Navigating the complexities of student loan repayment can feel overwhelming, especially when understanding the fluctuating interest rates. This guide provides a clear and concise overview of the current interest rate on unsubsidized federal student loans, shedding light on the factors that influence these rates and offering practical advice for borrowers. We’ll explore different loan types, calculate potential repayment amounts, and discuss strategies for managing your loan debt effectively.

Understanding the current interest rate is crucial for budgeting and planning your financial future. This information empowers you to make informed decisions about your loan repayment strategy, helping you minimize the overall cost of your education and avoid potential financial pitfalls. We will cover historical trends, projected changes, and resources to help you stay informed and in control of your student loan debt.

Understanding the Current Interest Rate

Unsubsidized federal student loans carry a fixed interest rate that remains consistent throughout the loan’s life. This rate is determined before the loan is disbursed and doesn’t change, unlike some variable-rate loans. Understanding this rate is crucial for borrowers to accurately budget for repayment.

The interest rate for unsubsidized federal student loans is set by Congress and is dependent on several factors. These factors influence the cost of borrowing and ultimately affect the total amount repaid over the life of the loan. The rates are typically announced each year for new loans, applying to loans disbursed during a specific federal fiscal year.

Factors Influencing Unsubsidized Loan Interest Rates

Several key elements play a role in establishing the interest rate. The most significant factor is the prevailing market interest rates. Government borrowing costs and overall economic conditions heavily influence the rates set for federal student loans. Legislative decisions also have a direct impact; Congress sets the maximum rate, and changes in policy can directly alter the rate for future borrowers. Finally, the type of loan itself plays a role; unsubsidized loans generally carry a higher interest rate compared to subsidized loans due to the inherent differences in their structure.

