Navigating the complexities of student loan repayment can feel overwhelming, especially when trying to locate the right contact information. This guide simplifies the process of finding contact details for your student loan servicer, whether it’s a federal or private lender. We’ll explore various methods, from utilizing online resources to employing effective direct communication strategies, ensuring you have the tools to manage your loans effectively.

Understanding your rights as a borrower is equally crucial. We’ll Artikel the steps to take if you encounter difficulties contacting your lender and provide resources to help you navigate potential challenges. This comprehensive guide aims to empower you with the knowledge and resources to confidently manage your student loan journey.

Understanding Student Loan Contact Information

Finding the right contact information for your student loans is crucial for managing your debt effectively. Whether you’re seeking repayment options, addressing billing issues, or simply needing clarification on your loan terms, having the correct contact details readily available is essential. This section will guide you through the process of locating the necessary information for both federal and private student loans.

Common Sources of Student Loan Contact Information

Locating the contact information for your student loans can be achieved through several avenues. The following table provides examples of common sources, although specific details may vary depending on your lender. It’s always best to check your loan documents for the most up-to-date information.

| Lender Name | Contact Phone Number | Website URL | Email Address |

|---|---|---|---|

| Sallie Mae | (Example: 800-SAL-MAIE) | (Example: www.salliemae.com) | (Example: [email protected]) |

| Navient | (Example: 800-NAVIENT) | (Example: www.navient.com) | (Example: [email protected]) |

| Nelnet | (Example: 800-311-4096) | (Example: www.nelnet.com) | (Example: [email protected]) |

| Federal Student Aid (FSA) | (Example: 1-800-4-FED-AID) | (Example: studentaid.gov) | (Example: Contact information varies depending on the specific service needed and is readily available on the website.) |

Locating Contact Information for Federal Student Loans

Federal student loans are managed by the U.S. Department of Education’s Federal Student Aid (FSA) office. The FSA website, studentaid.gov, is the primary resource for locating contact information and accessing your loan details. You can access your account online using your FSA ID, which allows you to view your loan servicer, contact information, and account details. If you’re unable to find your servicer’s information online, the FSA website provides multiple contact options, including phone numbers and email addresses for assistance.

Locating Contact Information for Private Student Loans

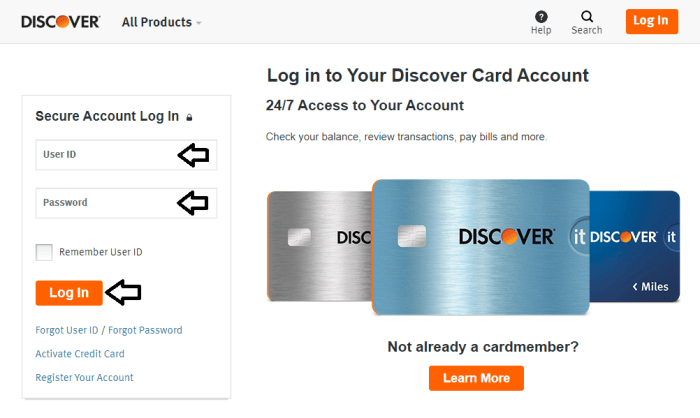

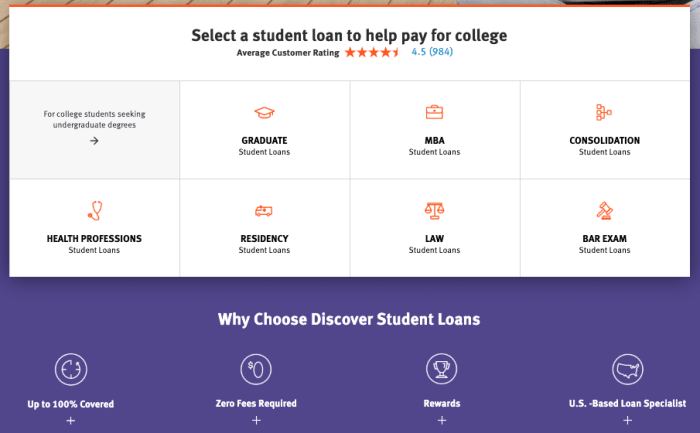

Finding contact information for private student loans depends heavily on the specific lender. Unlike federal loans, there’s no central repository for private loan information. The process typically involves checking your loan documents, which should clearly state the lender’s name, contact number, website address, and any available email addresses. If you’ve misplaced your loan documents, you can often find the lender’s information by searching online using the loan name or account number. Some private lenders offer online account access portals, similar to the FSA website, which provide a convenient way to view and manage your loan details and contact information. Contacting the lender directly through their website or phone is often the most effective method. The process may vary slightly depending on the lender; some may have dedicated customer service lines, while others may route inquiries through general contact channels.

