The soaring cost of higher education has left many students grappling with substantial student loan debt. Understanding the true cost of these loans—from interest rates and repayment plans to their long-term impact on personal finances and the economy—is crucial for informed decision-making. This guide delves into the complexities of student loan debt, providing insights into managing this significant financial burden.

We’ll explore the average debt accumulated by students pursuing various degrees, the different types of loans available, and the various repayment options. We’ll also examine the consequences of default and offer strategies for effective debt management, including budgeting, consolidation, and refinancing. Furthermore, we’ll discuss government policies, forgiveness programs, and the broader economic implications of this pervasive issue.

The Average Cost of Student Loans

The cost of higher education in the United States is a significant financial undertaking for many students and their families. Student loans have become a necessary tool for accessing higher education, but understanding the associated costs is crucial for responsible financial planning. This section will explore the average cost of student loans, breaking down the expenses by degree type and loan type, and examining factors that influence the overall cost.

Average Student Loan Debt by Degree Type

The average amount of student loan debt varies considerably depending on the degree pursued. Generally, longer programs leading to higher-earning potential result in higher debt levels. Data from the National Center for Education Statistics and other reputable sources show that students pursuing doctoral degrees typically accumulate the most debt, followed by master’s degree recipients, and then bachelor’s degree recipients. While precise figures fluctuate yearly, a reasonable estimate might show an average of $30,000 for a bachelor’s degree, $70,000 for a master’s degree, and $100,000 or more for a doctoral degree. This is a broad generalization, and the actual amount varies based on factors like the institution’s tuition costs, the student’s living expenses, and the type of loans taken out (public or private). Public loans often have lower interest rates than private loans, but the overall debt can still be substantial.

Average Monthly Student Loan Payments

The average monthly payment for student loans depends heavily on the total loan amount, the interest rate, and the repayment plan chosen. The standard repayment plan typically stretches over 10 years, but other options exist, including graduated repayment (lower payments initially, increasing over time), extended repayment (longer repayment period), and income-driven repayment (payments based on income). For example, a $50,000 loan at a 5% interest rate with a standard 10-year repayment plan would result in a monthly payment of approximately $530. However, an income-driven repayment plan for the same loan might result in a lower monthly payment initially, but it could extend the repayment period significantly, potentially increasing the total interest paid over the life of the loan.

Factors Influencing the Overall Cost of Student Loans

Several factors contribute to the overall cost of student loans. Tuition fees are a major component, varying significantly depending on the type of institution (public vs. private), location (in-state vs. out-of-state), and the specific program of study. Living expenses, including housing, food, transportation, and books, also add considerably to the overall cost. Finally, the interest rate applied to the loan significantly impacts the total amount repaid. Higher interest rates mean borrowers pay more in interest over the life of the loan. For example, a 7% interest rate will result in a higher total repayment cost than a 4% interest rate, even if the principal loan amount is the same.

Comparison of Total College Costs

The following table illustrates the estimated total cost of attending different types of colleges for a four-year undergraduate degree. These are averages and can vary widely based on specific institutions and individual circumstances.

| College Type | In-State Tuition & Fees | Out-of-State Tuition & Fees | Estimated Total Cost (4 years) |

|---|---|---|---|

| Public University | $10,000 | $25,000 | $40,000 – $100,000 |

| Private University | $30,000 | $30,000 | $120,000 – $200,000+ |

Interest Rates and Loan Repayment

Understanding the intricacies of interest rates and repayment plans is crucial for managing student loan debt effectively. The choices you make in these areas significantly impact the total amount you ultimately repay. Failing to grasp these concepts can lead to unexpected costs and prolonged repayment periods.

Student loans typically come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictable monthly payments. A variable interest rate, however, fluctuates based on market conditions. While a variable rate might start lower, it could increase over time, leading to higher payments and a greater total repayment amount. The choice between fixed and variable rates involves a trade-off between predictability and the potential for lower initial payments. For example, a borrower with a $50,000 loan at a fixed 5% interest rate will pay significantly more over the life of the loan than a borrower with the same loan amount at a variable rate that starts at 3% but increases to 7% over time. The total interest paid will be much higher in the latter case, even though the initial payments might be lower.

