Navigating the financial landscape of higher education often presents significant challenges for students. Beyond tuition fees, the cost of living – accommodation, food, transportation, and everyday expenses – can quickly become overwhelming. This necessitates exploring various funding options, and among them, cost of living loans for students offer a potential solution. Understanding the different types of loans available, their associated costs, and the potential risks involved is crucial for making informed financial decisions.

This guide aims to provide a comprehensive overview of cost of living loans for students, examining the various loan types, eligibility criteria, and factors influencing interest rates. We’ll also delve into effective budgeting strategies, explore alternative funding sources, and discuss the importance of understanding government regulations to protect yourself from predatory lending practices. By understanding these aspects, students can make well-informed choices and manage their finances effectively throughout their academic journey and beyond.

Types of Cost of Living Loans for Students

Securing funding for living expenses while studying can be challenging. Understanding the different loan options available, their eligibility criteria, and associated terms is crucial for making informed financial decisions. This section details various cost of living loans categorized by lender type, providing a comparison to aid in your selection process.

Cost of Living Loan Options by Lender Type

Choosing the right loan depends on your individual circumstances and financial profile. The table below Artikels key features of common cost of living loans, highlighting differences in eligibility, interest rates, and repayment terms. Remember that interest rates are variable and subject to change based on market conditions.

| Loan Type | Lender | Eligibility Criteria | Interest Rates |

|---|---|---|---|

| Federal Student Loans (Unsubsidized) | Government (e.g., US Department of Education) | US citizenship or eligible non-citizen status; enrollment at least half-time in an eligible program; completion of the Free Application for Federal Student Aid (FAFSA); may require a credit check for Parent PLUS loans. | Variable; dependent on loan type and market conditions. Check the current rates on the official government website. |

| Private Student Loans | Banks, Credit Unions, and Private Lending Institutions | Creditworthiness (credit score and history); co-signer may be required; proof of enrollment; may require a minimum GPA; income verification. | Variable; significantly influenced by credit score and co-signer’s creditworthiness. Rates can vary widely between lenders. |

| Home Equity Loans/Lines of Credit (HELOC) | Banks and Credit Unions | Homeownership; sufficient home equity; acceptable credit score; stable income. | Variable; typically lower than private student loans but secured by the home’s value. |

| Personal Loans | Banks, Credit Unions, and Online Lenders | Good credit history; stable income; proof of identity and residency; purpose of loan may be considered. | Variable; highly dependent on creditworthiness and the lender’s policies. |

Eligibility Requirements and Credit Score Considerations

Eligibility for cost of living loans varies significantly depending on the lender and loan type. Federal student loans generally have less stringent credit requirements than private loans. However, for Parent PLUS loans, a credit check is conducted, and applicants with adverse credit history may be denied. Private loans typically require a higher credit score and may necessitate a co-signer to mitigate risk. Income verification is often a standard requirement for all loan types. For example, a student applying for a private loan might need to demonstrate sufficient income or a co-signer with a stable income to secure approval. HELOCs require homeownership and sufficient equity in the property.

Loan Terms and Conditions: Repayment Periods and Penalties

Repayment periods and associated penalties vary considerably among loan types. Federal student loans often offer various repayment plans, including income-driven repayment options, which adjust monthly payments based on income. Private loans generally have shorter repayment periods, potentially leading to higher monthly payments. Late payments or defaulting on loans can result in penalties such as increased interest rates, late fees, and damage to credit scores. For instance, a late payment on a private student loan could lead to a significant increase in the interest rate, substantially increasing the total cost of borrowing. Understanding the terms and conditions of each loan option is crucial before signing any agreements.

Factors Influencing Loan Amounts and Interest Rates

Securing a cost of living loan as a student involves a multifaceted assessment process. Lenders consider various factors to determine the loan amount offered, the interest rate applied, and ultimately, whether to approve the loan application. Understanding these factors is crucial for students seeking financial assistance.