Navigating Student Loan Servicing Companies

Understanding your student loan servicer is crucial for managing your debt effectively. Your servicer is the company responsible for processing your payments, answering your questions, and helping you navigate repayment options. Knowing how to find and contact them is a vital first step in responsible student loan management.

Identifying Your Student Loan Servicer

Locating your student loan servicer is usually straightforward. Several methods are available, depending on the information you have readily accessible. First, check your most recent student loan statement. Your servicer’s name and contact information will be clearly displayed. If you don’t have a recent statement, you can access your account information online through the National Student Loan Data System (NSLDS). This website, maintained by the U.S. Department of Education, provides a centralized view of your federal student loans and identifies the servicer for each loan. Alternatively, you can contact your school’s financial aid office; they often have records indicating your loan servicer.

Common Student Loan Servicing Companies and Contact Methods

Several companies manage student loans in the United States. Examples include Navient, Nelnet, Great Lakes, FedLoan Servicing (now operating under the Department of Education), and others. Each company offers various contact methods, such as phone numbers, email addresses, and secure online portals. Contact information is readily available on their respective websites. It’s important to note that servicers can change, so regularly checking your loan statements or the NSLDS is advisable. For instance, a borrower might find their loans serviced by Navient one year and then transferred to Nelnet the following year.

Contacting Your Servicer for Specific Issues

The process for contacting your servicer will vary slightly depending on the issue. However, a general approach can be followed. The following flowchart illustrates this process:

A simple flowchart depicting the process:

1. Identify your servicer: (Refer to methods in “Identifying Your Student Loan Servicer”)

2. Determine your issue: (Payment, deferment, forbearance, etc.)

3. Locate appropriate contact method: (Phone, online portal, email; refer to your servicer’s website)

4. Contact your servicer: (Provide necessary information, such as your loan ID and social security number)

5. Follow up if necessary: (If you don’t receive a response within a reasonable timeframe)

Utilizing Online Resources for Contact Information

Finding the correct contact information for your student loan servicer can sometimes feel like searching for a needle in a haystack. While calling your servicer directly is always an option, leveraging online resources can be a helpful first step in your search, offering convenience and potentially saving you time. However, it’s crucial to approach these online searches with caution, as not all information found online is accurate or safe.

The internet provides a wealth of potential avenues for locating student loan contact details. Search engines like Google, Bing, or DuckDuckGo can be used to find contact information, but their effectiveness depends heavily on the accuracy and currency of the information indexed. While a quick search might yield results, verifying the information from multiple reliable sources is essential to ensure accuracy. Using online resources offers speed and convenience; however, it’s critical to evaluate the reliability of the sources.

Reliable Online Resources for Student Loan Contact Information

Several trustworthy online resources can assist in verifying student loan contact information. The official websites of your loan servicer, the Federal Student Aid website (studentaid.gov), and the National Student Loan Data System (NSLDS) are excellent starting points. These official sources provide direct links to contact information, ensuring accuracy and authenticity. For example, the Federal Student Aid website has a comprehensive search function that allows you to locate your servicer based on your loan details. This eliminates the risk of contacting the wrong entity or falling prey to fraudulent websites.

Potential Pitfalls of Using Online Search Engines

It’s crucial to be aware of potential issues when using online search engines for student loan contact information. The internet contains a vast amount of information, and not all of it is accurate or trustworthy.

- Outdated Information: Search results might lead to outdated contact details, leading to wasted time and frustration. For instance, a servicer might have changed its name or contact information, and older search results might not reflect these changes.

- Misleading Websites: Fraudulent websites mimicking legitimate servicers exist, attempting to gather personal information for malicious purposes. These sites often appear legitimate but are designed to steal sensitive data, including your loan information and financial details. Always verify the URL and look for security indicators (like HTTPS) before submitting any personal information.

- Inaccurate Contact Information: Even well-intentioned websites might contain inaccurate contact information due to errors or outdated data. This could lead to you contacting the wrong department or individual, delaying the resolution of your query.

