Navigating the complex world of student loan refinancing can feel overwhelming. Understanding current interest rates, eligibility criteria, and the potential benefits and drawbacks is crucial for making informed decisions. This guide explores the intricacies of refinancing your student loans, empowering you to make the best choices for your financial future.

From comparing federal and private loan rates to analyzing the impact on your credit score, we’ll provide a comprehensive overview. We’ll also delve into choosing the right lender, navigating the application process, and managing your loans post-refinancing. Our goal is to equip you with the knowledge necessary to confidently approach the student loan refinance process.

Understanding Current Student Loan Rates

Navigating the world of student loan refinancing can feel overwhelming, but understanding the factors that influence interest rates is crucial for securing the best possible terms. This section will clarify the key elements involved in determining your student loan interest rate, highlighting the differences between federal and private loans, and comparing fixed versus variable rate options.

Factors Influencing Student Loan Interest Rates

Several factors contribute to the interest rate you’ll receive on your student loan. Credit score is a major determinant; a higher credit score typically translates to a lower interest rate. Your debt-to-income ratio (DTI) also plays a significant role, as lenders assess your ability to repay the loan. The loan term itself influences the rate; longer terms often come with higher rates due to increased risk for the lender. Finally, the prevailing economic climate and market conditions impact overall interest rates, affecting both federal and private loan offerings. Lenders also consider your income and employment history to gauge your repayment reliability.

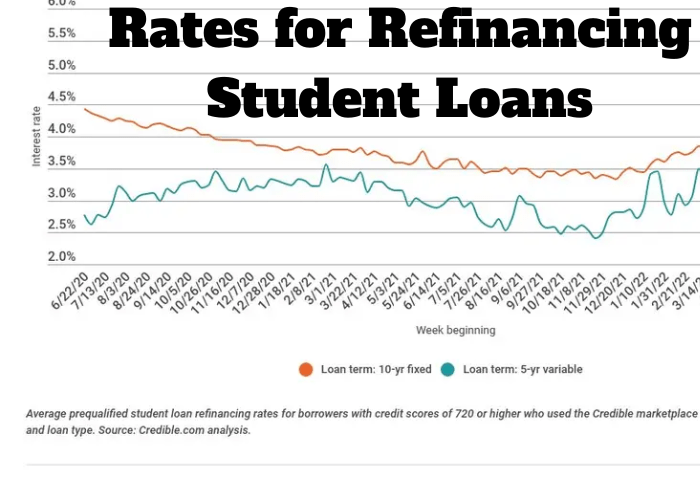

Federal vs. Private Student Loan Rates

Federal student loans are offered by the government and generally have more favorable terms and protections for borrowers. Interest rates on federal loans are set by the government and tend to be lower than those offered by private lenders. Federal loans also often come with income-driven repayment plans and options for loan forgiveness programs, which are not always available with private loans. Private student loans, on the other hand, are offered by banks and credit unions and have rates that vary widely depending on the borrower’s creditworthiness and the lender’s policies. These rates are typically influenced by market conditions and the lender’s assessment of risk.

