Navigating the world of student loan refinancing can feel overwhelming, especially with the constantly shifting landscape of interest rates. Understanding current rates is crucial for borrowers seeking to lower their monthly payments and potentially save thousands over the life of their loan. This guide provides a comprehensive overview of current student loan refinancing rates, helping you make informed decisions about your financial future.

From understanding the factors that influence rates to exploring eligibility criteria and comparing lender options, we aim to demystify the process. We’ll delve into the benefits and risks, providing practical advice and tools to help you confidently navigate this important financial step.

Understanding Current Student Loan Refinancing Rates

Refinancing your student loans can be a strategic move to potentially lower your monthly payments and save money over the life of your loan. However, understanding the current market and the factors influencing rates is crucial before making a decision. This section will explore the key elements affecting refinancing rates and provide a comparison of offers from various lenders.

Factors Influencing Student Loan Refinancing Rates

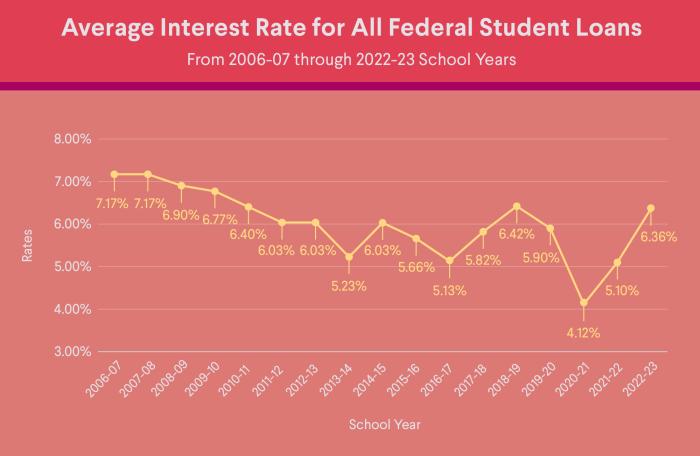

Several factors contribute to the interest rate you’ll receive when refinancing your student loans. These include your credit score, the type of loan (federal vs. private), your debt-to-income ratio, the loan amount, and the length of the repayment term. A higher credit score generally qualifies you for a lower interest rate, as lenders perceive you as a lower risk. Similarly, a lower debt-to-income ratio indicates greater financial stability, also leading to more favorable rates. The loan amount and repayment term also play a significant role; larger loan amounts and longer terms often come with higher interest rates. Finally, the type of loan matters; refinancing federal loans into private loans means losing federal protections like income-driven repayment plans.

Fixed Versus Variable Interest Rates

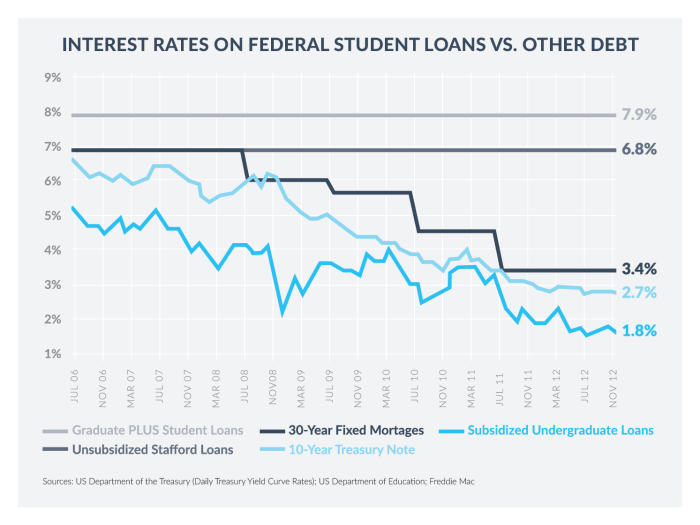

Student loan refinancing offers both fixed and variable interest rates. A fixed interest rate remains constant throughout the loan term, providing predictability in your monthly payments. A variable interest rate, on the other hand, fluctuates based on market indices like the prime rate or LIBOR. While variable rates might start lower, they can increase over time, potentially leading to higher payments. Choosing between a fixed and variable rate depends on your risk tolerance and financial outlook. If you prefer predictable payments, a fixed rate is generally safer. If you anticipate interest rates remaining low or believe you can pay off the loan quickly, a variable rate might offer initial savings.