Several key elements influence a lender’s decision regarding loan approval and terms. These factors interact to create a unique risk profile for each applicant, impacting both the amount of money offered and the cost of borrowing.

Credit History’s Impact on Loan Approval and Interest Rates

A strong credit history significantly improves a student’s chances of loan approval and can lead to more favorable interest rates. Lenders view a positive credit history—demonstrated through consistent on-time payments on existing debts like credit cards or personal loans—as an indicator of responsible financial management. Conversely, a poor credit history, marked by late or missed payments, defaults, or bankruptcies, can result in loan denial or significantly higher interest rates to compensate for the increased perceived risk. For example, a student with an excellent credit score might qualify for a loan with a 5% interest rate, while a student with a poor credit score might face an interest rate of 12% or higher, or even loan rejection.

Academic Performance’s Influence on Loan Terms

While not always a direct factor for all lenders, academic performance can indirectly influence loan terms. Strong academic standing, evidenced by a high GPA, demonstrates a commitment to education and potentially higher future earning potential. This can make a student a less risky borrower in the eyes of some lenders, potentially leading to more favorable loan terms. Conversely, poor academic performance might raise concerns about the student’s ability to complete their education and secure a well-paying job, potentially impacting loan approval or resulting in less favorable terms.

Co-Signer Availability and its Effect on Loan Approval

A co-signer is an individual who agrees to share responsibility for repaying the loan if the student defaults. The presence of a co-signer with a strong credit history can significantly improve a student’s chances of loan approval, particularly if the student lacks a credit history or has a poor credit score. The co-signer’s creditworthiness effectively mitigates the risk for the lender, potentially resulting in lower interest rates and more favorable loan terms for the student. However, it’s important to remember that the co-signer assumes significant financial responsibility.

Field of Study’s Influence on Loan Accessibility and Terms

The student’s chosen field of study can, in some cases, influence loan accessibility and terms. Fields with strong projected job growth and high earning potential might be viewed more favorably by some lenders, potentially leading to better loan terms. Conversely, fields with uncertain job prospects or lower average salaries might present a higher risk to lenders, potentially impacting loan approval or resulting in less favorable interest rates. This is not a universally applied factor, however, as many lenders prioritize the student’s creditworthiness and overall financial profile.

Loan Origination Fees and Associated Costs

Loan origination fees are charges levied by lenders to cover the administrative costs associated with processing the loan application. These fees can vary significantly depending on the lender and the type of loan. Other associated costs might include late payment fees, prepayment penalties, and potentially insurance premiums. These additional costs should be carefully considered when evaluating the overall expense of the loan. For instance, a seemingly low interest rate might be offset by high origination fees, leading to a higher total cost of borrowing. It is crucial to compare the total cost of the loan, including all fees and interest, when making a decision.

Managing Cost of Living Loans During and After Studies

Successfully navigating student loan debt requires careful planning and proactive management. Understanding your budget, repayment options, and strategies for minimizing interest are crucial for long-term financial health. This section provides practical steps and examples to help students effectively manage their cost of living loans throughout their studies and beyond.

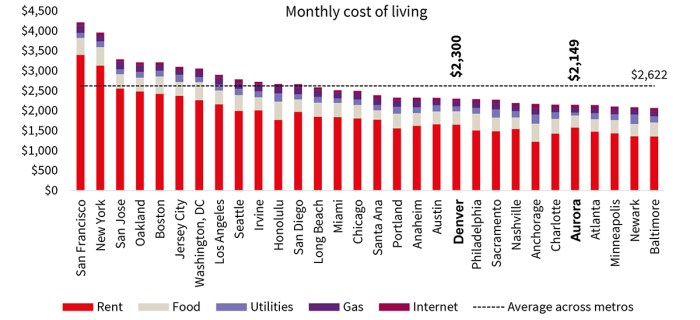

Effective budgeting is paramount to managing student loan debt alongside the costs of tuition and living expenses. Creating a realistic budget allows you to track income and expenses, ensuring you allocate sufficient funds for loan repayments while meeting your daily needs. Failing to budget adequately can lead to missed payments, impacting your credit score and potentially increasing your overall debt.

