Navigating the complex world of student loan debt can feel overwhelming, but understanding your options is the first step towards financial freedom. This guide explores the powerful tool of a student loan consolidation calculator, helping you make informed decisions about managing your student loans. We’ll delve into the intricacies of consolidation, exploring its benefits and potential drawbacks, and demonstrating how a calculator can simplify the process of comparing repayment plans and visualizing long-term cost savings.

From understanding the various types of consolidation programs available to analyzing the impact of different repayment plans on your overall debt, this resource provides a comprehensive overview. We’ll equip you with the knowledge and tools to confidently approach student loan consolidation, empowering you to choose the best path towards a debt-free future.

Understanding Student Loan Consolidation

Student loan consolidation simplifies your repayment process by combining multiple federal or private student loans into a single loan. This can lead to several advantages, depending on your individual circumstances. It’s a powerful tool, but understanding its nuances is crucial before making a decision.

Benefits of Student Loan Consolidation

Consolidation offers several potential benefits. A simplified repayment process is a major advantage; instead of juggling multiple payments, you’ll only have one. This can improve organization and reduce the risk of missed payments. A potentially lower monthly payment is another benefit, although this often comes with a longer repayment term. A fixed interest rate can also be advantageous, especially if you have loans with variable rates. Finally, it can streamline communication; you only need to deal with one lender. However, it’s important to note that these benefits are not guaranteed and depend on individual loan circumstances and the type of consolidation chosen.

Types of Student Loan Consolidation Programs

There are two primary types of student loan consolidation: federal and private. Federal consolidation programs are offered by the U.S. Department of Education and consolidate federal student loans. Private consolidation loans, on the other hand, are offered by private lenders and can consolidate both federal and private loans. Each option has its own eligibility requirements, interest rates, and repayment terms. Choosing the right option depends heavily on your specific financial situation and the types of loans you possess.

Applying for Student Loan Consolidation

Applying for student loan consolidation generally involves a straightforward process. First, you’ll need to gather all relevant information about your existing loans, including loan numbers, balances, and interest rates. Next, you’ll need to choose a consolidation program (federal or private). For federal consolidation, you’ll apply directly through the Federal Student Aid website. For private consolidation, you’ll apply through a private lender. The application process usually involves completing an application form and providing necessary documentation. After approval, your loans will be consolidated, and you’ll receive information about your new loan terms.

Situations Where Consolidation is Beneficial and When it is Not

Consolidation is beneficial in situations where managing multiple loans is challenging, where a lower monthly payment is desired (even if it extends the repayment period), or where a fixed interest rate is preferable to variable rates. However, it may not be beneficial if you have federal loans with low interest rates, as consolidation might result in a higher overall interest paid due to a longer repayment period. It’s also less advantageous if you qualify for income-driven repayment plans that offer lower payments based on your income. Careful consideration of your individual circumstances is vital.

Comparison of Federal and Private Loan Consolidation Options

| Feature | Federal Consolidation | Private Consolidation |

|---|---|---|

| Loan Types Consolidated | Federal student loans only | Federal and/or private student loans |

| Interest Rate | Weighted average of your existing loans (fixed) | Variable or fixed, determined by the lender (potentially higher) |

| Fees | Generally no fees | May involve origination fees or other charges |

| Repayment Plans | Various repayment plans available, including income-driven plans | Typically fewer repayment options |

Using a Student Loan Consolidation Calculator

Student loan consolidation calculators are invaluable tools for simplifying the complex process of managing multiple student loans. They provide a clear and concise overview of potential savings, repayment timelines, and overall financial implications of consolidating your loans. By inputting your current loan details, you can explore various scenarios and make informed decisions about your financial future.

A typical student loan consolidation calculator will request several key pieces of information. This usually includes the principal balance, interest rate, and repayment term for each individual loan. Some calculators may also ask for additional details, such as the loan type (federal or private), any existing deferments or forbearances, and your desired repayment term after consolidation. The more accurate and complete your input, the more reliable the results will be.

Inputting Loan Details and Resulting Calculations

The way you input your loan details directly influences the calculator’s output. For instance, inputting a higher interest rate for one of your loans will result in a higher overall consolidated interest rate and, consequently, a larger total repayment amount. Similarly, longer repayment terms will reduce your monthly payments but increase the total interest paid over the life of the loan. Conversely, shorter repayment terms will increase your monthly payment but reduce the total interest paid. The calculator dynamically adjusts the projected outcomes based on the data provided, allowing you to see the immediate impact of different loan characteristics.