Comparison of Rates Offered by Various Lenders

Numerous lenders offer student loan refinancing options, each with its own rate structure and terms. It’s essential to compare offers from multiple lenders before deciding. Rates are dynamic and change based on market conditions and individual borrower profiles. Therefore, the rates presented below are illustrative and should not be considered guarantees. Always check with the lender for their most up-to-date rates.

| Lender | Interest Rate (Example – Subject to Change) | Loan Term Options | Fees |

|---|---|---|---|

| Lender A | 4.5% – 7.5% (Fixed) | 3, 5, 7, 10 years | Origination fee (1%-2%) |

| Lender B | 4.0% – 7.0% (Variable) | 5, 7, 10 years | No origination fee |

| Lender C | 5.0% – 8.0% (Fixed) | 3, 5, 10, 15 years | Late payment fees |

Eligibility Criteria for Refinancing

Securing a student loan refinance requires meeting specific criteria set by lenders. These criteria aim to assess the borrower’s creditworthiness and ability to repay the loan, ultimately minimizing the lender’s risk. Understanding these requirements is crucial before applying, as failing to meet them will result in rejection.

Eligibility for student loan refinancing hinges on several key factors. Lenders carefully evaluate each applicant’s financial profile to determine their risk assessment. A thorough understanding of these factors can significantly improve your chances of successful refinancing.

Credit Score and Debt-to-Income Ratio

A strong credit score is paramount for loan refinancing approval. Lenders generally prefer applicants with scores above 670, considering them lower risk. Scores below this threshold may result in higher interest rates or even rejection. Similarly, your debt-to-income (DTI) ratio, which compares your monthly debt payments to your gross monthly income, plays a significant role. A lower DTI ratio, typically below 43%, indicates a greater capacity to manage additional debt, making you a more attractive candidate for refinancing. For example, an applicant with a 720 credit score and a 35% DTI ratio is far more likely to be approved than one with a 600 credit score and a 50% DTI ratio.

Eligible Loan Types

Not all student loans are eligible for refinancing. Generally, federal student loans, such as Direct Subsidized and Unsubsidized Loans, Federal Stafford Loans, and Federal PLUS Loans, are eligible for refinancing with private lenders. However, private student loans are typically also eligible. It’s crucial to check with the specific lender regarding the types of federal and private loans they accept. Some lenders may have restrictions on loan types or the age of the loans. For example, a lender might only accept loans originated within the last 10 years.

Situations Where Refinancing May Not Be Beneficial

While refinancing can offer lower interest rates and potentially save money, it’s not always the best option. Refinancing might not be advantageous if you have a low credit score and anticipate difficulty meeting the eligibility criteria. Additionally, if you’re already enjoying a low interest rate on your existing federal loans, the potential savings from refinancing might be minimal or nonexistent. Furthermore, refinancing federal loans into private loans means losing access to federal repayment programs like income-driven repayment plans and loan forgiveness programs. For example, a borrower with a low interest rate on a federal loan and a high credit score might find refinancing only marginally beneficial, potentially not outweighing the loss of federal protections.

The Refinancing Process

Refinancing your student loans can significantly reduce your monthly payments and overall interest paid, but understanding the process is crucial for a smooth transition. The application process involves several steps, from gathering necessary documentation to final loan approval. Careful preparation and attention to detail are key to a successful refinancing experience.

The refinancing process typically involves several key stages. These stages require careful attention to detail and accurate information to ensure a successful application. It’s advisable to thoroughly review all documents and understand the terms and conditions before proceeding.

Required Documentation for Loan Application

Before you begin the refinancing process, gather all the necessary documentation. Having these documents readily available will streamline the application and prevent delays. Incomplete applications often result in processing delays.

