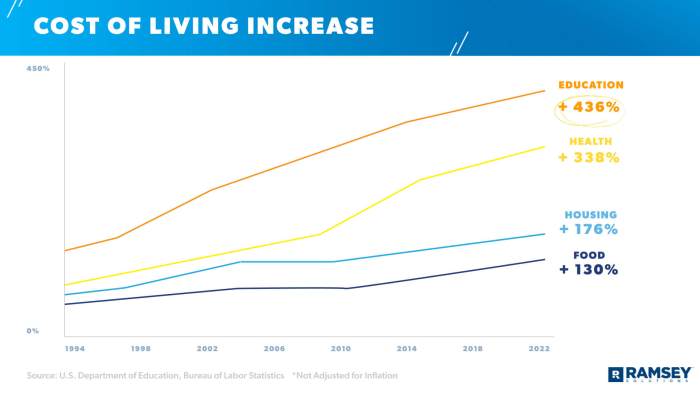

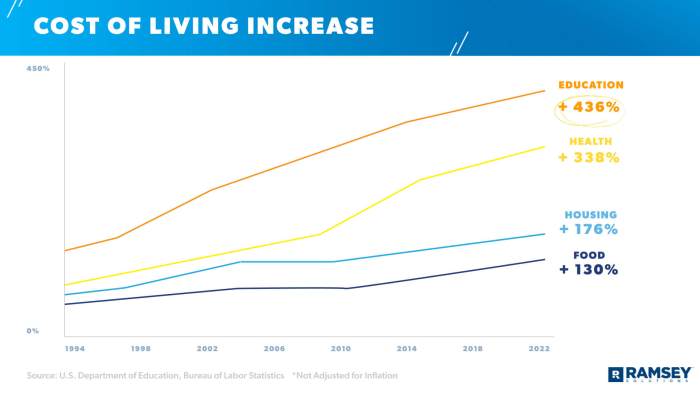

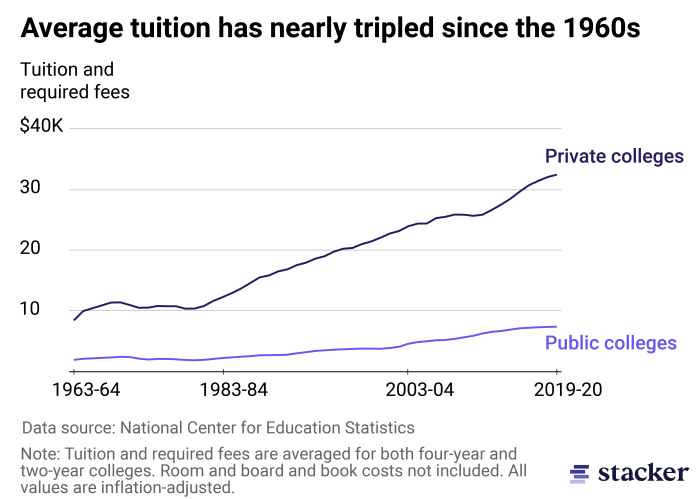

Navigating the complexities of higher education often involves more than just tuition fees; the cost of living presents a significant hurdle for many students. Securing adequate funding for everyday expenses like rent, groceries, and transportation can be challenging, but cost of living loans offer a potential solution. This guide explores the various types of these loans, the application process, financial implications, and viable alternatives, empowering students to make informed decisions about their financial well-being.

Understanding the nuances of cost of living loans is crucial for students to avoid potential pitfalls and make responsible borrowing choices. From comparing interest rates and repayment terms to exploring alternative funding sources, this guide provides a comprehensive overview to help students manage their finances effectively throughout their academic journey. The information presented here aims to demystify the process and equip students with the knowledge they need to navigate this important aspect of their education.

Types of Cost of Living Loans for Students

Securing funding for living expenses while studying can be a significant challenge for many students. Understanding the different types of loans available and their associated terms is crucial for making informed financial decisions. This section Artikels various cost of living loan options, comparing their interest rates, repayment terms, and eligibility criteria.

Types of Student Cost of Living Loans and Their Characteristics

Several loan types can help students cover living expenses during their studies. These often differ based on the lender, the student’s circumstances, and the specific purpose of the loan. While the exact options and their details vary geographically, some common categories include federal student loans, private student loans, and potentially grants or scholarships (though these are not technically loans).

