment Example (10-year loan, $30,000 principal) |

|---|---|---|---|

| 780+ (Excellent) | $80,000+ | 4.5% | Monthly payment: ~$305; Total interest paid: ~$6,600 |

| 700-779 (Good) | $60,000-$79,999 | 5.5% | Monthly payment: ~$325; Total interest paid: ~$9,600 |

| 620-699 (Fair) | $40,000-$59,999 | 7% | Monthly payment: ~$350; Total interest paid: ~$12,600 |

| Below 620 (Poor) | Below $40,000 | 9% | Monthly payment: ~$385; Total interest paid: ~$16,200 |

Repayment Plans and Their Effect on Total Interest Paid

Choosing the right repayment plan for your consolidated student loans significantly impacts the total interest you’ll pay over the life of the loan. Understanding the differences between plans is crucial for long-term financial planning and minimizing your overall debt burden. Different plans offer varying monthly payments and loan durations, directly influencing the accumulated interest.

The total interest paid on a student loan is determined by several factors, including the principal loan amount, the interest rate, and the repayment plan’s duration. Longer repayment periods generally lead to higher total interest payments, while shorter periods result in higher monthly payments but lower overall interest costs. Let’s examine how different repayment plans affect these factors.

Standard Repayment Plan

The standard repayment plan is typically a 10-year plan with fixed monthly payments. This plan offers the shortest repayment period among the standard options, resulting in the lowest total interest paid. However, the fixed monthly payments can be substantial, potentially straining your budget. For a $30,000 loan at 6% interest, the monthly payment would be approximately $330, and the total interest paid over 10 years would be around $7,800.

Extended Repayment Plan

The extended repayment plan stretches the repayment period to a maximum of 25 years. This significantly lowers the monthly payment, making it more manageable for borrowers. However, this extended repayment period comes at a cost: you’ll pay substantially more in interest over the life of the loan. Using the same $30,000 loan at 6% interest, the monthly payment would be around $165, but the total interest paid would likely exceed $16,000.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) base monthly payments on your income and family size. These plans, including plans like ICR, PAYE, REPAYE, andIBR, offer lower monthly payments, making them more affordable for borrowers with lower incomes. However, the extended repayment periods (often 20-25 years) can lead to higher total interest paid compared to standard repayment plans. The specific amount of interest will vary greatly depending on income fluctuations throughout the repayment period. For example, a borrower with a fluctuating income might see their payments adjusted several times, potentially extending the repayment term and increasing total interest paid. The benefit of an IDR plan is primarily its affordability during periods of low income, enabling borrowers to avoid default.

The following table summarizes the pros and cons of each repayment plan:

| Repayment Plan | Pros | Cons |

|---|---|---|

| Standard | Shortest repayment period, lowest total interest | High monthly payments |

| Extended | Lower monthly payments | Longest repayment period, highest total interest |

| Income-Driven | Affordable monthly payments based on income | Longest repayment period, potentially high total interest, complex calculations |

Comparing Consolidation with Refinancing

Consolidating and refinancing student loans are both strategies to simplify repayment, but they differ significantly in their processes and potential outcomes. Understanding these differences is crucial for making an informed decision that aligns with your individual financial situation. This section will explore the key distinctions between these two approaches, highlighting their benefits and drawbacks to help you determine which option best suits your needs.

Consolidation and refinancing share the goal of simplifying student loan payments, but achieve this through different mechanisms. Consolidation involves combining multiple federal student loans into a single new federal loan. Refinancing, on the other hand, replaces your existing student loans—federal or private—with a new private loan from a lender. This often results in a single monthly payment but involves a new private loan agreement, unlike the government-backed consolidation.

Processes and Outcomes of Consolidation versus Refinancing

Consolidation, typically handled through the Federal Student Aid website, is a relatively straightforward process. It involves applying online, providing necessary documentation, and waiting for approval. The outcome is a single federal loan with a weighted average interest rate based on your existing loans’ rates. Refinancing, conversely, involves applying through a private lender, often requiring a credit check and a more rigorous application process. The outcome is a new private loan with a potentially lower interest rate, depending on your creditworthiness, but with the loss of federal loan benefits.

Interest Rates and Repayment Terms

Consolidation usually results in a fixed interest rate that’s a weighted average of your existing loans’ rates. This rate may be slightly lower than the highest rate among your existing loans but rarely significantly lower. Refinancing, however, offers the potential for a substantially lower interest rate, especially for borrowers with excellent credit. Repayment terms can be adjusted in both cases, but refinancing often provides more flexibility, such as longer or shorter loan terms. The impact on total interest paid will depend on the specific interest rates and repayment terms offered. For example, a borrower with a high interest rate on their federal loans might save a considerable amount by refinancing to a lower rate, even with a longer repayment term. Conversely, a borrower with already low federal loan interest rates might not benefit significantly from refinancing and might lose important federal protections.

Situations Favoring Consolidation or Refinancing

Consolidation is preferable when you primarily have federal student loans and want to simplify repayment without significantly lowering your interest rate. This is especially true if you qualify for income-driven repayment plans available only on federal loans. Refinancing is a better option if you have a strong credit score, a mix of federal and private loans, and seek a potentially lower interest rate and more flexible repayment terms. For example, a borrower with a high credit score and several private loans with high interest rates might significantly reduce their total interest paid by refinancing. Conversely, a borrower with low credit and primarily federal loans might find consolidation a safer, if less advantageous, option.

