The crushing weight of student loan debt is a pervasive reality for many recent graduates and established professionals alike. Dave Ramsey, a renowned financial guru, offers a distinct strategy for tackling this burden, one that diverges significantly from traditional repayment plans. This exploration delves into the intricacies of Ramsey’s philosophy, examining its strengths, weaknesses, and applicability to various student loan scenarios. We’ll analyze his debt snowball method, explore alternative financing options he suggests, and critically assess the potential challenges and limitations of his approach.

This analysis will provide a comprehensive overview of how Dave Ramsey’s principles can be applied to student loan repayment, offering both practical advice and a balanced perspective on its effectiveness. We’ll examine the potential benefits and drawbacks, comparing his methodology to more conventional approaches and considering diverse financial situations.

Dave Ramsey’s Philosophy on Student Loans

Dave Ramsey, a prominent financial guru, holds a strong and often controversial stance on student loan debt. His philosophy centers on aggressive debt elimination and a prioritization of financial independence, often advocating for a more cautious approach to higher education financing. He emphasizes personal responsibility and strategic planning to avoid accumulating significant debt.

Dave Ramsey’s core belief regarding student loans is that they represent a significant obstacle to achieving financial freedom. He argues that the high cost of education often outweighs the potential return on investment, leading individuals into years of financial struggle. He strongly advises against incurring significant student loan debt, advocating instead for alternatives like working through college, attending a less expensive institution, or pursuing vocational training.

Ramsey’s Debt Snowball Method and Student Loans

The Ramsey method prioritizes tackling debts based on their size, not interest rate. Smaller debts are paid off first to create momentum and motivation. This psychological boost helps maintain commitment throughout the process. When applied to student loans, this means that any smaller, high-interest debts (like credit cards) would be paid off first before focusing on the often larger student loan balance. The emotional payoff of early wins can be crucial in overcoming the overwhelming feeling of a large student loan burden.

Comparison of Ramsey’s Approach to Traditional Repayment Plans

Traditional student loan repayment plans, such as the Standard Repayment Plan or Income-Driven Repayment (IDR) plans, are often structured around a fixed monthly payment over a set period (typically 10-20 years). Ramsey’s approach differs significantly, focusing on aggressive repayment regardless of the loan’s terms. Instead of following a standardized repayment plan, Ramsey encourages aggressive extra payments towards student loans after eliminating other debts, potentially shortening the repayment period considerably. This can lead to significant interest savings, but also requires a substantial level of discipline and income to be successful.

Conflicts Between Ramsey’s Principles and Student Loan Realities

Ramsey’s philosophy, while effective for some, can clash with the realities faced by many student loan borrowers. For example, many individuals require student loans to access higher education, particularly in fields with high tuition costs or limited scholarship opportunities. A strict adherence to Ramsey’s principles could mean forgoing a college degree entirely, potentially limiting future earning potential. Furthermore, graduates in high-demand fields with high earning potential may find that the long-term investment in a college education outweighs the short-term financial strain of student loan debt. A further conflict arises when facing unexpected life events such as job loss or medical emergencies. Ramsey’s aggressive repayment strategy leaves little room for financial buffer, making it challenging to navigate such unexpected circumstances. Finally, individuals with extremely high loan balances may find it nearly impossible to implement Ramsey’s method without significant lifestyle changes or a substantial increase in income.

Ramsey’s Recommended Alternatives to Student Loans

Dave Ramsey advocates strongly against student loan debt, urging prospective students and their families to explore alternative financing methods. He emphasizes the importance of prioritizing financial responsibility and avoiding the burden of significant debt early in life. His recommended alternatives focus on minimizing borrowing and maximizing personal responsibility for educational funding.

Alternative Financing Options

Ramsey primarily suggests several strategies to fund higher education without relying on student loans. These strategies emphasize saving, working, and leveraging grants and scholarships. The effectiveness of each method depends heavily on individual circumstances and planning.

Working and Saving

This involves diligently saving money prior to college and working part-time or full-time during studies. This approach requires significant self-discipline and potentially delaying college entry to accumulate sufficient funds. Ramsey stresses the importance of budgeting and frugal living to accelerate savings. For example, a student who saves $50 a week for four years accumulates over $10,000, a significant contribution to college costs.

