Navigating the complexities of student loan repayment begins with understanding the current interest rate landscape. This crucial factor significantly impacts the total cost and repayment timeline of your education investment. This guide explores the various types of federal student loans, the forces driving interest rate fluctuations, and effective strategies for managing your debt burden.

From subsidized and unsubsidized loans to the influence of government policies and economic conditions, we’ll delve into the details, providing you with the knowledge to make informed decisions about your financial future. We’ll also compare interest rates across different loan programs and offer insights into refinancing options and income-driven repayment plans.

Understanding the Current Student Loan Interest Rate Landscape

Navigating the world of student loan interest rates can be complex, but understanding the key factors and different loan types is crucial for responsible borrowing and repayment planning. This section provides a clear overview of the current landscape of federal student loan interest rates.

Federal Student Loan Types and Interest Rates

The federal government offers several types of student loans, each with its own interest rate structure. These rates are typically fixed, meaning they remain the same for the life of the loan, unlike variable rates which fluctuate. The primary types are subsidized and unsubsidized loans, both offered under the Federal Direct Loan Program. Subsidized loans are need-based and the government pays the interest while the borrower is in school at least half-time, during grace periods, and during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed, regardless of the borrower’s enrollment status. There are also PLUS loans, available to parents and graduate students, which generally have higher interest rates than subsidized and unsubsidized loans. Finally, there are Perkins Loans, a type of federal loan with lower interest rates but limited availability. The specific interest rate for each loan type is set annually by the government and is dependent on the loan’s disbursement date.

Factors Influencing Federal Student Loan Interest Rate Changes

Several factors influence the fluctuation of federal student loan interest rates. These rates are not directly tied to market forces in the same way as private loans. Instead, they are heavily influenced by broader economic conditions and government policy decisions. The 10-year Treasury note rate is often used as a benchmark, as the government aims to set interest rates that are competitive with other forms of borrowing while still ensuring the program’s financial sustainability. Congressional action can also directly impact interest rates, as legislation can set specific rate caps or adjustments. Finally, changes in the overall economy, such as inflation, can indirectly influence the rates set by the government.

Historical Overview of Student Loan Interest Rates (Past Decade)

Over the past decade, student loan interest rates have shown some variability, reflecting changes in the economic climate and government policies. While precise figures fluctuate depending on the loan type and disbursement date, a general trend of relatively low rates can be observed, particularly in the early years of the decade, followed by some modest increases. For example, subsidized Stafford loan rates have ranged from approximately 3.4% to 6.8% over the past ten years, while unsubsidized rates have been slightly higher. These changes often align with broader economic shifts and government decisions regarding student loan funding.

Comparison of Subsidized and Unsubsidized Loan Interest Rates

The following table provides a simplified comparison of interest rates for subsidized and unsubsidized federal student loans, acknowledging that actual rates vary based on the year the loan was disbursed. This is for illustrative purposes only and should not be considered financial advice.

| Loan Type | Interest Rate Range (Approximate, Past Decade) | Interest Accrual | Eligibility |

|---|---|---|---|

| Subsidized | 3.4% – 6.8% | While in school (at least half-time), grace period, deferment | Undergraduate students demonstrating financial need |

| Unsubsidized | 4.4% – 7.8% | From disbursement | Undergraduate and graduate students |

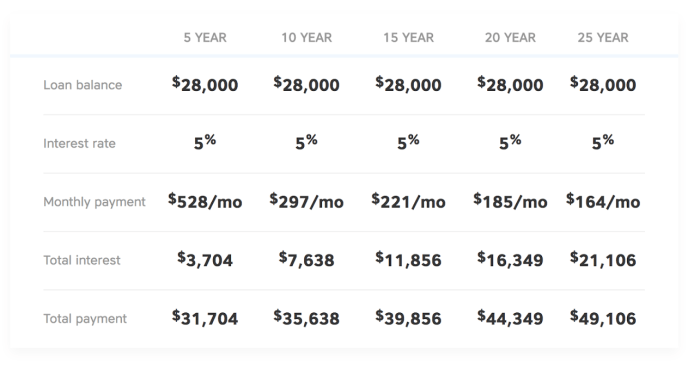

Impact of Interest Rates on Repayment

Understanding the interest rate applied to your student loans is crucial, as it significantly impacts the total amount you’ll repay over the life of the loan. Even seemingly small differences in interest rates can lead to substantial variations in your overall cost. This section explores the relationship between interest rates and repayment, highlighting the long-term financial implications.