Comparing Repayment Plans

Many calculators allow you to compare different repayment plans. This feature is crucial for understanding the trade-offs between monthly payments and total interest paid. For example, you can input the same loan details and compare the results of a standard 10-year repayment plan versus a 20-year repayment plan. The calculator will clearly show the difference in monthly payments and the total interest paid over each repayment period, enabling a side-by-side comparison. This allows for a thorough analysis of which repayment plan best aligns with your financial capabilities and long-term goals.

Hypothetical Scenario and Calculator Application

Let’s imagine Sarah has three student loans: Loan A ($20,000, 5% interest, 10-year term), Loan B ($15,000, 6% interest, 7-year term), and Loan C ($10,000, 4% interest, 5-year term). Using a consolidation calculator, she can input these details. The calculator would then calculate a potential consolidated loan amount, interest rate, and monthly payment based on her chosen repayment term (e.g., 10, 15, or 20 years). She could then compare the total interest paid under different scenarios to determine the most cost-effective option. She might find that consolidating into a 15-year plan offers a balance between manageable monthly payments and minimizing overall interest.

Factors Influencing Calculator Accuracy

Several factors influence the accuracy of a consolidation calculator’s results. The most significant factor is the accuracy of the input data. Incorrectly entered loan amounts, interest rates, or repayment terms will lead to inaccurate projections. Additionally, the calculator’s underlying assumptions about interest rate calculations and potential fees associated with consolidation also play a role. Finally, the calculator might not account for unforeseen circumstances, such as changes in interest rates or unexpected financial emergencies that could affect repayment. It’s important to remember that these calculators provide estimates, not guarantees, of future financial outcomes.

Repayment Plans and Their Impact

Consolidating your student loans can simplify your finances, but the choice of repayment plan significantly impacts your overall cost and repayment timeline. Understanding the various options and their implications is crucial for making an informed decision. This section will explore the key differences between common repayment plans and help you determine which best suits your financial situation.

Choosing the right repayment plan after student loan consolidation involves carefully considering your income, the total loan amount, and the interest rate. These factors interact to determine your monthly payment, the total interest you’ll pay over the life of the loan, and the length of your repayment period. Failing to consider these elements can lead to unexpected financial burdens.

Standard Repayment Plan

The standard repayment plan is a fixed monthly payment plan spread over 10 years. This plan offers predictable payments, but it often results in higher monthly payments compared to extended repayment options. The benefit is a shorter repayment period, leading to less interest paid overall. For example, a $30,000 loan at 7% interest would have a monthly payment of approximately $350 under a standard plan, resulting in a total interest paid of around $11,000.

Extended Repayment Plan

Extended repayment plans stretch your payments over a longer period, typically 25 years. This significantly lowers your monthly payment, making it more manageable for borrowers with lower incomes. However, extending the repayment period leads to substantially higher total interest paid over the life of the loan. Using the same $30,000 loan example at 7% interest, a 25-year extended plan would result in a monthly payment of roughly $190, but the total interest paid would increase to approximately $27,000 – more than double the standard plan.

Graduated Repayment Plan

A graduated repayment plan starts with lower monthly payments that gradually increase over time. This option can be beneficial for borrowers who anticipate higher income in the future. While the initial payments are easier to manage, the increasing payments can become challenging if income doesn’t rise as expected. The total interest paid will likely be higher than a standard plan but lower than an extended plan, depending on the rate of payment increase and the overall repayment period.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) base your monthly payment on your income and family size. These plans are designed to make repayment more affordable, especially for borrowers with lower incomes. Several types of IDR plans exist, each with its own formula for calculating payments. While monthly payments are lower, IDR plans often extend the repayment period to 20 or 25 years, leading to higher total interest paid. Furthermore, remaining balances after the repayment period might be forgiven after a specific timeframe, though this forgiveness may be considered taxable income.

Comparison of Repayment Plans: Pros and Cons

Understanding the trade-offs between shorter repayment periods and lower monthly payments is key to choosing the right plan.

- Standard Repayment Plan:

- Pros: Shorter repayment period, lower total interest paid.

- Cons: Higher monthly payments.