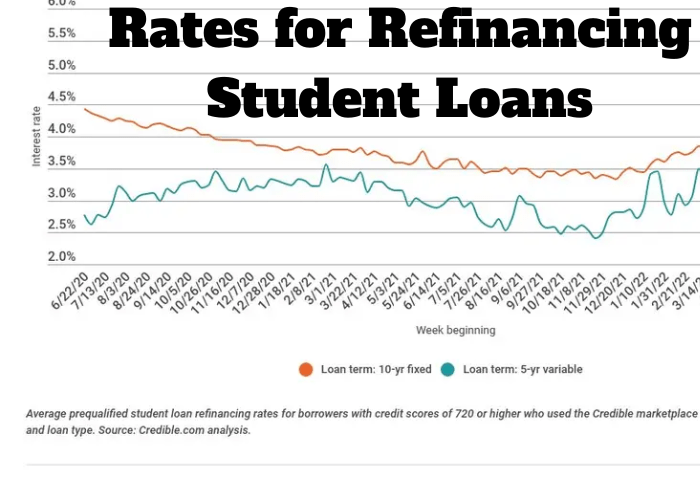

Fixed vs. Variable Interest Rates for Student Loans

Choosing between a fixed and variable interest rate is a crucial decision. A fixed interest rate remains constant throughout the loan term, providing predictability and stability in your monthly payments. While this predictability offers peace of mind, fixed rates may be slightly higher than variable rates at the outset. Conversely, a variable interest rate fluctuates based on market indices like the prime rate or LIBOR. Variable rates might offer a lower initial interest rate, but they carry the risk of increasing over time, potentially leading to higher monthly payments. The choice depends on your risk tolerance and financial outlook; a fixed rate is generally preferred for those prioritizing stability.

Average Interest Rates from Various Lenders

The following table presents average interest rates from various lenders. Remember that these are averages and your actual rate will depend on your individual circumstances. It’s crucial to shop around and compare offers from multiple lenders before making a decision.

| Lender | Average Fixed Rate (36-month loan) | Average Variable Rate (36-month loan) | Minimum Credit Score Requirement (Example) |

|---|---|---|---|

| Lender A | 6.5% | 5.5% – 7.5% (Variable) | 680 |

| Lender B | 7.0% | 6.0% – 8.0% (Variable) | 660 |

| Lender C | 6.8% | 5.8% – 7.8% (Variable) | 700 |

| Lender D | 7.2% | 6.2% – 8.2% (Variable) | 650 |

Refinance Eligibility Criteria

Successfully refinancing your student loans hinges on meeting specific eligibility requirements set by lenders. These criteria are designed to assess your creditworthiness and ability to repay the refinanced loan. Understanding these requirements is crucial to increasing your chances of approval and securing a favorable interest rate.

Lenders evaluate several key factors to determine your eligibility. The most significant are your credit score, income, and debt-to-income ratio. Meeting the minimum requirements for each is essential, but exceeding them can significantly improve your chances of securing a competitive refinance offer.

Credit Score Requirements

A strong credit score is paramount for student loan refinancing. Lenders generally prefer applicants with credit scores above 660, though some may accept lower scores depending on other factors in your financial profile. A higher credit score often translates to better interest rates and more favorable loan terms. For example, an applicant with a 750 credit score might qualify for a significantly lower interest rate than someone with a 670 score. A low credit score, on the other hand, might lead to loan rejection or higher interest rates to compensate for the increased risk to the lender. It’s important to check your credit report for accuracy before applying.

Income Requirements

Lenders require proof of sufficient income to ensure you can comfortably make your monthly loan payments. The specific income requirements vary depending on the lender and the loan amount you’re seeking to refinance. Generally, lenders want to see a consistent income stream that demonstrates your ability to manage your debt responsibly. Self-employed individuals may need to provide additional documentation, such as tax returns, to verify their income. The lender will assess your income relative to your existing debt and the amount you’re applying to refinance.

Debt-to-Income Ratio Impact

Your debt-to-income (DTI) ratio is a crucial factor in refinance approval. This ratio represents the percentage of your gross monthly income that goes towards paying your debts. A lower DTI ratio indicates a lower risk to the lender. Lenders typically prefer applicants with a DTI ratio below 43%, although this can vary. A high DTI ratio may signal to lenders that you’re already heavily burdened with debt, making it less likely that you’ll be able to manage additional debt from a refinanced loan. For example, an applicant with a DTI ratio of 55% may find it difficult to refinance, whereas someone with a DTI of 30% would likely have a much easier time.

