Navigating the complexities of federal student loan consolidation can feel overwhelming. Understanding current interest rates is crucial for making informed decisions about your financial future. This guide offers a clear overview of federal student loan consolidation, exploring the current rates, the consolidation process, and the potential benefits and drawbacks. We’ll examine how these rates are calculated, the impact on repayment plans, and factors to consider before consolidating your loans.

This exploration delves into the various federal student loan consolidation programs, providing a comparative analysis of their interest rates, eligibility requirements, and associated fees. We will also address the interplay between consolidation and loan forgiveness programs, outlining potential impacts on repayment timelines and eligibility criteria. Ultimately, this guide aims to empower you with the knowledge necessary to make the best choice for your individual circumstances.

Understanding Federal Student Loan Consolidation

Federal student loan consolidation simplifies your repayment by combining multiple federal student loans into a single loan with one monthly payment. This process can streamline your finances and potentially offer benefits, though it’s crucial to understand the implications before proceeding.

The Federal Student Loan Consolidation Process

Consolidating federal student loans involves applying through the Federal Student Aid website. The process begins with gathering information about your existing loans, including loan servicers, balances, and interest rates. You’ll then complete an application, providing details about your loans and choosing a new repayment plan. Once approved, your old loans are paid off, and a new consolidated loan is created with a single monthly payment amount. The entire process typically takes several weeks to complete.

Benefits and Drawbacks of Federal Student Loan Consolidation

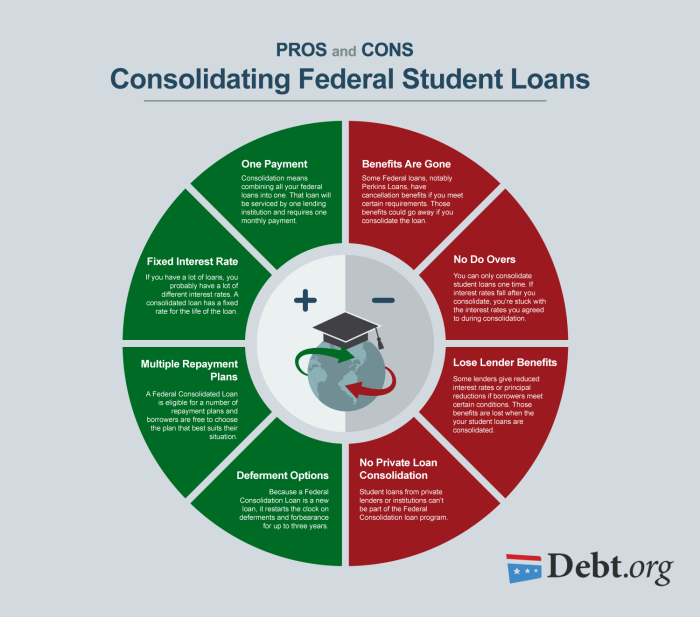

Consolidating federal student loans presents several potential advantages. A single monthly payment simplifies budgeting and reduces the risk of missed payments. Depending on your chosen repayment plan, you might qualify for a lower monthly payment amount. However, it’s important to note that consolidation usually results in a weighted average interest rate, which may be higher than the lowest rate among your original loans. Additionally, consolidation may extend your repayment period, leading to increased total interest paid over the life of the loan. Finally, consolidating federal loans may eliminate certain repayment options available under your original loans.

Applying for Federal Student Loan Consolidation: A Step-by-Step Guide

1. Gather Your Loan Information: Collect details about each federal student loan, including the lender, loan number, and outstanding balance.

2. Complete the Consolidation Application: Access the application through the Federal Student Aid website (StudentAid.gov). You will need your Federal Student Aid ID (FSA ID).

3. Choose a Repayment Plan: Select a repayment plan that aligns with your budget and financial goals. Options include standard, extended, graduated, and income-driven repayment plans.

4. Review and Submit Your Application: Carefully review your application for accuracy before submitting it.

5. Await Approval: The processing time for consolidation applications varies. You’ll receive notification once your application is approved.

6. Begin Making Payments: Once your application is approved, you’ll receive information about your new consolidated loan and begin making monthly payments to your new loan servicer.

