Navigating the complex landscape of student loan financing requires a clear understanding of current interest rates. This guide delves into the intricacies of both federal and private student loans, examining the factors that influence rates and providing crucial information to help borrowers make informed decisions. We’ll explore various loan types, repayment plans, and the impact of credit scores, equipping you with the knowledge to secure the most favorable terms possible.

From understanding the differences between subsidized and unsubsidized federal loans to comparing the offerings of various private lenders, we aim to demystify the process and empower you to take control of your student loan debt. We’ll also provide resources to help you find the most up-to-date interest rate information available.

Understanding Current Student Loan Rates

Navigating the world of student loans can be complex, particularly when understanding the various interest rates involved. This section clarifies the different types of federal student loans and the factors that influence their interest rates, providing a clear picture of the current landscape.

Federal Student Loan Types and Interest Rates

Federal student loans are offered through various programs, each with its own interest rate structure. These rates are set annually by the government and are generally lower than private loan rates. Key loan types include subsidized and unsubsidized loans for undergraduates and graduates, as well as PLUS loans for parents and graduate students. Subsidized loans typically offer lower interest rates because the government pays the interest while the student is in school (under certain conditions), whereas unsubsidized loans accrue interest from the time the loan is disbursed. PLUS loans often have higher interest rates than other federal loan types. It’s crucial to understand these distinctions to make informed borrowing decisions.

Factors Influencing Student Loan Interest Rates

Several factors determine the specific interest rate a borrower receives. The loan type is a primary determinant, as previously mentioned. Additionally, the interest rate can vary depending on whether the loan is for undergraduate or graduate studies, with graduate loans often carrying slightly higher rates. While credit history isn’t a factor for federal student loans (except for PLUS loans, which require a credit check), it can significantly impact private student loan rates. Finally, the repayment plan chosen can indirectly affect the overall cost of the loan, although it doesn’t directly change the interest rate itself. Longer repayment plans mean more interest paid over the life of the loan.

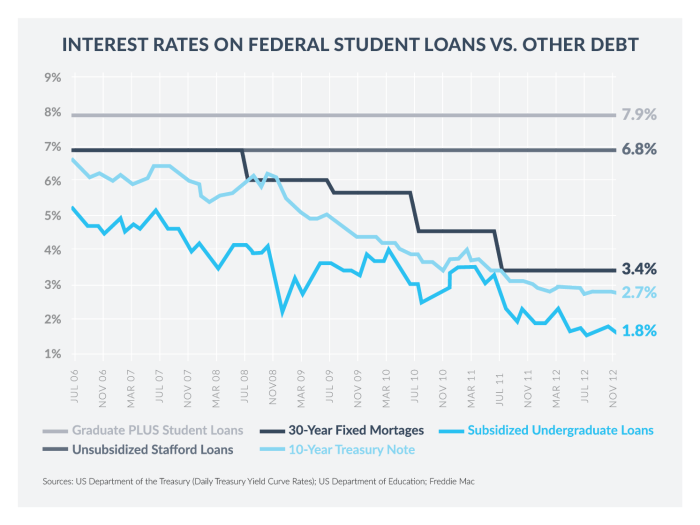

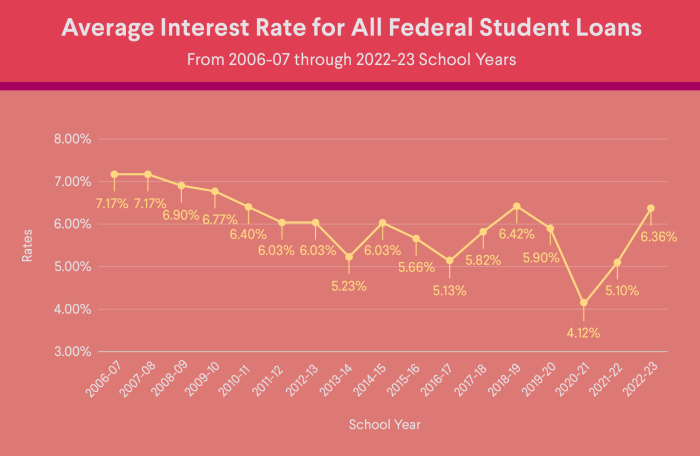

Comparison of Current Federal Student Loan Interest Rates

Precise interest rates for federal student loans fluctuate annually. Therefore, it’s essential to consult the official Federal Student Aid website for the most up-to-date information. However, a general comparison can illustrate the typical range. For example, in a recent year, unsubsidized undergraduate loans might have ranged from 4.99% to 6.54%, while graduate unsubsidized loans could have been slightly higher. PLUS loans typically carry a higher interest rate, reflecting the higher risk associated with these loans. It’s important to note that these figures are illustrative and subject to change.