Historical Overview of Unsubsidized Student Loan Interest Rates

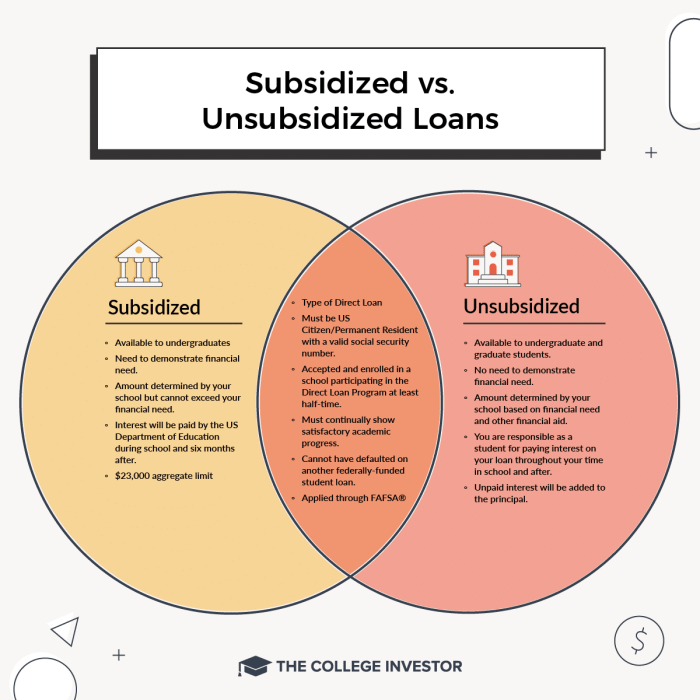

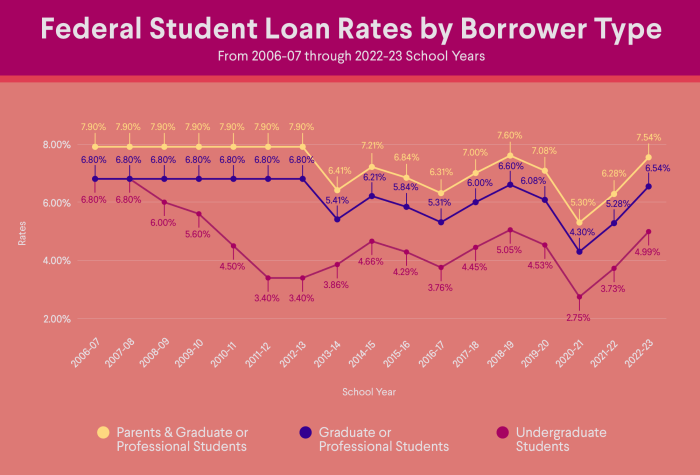

The interest rate for unsubsidized federal student loans has fluctuated over the years. While precise historical data requires consultation of official government sources, a general trend can be observed. In recent years, there’s been some variation, with rates sometimes increasing and sometimes decreasing depending on the economic climate and Congressional action. For example, rates were relatively low in some years, reflecting a period of low overall interest rates, and have risen in others due to various economic factors and legislative changes. A detailed review of historical data would reveal a more precise picture, showing the year-to-year fluctuations.

Comparison of Current Rate to Previous Years

To effectively compare the current rate to those of previous years, one needs access to the historical data published by the U.S. Department of Education or a reputable financial institution. This data will show the specific interest rate for each fiscal year. By comparing the current rate to the rates from the past several years, one can gain a perspective on the current rate’s position within the historical context. For instance, one might observe that the current rate is higher or lower than the average rate over the past decade, providing valuable context for borrowers. This comparative analysis highlights the dynamic nature of interest rates and the importance of understanding the historical trends.

Loan Types and Interest Rates

Understanding the different types of unsubsidized federal student loans and their associated interest rates is crucial for effective financial planning during and after your education. These rates fluctuate, so it’s vital to check the official Federal Student Aid website for the most up-to-date information. This section will provide a general overview and illustrate how various factors impact your overall loan cost.

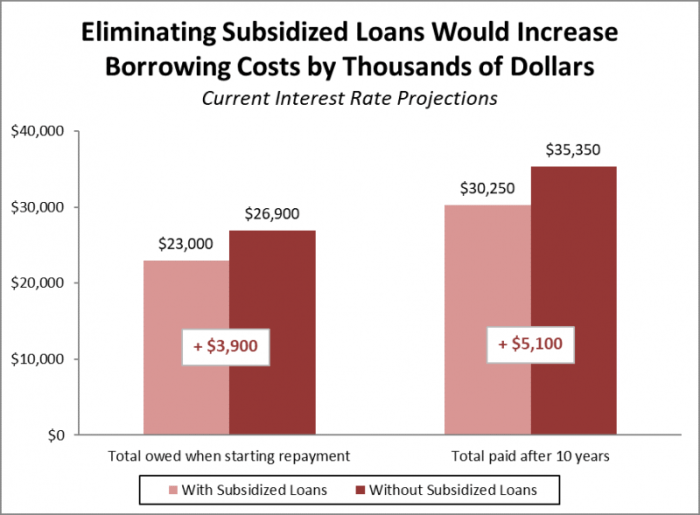

Unsubsidized federal student loans are available to undergraduate and graduate students, regardless of financial need. The key difference lies in the interest accrual: interest begins accruing immediately upon disbursement, unlike subsidized loans where interest accrual is deferred while the student is enrolled at least half-time. This difference significantly impacts the total amount you’ll eventually owe.

Undergraduate and Graduate Loan Interest Rate Differences

Interest rates for unsubsidized federal student loans differ between undergraduate and graduate programs. Generally, graduate loans tend to have higher interest rates than undergraduate loans. This reflects the higher cost of graduate education and the generally higher earning potential expected after completion. The specific rates are set annually by the government and are subject to change. For example, a recent year might show an undergraduate unsubsidized loan rate of 5.5% while a graduate unsubsidized loan carried a rate of 7%. This difference compounds over the loan repayment period, resulting in a larger total repayment for graduate loans.