Reasons for Refinance Application Rejection

Several reasons can lead to a student loan refinance application being rejected. These often include a low credit score, insufficient income, a high DTI ratio, incomplete or inaccurate application information, or a history of late payments. Some lenders may also have specific restrictions on the types of loans they will refinance, such as only accepting federal loans or loans from specific institutions. Understanding these potential reasons can help applicants prepare a strong application and improve their chances of approval. Reviewing your credit report, improving your DTI ratio, and ensuring the accuracy of your application are crucial steps in preventing rejection.

Benefits and Drawbacks of Refinancing

Refinancing your student loans can be a significant financial decision with the potential to offer substantial savings or introduce unforeseen complications. Understanding the advantages and disadvantages is crucial before proceeding. This section will Artikel the potential benefits and drawbacks, providing a clear picture to help you make an informed choice.

Refinancing student loans primarily aims to reduce your overall borrowing cost. This is achieved by securing a lower interest rate than your current loans, leading to lower monthly payments and faster loan payoff. However, refinancing also involves certain risks that need careful consideration.

Lower Interest Rates and Monthly Payments

A primary benefit of refinancing is the potential for significantly lower interest rates. Many private lenders offer interest rates below those of federal student loans, especially in a low-interest-rate environment. This translates directly into lower monthly payments, freeing up more of your budget for other financial priorities. For example, an individual with $50,000 in federal loans at 6% interest might find a refinance option at 4%, resulting in a considerable reduction in their monthly payment and total interest paid over the loan’s lifetime. The exact amount saved depends on the original loan terms, the new interest rate, and the new loan term.

Loss of Federal Loan Benefits

A significant drawback of refinancing is the loss of federal student loan benefits. Federal loans often come with protections such as income-driven repayment plans, loan forgiveness programs (e.g., Public Service Loan Forgiveness), and deferment or forbearance options during financial hardship. Refinancing with a private lender typically eliminates these benefits. This means if your financial circumstances change, you may lose the flexibility and safety net provided by federal programs.

Long-Term Cost Savings Comparison

The long-term cost savings of refinancing depend heavily on the interest rate difference between your current loans and the refinance offer, and the length of the new loan term. While a lower monthly payment might seem attractive, extending the loan term can increase the total interest paid over time. For instance, refinancing a $30,000 loan at 7% over 10 years will cost significantly less in total interest than refinancing the same loan at 5% over 15 years, despite the lower monthly payments in the latter scenario. Careful calculation of the total interest paid is essential to determine the true cost savings.

Financial Impact Scenario

Let’s consider two scenarios for a $40,000 student loan:

Scenario 1: Current loan at 7% interest, 10-year repayment term. Estimated monthly payment: $466. Total interest paid: approximately $15,840.

Scenario 2: Refinanced loan at 4% interest, 10-year repayment term. Estimated monthly payment: $396. Total interest paid: approximately $9,480.

In this example, refinancing results in a monthly payment savings of $70 and a total interest savings of approximately $6,360. However, if the refinance was at 4% interest but over a 15-year term, the monthly payment would decrease further, but the total interest paid would likely increase significantly, potentially negating some or all of the initial savings. A thorough comparison of total interest paid across different scenarios is crucial before making a decision.

Choosing a Refinance Lender

Choosing the right lender for your student loan refinance is crucial, as it directly impacts your interest rate, fees, and overall repayment experience. A thorough comparison of lenders is essential to secure the best possible terms. This section will guide you through the process of selecting a reputable lender and comparing their offers.

Lender Comparison: Rates, Fees, and Customer Service

Several major lenders offer student loan refinancing, each with varying rates, fees, and customer service levels. Direct comparison is key. For example, SoFi and Earnest are known for competitive rates and user-friendly online platforms. However, their fees might differ, and customer service experiences can vary based on individual circumstances. Lenders like PenFed Credit Union often cater to specific groups (like military personnel) and may offer unique benefits or rates. It’s important to check the fine print for details on origination fees, prepayment penalties, and any other associated charges. Customer service reviews, available on sites like the Better Business Bureau, can provide valuable insights into the responsiveness and helpfulness of each lender.