Decision-Making Flowchart

The flowchart would visually represent the decision-making process. It would start with a question: “Do you primarily have federal student loans?”. A “yes” branch would lead to a question: “Are you eligible for and want income-driven repayment plans?”. A “yes” would lead to “Consolidate”. A “no” would lead to a comparison of current interest rates with potential refinancing rates. A “no” branch from the initial question would lead directly to a comparison of current interest rates with potential refinancing rates. This comparison would consider credit score and the potential for a lower interest rate through refinancing. A significant potential interest rate reduction would lead to “Refinance”, while a minimal or no reduction would lead to “Consider Consolidation”.

Government Programs and Subsidized Loans

Government programs significantly influence consolidated student loan interest rates, particularly through subsidized loan programs. These programs aim to make higher education more accessible by offering loans with lower interest rates or even no interest accruing while the borrower is in school. Understanding these programs and their impact is crucial for borrowers seeking to consolidate their student loans.

The availability of subsidized loans and their associated interest rates are directly tied to government funding and policy decisions. Changes in government budgets, economic conditions, and legislative actions can all affect the terms of these loans, influencing the overall interest rate on a consolidated loan that includes subsidized components. For example, a decrease in government funding for student aid might lead to reduced subsidies or higher interest rates on new subsidized loans, impacting the overall interest rate of a subsequent consolidation.

Subsidized Loan Eligibility

Eligibility for subsidized federal student loans is primarily determined by financial need. The student’s demonstrated financial need, as assessed through the Free Application for Federal Student Aid (FAFSA), is a key factor. Generally, students from lower-income families are more likely to qualify for subsidized loans. Other factors, such as enrollment status (at least half-time), and academic standing may also be considered. The exact criteria and requirements can vary slightly depending on the specific loan program and the student’s educational institution. For example, a student pursuing a graduate degree may have different eligibility requirements than an undergraduate student.

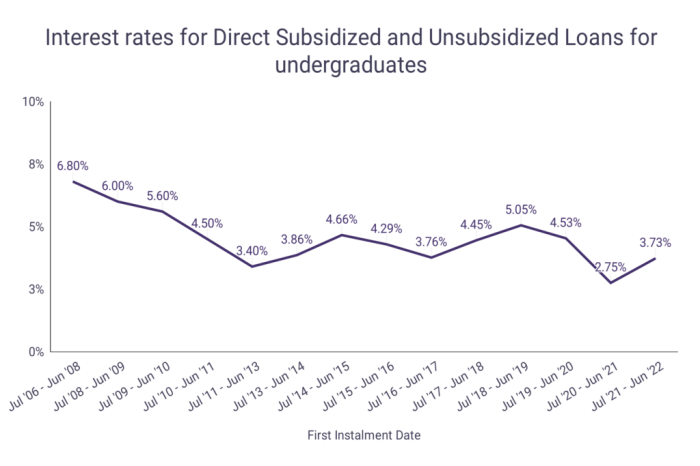

Interest Rate Benefits of Subsidized Loans

The primary benefit of subsidized loans is the absence of interest accrual while the borrower is enrolled in school at least half-time, during grace periods, and for certain deferment periods. This means the borrower does not incur additional debt during these periods, potentially leading to a smaller overall loan balance at repayment. This is a significant advantage compared to unsubsidized loans, where interest begins to accrue immediately. The interest rate itself is also generally lower for subsidized loans than for unsubsidized loans, further reducing the overall cost of borrowing. For instance, a subsidized loan might have a fixed interest rate of 4.5%, while a comparable unsubsidized loan could have a rate of 6.5%.

Impact of Government Policy Changes on Consolidated Loan Interest Rates

Changes in government policy can directly affect the interest rates of consolidated student loans, especially those including subsidized loans. For example, an increase in the interest rate on new subsidized loans will affect the weighted average interest rate of a future consolidated loan that includes those newer loans. Similarly, changes in the terms of income-driven repayment plans, which can influence the overall cost of borrowing, can indirectly impact the attractiveness of consolidation. Government decisions regarding loan forgiveness programs can also alter the overall cost-benefit analysis of consolidating loans. For example, a new loan forgiveness program may make it more appealing to consolidate and take advantage of those benefits.

Key Characteristics of Subsidized and Unsubsidized Consolidated Loans

The following table summarizes the key differences between subsidized and unsubsidized consolidated student loans:

| Characteristic | Subsidized Consolidated Loan | Unsubsidized Consolidated Loan |

|---|---|---|

| Interest Accrual During School | No interest accrues while enrolled at least half-time. | Interest accrues from the time the loan is disbursed. |

| Interest Rate | Generally lower than unsubsidized loans. | Generally higher than subsidized loans. |

| Eligibility | Based on financial need (determined through FAFSA). | Generally available to all students. |

| Government Subsidy | Receives government subsidy to cover interest during certain periods. | No government subsidy for interest. |

Last Point

Successfully navigating student loan consolidation requires a thorough understanding of interest rate calculations, repayment plans, and the impact of individual financial circumstances. By carefully considering the information presented, borrowers can make informed decisions that optimize their repayment strategy and minimize the overall cost of their debt. Remember, proactive planning and a clear understanding of your options are key to achieving financial freedom after graduation.

FAQ Guide

What happens to my loan terms after consolidation?

Consolidation combines multiple loans into one, resulting in a single monthly payment and potentially a new interest rate (weighted average of your previous rates). Your repayment term might change depending on the type of consolidation and your chosen repayment plan.

Can I consolidate private student loans?

Yes, but typically only with a private lender offering consolidation services. The terms and interest rates will vary significantly from federal consolidation options.

Will consolidating my loans improve my credit score?

Not directly. Consolidation itself doesn’t automatically boost your score. However, consistent on-time payments on your consolidated loan can positively impact your credit over time.

What is the difference between consolidation and refinancing?

Consolidation combines existing loans, while refinancing replaces existing loans with a new loan from a different lender, potentially with better terms. Refinancing usually isn’t an option for federal loans.