- Extended Repayment Plan:

- Pros: Lower monthly payments.

- Cons: Much longer repayment period, significantly higher total interest paid.

- Graduated Repayment Plan:

- Pros: Lower initial payments.

- Cons: Payments increase over time, potentially becoming unaffordable; higher total interest paid than standard plan.

- Income-Driven Repayment Plan:

- Pros: Payments based on income, potentially lower monthly payments.

- Cons: Longer repayment period, high total interest paid; potential tax implications on forgiven balance.

Potential Risks and Considerations

Consolidating your student loans can seem appealing, offering the promise of simplified repayment. However, it’s crucial to carefully weigh the potential drawbacks before making a decision. Understanding the risks involved will help you make an informed choice that aligns with your financial goals.

While consolidation simplifies your repayment process by combining multiple loans into one, it’s not without potential downsides. These risks should be carefully considered before proceeding.

Loss of Federal Loan Benefits

Consolidating federal student loans into a private loan can result in the loss of crucial benefits associated with federal loan programs. These benefits often include income-driven repayment plans, loan forgiveness programs (such as Public Service Loan Forgiveness), and deferment or forbearance options in times of financial hardship. For example, a borrower enrolled in an income-driven repayment plan with a low monthly payment might find their payment significantly increases after consolidating their federal loans into a private loan which doesn’t offer the same benefits. The potential loss of these benefits can significantly impact the long-term cost of your loan and your ability to manage repayment.

Impact of Credit Score on Consolidation Approval

Your credit score plays a significant role in the approval process for private loan consolidation. Lenders assess your creditworthiness to determine the interest rate and terms they’ll offer. A lower credit score can lead to a higher interest rate, ultimately increasing the total cost of your loan over time. For instance, a borrower with a poor credit history might be offered an interest rate several percentage points higher than a borrower with excellent credit, leading to thousands of dollars in additional interest charges over the life of the loan. It is vital to check your credit report before applying for consolidation to understand your creditworthiness and to address any inaccuracies.

Importance of Understanding Terms and Conditions

Before consolidating your loans, meticulously review the terms and conditions of the new loan. Pay close attention to the interest rate, repayment period, fees, and any prepayment penalties. A seemingly attractive low initial interest rate might be offset by a longer repayment term, leading to a higher total interest paid. Hidden fees or prepayment penalties can also unexpectedly increase the overall cost. Comparing offers from multiple lenders is crucial to ensure you’re getting the best possible terms. Understanding the fine print prevents unpleasant surprises down the line.

Decision-Making Flowchart

The decision-making process for student loan consolidation can be visualized using a flowchart.

[Imagine a flowchart here. The flowchart would start with a decision box: “Consider Consolidating Student Loans?”. If “No,” the flow ends. If “Yes,” it proceeds to a box asking: “Are all loans Federal?”. If “Yes,” it branches to a box asking: “Will I lose beneficial federal programs?”. If “Yes,” it branches to “Do not consolidate”. If “No,” it branches to “Consolidate Federal Loans”. If the initial “Are all loans Federal?” box answers “No,” it proceeds to a box asking: “Is my credit score good enough?”. If “No,” it branches to “Improve Credit Score then Reconsider”. If “Yes,” it branches to a box asking: “Have I compared multiple lenders?”. If “No,” it branches to “Compare lenders and review terms”. If “Yes,” it branches to “Consolidate Private/Mixed Loans”. All “Consolidate” branches lead to a final box: “Monitor repayment and budget accordingly.”]

Illustrative Examples

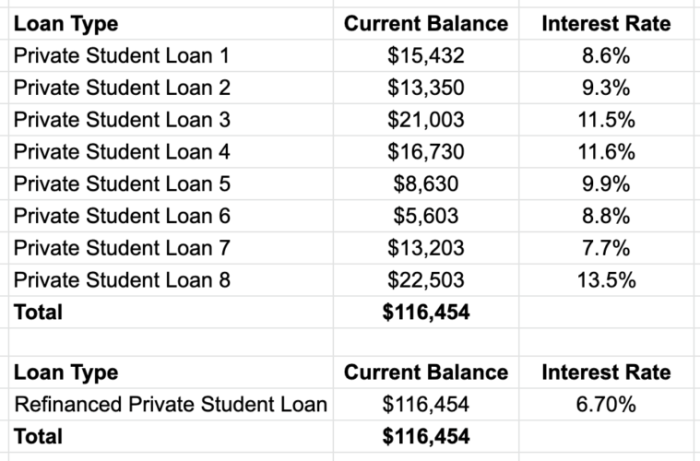

Understanding the benefits and drawbacks of student loan consolidation requires examining real-world scenarios. The following examples illustrate how consolidation can be advantageous in some situations and less so in others. They also demonstrate the utility of a consolidation calculator in visualizing long-term financial implications.