Scholarships and Grants

Ramsey encourages exhaustive searches for scholarships and grants. These are forms of financial aid that do not require repayment. Numerous scholarships exist based on academic merit, extracurricular activities, demographics, and other factors. Grants are often need-based and provided by government agencies or private organizations. Successfully securing multiple scholarships and grants can significantly reduce the overall cost of education.

Community Colleges and Trade Schools

Attending a community college for the first two years of undergraduate education can significantly lower costs compared to a four-year university. Community colleges generally have lower tuition fees. Alternatively, trade schools offer specialized training leading to in-demand careers. These programs often have shorter durations and lower tuition costs than traditional four-year colleges. This reduces the overall time spent in education and the associated financial burden.

Family Contributions

Ramsey encourages families to actively contribute to their children’s education. This might involve setting up a college savings plan early on, such as a 529 plan, or contributing directly to tuition expenses. Family support can substantially lessen the need for student loans. For instance, a family saving $200 per month for 18 years could accumulate over $50,000, greatly reducing the dependence on external financing.

Comparison of Financing Methods

| Financing Method | Cost | Accessibility | Repayment Terms |

|---|---|---|---|

| Student Loans | High, including interest | Relatively easy to obtain | Long-term repayment, potentially decades |

| Working and Saving | Variable, depends on savings and earnings | High, depends on individual effort | No repayment, immediate access to funds |

| Scholarships/Grants | Low to zero | Competitive, depends on eligibility | No repayment required |

| Community College/Trade School | Lower than four-year universities | Widely available | No repayment, shorter program duration |

| Family Contributions | Variable, depends on family resources | Depends on family support | No repayment, upfront contribution |

Long-Term Financial Implications

Choosing Ramsey’s alternatives over student loans often leads to significantly improved long-term financial health. Avoiding student loan debt frees up income for other financial priorities, such as saving for retirement, buying a home, or starting a family. The absence of monthly loan payments reduces financial stress and allows for greater flexibility in career choices. Individuals who avoid student loan debt often build stronger credit scores and have more financial freedom in the long run. For example, someone without student loan debt can allocate the funds they would have spent on loan repayments towards investments, potentially accumulating significant wealth over time.

Addressing Specific Student Loan Scenarios within the Ramsey Framework

Dave Ramsey’s approach to student loan debt, while aggressive, offers a clear path for many graduates. Understanding how his principles apply to different loan types and income levels is key to successfully implementing his debt-elimination plan. This section will explore various scenarios and provide actionable steps for navigating student loan repayment within the Ramsey framework.

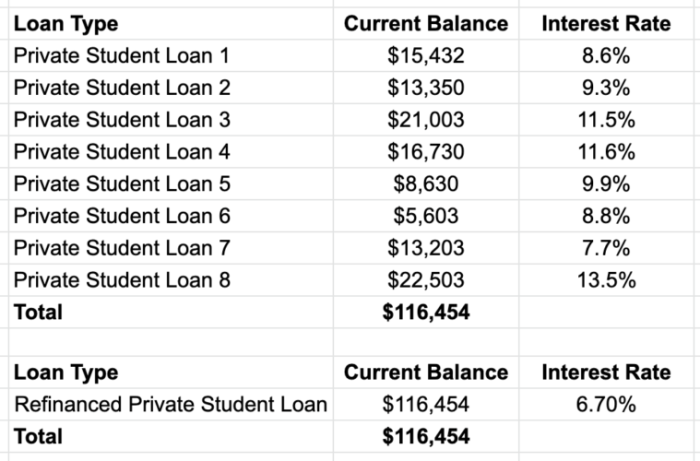

Federal vs. Private Student Loans within the Ramsey Framework

Ramsey’s philosophy prioritizes aggressive debt repayment, regardless of loan type. However, the strategies might differ slightly depending on whether the loans are federal or private. Federal loans often offer income-driven repayment plans and potential forgiveness programs, which Ramsey generally discourages as they extend the repayment timeline. Private loans, lacking these benefits, require a more focused and intense repayment strategy. The core principle remains the same: eliminate the debt as quickly as possible. This might involve refinancing private loans to a lower interest rate, if possible, but only if it aligns with the overall goal of rapid repayment. Negotiating with lenders is not typically part of the Ramsey plan, as the focus is on personal responsibility and aggressive repayment.