Student Loan Repayment Plans

Several repayment plans are available to help borrowers manage their student loan debt. The most suitable option depends on individual financial circumstances and income levels. Understanding the differences between these plans is vital for minimizing long-term costs and avoiding default.

The standard repayment plan involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeline but often results in higher monthly payments. Graduated repayment plans feature lower initial payments that gradually increase over time. This can be helpful for borrowers anticipating increased income in the future. Income-driven repayment plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base monthly payments on a percentage of your discretionary income. These plans typically extend the repayment period to 20 or 25 years, potentially reducing monthly payments but increasing the total interest paid over the loan’s lifetime. For instance, a borrower on an income-driven plan might have significantly lower monthly payments than someone on a standard plan, but they might end up paying considerably more in interest over the extended repayment period.

Long-Term Costs of Different Repayment Plans

The long-term costs associated with different repayment plans vary significantly. The total interest paid and the overall repayment duration are key factors to consider. Choosing a plan with lower monthly payments might seem appealing initially, but it can lead to substantially higher total interest costs over the long run. Conversely, opting for a plan with higher monthly payments might shorten the repayment period and reduce the total interest paid. A detailed comparison, considering your specific loan amount, interest rate, and income, is essential before making a decision. Financial advisors can assist in this process.

Consequences of Student Loan Default

Understanding the potential consequences of student loan default is crucial for responsible debt management. Defaulting on your student loans can have severe repercussions, impacting your financial future and creditworthiness.

- Damage to credit score: A significant drop in credit score, making it difficult to obtain loans, credit cards, or even rent an apartment.

- Wage garnishment: A portion of your wages can be legally seized to repay the defaulted loan.

- Tax refund offset: Your tax refund can be used to pay off the debt.

- Difficulty securing future employment: Some employers conduct credit checks, and a poor credit history due to loan default could hinder job prospects.

- Collection agency involvement: Aggressive collection efforts from debt collection agencies.

Impact of Student Loan Debt on Personal Finances

Student loan debt can significantly impact various aspects of personal finances, influencing major life decisions and creating long-term financial challenges. The weight of repayment can affect everything from buying a home to starting a family, underscoring the importance of understanding and managing this debt effectively.

Effects on Major Life Decisions

Student loan debt often delays or prevents major life milestones. The monthly payments can significantly reduce disposable income, making it difficult to save for a down payment on a house, hindering the ability to build wealth through homeownership. Similarly, the financial burden can postpone marriage or starting a family, as couples grapple with the combined weight of student loan payments and the expenses of raising children. For example, a young couple might delay purchasing a larger home or having children until their student loan debt is substantially reduced or paid off. This delay can impact family planning and overall life goals.

Financial Challenges Posed by Student Loan Debt

Significant student loan debt presents numerous financial hurdles. High monthly payments can restrict access to other financial products, such as credit cards or auto loans, due to reduced credit availability and higher interest rates. The constant pressure of repayment can also lead to financial stress and anxiety, impacting mental well-being. Furthermore, individuals may find it challenging to save for retirement or other long-term goals, as a substantial portion of their income is allocated to loan repayment. This can lead to a diminished financial safety net and limit future opportunities.

Strategies for Effective Student Loan Debt Management

Several strategies can help manage student loan debt effectively. Creating a detailed budget is crucial to understand spending habits and allocate funds for loan repayment. Debt consolidation involves combining multiple loans into a single loan, potentially simplifying repayment and lowering interest rates. Refinancing can also be a viable option, allowing borrowers to secure a lower interest rate, potentially reducing the overall cost of borrowing. Negotiating with lenders for income-driven repayment plans can also provide temporary relief, adjusting payments based on income levels. Careful financial planning and proactive debt management are key to navigating this challenge successfully.