The effect of varying interest rates on the total repayment amount is substantial. Higher interest rates increase the total amount you pay over the life of the loan, while lower rates decrease it. This is because interest accrues on the principal loan amount, and higher interest rates mean you’re paying more interest each month. This compounding effect becomes more pronounced over longer repayment periods.

Effect of Varying Interest Rates on Total Repayment

Consider two scenarios: a $20,000 student loan with a 5% fixed interest rate and the same loan with a 7% fixed interest rate, both repaid over 10 years. Using a standard amortization calculator (readily available online), the 5% loan would result in a total repayment of approximately $26,000, while the 7% loan would cost approximately $29,000. This demonstrates a $3,000 difference in total repayment simply due to a 2% increase in the interest rate.

Fixed versus Variable Interest Rates

Student loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictability in monthly payments. A variable interest rate, however, fluctuates based on market conditions. While a variable rate might start lower than a fixed rate, it carries the risk of increasing significantly, leading to higher payments and a larger overall repayment amount. The choice between fixed and variable rates depends on individual risk tolerance and predictions about future interest rate trends. For example, someone averse to risk might prefer a fixed rate, even if it is slightly higher initially, to avoid the uncertainty of a variable rate.

Hypothetical Repayment Schedule: Impact of a 1% Interest Rate Increase

Let’s examine a hypothetical scenario to illustrate the impact of a 1% interest rate increase on a $10,000 loan repaid over 5 years.

| Year | 5% Interest Rate (Approximate Monthly Payment) | 6% Interest Rate (Approximate Monthly Payment) | Difference in Total Paid |

|---|---|---|---|

| 1 | $190 | $193 | $36 |

| 2 | $190 | $193 | $36 |

| 3 | $190 | $193 | $36 |

| 4 | $190 | $193 | $36 |

| 5 | $190 | $193 | $36 |

| Total | $11,400 | $11,580 | $180 |

This table demonstrates that even a seemingly small 1% increase in the interest rate results in an extra $180 paid over the life of the loan. While this example uses simplified figures, it highlights the cumulative effect of interest rate changes on the total repayment amount. It is important to note that these are approximate figures and the actual amounts may vary slightly depending on the specific loan terms and repayment schedule.

Finding and Comparing Current Rates

Understanding the current interest rates for student loans is crucial for making informed borrowing decisions. Knowing where to find accurate information and how to compare rates from different sources is essential for minimizing your long-term borrowing costs. This section will guide you through the process of finding and comparing current student loan interest rates.

Finding reliable information on student loan interest rates requires careful selection of sources. Misinformation can lead to costly mistakes, so sticking to official government websites and reputable financial institutions is paramount. Direct comparison of rates between different loan programs allows borrowers to make the most financially savvy choice.

Reliable Sources for Student Loan Interest Rate Information

The most accurate and up-to-date information on federal student loan interest rates comes directly from the government. These rates are fixed annually and are published on official websites. While private lenders’ rates fluctuate more frequently, it’s still advisable to consult their websites directly for current offerings. Reputable financial websites often aggregate this data, providing a convenient comparison tool, but always verify information with the primary source.

- Federal Student Aid (FSA): The official website of the U.S. Department of Education’s Federal Student Aid office is the primary source for information on federal student loan interest rates. This website provides detailed information on rates for different loan programs, including subsidized and unsubsidized loans. It usually includes rate tables and explanations of how interest rates are determined.

- Individual Lender Websites: Private lenders, such as banks and credit unions, also offer student loans. Their websites are the best source for their current interest rates. Be aware that these rates are often variable and can change frequently based on market conditions.