- Third-Party Websites with Unverified Information: Many third-party websites offer student loan information; however, the accuracy and security of this information are not always guaranteed. Always exercise caution and prioritize official sources.

Direct Communication Strategies with Lenders

Effective communication with your student loan lender is crucial for managing your loans successfully. Understanding the best methods for contacting them, and knowing what information to provide, can streamline the process and prevent misunderstandings. This section Artikels effective strategies for contacting your lender via phone, email, and mail, and details the information you should gather beforehand.

Knowing how to effectively communicate with your student loan lender is essential for managing your loans efficiently. Clear and concise communication helps ensure that your requests are understood and processed promptly. Preparing necessary information before making contact saves time and avoids potential delays.

Contacting Lenders via Phone

When calling your lender, having your student loan account number readily available is essential. This number allows the representative to quickly access your account information and address your inquiry efficiently. Additionally, prepare a concise summary of your question or concern. This helps you articulate your needs clearly and prevents unnecessary back-and-forth during the call. Note the date and time of the call, the representative’s name, and any key information discussed or agreed upon. This record can be invaluable if you need to follow up later.

Contacting Lenders via Email

Email is a convenient method for contacting lenders, especially for non-urgent matters. Before composing your email, gather all relevant account information, such as your name, account number, and the specific information you need. A well-structured email will improve the chances of a timely response. For example, a subject line clearly stating your request (e.g., “Inquiry Regarding Loan Deferment”) helps the lender prioritize your email.

Writing a Professional Email

A professional email should include a clear subject line, a polite and concise introduction, a detailed description of your request, and a closing statement expressing gratitude for their assistance. For example:

Subject: Inquiry Regarding Loan Deferment – Account # [Your Account Number]

Dear [Lender Representative Name or “To Whom It May Concern”],

I am writing to inquire about the possibility of deferring my student loan payments due to [briefly explain your reason, e.g., unforeseen job loss]. My account number is [Your Account Number]. Could you please provide information regarding the deferment process, including the required documentation and application deadlines?

Thank you for your time and assistance.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

This example demonstrates a professional and effective way to request specific information. Remember to always maintain a respectful and courteous tone in your communication.

Contacting Lenders via Mail

Sending a letter via mail is appropriate for formal requests or when you need a documented record of your communication. Include your account number, a clear statement of your request, and any supporting documentation. Sending your letter via certified mail with return receipt requested provides proof of delivery and can be helpful in case of any disputes. Remember to keep a copy of the letter and any enclosures for your records.

Understanding Your Rights as a Borrower

Navigating the student loan system can be complex, but understanding your rights as a borrower is crucial for managing your debt effectively. Knowing what information you’re entitled to and how to effectively communicate with your lender can significantly reduce stress and prevent potential problems. This section Artikels your key rights and provides guidance on resolving communication difficulties.

Borrowers possess significant rights regarding access to their loan information and communication with their lenders. Federal law grants you the right to receive clear, concise, and accurate information about your loans, including your loan balance, interest rate, repayment schedule, and servicer contact information. You also have the right to easily contact your loan servicer through various channels, such as phone, mail, and online portals. This access is vital for tracking your loan progress, understanding your repayment options, and addressing any issues promptly.

Accessing Student Loan Information

You have the right to obtain a detailed statement of your loan account at any time. This statement should include your loan balance, payment history, interest accrued, and any fees charged. You can typically access this information online through your loan servicer’s website, which often provides a secure portal for managing your account. Alternatively, you can contact your servicer directly to request a statement via mail or phone. If you encounter difficulties accessing your information, contacting the Federal Student Aid (FSA) website can provide guidance and further resources. The FSA website acts as a central hub for information regarding all federal student loans.

Resources for Communication Difficulties

Experiencing challenges in communicating with your student loan servicer is unfortunately not uncommon. However, several resources are available to assist borrowers in resolving these issues. The Federal Student Aid (FSA) website offers a wealth of information and contact details for various loan servicers. Additionally, many consumer protection agencies, such as the Consumer Financial Protection Bureau (CFPB), provide resources and assistance for navigating disputes with lenders. These agencies can offer guidance on effective communication strategies and help resolve conflicts fairly. They also provide avenues for filing complaints if necessary.