Comparison of Federal Student Loan Consolidation Programs

| Program Name | Interest Rate | Eligibility Requirements | Fees |

|---|---|---|---|

| Direct Consolidation Loan | Fixed, weighted average of your existing loans’ interest rates | Must have eligible federal student loans | None |

| (No other specific programs beyond Direct Consolidation exist that are meaningfully different. Variations come from repayment plan choices, not the consolidation itself.) |

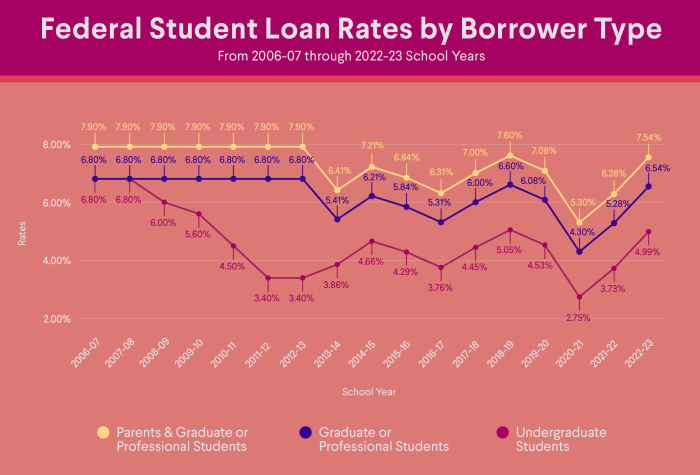

Current Interest Rates and Weighted Average Interest Rates

Understanding the interest rate on your consolidated federal student loan is crucial for effective financial planning. This section will clarify the current rates and the process of calculating your weighted average interest rate. It’s important to remember that these rates are subject to change, so always check the official Federal Student Aid website for the most up-to-date information.

The interest rate for a federal student loan consolidation is not a fixed number. Instead, it’s a weighted average of the interest rates on your existing loans. This means the rate will depend on the interest rates of your individual loans and their respective balances. This weighted average is then rounded up to the nearest one-eighth of a percent.

Fixed Interest Rate Calculation

The interest rate applied to your consolidated loan is a fixed rate, calculated as a weighted average of the interest rates on your eligible federal student loans. This means that loans with larger balances will have a greater impact on the final interest rate than loans with smaller balances. The formula for calculating the weighted average interest rate is:

Weighted Average Interest Rate = (Sum of (Individual Loan Interest Rate * Individual Loan Balance)) / Total Loan Balance

For example, imagine you have two loans: Loan A with a $10,000 balance and a 5% interest rate, and Loan B with a $20,000 balance and a 7% interest rate. The calculation would be:

Weighted Average Interest Rate = (($10,000 * 0.05) + ($20,000 * 0.07)) / ($10,000 + $20,000) = 0.06 or 6%

This 6% would then be rounded up to the nearest one-eighth of a percent, resulting in the final interest rate for your consolidated loan.

Factors Influencing the Final Interest Rate

Several factors contribute to the final interest rate of a consolidated federal student loan. The most significant is the weighted average interest rate, as detailed above. However, the timing of the consolidation also plays a role. The interest rate is fixed at the time of consolidation and will not change even if market interest rates fluctuate afterward. The type of federal loans being consolidated also matters, as different loan types may have different interest rate calculations. Finally, the exact formula and rounding methods are determined by the Department of Education and are subject to change.

Illustrative Example of Weighted Average Calculation

Let’s visualize how different loan types and balances impact the weighted average interest rate. Imagine a table representing three different scenarios:

| Scenario | Loan Type & Balance | Interest Rate | Weighted Average Calculation | Final Interest Rate (Rounded) |

|---|---|---|---|---|

| Scenario 1 | Subsidized Loan: $15,000 Unsubsidized Loan: $5,000 |

Subsidized: 4.5% Unsubsidized: 6% |

((15000 * 0.045) + (5000 * 0.06)) / 20000 = 0.05 or 5% | 5% |

| Scenario 2 | Subsidized Loan: $5,000 Unsubsidized Loan: $15,000 |

Subsidized: 4.5% Unsubsidized: 6% |

((5000 * 0.045) + (15000 * 0.06)) / 20000 = 0.05625 or 5.625% | 5.625% |

| Scenario 3 | Direct Consolidation Loan: $20,000 | 7% | 20000 * 0.07 / 20000 = 0.07 or 7% | 7% |

This table demonstrates how a larger balance on a higher-interest loan significantly impacts the final weighted average. Note that the final interest rate is always rounded up to the nearest one-eighth of a percent.