Consolidation Benefits: A Case Study

Imagine Sarah, a recent graduate with three federal student loans: a subsidized loan of $15,000 at 4.5% interest, an unsubsidized loan of $10,000 at 6%, and a graduate PLUS loan of $20,000 at 7%. Managing three separate loans with varying interest rates and repayment schedules is complex. Consolidating these loans into a single federal Direct Consolidation Loan could simplify her repayment process. Assuming she consolidates at a weighted average interest rate of 5.5%, she’ll have one monthly payment to manage instead of three, potentially reducing administrative burden and improving her financial organization. Furthermore, if she qualifies, she might be able to choose a longer repayment term, resulting in lower monthly payments (though this will ultimately increase the total interest paid over the life of the loan). A consolidation calculator would help her compare these different scenarios and their overall costs.

Consolidation Drawbacks: A Scenario

Consider David, who has a small, low-interest federal loan nearing its end and a larger, high-interest private loan with several years remaining. Consolidating these loans might seem appealing, but it could be detrimental. Consolidating would likely result in a higher overall interest rate, negating the benefits of the low-interest federal loan. The weighted average interest rate could be significantly higher than the low rate on the existing loan, increasing his total interest paid over time. A consolidation calculator would show David that, in his specific case, keeping the loans separate might be the more financially prudent option.

Calculator Visualization: Long-Term Cost Savings

A student loan consolidation calculator allows borrowers to input their existing loan details, including principal balances and interest rates. The calculator then projects different repayment scenarios based on varying consolidation options and interest rates. For example, a borrower might input their current loans and see that consolidating into a 10-year plan results in a monthly payment of $500, with a total interest paid of $10,000. In contrast, a 15-year plan might show a monthly payment of $350 but a total interest paid of $15,000. This visual comparison allows the borrower to weigh the trade-off between lower monthly payments and increased total interest. The calculator helps them make an informed decision based on their financial priorities and long-term goals.

Successful Consolidation: A Before-and-After Analysis

Let’s examine a simplified before-and-after scenario. Suppose a borrower has two loans: $10,000 at 5% interest and $15,000 at 7% interest. Before consolidation, their monthly payments (assuming a standard 10-year repayment plan) would be approximately $106 and $163 respectively, totaling $269 per month. After consolidation at a weighted average interest rate of 6%, their monthly payment on a 10-year plan would be approximately $225. While the total interest paid will still likely be less than the combined total interest from the two separate loans, the immediate benefit is a reduction in the monthly payment of approximately $44. This provides the borrower with increased financial flexibility, even though the overall cost may still increase compared to paying off the lower interest loan first. A calculator would provide precise figures based on the specific loan terms and consolidation rate.

Conclusive Thoughts

Ultimately, a student loan consolidation calculator serves as an invaluable tool in the journey towards managing student loan debt effectively. By understanding the nuances of consolidation, utilizing a calculator to explore different scenarios, and carefully considering the potential risks and benefits, you can make informed decisions that align with your financial goals. Remember to thoroughly research and compare your options before making any decisions about consolidating your student loans.

Answers to Common Questions

What happens to my interest rate after consolidation?

Your new interest rate after consolidation will be a weighted average of your previous loan interest rates. It might be higher or lower depending on your individual loan portfolio.

Can I consolidate private and federal student loans together?

While some private lenders offer consolidation options, you generally cannot consolidate federal and private loans into a single federal loan. You may be able to consolidate private loans separately.

How accurate are online student loan calculators?

Online calculators provide estimates based on the information you input. Accuracy depends on the completeness and correctness of your data. They are useful for comparison but shouldn’t be considered definitive financial advice.

What if I don’t qualify for student loan consolidation?

Factors like credit score and loan history influence eligibility. If you don’t qualify, explore alternative repayment options such as income-driven repayment plans offered by your lender.