Impact of Student Loan Debt on Credit Scores and Future Borrowing

| Level of Student Loan Debt | Impact on Credit Score | Impact on Future Borrowing | Example |

|---|---|---|---|

| Low (e.g., under $10,000) and consistently paid on time | Minimal negative impact; may even be positive if it demonstrates responsible credit use | Minimal impact; access to most financial products remains largely unaffected. | Individual with a low debt load and a history of on-time payments may easily qualify for a mortgage or auto loan. |

| Moderate (e.g., $10,000-$50,000) and consistently paid on time | Moderate negative impact; score may be slightly lower than someone with no debt. | May face slightly higher interest rates on future loans or slightly less favorable loan terms. | Individual might qualify for a loan, but with a slightly higher interest rate than someone with no student loan debt. |

| High (e.g., over $50,000) and/or missed payments | Significant negative impact; can severely lower credit score. | Significant impact; may face difficulty obtaining loans, higher interest rates, or loan applications being denied. | Individual might find it very difficult to qualify for a mortgage or be forced to accept significantly less favorable terms. |

Government Policies and Student Loan Forgiveness Programs

The student loan debt crisis in the United States has prompted the government to implement various programs aimed at assisting borrowers. These initiatives range from flexible repayment plans tailored to individual income levels to outright loan forgiveness programs for specific professions or situations. Understanding these programs is crucial for borrowers navigating the complexities of loan repayment. The effectiveness of these interventions, however, is a subject of ongoing debate.

Income-Driven Repayment Plans

Several income-driven repayment (IDR) plans are available to help borrowers manage their monthly payments. These plans calculate monthly payments based on a borrower’s income and family size, often resulting in lower monthly payments than standard repayment plans. Eligibility typically requires borrowers to be enrolled in federal student loan programs and meet specific income requirements. Limitations include the possibility of extending the repayment period significantly, leading to increased overall interest paid over the life of the loan. For example, the Revised Pay As You Earn (REPAYE) plan caps monthly payments at 10% of discretionary income, but the repayment period can extend to 25 years. The Income-Based Repayment (IBR) plan offers similar features but with slightly different eligibility criteria and payment calculations.

Public Service Loan Forgiveness Program

The Public Service Loan Forgiveness (PSLF) program offers complete loan forgiveness after 120 qualifying monthly payments under an IDR plan for those working full-time in public service. Eligibility is strictly defined, requiring employment by a government organization or a non-profit organization. Limitations include stringent requirements for qualifying payments, and the program has faced criticism for its complex application process and high rejection rate due to borrowers not meeting all the requirements. For instance, even a single missed payment or a brief period of non-qualifying employment can jeopardize loan forgiveness. The program’s strict adherence to these criteria is meant to ensure its fiscal responsibility, but has created considerable hardship for some borrowers who believed they qualified.

Teacher Loan Forgiveness Program

This program provides partial loan forgiveness for teachers who have completed five years of full-time teaching in low-income schools or educational service agencies. Borrowers must meet specific teaching requirements and have federal student loans. The amount of forgiveness is capped at a certain amount, depending on the type of loan and the number of years of qualifying service. This program aims to attract and retain qualified teachers in underserved communities, addressing a critical need in the education sector. However, the relatively modest amount of loan forgiveness may not significantly alleviate the overall burden of student loan debt for many participating teachers.

Comparison of Government Interventions

While IDR plans provide short-term relief by lowering monthly payments, they often extend the repayment period, leading to increased total interest paid. Loan forgiveness programs, like PSLF and the Teacher Loan Forgiveness Program, offer more significant long-term relief but come with stringent eligibility requirements and potential administrative hurdles. The effectiveness of these interventions varies depending on individual circumstances and the specific program utilized. The government continuously assesses and adjusts these programs based on their effectiveness and cost. The overall success of these programs in addressing the student loan debt crisis is a complex issue with ongoing debate regarding their efficacy and long-term financial sustainability.

Long-Term Economic Consequences of Student Loan Debt

The escalating burden of student loan debt in many countries presents a significant and multifaceted challenge with far-reaching economic implications. The sheer scale of this debt impacts not only individual borrowers but also broader economic trends, influencing everything from consumer spending to national economic growth. Understanding these long-term consequences is crucial for developing effective policy responses.