Loan Forgiveness Programs and Consolidation

Consolidating your federal student loans can significantly impact your eligibility for loan forgiveness programs. Understanding this interplay is crucial for borrowers aiming to reduce or eliminate their debt. While consolidation simplifies repayment by combining multiple loans into one, it can also affect the timelines and requirements for forgiveness.

Consolidating your federal student loans can affect your eligibility for several forgiveness programs, most notably Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Income-Driven Repayment (IDR) plans leading to forgiveness. The impact varies depending on the program and your pre-consolidation loan types and repayment history.

Public Service Loan Forgiveness (PSLF) and Consolidation

Consolidation can be a strategic tool for those pursuing PSLF. However, it’s vital to understand that consolidating loans into a Direct Consolidation Loan is often a requirement to be eligible for PSLF. Before consolidation, borrowers must ensure they’ve already made 120 qualifying monthly payments under an eligible repayment plan on their Federal Family Education Loan (FFEL) Program or Perkins Loans. Consolidating these loans into a Direct Consolidation Loan allows them to continue tracking their progress toward PSLF. However, any payments made *before* consolidation on FFEL or Perkins loans may not count toward the 120 payment requirement if the consolidation occurs after October 1, 2022. This highlights the importance of careful planning and understanding the implications of consolidation timing.

Teacher Loan Forgiveness and Consolidation

The Teacher Loan Forgiveness program requires borrowers to teach full-time for five consecutive academic years in a low-income school or educational service agency. Consolidating eligible loans into a Direct Consolidation Loan is generally not a barrier to this program, but it’s essential to ensure all the qualifying loans are included in the consolidation to receive the full benefit. It’s also critical that the teaching requirements are met *before* applying for forgiveness.

Income-Driven Repayment (IDR) Plans and Consolidation

Many IDR plans, such as the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Pay As You Earn (PAYE) plans, can lead to loan forgiveness after a set period of qualifying payments. Consolidation into a Direct Consolidation Loan is often necessary to access these IDR plans, especially if you have FFEL or Perkins loans. However, consolidating does not automatically enroll you in an IDR plan; you must actively apply. The consolidated loan will then be subject to the payment terms and forgiveness rules of the chosen IDR plan.

Potential Impacts of Consolidation on Loan Forgiveness Timelines

Understanding the potential impacts of consolidation on your loan forgiveness timeline is paramount. Here are some key considerations:

- Resetting Payment Counts: Consolidation may reset your payment count for some forgiveness programs, particularly if you consolidate loans that aren’t already Direct Loans. This means you might have to start over with the required number of payments.

- Extension of Repayment Period: Consolidating loans often results in a longer repayment term. While this lowers your monthly payments, it can also extend the time it takes to reach loan forgiveness.

- Change in Interest Rate: Your new interest rate after consolidation will be a weighted average of your previous loan rates. This could potentially slightly increase or decrease your total interest paid, impacting the overall cost and the amount forgiven.

- Eligibility Requirements: Consolidation may alter your eligibility for certain forgiveness programs depending on the type of loans being consolidated and the timing of the consolidation.

- Impact on Loan Forgiveness Amount: The total amount of loan forgiveness you qualify for may be affected if the consolidation alters your eligibility or repayment timeline.

Impact of Consolidation on Repayment Plans

Consolidating your federal student loans can significantly impact your repayment strategy. By combining multiple loans into a single loan, you simplify the repayment process and potentially gain access to different repayment plans. However, the effect on your monthly payments and overall interest paid depends heavily on the chosen repayment plan and your individual circumstances.