Interest Capitalization and its Effect on Total Loan Cost

Interest capitalization is a critical factor influencing the total cost of your student loans. This process occurs when accrued but unpaid interest is added to the principal loan balance. This effectively increases the principal amount on which future interest is calculated, leading to a larger total loan repayment. For instance, if you don’t make interest payments while in school on an unsubsidized loan, that unpaid interest is capitalized at the end of your grace period (typically six months after graduation). This capitalization increases your principal balance, meaning you will pay interest on a larger amount during repayment. Understanding this process is key to minimizing your overall borrowing costs.

Comparison of Unsubsidized Federal Student Loan Interest Rates

The following table provides a sample comparison of interest rates for various unsubsidized federal student loan types. Remember that these rates are subject to change and should be verified with the official source before making any financial decisions. This table uses hypothetical rates for illustrative purposes only.

| Loan Type | Interest Rate (Example) | Loan Period (Example) | Capitalization |

|---|---|---|---|

| Undergraduate Unsubsidized Loan | 5.0% | 10 years | At the end of grace period |

| Graduate Unsubsidized Loan | 7.0% | 10 years | At the end of grace period |

| Parent PLUS Loan | 8.0% | 10 years | Annually, if interest is not paid |

Calculating Loan Repayment

Understanding how to calculate your monthly student loan payments and estimate your total repayment cost is crucial for effective financial planning. This section will guide you through the process, illustrating different repayment scenarios and their potential impact on your finances. We’ll use a simplified example, but remember to consult your loan servicer for precise figures related to your specific loan.

Calculating monthly payments on an unsubsidized student loan involves using an amortization formula, which considers the loan principal, interest rate, and loan term. While loan servicers provide this calculation, understanding the underlying process helps you make informed decisions. A common simplification uses a formula readily available online calculators or through your loan servicer’s website.

Loan Payment Calculation

The most common method for calculating monthly payments uses the following formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount (the initial loan amount)

- i = Monthly Interest Rate (annual interest rate divided by 12)

- n = Number of Months (loan term in years multiplied by 12)

For example, let’s assume a $20,000 unsubsidized loan with a 5% annual interest rate and a 10-year repayment term.

First, we calculate the monthly interest rate: 5% / 12 = 0.004167

Next, we calculate the number of months: 10 years * 12 months/year = 120 months

Substituting these values into the formula, we get:

M = 20000 [ 0.004167 (1 + 0.004167)^120 ] / [ (1 + 0.004167)^120 – 1]

Solving this equation (using a calculator or online amortization tool) yields a monthly payment of approximately $212.84. Remember, this is a simplified example. Your actual payment may vary based on your specific loan terms and any fees.

Repayment Plan Examples and Interest Impact

Different repayment plans significantly affect the total interest paid over the life of the loan. Choosing the right plan depends on your financial situation and repayment goals.

- Standard Repayment Plan: This plan typically involves fixed monthly payments over 10 years. While it leads to quicker repayment and less overall interest paid, the monthly payments can be higher.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years). Lower monthly payments are a benefit, but the trade-off is substantially higher total interest paid over the life of the loan.

- Graduated Repayment Plan: Payments start low and gradually increase over time. This can be helpful initially, but payments can become quite substantial later in the repayment period. Total interest paid falls somewhere between the standard and extended plans.

Estimating Total Loan Repayment Costs

Estimating total repayment costs requires a step-by-step approach:

- Determine your loan principal amount.

- Identify your annual interest rate.

- Determine your chosen repayment plan and its corresponding loan term (number of years).

- Use a loan amortization calculator (available online) to calculate your monthly payment and total interest paid over the loan’s life.

- Add the total interest paid to your principal loan amount to determine the total repayment cost.

For instance, using our previous example with the standard 10-year repayment plan, the total interest paid would be approximately $5,540.80. Adding this to the $20,000 principal, the total repayment cost would be around $25,540.80. Again, this is a simplified illustration; your actual costs will vary.