- Reputable Financial Websites: Several reputable financial websites compile information on student loan interest rates from various sources. These websites can be helpful for comparing rates from different lenders, but always double-check the information with the original source.

Comparing Interest Rates Offered by Different Federal Student Loan Programs

Federal student loan programs offer different interest rates depending on the type of loan and the borrower’s eligibility. Direct subsidized loans typically have lower interest rates than unsubsidized loans, reflecting the government’s interest in assisting students. The interest rates are set annually by Congress and are fixed for the life of the loan. Understanding these differences is vital in choosing the most cost-effective loan option.

- Direct Subsidized Loans: These loans are for undergraduate students who demonstrate financial need. The government pays the interest while the student is in school at least half-time, during grace periods, and during periods of deferment.

- Direct Unsubsidized Loans: These loans are available to undergraduate, graduate, and professional students, regardless of financial need. Interest begins accruing immediately, even while the student is in school.

- Direct PLUS Loans: These loans are available to graduate or professional students and parents of dependent undergraduate students. They typically have higher interest rates than subsidized and unsubsidized loans.

Locating Current Interest Rate Data on Official Government Websites

Navigating government websites can sometimes be challenging. To find the current interest rates for federal student loans, start by visiting the Federal Student Aid website (StudentAid.gov). Look for sections dedicated to “Interest Rates,” “Loan Types,” or similar headings. The website usually provides tables summarizing the current rates for each loan program. Pay close attention to the effective date of the rates, as they are updated annually. The site often includes FAQs and detailed explanations to help users understand the information presented.

Strategies for Managing Student Loan Debt

Managing student loan debt effectively requires a proactive approach to minimize the long-term financial burden. High interest rates can significantly increase the total cost of repayment, making it crucial to understand and implement strategies that mitigate this impact. This section explores several approaches to help borrowers navigate their student loan repayment journey successfully.

Minimizing the Impact of High Interest Rates

High interest rates accelerate the growth of your loan balance. To minimize their impact, prioritize high-interest loans for early repayment. This means focusing your extra payments on the loans with the highest interest rates first, a strategy known as the avalanche method. Alternatively, the snowball method involves paying off the smallest loan first, regardless of interest rate, for psychological motivation. Careful budgeting and identifying areas to reduce spending can free up additional funds for loan repayment. Consider exploring opportunities for additional income through part-time work or freelance projects. Every extra dollar applied to your principal balance reduces the overall interest paid over the life of the loan.

Loan Refinancing Options

Refinancing your student loans involves replacing your existing loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total interest paid over the life of the loan. However, it’s essential to compare offers from multiple lenders to find the best terms. Factors to consider include the interest rate, fees, and loan term. Refinancing might not be suitable for everyone, especially those with poor credit scores or who are currently enrolled in an income-driven repayment plan. Carefully weigh the potential benefits against any associated risks before making a decision.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. This can make payments more manageable, particularly during periods of low income. Several IDR plans exist, each with its own eligibility requirements and repayment terms. The benefits include lower monthly payments and potential loan forgiveness after a specified period (typically 20 or 25 years). However, IDR plans often extend the repayment period, leading to higher total interest paid over the life of the loan. Furthermore, the potential for loan forgiveness is subject to changes in government policy.

Visual Representation of Long-Term Cost Savings

Imagine a bar graph. The horizontal axis represents different repayment strategies: Standard Repayment (highest interest paid), Avalanche Method, Snowball Method, and Income-Driven Repayment. The vertical axis represents the total amount repaid over the life of the loan (principal + interest). The bar for Standard Repayment would be the tallest, showing the highest total cost. The bar for the Avalanche Method would be shorter, reflecting the savings from prioritizing high-interest loans. The Snowball Method bar would be slightly taller than the Avalanche Method, illustrating the trade-off between psychological benefit and slightly higher total cost. Finally, the IDR plan bar would be the longest, reflecting the extended repayment period and higher total interest paid, despite lower monthly payments. The visual clearly demonstrates how different strategies can significantly impact the overall cost of repaying student loans over time. The graph would use realistic figures based on average interest rates and loan amounts to provide a concrete illustration of the potential savings. For example, a $50,000 loan at 7% interest might show a $10,000 difference in total cost between the Standard and Avalanche methods over 10 years.

