Navigating the world of student loans can feel overwhelming, but understanding your options is key to a successful financial future. This guide delves into DCU’s student loan offerings, providing a clear picture of interest rates, eligibility requirements, repayment plans, and potential benefits. We’ll explore the factors influencing rates, compare DCU to other lenders, and equip you with the knowledge to make informed decisions about your education financing.

From understanding the different loan types and their associated costs to mastering the application process and developing effective repayment strategies, we aim to demystify the process and empower you to take control of your student loan journey. We’ll also examine potential pitfalls and offer practical advice on budgeting and managing your debt effectively. Whether you’re a prospective borrower or already managing DCU student loans, this comprehensive guide offers valuable insights and actionable steps.

Understanding DCU Student Loan Rates

Securing a student loan is a significant financial decision, and understanding the interest rates involved is crucial for responsible borrowing. This section delves into the intricacies of DCU’s student loan rates, providing a clear picture to help prospective borrowers make informed choices.

Factors Influencing DCU Student Loan Interest Rates

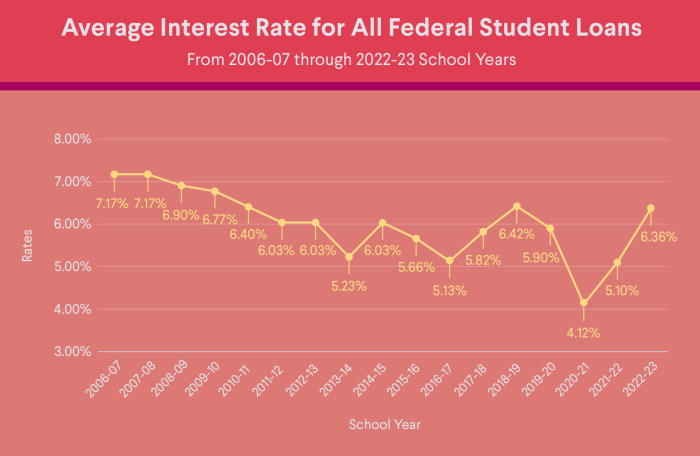

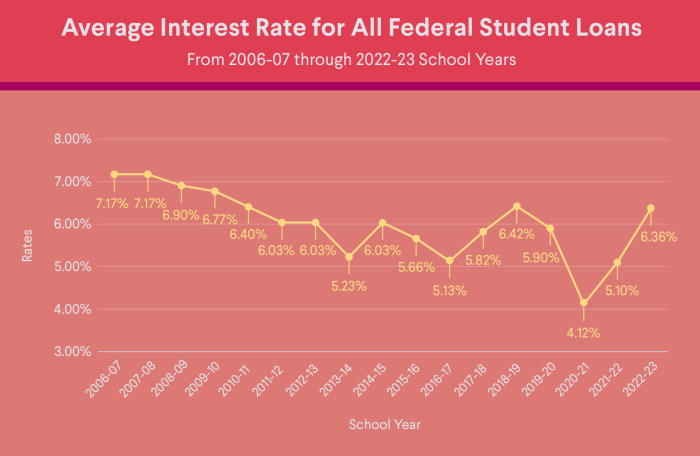

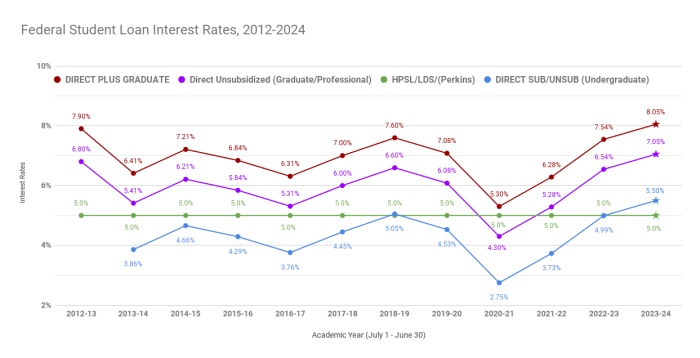

Several factors contribute to the interest rate a borrower receives on their DCU student loan. These include the type of loan (e.g., undergraduate, graduate, parent), the borrower’s credit history (if applicable), the loan term length, and prevailing market interest rates. A strong credit history generally leads to lower rates, while longer loan terms often result in higher rates due to increased risk for the lender. Furthermore, the overall economic climate and the Federal Reserve’s actions directly impact interest rates across the lending industry, including DCU’s offerings.