- Proof of Income: This usually includes pay stubs from the last two months, tax returns from the previous two years, or W-2 forms. Self-employed individuals may need to provide additional documentation such as profit and loss statements.

- Student Loan Information: You will need your loan servicer’s name and contact information, your loan balance, interest rate, and loan ID numbers for each loan you intend to refinance. This information can usually be found on your monthly statements or your loan servicer’s website.

- Credit Report: Lenders will review your credit report to assess your creditworthiness. A higher credit score generally results in more favorable interest rates. You can obtain a free copy of your credit report from AnnualCreditReport.com.

- Personal Information: This includes your full name, address, date of birth, Social Security number, and contact information. Accuracy is paramount here to avoid delays.

- Employment Verification: Some lenders may request verification of your employment directly from your employer. This helps confirm your income and employment stability.

Step-by-Step Guide to Refinancing Student Loans

This step-by-step guide provides a clear pathway for borrowers considering refinancing their student loans. Following these steps will help ensure a smooth and efficient application process.

- Compare Lenders and Rates: Research different lenders and compare their interest rates, fees, and repayment terms. Consider factors like credit score requirements and loan amounts. Using online comparison tools can be beneficial.

- Check Your Credit Report: Review your credit report for any errors and take steps to correct them before applying. A higher credit score improves your chances of securing a favorable interest rate.

- Gather Required Documentation: Collect all the necessary documentation as Artikeld above. Organize these documents for easy access during the application process.

- Complete the Application: Carefully complete the lender’s online application form, providing accurate and complete information. Double-check all details before submitting.

- Submit Documentation: Upload or mail the required supporting documents to the lender. Keep copies of all submitted documents for your records.

- Await Approval: The lender will review your application and supporting documents. The approval process can take several days or weeks depending on the lender and the complexity of your application.

- Review Loan Terms: Carefully review the final loan terms and conditions before signing the loan agreement. Understand the interest rate, repayment schedule, and any associated fees.

- Sign and Finalize: Once you’ve reviewed and agreed to the terms, sign the loan agreement and finalize the refinancing process.

Comparing Refinancing Options

Choosing the right student loan refinancing lender is crucial, as rates and terms can significantly impact your overall repayment costs. This section will explore the key differences between lenders, highlighting the benefits and drawbacks of each to aid in your decision-making process.

Different lenders offer varying interest rates, loan terms, and fees. These variations stem from factors like your credit score, debt-to-income ratio, and the type of loan you’re refinancing. Understanding these nuances is vital for securing the most favorable refinancing option.

Lender Comparisons: Benefits and Drawbacks

Consider the following comparison of hypothetical lenders, “Lender A,” “Lender B,” and “Lender C.” These examples illustrate the range of options available and the impact of lender selection. Remember that these are illustrative examples, and actual lender offerings will vary.

| Lender | Interest Rate (Fixed) | Fees | Loan Term Options | Benefits | Drawbacks |

|---|---|---|---|---|---|

| Lender A | 6.5% | $200 origination fee | 5, 7, 10 years | Competitive interest rate, multiple term options. | Higher origination fee compared to others. |

| Lender B | 7.0% | $0 origination fee | 5, 10 years | No origination fee, simple application process. | Higher interest rate, fewer term options. |

| Lender C | 6.8% | $100 origination fee | 7, 10 years | Mid-range interest rate, low origination fee. | Fewer term options than Lender A. |

Loan Term Implications

The length of your loan term directly impacts your monthly payment and total interest paid. Shorter terms mean higher monthly payments but less interest paid overall. Longer terms result in lower monthly payments but significantly higher total interest costs.

For instance, a $50,000 loan at 6.5% interest would have the following approximate repayment schedules:

| Loan Term | Monthly Payment (approx.) | Total Interest Paid (approx.) |

|---|---|---|

| 5 years | $966 | $10,000 |

| 10 years | $560 | $20,000 |

Interest Rate Changes and Total Loan Cost

Even small interest rate changes can significantly impact the total cost of your refinanced loan over time. A difference of just one percentage point can add thousands of dollars to your total repayment cost, especially on larger loan amounts and longer terms.