Loan Type Comparison Table

The following table provides a general comparison. It’s crucial to remember that specific interest rates, repayment terms, and eligibility criteria will vary greatly depending on the lender and the individual applicant’s financial profile. Always check directly with the lender for the most up-to-date and accurate information.

| Loan Type | Interest Rate | Repayment Terms | Eligibility Criteria |

|---|---|---|---|

| Federal Student Loans (e.g., unsubsidized Stafford Loans) | Variable; typically lower than private loans. Rates are set by the government. | Typically begin 6 months after graduation or leaving school. Various repayment plans are available (standard, graduated, extended). | US citizenship or eligible non-citizen status; enrollment in an eligible educational program; completion of the Free Application for Federal Student Aid (FAFSA). Credit history is not typically a factor. |

| Private Student Loans | Variable; generally higher than federal loans. Rates depend on creditworthiness, co-signer availability, and the loan amount. | Repayment typically begins within months of loan disbursement. Terms vary based on the lender. | Generally requires a credit check; a good or excellent credit score often improves interest rates. A co-signer with good credit may be necessary if the student lacks sufficient credit history. Income verification is usually required. |

| Parent PLUS Loans (Federal) | Variable; rates are set by the government. | Repayment typically begins within 60 days of the loan’s disbursement. | Parent of a dependent student; US citizenship or eligible non-citizen status; completion of the FAFSA; credit check; meeting certain credit history requirements (can be stricter than student loan requirements). |

Important Considerations Regarding Loan Eligibility

Eligibility for various student loans hinges on several factors. Federal loans often prioritize need and enrollment status, while private loans place greater emphasis on creditworthiness and income. Income verification processes can involve submitting tax returns, pay stubs, or bank statements. Credit score requirements for private loans vary by lender but generally favor applicants with higher scores, potentially leading to more favorable interest rates. The availability of a co-signer can significantly impact eligibility and interest rates for those with limited credit history. It is essential to thoroughly research all loan options and compare them before committing to a loan.

Accessing and Applying for Cost of Living Loans

Securing funding for living expenses while studying can significantly ease the financial burden on students. Understanding the application process for various cost of living loans is crucial for a successful application. This section Artikels the steps involved and highlights common pitfalls to avoid.

The application process generally involves completing an online form, providing supporting documentation, and undergoing a credit check (depending on the loan type). Specific requirements vary depending on the lender and the type of loan. For example, government-backed loans often have simpler application processes than private loans, which typically require more extensive financial information.

Government-Backed Loan Application Process

Government-backed student loans, often managed through a dedicated government agency or student aid office, typically have a straightforward application process. Students usually begin by creating an online account on the relevant government website. This involves providing personal details, academic information (proof of enrollment), and sometimes financial information to assess need. The required documentation might include proof of identity, acceptance letter from the educational institution, and possibly tax returns or bank statements to verify income. Once the application is submitted, it is processed, and the student is notified of the approval or rejection, along with the disbursement details. Applicants should carefully review the terms and conditions before accepting the loan.

Private Loan Application Process

Private lenders offer cost of living loans with varying terms and conditions. The application process for private loans often involves a more extensive review of the applicant’s financial profile. Students will typically need to fill out a comprehensive application form, providing detailed financial information, including credit history, income, and existing debts. Documentation required may include proof of identity, proof of enrollment, tax returns, bank statements, and potentially a co-signer’s financial information. The lender will then conduct a credit check and assess the applicant’s creditworthiness. Approval and disbursement timelines vary depending on the lender’s policies and the complexity of the application.

Common Application Mistakes and How to Avoid Them

Careful preparation is key to a successful loan application. Overlooking crucial details or submitting incomplete applications can lead to delays or rejection.

- Incomplete Application Forms: Double-check all sections of the application form for accuracy and completeness before submission. Missing information can significantly delay the process.

- Inaccurate Information: Providing false or misleading information is a serious offense and can result in loan rejection or even legal consequences. Ensure all information provided is accurate and truthful.

- Late Submission: Adhere to application deadlines. Late submissions might not be considered, leading to missed opportunities for funding.

- Ignoring Terms and Conditions: Carefully read and understand the loan terms and conditions before signing any agreements. This includes interest rates, repayment schedules, and any associated fees.

- Poor Financial Planning: Budgeting effectively and understanding your repayment capabilities is crucial. Avoid borrowing more than you can comfortably repay.

Financial Implications and Responsibilities

Taking out a cost of living loan can significantly impact your financial future. Understanding the long-term implications, including interest accrual and repayment schedules, is crucial for responsible financial management during and after your studies. Failing to plan effectively can lead to substantial debt and hinder your post-graduation financial stability.