Selecting a Reputable and Trustworthy Lender

Identifying a reputable lender involves verifying their licensing and accreditation. Look for lenders registered with your state’s financial regulatory authorities. Check online reviews and ratings from independent sources to gauge the experiences of other borrowers. Pay close attention to complaints regarding hidden fees, unresponsive customer service, or difficulties in the loan modification process. A lender’s transparency in their terms and conditions is also a significant indicator of trustworthiness. Avoid lenders who make unrealistic promises or pressure you into making quick decisions. A thorough due diligence process will help mitigate the risks associated with choosing a lender.

Questions to Ask Potential Lenders

Before committing to a refinance, gather essential information from potential lenders. This includes detailed inquiries about interest rates, including fixed versus variable options, and the associated fees. Clarify the lender’s eligibility criteria and the required documentation. Understand the loan repayment terms, including the length of the repayment period and the available payment options. Inquire about the lender’s customer service channels and their responsiveness to borrower inquiries. Finally, ask about the lender’s process for handling loan modifications or hardship situations. A comprehensive understanding of these aspects will allow for a well-informed decision.

Comparing Loan Offers: A Sample Calculation

Let’s compare two hypothetical loan offers to illustrate the importance of detailed analysis. Suppose you have a $30,000 student loan balance.

Lender A offers a 5% fixed interest rate for a 10-year loan with a $500 origination fee.

Lender B offers a 5.5% fixed interest rate for a 10-year loan with no origination fee.

To determine the better option, calculate the total cost of each loan.

Using a loan calculator (many are available online), the total repayment cost for Lender A would be approximately $36,686.44 ($30,000 + $500 origination fee + interest). For Lender B, the total repayment cost would be approximately $38,161.20 ($30,000 + interest).

In this example, despite the higher interest rate, Lender A is slightly cheaper due to the absence of an origination fee. However, this is a simplified example, and other factors, such as your financial situation and risk tolerance, might influence your decision. Always use a loan calculator to compare the total cost of loans over their lifespan, including all fees and interest.

The Refinance Application Process

Refinancing your student loans can significantly reduce your monthly payments and overall interest paid, but navigating the application process requires careful preparation and understanding. The process generally involves several key steps, from gathering necessary documentation to final loan approval. Understanding these steps will help you streamline the process and increase your chances of securing a favorable refinance rate.

The application process for student loan refinancing typically involves submitting a comprehensive application, providing supporting documentation, undergoing a credit check, and finally, receiving a loan offer. Lenders assess your creditworthiness, income, and debt-to-income ratio to determine your eligibility and the interest rate they offer. The entire process can take several weeks, depending on the lender and the complexity of your application.

Required Documentation

Gathering the necessary documentation upfront is crucial for a smooth and efficient application process. Missing documents can delay the process considerably. Lenders typically require proof of identity, income verification, and details about your existing student loans.

- Proof of Identity: This usually includes a government-issued ID, such as a driver’s license or passport.

- Income Verification: You’ll need to provide documentation such as pay stubs, tax returns, or W-2 forms to demonstrate your income stability.

- Student Loan Details: This includes your loan servicer’s name, loan amounts, interest rates, and account numbers for all the federal and private student loans you wish to refinance.

- Credit Report: While lenders will typically pull your credit report, providing a copy of your own credit report can expedite the process and allow you to identify any potential errors.

Improving Chances of Approval

Several factors influence a lender’s decision to approve your refinance application. A strong credit score, stable income, and a low debt-to-income ratio significantly increase your chances of approval and securing a favorable interest rate.

- High Credit Score: Aim for a credit score above 700 to qualify for the best rates. Check your credit report regularly and address any errors.

- Stable Income: Demonstrate a consistent income stream through pay stubs or tax returns. A steady employment history strengthens your application.

- Low Debt-to-Income Ratio: Keep your debt-to-income ratio (DTI) as low as possible. This is calculated by dividing your monthly debt payments by your gross monthly income. A lower DTI indicates lower risk to the lender.