For example, a $30,000 loan refinanced at 7% for 10 years will cost approximately $12,000 in interest. Refinancing the same loan at 6% would reduce the interest paid to approximately $9,000 – a savings of $3,000.

Repayment Plan Comparison

A visual representation of repayment plans could be a graph showing the monthly payment amounts over the loan term for different scenarios. For example, one line could represent a standard repayment plan with fixed monthly payments, another a graduated repayment plan with increasing monthly payments, and a third an income-driven repayment plan where payments adjust based on income. The graph would clearly illustrate the differences in monthly payments and total repayment time for each plan. The x-axis would represent the time (months) and the y-axis would represent the monthly payment amount. The graph would show that the standard repayment plan has a consistent monthly payment, the graduated plan starts low and increases over time, and the income-driven plan fluctuates based on income.

Potential Risks and Benefits

Refinancing student loans can offer significant advantages, but it’s crucial to carefully weigh the potential benefits against the inherent risks. Understanding these aspects is vital to making an informed decision that aligns with your individual financial circumstances and long-term goals. A thorough assessment of your current financial situation and future projections is essential before proceeding with refinancing.

Refinancing can potentially lead to lower monthly payments, a shorter repayment period, or a switch to a more favorable interest rate. However, it also carries risks that could negatively impact your financial well-being if not carefully considered. These risks include losing access to federal loan benefits, increasing your overall interest paid, and potentially facing financial hardship if your circumstances change unexpectedly.

Potential Risks of Student Loan Refinancing

Several risks are associated with refinancing student loans. These risks should be carefully considered before making a decision. Failing to do so could result in unforeseen financial difficulties.

- Loss of Federal Loan Benefits: Refinancing federal student loans into private loans means losing access to federal protections, such as income-driven repayment plans, deferment options, and forbearance programs. These programs offer crucial support during periods of financial hardship, and their absence can leave borrowers vulnerable.

- Higher Total Interest Paid: While refinancing might lower your monthly payment, it could potentially increase the total amount of interest paid over the life of the loan, especially if you extend the repayment term. This is because you’ll be paying interest for a longer period.

- Increased Risk During Economic Downturns: During economic downturns or periods of personal financial instability, the fixed monthly payment of a refinanced loan could become difficult to manage. The lack of federal safety nets increases the risk of default.

- Prepayment Penalties: Some private lenders may impose prepayment penalties if you pay off your loan early. This can negate some of the benefits of refinancing.

Potential Benefits of Student Loan Refinancing

Despite the risks, refinancing can offer several advantages for borrowers in suitable situations. Careful consideration of your financial circumstances is key to maximizing the benefits.

- Lower Monthly Payments: Refinancing can significantly reduce your monthly payments by extending the loan term or securing a lower interest rate. This can free up cash flow for other financial priorities.

- Lower Interest Rate: If your credit score has improved since you initially took out your student loans, refinancing can secure a lower interest rate, saving you money in the long run. A lower interest rate directly reduces the total amount of interest paid.

- Simplified Repayment: Consolidating multiple student loans into a single loan simplifies repayment, making it easier to manage your finances.

- Fixed Interest Rate: Refinancing can allow you to switch from a variable interest rate to a fixed interest rate, providing predictability and stability in your monthly payments.

Scenarios Leading to Financial Hardship After Refinancing

Certain circumstances can increase the likelihood of financial hardship after refinancing. Understanding these scenarios is critical to making a responsible decision.

- Unexpected Job Loss: Losing your job can make it challenging to meet your monthly loan payments, especially without the safety net of federal loan programs.

- Unforeseen Medical Expenses: Significant medical bills can strain your finances, making loan payments difficult to manage if you lack financial flexibility.

- Significant Life Changes: Major life events, such as marriage, divorce, or having children, can impact your budget and make it difficult to maintain loan payments.

- Failure to Budget Effectively: Even with lower monthly payments, failure to budget effectively and manage your finances can lead to missed payments and potential default.