Responsible borrowing involves careful consideration of the loan amount, interest rates, and repayment terms. It also necessitates creating a realistic budget that allocates funds for loan repayments alongside other essential expenses. Budgeting strategies, including tracking income and expenditure, identifying areas for potential savings, and prioritizing essential needs, are essential for successful loan management. Ignoring these aspects can result in missed payments, increased interest charges, and damage to your credit score.

Long-Term Financial Implications of Cost of Living Loans

Cost of living loans, while providing immediate financial relief, come with significant long-term financial implications. The total amount repaid will almost always exceed the initial loan amount due to accumulated interest. For example, a £10,000 loan with a 5% annual interest rate over 5 years could result in a total repayment exceeding £12,000, depending on the repayment schedule. This interest burden can significantly affect future financial decisions, such as purchasing a property, investing, or starting a family. Understanding the compounding effect of interest is paramount. A detailed amortization schedule, typically provided by the lender, Artikels the principal and interest components of each repayment, helping students visualize the long-term cost. Delayed repayments can lead to further interest charges and potentially damage your credit rating, making future borrowing more difficult and expensive.

Responsible Borrowing Practices and Budgeting Strategies

Responsible borrowing begins with thorough research. Compare loan offers from different lenders, considering interest rates, fees, and repayment options. Only borrow the amount you absolutely need, avoiding unnecessary debt. Prioritize needs over wants. Create a detailed budget that accurately reflects your income and expenses. Track your spending meticulously to identify areas where you can cut back. Explore options for part-time employment or scholarships to supplement your income and reduce your reliance on the loan. Regularly review and adjust your budget as needed to ensure you stay on track with your repayments. Consider setting up automatic payments to avoid missed payments and associated penalties. Finally, seek professional financial advice if you are struggling to manage your finances.

Sample Student Budget Using a Cost of Living Loan

A well-structured budget is essential for managing a cost of living loan effectively. The following table presents a sample budget, illustrating how essential expenses can be balanced against loan repayments and potential savings. Remember, this is a sample and needs adjustment based on individual circumstances.

| Category | Monthly Budget | Notes | Strategies for Saving |

|---|---|---|---|

| Rent/Accommodation | £500 | Consider shared accommodation to reduce costs. | Explore cheaper housing options; negotiate rent. |

| Food | £200 | Cook at home more often; avoid eating out. | Meal planning; utilizing cheaper grocery stores; reducing food waste. |

| Utilities (Electricity, Gas, Water) | £100 | Monitor usage to reduce bills. | Energy-efficient appliances; turning off lights when leaving a room. |

| Transportation | £50 | Utilize public transport or cycling where possible. | Walk or cycle instead of using taxis or private cars. |

| Loan Repayment | £250 | Prioritize timely repayments to avoid penalties. | Budget carefully to ensure sufficient funds are available. |

| Books & Study Materials | £50 | Borrow books from the library; utilize online resources. | Buy used books; share resources with classmates. |

| Personal Care & Clothing | £50 | Avoid impulse purchases. | Shop sales; buy only essential items. |

| Entertainment & Social Activities | £50 | Limit spending on non-essential activities. | Explore free or low-cost entertainment options. |

| Savings | £50 | Build an emergency fund for unexpected expenses. | Automate savings; identify areas for additional savings. |

Alternatives to Cost of Living Loans

Securing funding for living expenses during your studies doesn’t always necessitate borrowing. Several viable alternatives exist, each with its own set of benefits and drawbacks. Carefully considering these options can significantly impact your financial well-being during and after your education. Choosing the right approach depends heavily on individual circumstances and resourcefulness.

Exploring alternative funding sources can reduce reliance on loans and potentially alleviate the burden of future debt repayment. This section will examine various options, comparing their advantages and disadvantages to help you make informed decisions.

Scholarships and Grants

Scholarships and grants represent non-repayable financial aid awarded based on merit, need, or specific criteria. Unlike loans, they don’t require repayment, making them highly attractive funding sources. However, competition for scholarships and grants can be fierce, and eligibility requirements vary significantly.

A comprehensive search strategy involves utilizing online databases and directly contacting potential providers. Many universities maintain internal scholarship databases specifically for their students. Furthermore, numerous private organizations and foundations offer scholarships based on academic achievement, extracurricular involvement, or demonstrated financial need. Government agencies also provide grants for students meeting specific criteria, often focusing on areas like academic excellence or demonstrated financial hardship. Examples of reputable providers include national and international scholarship foundations, professional associations related to your field of study, and individual college or university scholarship programs. These organizations often have application processes that require essays, transcripts, and letters of recommendation.