Consolidation alters your repayment options by offering a single monthly payment, streamlining your financial management. The interest rate on your consolidated loan is a weighted average of your original loans’ rates, which may be higher or lower than your highest individual rate. This impacts the total interest paid over the life of the loan. Choosing the right repayment plan after consolidation is crucial for managing your debt effectively.

Repayment Plan Options After Consolidation

After consolidating your federal student loans, you’ll have access to several repayment plans. The Standard Repayment Plan is the default option, typically spreading payments over 10 years. However, income-driven repayment plans, such as the Income-Driven Repayment (IDR) plan, Income-Based Repayment (IBR) plan, Pay As You Earn (PAYE) plan, and Revised Pay As You Earn (REPAYE) plan, base your monthly payments on your income and family size. These plans often result in lower monthly payments but may extend the repayment period and increase the total interest paid over the loan’s lifetime. Extended Repayment Plans offer longer repayment periods than the standard plan, lowering monthly payments but potentially increasing the total interest paid.

Impact of Consolidation on Monthly Payments

The impact of consolidation on monthly payments varies greatly depending on the chosen repayment plan and the total loan amount. For example, a $50,000 consolidated loan on the Standard Repayment Plan might result in a significantly higher monthly payment compared to an income-driven repayment plan. However, the income-driven plan would likely extend the repayment period, leading to a higher total interest paid over time. Conversely, a smaller loan amount, such as $20,000, would result in lower monthly payments regardless of the repayment plan chosen, although the total interest paid will still vary depending on the plan’s terms.

Examples of Income and Loan Amount Influence

Let’s consider two scenarios:

Scenario 1: An individual with a $60,000 consolidated loan and a high income might choose the Standard Repayment Plan due to its shorter repayment period. Their monthly payment would be higher, but they would pay less total interest.

Scenario 2: An individual with a $30,000 consolidated loan and a low income might opt for an income-driven repayment plan. Their monthly payments would be lower, aligned with their income, but they would pay more total interest over a longer repayment period.

Monthly Payment Comparison Across Repayment Plans

The following table illustrates the potential differences in monthly payments and total interest paid for a $40,000 consolidated loan under different repayment plans. These are illustrative examples and actual payments may vary based on individual circumstances and interest rates.

| Repayment Plan | Approximate Monthly Payment | Approximate Total Interest Paid |

|---|---|---|

| Standard Repayment (10 years) | $450 | $12,000 |

| Income-Driven Repayment (20 years) | $250 | $20,000 |

| Extended Repayment (25 years) | $200 | $25,000 |

Potential Risks and Considerations

While federal student loan consolidation offers the potential for simplified repayment, it’s crucial to understand the potential drawbacks before making a decision. Consolidation isn’t always the best solution, and a thorough evaluation of your individual circumstances is essential. Failing to do so could lead to unforeseen financial consequences.

Consolidating federal student loans involves combining multiple loans into a single loan with a new interest rate. This new rate is a weighted average of your existing loan interest rates, and it can potentially increase your overall interest paid over the life of the loan. Furthermore, consolidation may result in the loss of certain benefits associated with your individual loans, such as income-driven repayment plans with lower monthly payments or loan forgiveness programs.

Situations Where Consolidation May Not Be Beneficial

Consolidation might not be advantageous if you currently benefit from favorable interest rates on some or all of your existing loans. For instance, if you have loans with subsidized interest rates (meaning the government pays the interest while you’re in school or during grace periods), consolidating could result in a higher interest rate on your entire loan balance. Similarly, if you’re enrolled in an income-driven repayment plan tailored to your financial situation, consolidation might remove you from that plan and increase your monthly payments. Finally, certain types of federal student loans, such as Perkins Loans, might lose specific benefits upon consolidation.

Factors to Consider Before Consolidating

Before deciding to consolidate, borrowers should carefully assess their current loan portfolio, including interest rates, loan types, and repayment plans. They should compare the potential benefits of consolidation—such as a single monthly payment—against the potential risks, such as a higher overall interest rate or loss of specific loan benefits. Consider obtaining professional financial advice to help you weigh the pros and cons tailored to your unique financial circumstances. Additionally, thoroughly review the terms and conditions of the consolidated loan to understand the implications of your decision. Finally, explore all available repayment options before choosing consolidation.