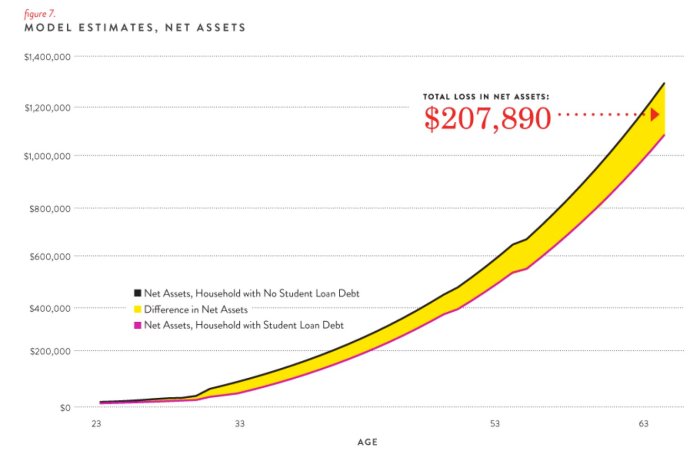

The accumulation of substantial student loan debt can significantly hinder economic growth and consumer spending. Borrowers often face a prolonged period of financial strain, diverting funds away from other crucial economic activities. This delayed investment in housing, starting businesses, and other significant purchases reduces overall economic dynamism.

Impact on Economic Growth

High levels of student loan debt negatively correlate with economic growth. When a large segment of the population is burdened by significant debt repayments, less disposable income is available for consumption and investment. This reduced consumer spending weakens aggregate demand, slowing down economic expansion. Furthermore, the debt can stifle entrepreneurship as individuals postpone starting businesses due to financial constraints. This ultimately limits innovation and job creation, further hindering long-term economic progress. For example, a study by the Federal Reserve Bank of New York found a significant negative relationship between student loan debt and entrepreneurial activity among young adults.

Student Loan Debt and Key Economic Indicators

The relationship between student loan debt and other crucial economic indicators is demonstrably clear.

- Unemployment Rates: High student loan debt can lead to prolonged job searching, as graduates may accept lower-paying jobs to manage their debt, potentially increasing unemployment figures, or delaying entry into the workforce altogether to focus on debt reduction.

- Homeownership Rates: The significant monthly payments associated with student loans often reduce the affordability of homeownership. This restricts access to a key asset that typically contributes to wealth building and overall economic stability. The substantial down payment requirement further exacerbates this challenge for many young adults burdened with student loan debt.

- Savings and Investment: The considerable financial burden of student loan repayment often limits individuals’ ability to save for retirement or invest in other assets. This can have long-term consequences for individual financial security and broader economic productivity, reducing the overall savings pool available for investment.

Potential Solutions to Mitigate Long-Term Economic Consequences

Addressing the long-term economic consequences of student loan debt requires a multi-pronged approach. This involves a combination of policy interventions aimed at increasing affordability of higher education, improving loan repayment options, and stimulating economic growth through targeted investments.

- Increased Funding for Public Higher Education: Substantial investment in public colleges and universities can lower tuition costs, making higher education more accessible and affordable for a larger segment of the population. This reduces the need for substantial student loans and diminishes the long-term economic burden on graduates.

- Income-Driven Repayment Plans: Expanding and improving income-driven repayment plans allows borrowers to manage their debt more effectively based on their income levels. This provides crucial financial flexibility and reduces the risk of default, minimizing the negative economic impact on individuals and the broader economy.

- Targeted Loan Forgiveness Programs: Well-designed loan forgiveness programs, focused on specific sectors or professions crucial for economic growth (e.g., healthcare, education, and technology), can incentivize individuals to pursue these fields and boost economic productivity.

Concluding Remarks

Navigating the complexities of student loan debt requires careful planning and a thorough understanding of the available options. By understanding the average costs, interest rates, repayment plans, and potential long-term consequences, students and borrowers can make informed decisions that minimize their financial burden. Proactive management strategies, coupled with awareness of government programs and resources, can significantly improve the outlook for those facing significant student loan debt. Remember, seeking professional financial advice can provide personalized guidance tailored to your specific circumstances.

FAQ Guide

What happens if I can’t repay my student loans?

Failure to repay your student loans can result in serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Explore options like income-driven repayment plans or loan rehabilitation programs before defaulting.

Can I refinance my student loans?

Yes, refinancing can potentially lower your monthly payments and interest rate, but it often involves consolidating multiple loans into a single one. Carefully compare offers from different lenders before refinancing.

What are income-driven repayment plans?

Income-driven repayment plans base your monthly payments on your income and family size. They may result in loan forgiveness after a certain number of years, but they often extend the repayment period, leading to higher total interest paid.

How do student loans affect my credit score?

Missed or late payments on your student loans will negatively impact your credit score, making it harder to obtain loans or credit cards in the future. On-time payments help build a positive credit history.