Interest Rate Changes and Their Impact

Unsubsidized student loan interest rates are not static; they fluctuate based on various economic factors. Understanding these potential changes and their impact is crucial for responsible financial planning. Borrowers need to be aware that their monthly payments and overall loan cost can significantly change depending on these fluctuations.

Interest rate changes on unsubsidized student loans are primarily influenced by broader economic conditions. The Federal Reserve’s monetary policy plays a significant role. For example, when the Fed raises the federal funds rate (the target rate banks charge each other for overnight loans), it generally leads to increased borrowing costs across the board, including student loans. Inflation also exerts pressure on interest rates; high inflation often prompts the Fed to raise rates to cool down the economy, impacting loan interest rates. Additionally, market forces, such as investor demand for government securities, influence the yield on Treasury notes, which in turn affects the index rate used to calculate student loan interest rates.

Economic Factors Influencing Interest Rate Changes

Several economic factors contribute to the variability of unsubsidized student loan interest rates. The most prominent is the Federal Reserve’s monetary policy. When the economy is overheating, characterized by high inflation and low unemployment, the Fed typically raises interest rates to curb economic activity. Conversely, during economic downturns or recessions, the Fed may lower interest rates to stimulate borrowing and investment. This “tightening” or “loosening” of monetary policy directly impacts the cost of borrowing, affecting student loan rates. Government borrowing also plays a part; increased government borrowing can push up interest rates across the board, including student loan rates, due to increased competition for funds. Global economic events can also have an indirect impact. For example, a global financial crisis could lead to increased risk aversion among investors, potentially increasing borrowing costs for all borrowers, including student loan borrowers.

Preparing for Potential Interest Rate Increases

Proactive measures can help borrowers mitigate the impact of potential interest rate increases. One strategy is to explore refinancing options if rates fall below the current rate of the loan. Refinancing can lock in a lower interest rate for a fixed period, protecting against future increases. Another approach is to make extra principal payments whenever possible. Paying down the loan principal faster reduces the amount of interest accrued over the life of the loan, minimizing the overall cost even if rates rise. Budgeting and financial planning are essential. Creating a realistic budget that includes loan repayments, even with a potential rate increase, helps borrowers stay on track and avoid falling behind on payments. Finally, monitoring interest rate trends and understanding the factors that influence them can allow borrowers to anticipate potential changes and adjust their repayment strategies accordingly. This might involve adjusting spending habits or increasing income to accommodate higher payments.

Impact of Interest Rate Fluctuations on Long-Term Repayment

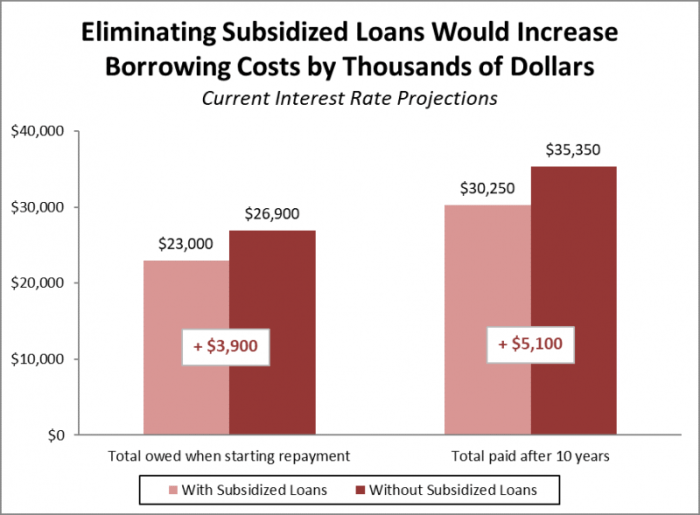

Fluctuations in interest rates significantly impact the long-term cost of unsubsidized student loans. Even small changes in interest rates can compound over the loan’s lifespan, leading to substantial differences in total repayment amounts. For instance, a 1% increase in the interest rate on a $50,000 loan over 10 years could translate to thousands of dollars in additional interest paid over the life of the loan. This impact is amplified by the loan’s term; longer repayment periods magnify the effect of interest rate changes. Therefore, understanding the potential for rate increases is crucial for borrowers to make informed decisions about loan repayment strategies and to adequately plan for potential financial burdens. For example, a borrower might choose to accelerate repayment to minimize the impact of a potential rate hike, or they might explore income-driven repayment plans to manage their payments more effectively if rates increase significantly.