Budgeting Effectively While Managing Student Loan Debt

A well-structured budget is essential for successfully managing your finances while studying. The following steps Artikel a process for creating and maintaining a realistic budget that accounts for all your expenses, including loan repayments.

- Track your income and expenses: For at least a month, meticulously record every dollar you earn and spend. Use a budgeting app, spreadsheet, or notebook. This will provide a clear picture of your current financial situation.

- Categorize your expenses: Group your expenses into categories such as housing, food, transportation, utilities, books, loan repayments, and entertainment. This helps identify areas where you can potentially cut back.

- Create a realistic budget: Allocate funds to each category based on your income and expenses tracking. Prioritize essential expenses (housing, food, tuition, loan repayments) before allocating funds to non-essential items. Aim for a budget that leaves some room for savings.

- Regularly review and adjust your budget: Your financial circumstances may change throughout the year. Regularly review your budget to ensure it still reflects your income and expenses. Adjust it as needed to maintain a healthy financial balance.

- Automate loan repayments: Set up automatic payments for your student loans to avoid late fees and ensure consistent repayments. This simplifies the process and helps build good financial habits.

Sample Student Budget

This sample budget illustrates how a student might allocate funds. Remember that individual circumstances vary greatly, and this is just an example. Adjust the amounts to fit your specific situation.

| Category | Monthly Amount |

|---|---|

| Tuition | $1000 |

| Housing (Rent/Dorm) | $800 |

| Food | $400 |

| Transportation | $150 |

| Utilities (Electricity, Internet) | $100 |

| Books & Supplies | $50 |

| Loan Repayments | $200 |

| Personal Expenses/Entertainment | $100 |

| Savings | $100 |

| Total Monthly Expenses | $3000 |

Strategies for Minimizing Interest and Accelerating Loan Repayment

Minimizing interest accumulation and accelerating loan repayment are key to reducing the overall cost of your loans and achieving financial freedom sooner. Several strategies can help achieve this.

- Make extra payments: Whenever possible, make extra payments towards your principal loan balance. Even small additional payments can significantly reduce the total interest paid over the life of the loan.

- Refinance your loans: Explore refinancing options after graduation to potentially secure a lower interest rate. This can significantly reduce your monthly payments and the total interest paid.

- Consider an income-driven repayment plan: If you’re struggling to make your payments, consider an income-driven repayment plan. These plans adjust your monthly payments based on your income, making them more manageable. However, keep in mind that this may extend the repayment period and increase the total interest paid over time.

- Budget for loan repayment: Treat your loan repayments as a non-negotiable expense. Prioritize them in your budget to ensure consistent payments and avoid late fees.

Potential Risks and Alternatives to Cost of Living Loans

Securing funding for living expenses during your studies is crucial, but it’s vital to understand the potential drawbacks of relying solely on cost of living loans and to explore alternative financing options. Carefully weighing the pros and cons of each approach can significantly impact your financial well-being throughout and after your studies.

Cost of living loans, while providing necessary funds, carry inherent risks. These risks primarily revolve around accumulating substantial debt and the associated long-term financial implications. High interest rates can quickly inflate the total amount owed, making repayment a significant burden after graduation. Furthermore, the extended repayment period can delay other financial goals, such as saving for a down payment on a house or investing in retirement. A thorough understanding of these potential downsides is crucial before committing to a loan.

High Interest Rates and Long-Term Debt

High interest rates are a major concern associated with cost of living loans. The interest accrued can significantly increase the total amount repaid, potentially doubling or even tripling the initial loan amount over the repayment period. For example, a £10,000 loan with a 10% interest rate over 5 years could result in a total repayment exceeding £15,000, depending on the repayment schedule. This substantial increase can place considerable strain on post-graduation finances. Long-term debt also impacts credit scores and can limit future borrowing opportunities. Managing this debt responsibly requires careful budgeting and adherence to a repayment plan.