Types of DCU Student Loans and Their Rates

DCU offers various student loan products, each with its own rate structure. While specific rates are subject to change and are best obtained directly from DCU, we can Artikel the general categories. These typically include undergraduate student loans, graduate student loans, and parent loans. Undergraduate loans often have lower rates than graduate loans due to factors such as loan amounts and repayment periods. Parent loans, designed to assist parents in financing their children’s education, may also have varying rates based on creditworthiness and other factors. It’s important to note that rates are not fixed and will vary depending on the applicant’s individual circumstances and the prevailing economic conditions.

Comparison of DCU Student Loan Rates with Other Major Lenders

Comparing DCU’s student loan rates with other major lenders requires examining current market conditions and specific loan offers. A direct comparison isn’t feasible without real-time data, as rates are dynamic. However, potential borrowers should actively compare rates from various lenders, including national banks, credit unions, and private lenders, to identify the most favorable option for their unique situation. Factors beyond interest rates, such as fees, repayment terms, and customer service, should also be carefully considered during the comparison process.

Comparison of DCU Student Loan Options

The following table provides a hypothetical example to illustrate potential variations in interest rates, loan terms, and fees for different DCU student loan options. Remember that these are illustrative figures and actual rates will vary based on individual circumstances and prevailing market conditions. Always check with DCU for the most up-to-date information.

| Loan Type | Interest Rate (Example) | Loan Term (Example) | Fees (Example) |

|---|---|---|---|

| Undergraduate | 4.5% | 10 years | $0 Origination Fee |

| Graduate | 6.0% | 15 years | $100 Origination Fee |

| Parent | 7.0% | 10 years | $0 Origination Fee |

Eligibility and Application Process

Securing a DCU student loan involves meeting specific eligibility requirements and navigating a straightforward application process. Understanding these aspects will significantly enhance your chances of successful loan approval and streamline the borrowing experience. This section details the criteria, steps, and helpful tips to guide you through the process.

DCU’s student loan eligibility criteria are designed to assess the applicant’s ability to repay the loan. While specific requirements may vary depending on the type of loan and the applicant’s circumstances, generally, applicants must be enrolled or accepted into an eligible educational institution, be a US citizen or permanent resident, and meet certain credit and income requirements. The institution will likely require proof of enrollment, and a credit check is standard practice. Further details on precise requirements are available directly from DCU.

Eligibility Criteria

Eligibility for a DCU student loan hinges on several key factors. These typically include, but are not limited to, enrollment status at an accredited institution, US citizenship or permanent residency, and a satisfactory credit history (or a co-signer with a satisfactory credit history). The applicant’s income may also be considered, along with the purpose of the loan and the loan amount requested. Meeting these criteria demonstrates a commitment to repayment, which is a significant factor in the loan approval process. It’s important to review the specific eligibility requirements directly with DCU to ensure you meet all the criteria before applying.

Application Process Steps

The application process is designed to be efficient and user-friendly. While specifics may vary slightly, the overall process generally follows a consistent pattern. Gathering the necessary documentation beforehand significantly streamlines the process and reduces potential delays.

- Complete the Application Form: Begin by filling out DCU’s online student loan application form accurately and completely. This form requests personal information, educational details, and loan amount requested.

- Gather Required Documentation: Assemble all necessary supporting documents. This typically includes proof of enrollment (acceptance letter or transcript), tax returns (or other income verification), and possibly a co-signer’s financial information if required.

- Submit the Application: Submit the completed application form and all supporting documents electronically through the DCU online portal. Ensure all information is accurate and legible to avoid delays.

- Review and Approval: DCU will review your application and supporting documents. This process may take some time. You will be notified of the decision via email or mail.

- Loan Disbursement: Upon approval, the loan proceeds will be disbursed according to the terms Artikeld in your loan agreement. Funds are usually disbursed directly to the educational institution.

Tips for Improving Loan Approval Chances

Proactive steps can significantly improve the likelihood of loan approval. Careful preparation and attention to detail are key.

- Maintain a Good Credit History: A strong credit history demonstrates responsible financial management, increasing the chances of approval. Addressing any existing credit issues before applying is advisable.

- Accurate and Complete Application: Ensure all information provided in the application is accurate and complete. Inaccuracies or omissions can lead to delays or rejection.

- Secure a Co-Signer (if needed): If you lack a strong credit history, a co-signer with good credit can significantly improve your chances of approval. This demonstrates a shared responsibility for repayment.