- Co-Signer (If Necessary): If your credit score or income is insufficient, consider a co-signer with a strong credit history to improve your chances of approval.

Step-by-Step Application Guide

Following a structured approach can significantly simplify the refinance application process. Be sure to carefully review each lender’s requirements and follow their instructions diligently.

- Research and Compare Lenders: Compare rates, fees, and repayment terms from multiple lenders to find the best option for your financial situation.

- Pre-Qualify: Most lenders offer a pre-qualification process that allows you to check your eligibility without impacting your credit score.

- Gather Documentation: Collect all the necessary documentation as Artikeld above.

- Complete the Application: Carefully complete the online application form, ensuring accuracy in all provided information.

- Submit Application and Documentation: Submit your completed application and all required documents electronically.

- Loan Approval and Disbursement: Once your application is approved, the lender will disburse the funds to pay off your existing student loans.

Impact of Refinancing on Credit Score

Refinancing your student loans can have a noticeable impact on your credit score, both positive and negative. The overall effect depends on several factors, including your current credit history, the terms of your new loan, and how you manage the process. Understanding these potential impacts allows you to make informed decisions and mitigate any negative consequences.

Refinancing typically involves a hard credit inquiry, which temporarily lowers your score. However, a lower interest rate and improved repayment terms can ultimately lead to a higher score over time. The key is to carefully manage the process to minimize the negative impact while maximizing the positive benefits.

Hard Inquiries and Their Impact

A hard inquiry occurs when a lender checks your credit report to assess your creditworthiness. Each hard inquiry slightly lowers your credit score, typically by a few points. Multiple hard inquiries within a short period can have a more significant impact. When refinancing, a hard inquiry is unavoidable as lenders need to verify your credit history. However, shopping around for the best rates within a short timeframe (typically 14-45 days) is considered a single inquiry by many credit scoring models, mitigating this negative effect. For example, applying to three lenders within a two-week period might only result in one hard inquiry on your credit report, depending on the scoring model used.

Impact of New Credit Account

Opening a new loan, even with better terms, is considered a new credit account. This affects your credit utilization ratio (the percentage of available credit you are using) and your average age of accounts. While a lower interest rate is beneficial, a shorter repayment period can temporarily increase your credit utilization if the monthly payment is significantly higher. For instance, if you refinance a $50,000 loan with a 10-year repayment term to a $50,000 loan with a 5-year repayment term, your monthly payment will double. If you don’t adjust your spending accordingly, your credit utilization ratio will increase, potentially negatively impacting your credit score.

Positive Impact of Improved Credit Utilization and Payment History

Once you successfully refinance your student loans and consistently make on-time payments, your credit score will likely improve. Lowering your debt-to-income ratio and maintaining a low credit utilization ratio are major contributors to a higher credit score. For example, if your previous student loan payments were high and negatively impacted your credit utilization, refinancing to a lower interest rate and longer repayment term (if needed) can reduce the monthly payment, improving your credit utilization ratio. This, coupled with consistent on-time payments, leads to a gradual increase in your credit score.

Minimizing Negative Impact

To minimize negative impact, compare rates from several lenders within a short period to consolidate hard inquiries. Ensure you have a strong credit history before applying to improve your chances of approval and favorable terms. Maintaining a low credit utilization ratio throughout the refinancing process and making on-time payments after refinancing are crucial for maximizing the positive impact on your credit score.

Credit Score Changes Throughout Refinancing: A Flowchart

The flowchart would visually represent the following stages:

1. Pre-Refinance: Shows the initial credit score.

2. Application Stage: Shows a temporary dip in the score due to hard inquiries.

3. Approval and Loan Origination: Shows a slight further dip potentially due to the new credit account opening.

4. Post-Refinance (short-term): Shows a potentially flat or slightly lower score due to the new account and the temporary impact of the hard inquiry.

5. Post-Refinance (long-term): Shows a gradual increase in the score as a result of improved credit utilization, reduced debt-to-income ratio, and consistent on-time payments.