Alternative Funding Options for Living Expenses

Several alternatives to cost of living loans exist, each with its own advantages and disadvantages. These options can significantly reduce reliance on loans or, in some cases, eliminate the need entirely. Careful consideration of these alternatives is vital for making informed financial decisions.

Part-Time Employment

Working part-time offers a practical way to supplement living expenses. The income generated can cover a portion or, depending on the work hours, even all living costs. However, balancing work and studies requires effective time management and can potentially impact academic performance if not carefully managed. The income earned is immediate and doesn’t accrue interest.

Scholarships and Grants

Scholarships and grants offer a form of financial aid that doesn’t need to be repaid. These are typically awarded based on academic merit, financial need, or specific criteria set by the awarding institution or organization. Securing scholarships and grants can substantially reduce or eliminate the need for cost of living loans. The application process for scholarships and grants can be competitive and requires considerable effort.

Comparison of Funding Options

| Funding Option | Pros | Cons |

|---|---|---|

| Cost of Living Loan | Provides immediate access to funds; allows flexibility in budgeting. | High interest rates; long-term debt; impacts credit score; can delay other financial goals. |

| Part-Time Job | Generates immediate income; no debt incurred; improves time management skills. | Requires balancing work and studies; potential impact on academic performance; income may be limited. |

| Scholarships and Grants | No repayment required; can significantly reduce or eliminate loan dependence. | Competitive application process; availability is limited; may not cover all living expenses. |

Government Regulations and Student Loan Protection

Navigating the world of student loans can be complex, especially when considering cost of living expenses. Fortunately, various government regulations are in place to protect students from predatory lending practices and ensure fair treatment. These regulations aim to promote transparency, prevent abusive fees, and provide avenues for redress if problems arise.

Government regulations concerning student loans vary by country, but common themes include limitations on interest rates, clear disclosure of loan terms, and established procedures for handling complaints. Many jurisdictions have consumer protection agencies specifically tasked with overseeing the student loan industry and ensuring compliance with these regulations. These agencies often publish guidelines and resources to help students understand their rights and responsibilities.

Student Loan Protection Mechanisms

Numerous mechanisms exist to protect students from unfair lending practices. These include caps on interest rates, restrictions on origination fees, and requirements for clear and concise loan agreements. For instance, some countries mandate that loan providers provide borrowers with a detailed breakdown of all fees and charges before they sign a loan agreement. Additionally, regulations often stipulate that loan providers must adhere to specific procedures when dealing with borrowers who experience financial hardship, such as offering forbearance or deferment options. The specific protections available will vary based on the country and type of loan.

Filing a Complaint Regarding Unfair Lending Practices

If a student suspects unfair lending practices, several avenues are available for filing a formal complaint. The first step is typically to contact the lender directly and attempt to resolve the issue informally. If this approach is unsuccessful, the student can then file a complaint with the relevant consumer protection agency or regulatory body in their jurisdiction. These agencies have procedures for investigating complaints, and they can take action against lenders who violate regulations. Documentation, such as loan agreements, communication records, and evidence of financial hardship, is crucial when filing a complaint. The process and timeline for resolving complaints can vary depending on the specific agency and the complexity of the case.

Resources and Support Services for Students Struggling with Student Loan Debt

Students facing difficulties managing their student loan debt can access various resources and support services. Many government agencies offer free counseling and guidance on debt management strategies, including options like consolidation, repayment plans, and debt forgiveness programs. Non-profit organizations also provide similar services, often specializing in specific types of student loans or financial situations. These organizations can help students navigate the complexities of their loan agreements, explore available options for repayment, and develop a sustainable budget. Online resources, such as government websites and educational materials from non-profit organizations, can provide valuable information on managing student loan debt effectively. Seeking professional advice from a financial counselor can be particularly beneficial for students facing significant financial challenges.