- Realistic Loan Amount: Request a loan amount that aligns with your educational expenses and your projected repayment capacity. Avoid requesting an excessively high amount.

Repayment Options and Plans

Choosing the right repayment plan for your DCU student loan is crucial for managing your debt effectively and minimizing the total interest paid. Understanding the various options available and their implications will help you make an informed decision that aligns with your financial situation and goals. This section Artikels the common repayment plans offered by DCU and provides examples to illustrate their impact on your loan repayment journey.

DCU Student Loan Repayment Options

DCU likely offers several repayment options, including standard repayment, extended repayment, graduated repayment, and potentially income-driven repayment plans (IDR). The standard repayment plan involves fixed monthly payments over a set period (typically 10 years), while extended repayment plans stretch the repayment period, leading to lower monthly payments but higher total interest paid. Graduated repayment plans start with lower monthly payments that gradually increase over time, offering flexibility in the early years. Income-driven repayment plans, if available, base your monthly payment on your income and family size, providing more affordability but potentially extending the repayment term significantly. It’s important to note that specific plan details and availability might vary, so checking directly with DCU is recommended.

Impact of Repayment Plan Choice on Total Interest Paid

The choice of repayment plan significantly influences the total interest paid over the loan’s lifetime. Shorter repayment terms, like the standard 10-year plan, result in higher monthly payments but lower overall interest costs because the principal is paid down faster. Conversely, longer repayment terms, such as those offered by extended or income-driven repayment plans, lead to lower monthly payments but significantly higher total interest paid due to the extended borrowing period. For example, a $30,000 loan at 5% interest repaid over 10 years will incur considerably less interest than the same loan repaid over 20 years. This difference can amount to thousands of dollars over the loan’s life.

Examples of Repayment Schedules

To illustrate, let’s consider a simplified example using a $10,000 loan at a 5% annual interest rate. The following table demonstrates potential repayment schedules under different plans. Remember that these are simplified examples and actual figures will depend on the specific loan terms and DCU’s current interest rates.

| Month | Standard Repayment (10-year) | Extended Repayment (15-year) | Graduated Repayment (10-year, increasing 5% annually) |

|---|---|---|---|

| 1 | $106.07 (Principal: $81.07, Interest: $25.00) | $70.69 (Principal: $45.69, Interest: $25.00) | $86.00 (Principal: $71.00, Interest: $15.00) |

| 2 | $106.07 (Principal: $81.70, Interest: $24.37) | $70.69 (Principal: $46.32, Interest: $24.37) | $90.30 (Principal: $75.30, Interest: $15.00) |

| 3 | $106.07 (Principal: $82.33, Interest: $23.74) | $70.69 (Principal: $46.95, Interest: $23.74) | $94.78 (Principal: $79.78, Interest: $15.00) |

| … | … | … | … |

Note: These figures are illustrative and do not include any fees or charges. Actual repayment amounts will vary.

Potential Benefits and Drawbacks

Choosing a student loan provider is a significant decision impacting your financial future. Understanding the advantages and disadvantages of different lenders, including DCU, is crucial for making an informed choice. This section will explore the potential benefits and drawbacks associated with DCU student loans, comparing them to other loan providers to help you assess their suitability for your needs.

DCU, as a credit union, often positions itself as offering a member-centric approach to lending. This translates into potentially favorable interest rates, flexible repayment options, and personalized customer service. However, it’s important to remember that no loan provider is perfect, and DCU loans have limitations as well. A thorough comparison is necessary to determine if DCU aligns with your individual financial circumstances and borrowing goals.

Advantages of DCU Student Loans

DCU’s potential advantages stem from its credit union status. This often translates to more competitive interest rates compared to some private lenders, particularly for members who have established a strong credit history with the institution. Furthermore, DCU may offer more flexible repayment options, such as extended repayment periods or the ability to defer payments under certain circumstances. Their commitment to member service can also provide a more personalized and supportive borrowing experience. For example, DCU may offer financial counseling or resources to help members manage their student loan debt effectively. Finally, membership eligibility often broadens access to these benefits, potentially making financing more accessible than with strictly private lenders.

Disadvantages of DCU Student Loans

While DCU offers potential benefits, limitations exist. Membership requirements might restrict eligibility for some applicants. Furthermore, while DCU often advertises competitive rates, it’s crucial to compare their offerings with other lenders, including federal loan programs, to ensure they remain the most advantageous option. The availability of specific repayment plans and their terms might be less extensive than those offered by larger national lenders. Additionally, the range of loan amounts offered by DCU might be limited compared to some private lenders, potentially impacting access to the full amount needed for tuition and expenses. Finally, access to customer service and resources might vary depending on location and member status.