Steps to Take When Unable to Reach Your Lender

If you’ve made multiple attempts to contact your loan servicer without success, several steps can be taken. First, meticulously document all your attempts, including dates, times, methods of contact (phone calls, emails, letters), and the outcomes of those attempts. This documentation is crucial if you need to escalate the issue. Next, try contacting your lender through alternative channels. If you’ve only tried calling, try emailing or sending a letter. If you’ve only used online methods, try calling. Finally, if all other attempts fail, consider contacting the Federal Student Aid (FSA) or a consumer protection agency for assistance in resolving the communication breakdown. They can intervene and help facilitate communication between you and your lender. Remember, persistence is key, and seeking external assistance is a legitimate option when facing persistent communication barriers.

Illustrative Examples of Contacting Student Loan Lenders

Understanding how to effectively contact your student loan lender is crucial for managing your debt responsibly. This section provides practical examples to guide you through various communication methods. Effective communication ensures your concerns are addressed promptly and efficiently.

Scenario: Addressing a Payment Issue

Imagine Sarah, a student loan borrower, experiences an unexpected job loss and is unable to make her scheduled payment. To resolve this, she should first gather all relevant information: her loan account number, the amount due, the reason for the missed payment (job loss, with supporting documentation if possible), and any potential solutions she’s considering (deferment, forbearance, or repayment plan adjustment). She should then attempt to contact her lender through their preferred method (phone, email, or online portal), clearly explaining her situation and requesting assistance. Providing supporting documentation, such as a layoff notice, strengthens her case and demonstrates her commitment to resolving the issue. Following up on her initial contact within a reasonable timeframe is also vital to ensure her request is processed.

Example of Successful Email Communication

Subject: Payment Issue – Account [Account Number] – Sarah Miller

Dear [Lender Name],

I am writing to inform you of a temporary hardship impacting my ability to make my scheduled student loan payment. Due to an unexpected job loss on [Date], I am currently facing financial difficulties. I have attached a copy of my layoff notice for your review.

I would appreciate it if you could explore options such as a temporary deferment or forbearance to alleviate the immediate payment pressure. I am committed to repaying my loan in full and would like to discuss a suitable repayment plan once my employment situation stabilizes. Please contact me at [Phone Number] or [Email Address] to discuss this further.

Thank you for your understanding and assistance.

Sincerely,

Sarah Miller

Response from Lender:

Subject: Re: Payment Issue – Account [Account Number] – Sarah Miller

Dear Sarah Miller,

Thank you for contacting us regarding your payment. We have received your email and the attached documentation. We understand that unexpected circumstances can impact your ability to make payments.

We are happy to explore options for temporary assistance. We can initiate a forbearance on your account for [Duration]. This will temporarily suspend your payments, but interest may still accrue. We will send you a formal confirmation shortly. Please do not hesitate to contact us if you have any questions.

Sincerely,

[Lender Name]

Example of a Successful Phone Conversation

The conversation begins with Sarah identifying herself and stating the purpose of her call: “Hello, my name is Sarah Miller, and my account number is [Account Number]. I’m calling because I’ve experienced a job loss and am unable to make my current payment.” The lender then verifies her identity and asks for details about her situation, including the date of job loss and the reason for the call. Sarah explains her situation and provides the necessary information. The lender listens attentively, asks clarifying questions, and explains the available options (deferment, forbearance, etc.). They then discuss the best course of action and agree on a plan, with the lender confirming the next steps and providing Sarah with a reference number for future communication. The conversation ends with both parties confirming their understanding and the agreed-upon solution. Sarah receives confirmation of the agreed-upon actions via email or mail.

Closing Notes

Successfully contacting your student loan servicer is key to responsible loan management. By utilizing the strategies and resources Artikeld in this guide, you can effectively communicate your needs, resolve issues, and maintain a clear understanding of your repayment plan. Remember to always keep accurate records of your communications and utilize available resources to protect your rights as a borrower. Proactive communication can significantly reduce stress and ensure a smoother repayment experience.

User Queries

What if I can’t find my student loan servicer’s contact information online?

Contact the National Student Loan Data System (NSLDS) or your school’s financial aid office. They can provide information about your servicer.

How long should I wait for a response from my lender?

Allow a reasonable timeframe, typically a few business days for email responses and a shorter time for phone calls. If you don’t hear back, follow up with another method of contact.

What information should I have ready when contacting my lender?

Have your loan details (loan ID, account number), the reason for your contact, and any relevant documentation (payment history, etc.) readily available.

Can I negotiate my student loan payment plan?

Yes, many lenders offer options like income-driven repayment plans or deferment. Contact your servicer to discuss your options and eligibility.