The flowchart would use arrows to indicate the progression from one stage to the next, and the credit score at each stage would be represented numerically or visually (e.g., using a bar graph). The visual representation would clearly illustrate the temporary negative impact and the eventual positive long-term effects on the credit score.

Post-Refinance Management

Successfully refinancing your student loans is a significant step towards financial freedom, but the work doesn’t end there. Effective post-refinance management is crucial to ensuring you reap the benefits of your lower interest rate and ultimately pay off your debt efficiently. This involves establishing a robust repayment plan and proactively addressing any potential challenges.

Careful planning and consistent effort are key to navigating this phase successfully. Understanding your new repayment terms, setting realistic budgets, and having a contingency plan in place are all essential components of a successful post-refinance strategy. Proactive management minimizes stress and maximizes your chances of becoming debt-free sooner.

Timely Payment Strategies

Making timely payments is paramount after refinancing your student loans. Late payments can negatively impact your credit score, potentially offsetting the positive effects of refinancing. A consistent payment history demonstrates financial responsibility and strengthens your credit profile, which can be beneficial for future financial endeavors. Consider setting up automatic payments to ensure you never miss a deadline. This simple step can eliminate the risk of late fees and maintain a positive payment history. Budgeting tools and apps can also assist in tracking expenses and ensuring sufficient funds are allocated for loan repayments.

Options for Payment Difficulties

Unexpected life events can sometimes make it challenging to meet your loan repayment obligations. If you anticipate difficulties, it’s crucial to communicate with your lender promptly. Most lenders offer various options to help borrowers facing temporary financial hardship. These may include forbearance, which temporarily suspends or reduces your payments, or deferment, which postpones payments for a specific period. In some cases, lenders may offer income-driven repayment plans that adjust your monthly payments based on your income and family size. It’s essential to explore these options early to avoid defaulting on your loan. Failing to communicate with your lender can lead to more severe consequences.

Resources for Borrowers Facing Repayment Challenges

Several resources are available to assist borrowers struggling with student loan repayments. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, providing guidance on budgeting, debt management, and negotiating with creditors. The United States Department of Education also provides valuable resources and information on federal student loan programs and repayment options. Additionally, many non-profit organizations offer financial literacy programs and debt management assistance. Exploring these resources can provide valuable support and guidance during challenging financial times. Remember, seeking help is a sign of strength, not weakness. Proactive engagement with available resources can significantly improve your chances of successfully managing your student loan debt.

Concluding Remarks

Refinancing student loans presents a significant financial decision with the potential for substantial long-term savings. By carefully considering your eligibility, comparing lenders, and understanding the potential implications, you can strategically lower your monthly payments and overall interest burden. Remember to prioritize responsible borrowing and proactive loan management to ensure a smooth and successful refinancing experience. This guide provides a strong foundation, but always seek professional financial advice tailored to your unique circumstances.

Essential Questionnaire

What is the impact of a late payment on my refinance application?

Late payments negatively affect your credit score, reducing your chances of approval or resulting in higher interest rates.

Can I refinance both federal and private student loans together?

Some lenders allow refinancing of both federal and private loans, while others may only refinance private loans. Check lender requirements carefully.

How long does the refinance application process typically take?

The process can vary, but generally takes several weeks from application to loan disbursement. Factors like document processing times influence the timeline.

What happens if I lose my job after refinancing?

Most lenders offer forbearance or deferment options in cases of hardship. Contact your lender immediately to explore available options.

https://nicesongtoyou.com/라이프/장애등급-혜택-총정리-및-주요-내용-안내/

https://infohelpforyou.com/tag/eb8298eb8a94-ec8694eba19c-14eab8b0/

https://itgunza.com/3457

https://blog.naver.com/vckse2ks/223715140515

https://new-software.download/windows/3dp-chip/

https://pornmaster.fun/hd/zzhs

이태원스웨디시안마게이클럽