Undergraduate vs. Graduate Loan Interest Rates

The following table provides a hypothetical comparison of interest rates for undergraduate and graduate federal student loans. Remember that these rates are examples and may not reflect current rates. Always check the official Federal Student Aid website for the most current information.

| Loan Type | Undergraduate Rate (Example) | Graduate Rate (Example) | Notes |

|---|---|---|---|

| Subsidized | 4.5% | 5.0% | Interest does not accrue while in school (under specific conditions). |

| Unsubsidized | 5.5% | 6.0% | Interest accrues from disbursement. |

| PLUS | 7.0% | 7.5% | Higher rate due to credit check and higher risk. |

Private Student Loan Rates

Private student loans offer an alternative funding source for higher education, but understanding their interest rates is crucial before borrowing. Unlike federal loans, which have rates set by the government, private loan rates are determined by a complex interplay of factors specific to each lender and the borrower. This makes comparing options and understanding the potential costs essential.

Private student loan interest rates are influenced by several key factors. Creditworthiness is paramount; borrowers with strong credit histories and high credit scores generally qualify for lower rates. The loan term also plays a role; longer repayment periods often come with higher interest rates to compensate the lender for the extended risk. The amount borrowed can influence rates as well; larger loan amounts might carry slightly higher rates due to increased risk for the lender. Finally, the prevailing economic conditions, including prevailing interest rates in the broader financial market, significantly impact the rates offered by private lenders. Lenders adjust their rates to reflect their cost of borrowing and their assessment of the risk associated with each loan application.

Comparison of Private Student Loan Interest Rates

Several major private student loan lenders exist, each offering a range of interest rates. It’s impossible to provide exact, up-to-the-minute rates here, as these fluctuate constantly. However, we can illustrate the general range and factors influencing those rates. For example, a borrower with excellent credit might secure a rate from one lender in the range of 6-8%, while a borrower with less-than-perfect credit might face rates of 10-14% or even higher, depending on the lender’s risk assessment and the specific loan terms. Differences in rates between lenders reflect their varying risk tolerance and business models. Some lenders may focus on borrowers with strong credit profiles, offering lower rates to this segment, while others may cater to a broader range of creditworthiness, resulting in a wider range of interest rates.

Benefits and Drawbacks of Private Student Loans Compared to Federal Loans

Private student loans can offer larger loan amounts in some cases than federal loans, potentially covering the full cost of tuition and living expenses. However, they lack many of the consumer protections offered by federal loans. Federal loans typically offer income-driven repayment plans, deferment options, and forgiveness programs in certain circumstances. Private loans generally do not provide these benefits, and defaulting on a private loan can have severe consequences, including damage to credit scores and potential legal action. The interest rates on private loans are often higher than those on federal loans, especially for borrowers with less-than-perfect credit. Furthermore, private loan applications often require a co-signer with good credit, adding another layer of complexity to the borrowing process.

Key Differences Between Federal and Private Student Loan Interest Rates and Terms

Understanding the key distinctions between federal and private student loans is vital for making informed borrowing decisions. Below is a summary of these crucial differences:

- Interest Rates: Federal student loan interest rates are generally lower and fixed, while private loan interest rates are often higher and can be variable or fixed, depending on the lender and the borrower’s creditworthiness.

- Repayment Plans: Federal loans offer various income-driven repayment plans, deferment options, and forgiveness programs, while private loans typically offer fewer repayment options and less flexibility.

- Loan Fees: Federal loans typically have lower or no origination fees, whereas private loans often involve origination fees and other charges that can increase the overall cost of borrowing.

- Credit Requirements: Federal loans generally have less stringent credit requirements, while private loans often require a good credit history or a co-signer.

- Borrower Protections: Federal loans provide greater borrower protections, including specific regulations on collection practices and debt relief options, whereas private loans offer fewer protections.