Part-Time Employment

Working part-time offers a direct way to fund living expenses while studying. This approach provides immediate financial support and valuable work experience. However, balancing work and studies can be challenging, potentially affecting academic performance if not managed effectively. The income generated is directly related to the hours worked, limiting the potential earnings compared to other funding options. Finding a job that complements your study schedule is crucial for successful implementation of this strategy. Many students find employment in areas like tutoring, food service, retail, or administrative support, depending on their skills and availability.

Creating a Comprehensive Financial Aid Application Strategy

A successful financial aid application strategy requires proactive planning and thorough research. Begin by creating a detailed budget to understand your living expenses. Then, research and identify all potential funding sources, including scholarships, grants, and part-time job opportunities. Organize your application materials well in advance of deadlines. Prepare compelling essays that highlight your achievements, goals, and financial need (where applicable). Seek feedback on your applications from trusted advisors or mentors. Maintain accurate records of all applications submitted and deadlines. Finally, remain persistent and don’t be discouraged by rejections. Multiple applications increase your chances of securing funding.

Potential Risks and Scams

Taking out a cost of living loan can be a helpful way to manage expenses during your studies, but it’s crucial to understand the potential downsides and risks involved. Failing to do so can lead to significant financial difficulties in the future. This section will highlight some key risks and common scams to watch out for.

Cost of living loans, while offering financial relief, come with inherent risks that students should carefully consider before applying. Understanding these risks is paramount to making informed decisions and avoiding potential pitfalls. Furthermore, the ease of access to online lending platforms has unfortunately created an environment ripe for fraudulent activities targeting financially vulnerable students.

High Interest Rates and Debt Accumulation

High interest rates are a significant risk associated with cost of living loans, especially those from private lenders. These rates can quickly escalate the total amount you owe, making repayment a considerable burden after graduation. For example, a loan of £5,000 with a 10% interest rate could easily become significantly larger over several years, even with regular repayments. It’s essential to compare interest rates from different lenders and choose the most favorable option. Carefully reviewing the loan agreement and understanding the repayment schedule is vital to avoid unexpected costs. Failing to do so can lead to substantial debt accumulation that impacts your credit score and future financial prospects.

Common Scams Targeting Students

Many scams prey on students’ financial vulnerability. These scams often involve fake loan offers with promises of low interest rates or easy approval, regardless of credit history. These fraudulent schemes often request upfront fees or personal information, which is then used for identity theft or other malicious purposes. Another common tactic involves phishing emails or text messages mimicking legitimate financial institutions, attempting to steal login credentials or banking details. Be wary of any loan offer that seems too good to be true or requires payment before receiving funds.

Recognizing and Reporting Fraudulent Loan Offers

Several red flags can indicate a fraudulent loan offer. These include unsolicited emails or texts offering loans, requests for upfront fees, vague or incomplete loan details, pressure to apply quickly, and promises of guaranteed approval regardless of creditworthiness. If you suspect a loan offer is fraudulent, do not respond to it. Instead, contact your university’s financial aid office or a reputable consumer protection agency to report the scam. Always verify the legitimacy of any lender before providing personal information or making payments. Report suspicious activity to the relevant authorities to protect yourself and other potential victims.

Final Conclusion

Successfully managing the cost of living during your studies requires careful planning and a thorough understanding of available financial resources. While cost of living loans can provide much-needed support, it’s essential to approach borrowing responsibly, weighing the long-term financial implications and exploring alternative options whenever possible. By carefully considering the information presented in this guide, students can develop a comprehensive financial aid strategy that aligns with their individual needs and goals, ensuring a smoother and more financially secure educational experience.

Question & Answer Hub

What happens if I can’t repay my cost of living loan?

Failure to repay can lead to negative impacts on your credit score and potential collection actions. Contact your lender immediately if you anticipate difficulties.

Can I use a cost of living loan for anything?

Typically, these loans are intended for essential living expenses, not luxury items. Check your loan agreement for specifics.

Are there any tax benefits associated with cost of living loans?

Tax implications vary depending on your location and the type of loan. Consult a tax professional for personalized advice.

How long does the application process usually take?

Processing times vary depending on the lender and the completeness of your application. Allow ample time for the process.