Resources and Further Information

Understanding where to find reliable information about student loan interest rates is crucial for responsible financial planning. Several trustworthy sources offer detailed and up-to-date information, empowering borrowers to make informed decisions about their loans. These sources range from government agencies directly involved in loan administration to reputable financial institutions offering independent analysis and advice.

Reliable sources for obtaining current interest rate information possess several key characteristics. Government websites, for example, provide official and unbiased data, ensuring accuracy and transparency. Reputable financial institutions, on the other hand, often offer detailed analyses and comparisons of different loan options, helping borrowers navigate the complexities of the student loan market. These institutions usually base their information on publicly available data from government sources and their own internal research, but always double-check the source and date of their information. Look for sites with clear disclosure statements and contact information.

Government Websites and Their Information

Official government websites dedicated to student aid offer comprehensive details on student loan interest rates. This information typically includes the current interest rates for various federal loan programs, such as subsidized and unsubsidized Stafford loans, PLUS loans, and Grad PLUS loans. These sites usually provide interest rate information broken down by loan type and the loan disbursement year. Additionally, they often include historical interest rate data, allowing borrowers to track changes over time. Explanations of how interest rates are determined, including factors influencing rate changes, are usually provided, as well as details on repayment plans and their associated interest calculations.

Government Agencies and Their Roles

The following is a list of key government agencies involved in managing student loan interest rates and their respective roles:

- The U.S. Department of Education (ED): The ED oversees federal student aid programs, sets the interest rates for federal student loans, and manages the overall administration of these programs.

- The Federal Student Aid (FSA): FSA, a part of the ED, is responsible for the day-to-day operation of federal student aid programs, including the disbursement of loans and the management of loan repayment. They also provide resources and information to borrowers.

- The National Student Loan Data System (NSLDS): NSLDS is a database that provides access to student loan information to borrowers, lenders, and schools. While not directly involved in setting interest rates, it provides a centralized source of information regarding loan details, including the interest rate associated with each loan.

Key Advice for Borrowers

Understanding your loan’s interest rate is crucial for effective repayment planning. Explore different repayment options to find one that suits your budget and minimizes the total interest paid. Consider income-driven repayment plans if you’re facing financial hardship. Prioritize paying down high-interest loans first to save money in the long run. Regularly review your loan details and stay informed about any changes in interest rates or repayment plans.

End of Discussion

Successfully managing unsubsidized student loans requires a proactive approach to understanding the interest rates and available repayment options. By carefully considering the information presented, including the factors that influence interest rates, and exploring various repayment plans, borrowers can effectively plan for their financial future. Remember to utilize the resources available from government agencies and reputable financial institutions to stay informed and make informed decisions about your student loan repayment strategy.

Clarifying Questions

What is the difference between subsidized and unsubsidized student loans?

Subsidized loans have interest paid by the government while you’re in school (under certain conditions), while unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my unsubsidized student loans?

Yes, refinancing may offer a lower interest rate, but it often involves private lenders and may eliminate federal protections.

What happens if I don’t make my student loan payments?

Defaulting on your loan can result in serious consequences, including damage to your credit score, wage garnishment, and tax refund offset.

Where can I find my current loan interest rate?

Check your loan servicer’s website or your federal student aid account on studentaid.gov.

How often do unsubsidized student loan interest rates change?

The rates are typically set annually by the government and may change based on economic factors.