The Role of Government Policy in Student Loan Interest Rates

Government policies significantly influence student loan interest rates, impacting accessibility and affordability of higher education. These policies are intertwined with broader economic conditions and budgetary considerations, creating a complex interplay of factors that shape the cost of borrowing for students.

The federal government plays a dominant role in the student loan market, setting interest rates for federal student loans and influencing the overall landscape through various programs and regulations. Economic conditions, such as inflation and overall interest rate trends, also exert considerable pressure on these rates.

Influence of Government Policies and Economic Conditions

Government policies directly impact student loan interest rates through legislation setting rate caps, subsidies, and repayment plans. For example, Congress can mandate specific interest rates for federal loans, or it can authorize adjustments based on market indices like the 10-year Treasury note. Simultaneously, prevailing economic conditions, such as inflation and the overall health of the economy, influence the cost of borrowing for the government itself. Higher inflation might necessitate higher interest rates to compensate for the decreased value of money over time. Conversely, periods of low inflation and economic stability could lead to lower rates. This dynamic relationship between government policy and economic factors is constantly shifting, affecting the cost of student loans for borrowers.

Impact of Federal Budget Allocations on Student Loan Programs

Changes in federal budget allocations directly impact the availability and terms of student loan programs. Increased funding can lead to lower interest rates through increased subsidies, expansion of loan programs, or the creation of more generous repayment options. Conversely, budget cuts might necessitate higher interest rates, reduced loan amounts, or stricter eligibility criteria. The annual budget process thus significantly influences the student loan landscape, determining the level of government support available for higher education. For instance, increased funding for Pell Grants could reduce the reliance on student loans, indirectly affecting the demand and consequently the interest rates.

Examples of Past Government Interventions

Several instances of government intervention demonstrate the power of policy to shape student loan interest rates. The 2007-2008 financial crisis, for example, led to significant government intervention in the student loan market, including increased subsidies and temporary rate reductions to stimulate borrowing and support the economy. Conversely, periods of fiscal austerity have sometimes led to increases in interest rates or reduced loan amounts, reflecting a shift in government priorities. The Health Care and Education Reconciliation Act of 2010, for instance, introduced significant changes to the student loan system, including a shift towards variable interest rates for certain loan types. These examples highlight the direct impact of government policy decisions on student loan interest rates.

Relationship Between the Federal Funds Rate and Student Loan Interest Rates

The federal funds rate, the target rate set by the Federal Reserve, indirectly influences student loan interest rates. While student loan rates aren’t directly tied to the federal funds rate, the overall market interest rate environment, influenced by the federal funds rate, plays a role. A higher federal funds rate typically leads to higher borrowing costs across the board, potentially impacting the interest rates offered on student loans, especially for variable-rate loans. Conversely, a lower federal funds rate generally leads to a lower interest rate environment, potentially resulting in lower interest rates on student loans. This relationship is not always direct or immediate, but the overall trend of market interest rates, significantly shaped by the federal funds rate, does exert influence.

Conclusion

Understanding current student loan interest rates is paramount for responsible financial planning. By carefully considering the factors influencing these rates, exploring available repayment options, and actively managing your debt, you can effectively navigate the complexities of student loan repayment and pave the way for a secure financial future. Remember to regularly review your loan terms and seek professional advice when needed.

Expert Answers

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

Can I refinance my federal student loans with a private lender?

Yes, but be aware that refinancing federal loans means losing federal protections like income-driven repayment plans.

How often do student loan interest rates change?

Interest rates for federal student loans are typically set annually and can change based on economic factors.

What happens if I don’t make my student loan payments?

Delinquency can lead to penalties, damage to your credit score, and wage garnishment.

Where can I find my current student loan interest rate?

Check your loan servicer’s website or your monthly statements.