Illustrative Examples of Loan Repayment Scenarios

Understanding the long-term financial implications of different repayment plans is crucial for responsible student loan management. The following examples illustrate how varying repayment schedules and interest rates can significantly impact the total cost of borrowing. We’ll consider a hypothetical loan of $20,000 to highlight these differences.

These scenarios demonstrate the importance of carefully considering repayment options before committing to a student loan. Factors such as interest rates, loan terms, and individual financial circumstances all play a significant role in determining the optimal repayment strategy.

Loan Repayment Scenarios Comparison

The table below compares three different repayment scenarios for a $20,000 student loan, highlighting the impact of varying repayment plans and interest rates on monthly payments and total interest paid. These are simplified examples and do not account for potential fees or changes in interest rates.

| Scenario | Repayment Plan | Monthly Payment | Total Interest Paid |

|---|---|---|---|

| Scenario 1: Standard Repayment | 10-year repayment plan at 6% interest | $211.95 | $4,634.00 |

| Scenario 2: Extended Repayment | 15-year repayment plan at 6% interest | $150.75 | $7,135.00 |

| Scenario 3: Accelerated Repayment | 7-year repayment plan at 5% interest | $304.67 | $2,326.00 |

Scenario 1: Standard Repayment demonstrates a typical repayment plan. While the monthly payments are manageable, the total interest paid over ten years is significant. This scenario represents a common balance between affordability and total cost.

Scenario 2: Extended Repayment significantly reduces the monthly payment burden. However, extending the repayment period dramatically increases the total interest paid. This is because you’re paying interest for a longer duration. This option might be suitable for those with immediate financial constraints, but the long-term cost is substantially higher.

Scenario 3: Accelerated Repayment involves higher monthly payments but results in substantially lower total interest paid. While demanding more upfront, this approach significantly reduces the overall cost of borrowing and saves a considerable amount of money in the long run. This scenario illustrates the value of prioritizing loan repayment and minimizing interest accumulation.

The differences in total repayment costs across the scenarios are primarily due to the interaction between the repayment period and the interest rate. Longer repayment periods lead to higher total interest payments, even with lower monthly payments. Conversely, shorter repayment periods, even with higher monthly payments, result in significantly less interest paid overall. The interest rate itself also plays a critical role; a lower interest rate, all else being equal, will always result in lower total interest payments.

Final Wrap-Up

Securing funding for living expenses during your studies is a critical step in ensuring academic success. While cost of living loans can provide necessary financial support, it’s vital to approach them strategically. Careful consideration of loan types, interest rates, and repayment plans, alongside exploration of alternative funding options, is essential. By understanding the potential risks and employing effective budgeting strategies, students can navigate the complexities of student finance and graduate with a manageable debt burden. Remember to utilize available resources and seek guidance when needed to make informed decisions that support your long-term financial well-being.

Question Bank

What happens if I can’t repay my cost of living loan?

Failure to repay your loan can lead to negative consequences, including damage to your credit score, collection agency involvement, and potential legal action. Contact your lender immediately if you anticipate difficulties making payments to explore options like deferment or forbearance.

Can I use a cost of living loan for anything other than essential living expenses?

Generally, cost of living loans are intended for essential expenses like rent, food, and utilities. Using the funds for non-essential purchases could violate loan terms and impact your eligibility for future loans.

Are there any tax benefits associated with cost of living loans for students?

Tax benefits related to student loans vary depending on your location and specific loan type. Consult a tax professional or refer to relevant government resources for accurate information on potential deductions or credits.

How does my credit score impact my loan application?

A good credit score significantly improves your chances of loan approval and can result in more favorable interest rates. A poor credit score may make it difficult to secure a loan or result in higher interest rates.