Strategies to Mitigate Refinancing Risks

Several strategies can help mitigate the risks associated with student loan refinancing. Proactive planning and careful consideration are essential for minimizing potential financial hardship.

- Thorough Research: Compare offers from multiple lenders to find the best terms and interest rates. Carefully review the terms and conditions of each loan before signing.

- Assess Your Financial Situation: Create a realistic budget to determine if you can comfortably afford the monthly payments, even in the event of unforeseen circumstances. Consider potential job losses or other unexpected expenses.

- Emergency Fund: Build an emergency fund to cover several months’ worth of loan payments in case of job loss or other unexpected events.

- Maintain Good Credit: A good credit score will help you secure a lower interest rate and more favorable terms.

Long-Term Financial Implications

Refinancing your student loans can significantly impact your long-term financial health, affecting everything from your overall debt burden to your credit score. Understanding these long-term implications is crucial before making a decision. Careful consideration of interest rates, repayment schedules, and potential risks is essential for making informed choices that align with your financial goals.

Refinancing alters the trajectory of your debt repayment, influencing your ability to achieve other financial objectives. Lower interest rates translate to lower monthly payments and reduced total interest paid over the life of the loan. Conversely, higher interest rates can lead to increased monthly payments and significantly higher total interest paid, potentially delaying the achievement of long-term goals such as homeownership or retirement savings.

Impact of Interest Rates on Total Repayment

Different interest rates dramatically affect the total amount repaid. Consider two scenarios: Scenario A involves a $50,000 loan refinanced at 6% interest over 10 years, resulting in a total repayment of approximately $63,000. Scenario B involves the same loan refinanced at 8% interest over the same period, increasing the total repayment to approximately $69,000. This demonstrates a $6,000 difference solely due to a 2% interest rate change. The longer the loan term, the more pronounced this effect becomes.

Impact of Refinancing on Credit Score

The impact of refinancing on your credit score is multifaceted. Successfully refinancing can potentially boost your credit score if you demonstrate responsible repayment behavior after refinancing to a lower interest rate loan. However, the process of applying for refinancing involves a hard credit inquiry, which can temporarily lower your score. Furthermore, if you fail to make payments on your refinanced loan, your credit score will suffer significantly, potentially impacting future borrowing opportunities. Therefore, responsible financial management after refinancing is key to maintaining a healthy credit score.

Effect of Repayment Schedules on Total Interest Paid

Choosing a shorter repayment schedule generally leads to paying less interest over the life of the loan, despite higher monthly payments. Conversely, opting for a longer repayment term reduces monthly payments but increases the total interest paid. For example, a $30,000 loan refinanced at 7% interest over 5 years would result in a significantly lower total interest paid compared to the same loan refinanced over 15 years. While the monthly payments are higher with the shorter term, the substantial savings in interest over the long run can be substantial. It’s important to balance affordability with the long-term cost of interest.

Outcome Summary

Ultimately, refinancing your student loans can be a powerful tool for improving your financial well-being, but it requires careful consideration. By understanding the factors that influence rates, your eligibility, and the potential risks and benefits, you can make an informed decision that aligns with your long-term financial goals. Remember to compare offers from multiple lenders and thoroughly review the terms and conditions before committing to a refinancing plan.

Answers to Common Questions

What is the average current student loan refinancing rate?

The average rate varies significantly based on credit score, loan amount, and lender. Checking multiple lenders for personalized quotes is essential.

How long does the refinancing process typically take?

The timeframe can range from a few weeks to several months, depending on lender processing times and the completeness of your application.

Can I refinance federal student loans?

Yes, but refinancing federal loans means losing federal protections like income-driven repayment plans. Carefully weigh the pros and cons before proceeding.

What happens if I miss a payment after refinancing?

Late payments can negatively impact your credit score and may lead to penalties from your lender.

Should I consider a fixed or variable interest rate?

Fixed rates offer predictability, while variable rates may initially be lower but carry the risk of increasing over time.