Warning Signs Consolidation May Not Be the Best Option

It’s important to recognize warning signs that consolidation might not be the best course of action. Consider the following:

- You have several loans with low interest rates.

- You are currently enrolled in an income-driven repayment plan that offers significantly lower monthly payments.

- You are eligible for a loan forgiveness program tied to a specific loan type.

- You anticipate significant changes in your income or financial situation in the near future.

- You haven’t thoroughly researched and compared all available repayment options.

Resources and Further Information

Navigating the complexities of federal student loan consolidation can be challenging, but thankfully, numerous resources are available to provide guidance and support. Understanding where to find accurate and reliable information is crucial for making informed decisions about your student loans. This section Artikels key resources, contact information, and steps to take if you need further assistance.

Accessing reliable information is paramount when dealing with your student loans. Misinformation can lead to costly mistakes, so it’s essential to consult official government sources and reputable organizations. The following resources offer comprehensive information and support to help you understand and manage your federal student loans.

Reputable Websites and Organizations

Several government websites and non-profit organizations provide detailed information on federal student loan consolidation. These resources offer valuable tools and resources to help you navigate the process effectively.

- StudentAid.gov: The official website of the U.S. Department of Education’s Federal Student Aid office. This is your primary source for information on all aspects of federal student loans, including consolidation.

- Federal Student Aid Information Center: This center provides phone and online support to answer questions about federal student aid programs. Their contact information is listed below.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that offers free and low-cost credit counseling services, including assistance with student loan management and consolidation.

- Consumer Financial Protection Bureau (CFPB): The CFPB offers resources and tools to help consumers understand their rights and protect themselves from predatory lending practices. Their website provides valuable information on student loans.

Contact Information for Relevant Government Agencies and Student Loan Servicers

Direct contact with relevant agencies and your loan servicer is often necessary for specific questions or to manage your loans effectively. Having this information readily available streamlines the process.

- Federal Student Aid Information Center: 1-800-4-FED-AID (1-800-433-3243)

- Your Student Loan Servicer: Your servicer’s contact information will be listed on your student loan statements. This is the organization responsible for processing your payments and answering questions specific to your loans.

Obtaining Additional Assistance

If you require further assistance understanding federal student loan consolidation, several avenues are available to seek support. Don’t hesitate to reach out for help if you are feeling overwhelmed or unsure about any aspect of the process.

- Contact your Student Loan Servicer: Your servicer is your first point of contact for questions about your specific loans and the consolidation process. They can provide personalized guidance.

- Use the Federal Student Aid Information Center: The information center provides comprehensive support and can answer general questions about federal student loan programs.

- Seek guidance from a non-profit credit counseling agency: Organizations like the NFCC offer free or low-cost counseling services to help you manage your debt and make informed decisions.

- Consult with a financial advisor: A financial advisor can provide personalized advice based on your individual financial situation and goals.

Ending Remarks

Consolidating federal student loans presents a significant financial decision with both advantages and potential pitfalls. While it can simplify repayment and potentially lower monthly payments, it’s essential to carefully weigh the long-term implications, including the impact on your overall interest rate and eligibility for loan forgiveness programs. By understanding the current rates, the intricacies of the weighted average interest rate calculation, and the various repayment plan options available, you can make a well-informed choice that aligns with your financial goals and circumstances. Remember to thoroughly research and compare different programs before proceeding.

Essential FAQs

What is the current fixed interest rate for federal student loan consolidation?

The fixed interest rate for federal student loan consolidation is a weighted average of the interest rates on your existing loans. It’s not a single, published rate; it’s unique to each borrower.

Can I consolidate private student loans with federal student loans?

No, federal student loan consolidation programs only consolidate federal student loans. Private loans must be addressed separately.

Does consolidating my loans affect my credit score?

The impact on your credit score is generally minimal, but it depends on your individual credit history and how you manage your consolidated loan. A hard inquiry may slightly lower your score temporarily.

How long does the consolidation process take?

The processing time varies, but it generally takes several weeks to complete the consolidation process.