Hypothetical Budget for a Recent Graduate Implementing Ramsey’s Principles

Let’s consider a recent graduate, Sarah, with $30,000 in student loan debt and a starting salary of $45,000. Following Ramsey’s 7 Baby Steps, Sarah would prioritize building a $1,000 emergency fund first. Then, she’d aggressively attack her student loans using the debt snowball method. A sample monthly budget might look like this:

| Category | Amount |

|---|---|

| Housing (Rent/Mortgage) | $1,000 |

| Food | $300 |

| Transportation | $200 |

| Utilities | $150 |

| Student Loan Payment (Aggressive Extra Payments) | $1,500 |

| Other Expenses (minimal entertainment, etc.) | $150 |

| Savings (for future goals after debt is paid) | $200 |

| Total | $3,500 |

Note: This budget is highly simplified and may need adjustments based on Sarah’s specific circumstances and location. It emphasizes aggressive student loan repayment while still maintaining essential living expenses.

Step-by-Step Plan for Significant Student Loan Debt

Someone with significant student loan debt, let’s say $100,000, needs a more structured approach. The steps would be:

- Emergency Fund: Establish a $1,000 emergency fund. This provides a safety net during unexpected expenses, preventing additional debt.

- Debt Snowball: List all debts from smallest to largest balance, regardless of interest rate. Focus on paying off the smallest debt first, then rolling that payment amount into the next smallest debt, and so on. This provides psychological momentum.

- Aggressive Repayment: Maximize monthly payments. Work extra jobs, sell assets, or cut expenses to free up as much money as possible for debt repayment.

- Budgeting and Tracking: Meticulously track income and expenses to identify areas for further cost reduction. A zero-based budget is highly recommended.

- Financial Discipline: Avoid accumulating new debt during this process. This requires strong self-discipline and a commitment to the long-term goal.

Adjusting Ramsey’s Plan Based on Income and Debt

The core principles remain consistent regardless of income and debt amount. However, the timeline and the level of sacrifice will vary. Someone with a lower income and higher debt will need to make more significant sacrifices and potentially work multiple jobs to accelerate repayment. Conversely, someone with a higher income and lower debt can potentially pay off their loans faster with less extreme measures. The key is to adjust the budget and repayment strategy to match the individual’s specific financial situation while maintaining the core principle of aggressive debt elimination. For example, a person with a lower income might need to significantly reduce discretionary spending and potentially live more frugally to allocate more funds towards debt repayment.

Final Conclusion

Ultimately, navigating the complexities of student loan debt requires a personalized strategy. While Dave Ramsey’s aggressive debt snowball method offers a compelling alternative to traditional repayment plans, its suitability depends heavily on individual circumstances and financial realities. A thorough understanding of his philosophy, coupled with a realistic assessment of one’s own financial situation, is crucial for making informed decisions. This exploration has highlighted both the potential advantages and limitations of Ramsey’s approach, empowering readers to make choices aligned with their unique financial goals.

Commonly Asked Questions

What if I can’t afford to make the minimum payments on my student loans while following Ramsey’s plan?

Ramsey’s plan prioritizes aggressive debt repayment. If minimum payments are unattainable, consider seeking professional financial advice to explore options like income-driven repayment plans or forbearance, although Ramsey generally discourages these.

Does Ramsey’s plan work for all types of student loan debt?

The principles can be applied to both federal and private student loans, but the specific strategies might need adjustment based on loan terms and interest rates. Federal loan programs may offer additional repayment options not considered in Ramsey’s approach.

How does Ramsey’s approach compare to the avalanche method of debt repayment?

The avalanche method prioritizes paying off high-interest debt first, while the snowball method focuses on paying off the smallest debts first for psychological motivation. Ramsey advocates for the snowball method, emphasizing the motivational aspect.

What if I have other debts besides student loans? How does Ramsey incorporate those?

Ramsey’s plan usually incorporates all debts into the snowball, starting with the smallest regardless of interest rate. Student loans are treated no differently.