Repayment Plans and Their Impact on Rates

Choosing the right repayment plan for your federal student loans significantly impacts the total amount you’ll pay over the life of the loan. Different plans offer varying monthly payment amounts and repayment periods, directly influencing the total interest accrued. Understanding these nuances is crucial for effective financial planning.

Understanding the various federal student loan repayment plans and their effects on total interest paid is essential for borrowers. The optimal plan depends on individual financial circumstances and long-term goals. While some plans offer lower monthly payments, they often result in higher total interest paid over the loan’s lifespan. Conversely, plans with higher monthly payments generally lead to lower overall interest costs.

Federal Student Loan Repayment Plan Comparison

The following Artikels several common federal student loan repayment plans, categorized by their impact on the total interest paid, from lowest to highest. It’s important to note that these are generalizations, and the actual impact will depend on individual loan amounts, interest rates, and income.

| Repayment Plan | Monthly Payment | Total Interest Paid | Description |

|---|---|---|---|

| Standard Repayment Plan | Fixed, typically higher | Lowest | Fixed monthly payments over 10 years. This plan results in the lowest total interest paid due to its shorter repayment period. For example, a $30,000 loan at 5% interest would have a significantly lower total interest cost compared to other plans. |

| Graduated Repayment Plan | Starts low, gradually increases | Moderate | Payments start low and increase every two years. While initially more manageable, the increasing payments and longer repayment period result in higher overall interest costs. A similar $30,000 loan at 5% would see a higher total interest burden compared to the Standard plan, but lower than income-driven plans. |

| Extended Repayment Plan | Lower, longer repayment period | High | Offers longer repayment terms (up to 25 years), resulting in lower monthly payments. However, this significantly increases the total interest paid over the life of the loan. The same $30,000 loan example would show a substantial increase in total interest due to the extended repayment period. |

| Income-Driven Repayment (IDR) Plans | Based on income and family size | Highest (potentially) | Payments are calculated based on your discretionary income and family size. While monthly payments are typically lower, the extended repayment period (often 20-25 years) can lead to significantly higher total interest paid. For instance, a borrower with a low income might see very low monthly payments, but pay considerably more in interest over the long term than with the Standard plan. Specific IDR plans include ICR, PAYE, REPAYE, and IBR. |

Impact of Income-Driven Repayment Plans

Income-driven repayment (IDR) plans significantly affect both monthly payments and overall interest paid. These plans are designed to make student loan repayment more manageable for borrowers with lower incomes. However, this affordability comes at a cost: the longer repayment periods often lead to a substantially higher total interest paid compared to other repayment plans. For example, a borrower with a low income might see their monthly payment reduced to a few hundred dollars under an IDR plan, but end up paying tens of thousands of dollars more in interest over the life of the loan than they would have under a standard repayment plan. The forgiveness aspect of some IDR plans after 20-25 years should also be considered; however, this forgiveness is often taxed as income.

Factors Affecting Individual Loan Rates

Securing a student loan involves more than just the amount you borrow; the interest rate significantly impacts the overall cost. Several factors influence the interest rate you’ll receive, ultimately determining how much you’ll pay back over the loan’s lifespan. Understanding these factors empowers borrowers to make informed decisions and potentially secure more favorable terms.

Your creditworthiness plays a crucial role in determining your eligibility for lower interest rates. Lenders assess your credit history to gauge your risk as a borrower. A strong credit history, demonstrated by responsible credit management, often translates to lower rates, reflecting the lender’s confidence in your ability to repay the loan. Conversely, a poor credit history increases your perceived risk, leading to higher interest rates.

Credit Score’s Influence on Interest Rates

A borrower’s credit score is a primary factor determining the interest rate offered on student loans, particularly private student loans. Lenders use credit scores (like FICO scores) to assess the likelihood of repayment. Individuals with higher credit scores are considered lower-risk borrowers, making them eligible for lower interest rates. This is because lenders believe these individuals are more likely to repay their loans on time, minimizing the lender’s risk of loss. Conversely, borrowers with lower credit scores are viewed as higher-risk borrowers, leading to higher interest rates to compensate for the increased risk of default.

The Role of Co-signers in Securing Lower Rates

A co-signer acts as a guarantor on a loan, assuming responsibility for repayment should the primary borrower default. The inclusion of a co-signer with a strong credit history significantly improves the borrower’s chances of securing a lower interest rate. The lender considers the co-signer’s creditworthiness alongside the borrower’s, effectively mitigating the risk. This allows borrowers with limited or damaged credit histories to access loans with more favorable terms, often at significantly lower interest rates than they would receive without a co-signer.

Examples of Credit Score and Interest Rate Correlation

Let’s illustrate the impact of credit scores on interest rates with hypothetical examples. Assume a private student loan with a principal amount of $10,000.

| Credit Score Range | Approximate Interest Rate |

|---|---|

| 750-850 (Excellent) | 4.5% – 6.0% |

| 680-749 (Good) | 6.5% – 8.0% |

| 620-679 (Fair) | 8.5% – 10.0% |

| Below 620 (Poor) | 10.0% + or Loan Denial |

*Note: These are illustrative examples and actual rates vary depending on lender, loan terms, and other factors.*

Visual Representation of Credit Score and Interest Rate Relationship

The relationship between credit score and interest rate can be depicted as an inverse relationship.

“`

Interest Rate (%)

^

| /

| /

| /

| /

| /

| /

——-+——————-> Credit Score

/ \

/ \

/ \

/ \

/ \

/ \

V

“`

This visual representation shows that as the credit score increases (moves to the right), the interest rate decreases (moves down). The slope reflects the generally inverse relationship, although the exact relationship is not linear and varies among lenders.

Resources for Finding Current Rate Information

Finding accurate and up-to-date information on student loan interest rates is crucial for making informed borrowing decisions. Understanding where to look and how to interpret the data can significantly impact your financial planning. This section Artikels reliable resources and steps to help you navigate this process effectively.

Several government websites and reputable financial institutions provide current student loan rate information. However, the specific rates you qualify for will depend on your creditworthiness, the type of loan, and the lender. It’s important to remember that these resources provide general information and estimates; your actual rate may vary.

Reliable Resources for Student Loan Rate Information

The following table lists reliable websites and government resources that offer information on student loan interest rates. The reliability rating is a subjective assessment based on the reputation of the source and the clarity of the information provided. Always verify information from multiple sources before making any financial decisions.

| Resource Name | URL | Type of Information Provided | Reliability Rating |

|---|---|---|---|

| Federal Student Aid (FSA) | studentaid.gov | Information on federal student loan interest rates, repayment plans, and borrowing limits. | High |

| National Education Association (NEA) | nea.org | Resources and articles on student loan debt, including information on interest rates and repayment options. While not directly providing rates, they link to reliable sources. | Medium |

| Individual Lenders’ Websites (e.g., Sallie Mae, Discover, etc.) | (Vary by lender) | Information on private student loan interest rates, terms, and eligibility requirements. | Medium |

| Consumer Financial Protection Bureau (CFPB) | consumerfinance.gov | General information on student loans, debt management, and consumer rights, including resources to compare lenders and interest rates. | High |

| The Institute for College Access & Success (TICAS) | ticas.org | Research and data on student loan debt, including trends in interest rates and repayment challenges. This is more of an analytical resource rather than a direct rate provider. | High |

Steps to Find Personalized Interest Rate Estimates

While precise interest rates can only be determined through a formal loan application, you can obtain personalized estimates by using the resources listed above. The process generally involves providing some personal information, such as your credit score, income, and the type of loan you are seeking. Remember, these are estimates, and your final rate may differ.

For example, visiting a lender’s website and using their loan calculator will require inputting details like the loan amount, your credit score (if known), and the loan term. This will generate a personalized rate estimate. Similarly, exploring the resources on the FSA website can provide an understanding of the range of federal loan interest rates available based on the loan type and your eligibility.

Wrap-Up

Securing favorable student loan rates is a crucial step in managing your educational financing. By understanding the factors influencing interest rates, exploring different loan options, and utilizing available resources, you can make informed choices that minimize your long-term financial burden. Remember to carefully compare offers, consider your repayment options, and proactively manage your credit to achieve the best possible outcome. This knowledge empowers you to navigate the complexities of student loan repayment with confidence and financial stability.

Helpful Answers

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but it often involves switching from a federal loan to a private loan, which may have less favorable protections.

How often do student loan interest rates change?

Federal student loan interest rates are typically set annually and may vary based on the loan type and program. Private loan rates are determined by the lender and can change more frequently.

What is a cosigner, and how does it affect my loan rate?

A cosigner is someone who agrees to repay your loan if you can’t. Having a cosigner with good credit can significantly improve your chances of securing a lower interest rate.