Comparison with Other Loan Providers

Comparing DCU student loans with other providers requires a multifaceted approach. Federal student loans often provide the most favorable terms, including income-driven repayment plans and loan forgiveness programs, but may have stricter eligibility requirements. Private lenders, on the other hand, might offer higher loan amounts and less stringent eligibility criteria, but typically come with higher interest rates and less flexible repayment options. DCU aims to occupy a middle ground, offering a potentially more member-focused approach with competitive rates, but the specific advantages will depend on individual circumstances and a thorough comparison of all available options. It is essential to obtain multiple quotes and compare the terms and conditions carefully before making a decision.

Pros and Cons of DCU Student Loans

Before making a decision, consider the following points:

- Pros: Potentially lower interest rates than some private lenders; flexible repayment options; personalized customer service; potentially easier access to funds for members.

- Cons: Membership requirements may limit eligibility; loan amounts may be restricted; rate competitiveness needs to be verified against other lenders, including federal loan programs; repayment plan options might be less extensive than some competitors.

Financial Aid and Budgeting

Securing funding for higher education and effectively managing finances are crucial for a successful student experience. This section details strategies for managing student loan debt, creating a realistic budget, and utilizing available resources to support your financial well-being while using DCU student loans.

Effective management of student loan debt requires proactive planning and consistent effort. Understanding your repayment options, exploring potential income-driven repayment plans, and budgeting carefully are essential steps. Failing to plan can lead to increased interest accrual and potential financial hardship.

Strategies for Managing Student Loan Debt

Developing a comprehensive debt management strategy is vital. This involves understanding your loan terms, including interest rates and repayment schedules. Consider exploring options like income-driven repayment plans, which adjust your monthly payments based on your income and family size. These plans can provide short-term relief, but it’s important to understand the long-term implications, such as potentially extending the repayment period and paying more interest overall. Prioritizing high-interest loans for repayment can minimize the total interest paid over the life of the loan. Regularly monitoring your loan balance and making extra payments when possible can significantly reduce the time it takes to repay your debt.

Creating a Realistic Budget for Students with DCU Loans

A realistic budget is essential for managing expenses and ensuring timely loan repayments. Start by tracking your income and expenses for a month to get a clear picture of your spending habits. Categorize your expenses (housing, food, transportation, entertainment, etc.) to identify areas where you can cut back. Allocate a specific amount each month for your DCU student loan payments. Consider using budgeting apps or spreadsheets to help you track your progress and stay organized. Remember to build a small emergency fund to cover unexpected expenses, preventing you from falling behind on loan payments.

Resources for Financial Aid and Budgeting Assistance

Numerous resources are available to help students manage their finances and navigate the complexities of student loan repayment. DCU itself likely offers financial literacy workshops or online resources for its borrowers. Government websites, such as the Federal Student Aid website (studentaid.gov), provide valuable information on loan repayment plans, budgeting tools, and financial aid options. Many universities also offer financial aid offices and counseling services to assist students with budgeting and debt management. Non-profit organizations focused on financial literacy provide free resources and workshops to help students build healthy financial habits.

Sample Budget Template for Students Using DCU Student Loans

This template provides a basic framework. Adjust categories and amounts to reflect your individual circumstances.

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| DCU Loan Disbursement | $XXX | Housing (Rent/Mortgage) | $XXX |

| Part-time Job | $XXX | Food (Groceries/Dining) | $XXX |

| Scholarships/Grants | $XXX | Transportation (Car Payment/Gas/Public Transit) | $XXX |

| Other Income | $XXX | Utilities (Electricity/Water/Internet) | $XXX |

| Total Income | $XXX | DCU Student Loan Payment | $XXX |

| Books/Supplies | $XXX | ||

| Personal Care | $XXX | ||

| Entertainment | $XXX | ||

| Savings | $XXX | ||

| Total Expenses | $XXX | ||

| Net Income (Income – Expenses) | $XXX |

Illustrative Scenarios

Understanding the impact of various factors on your DCU student loan repayment is crucial for effective financial planning. The following scenarios illustrate how different loan amounts, interest rates, repayment plans, and payment strategies can significantly affect your overall repayment costs and long-term financial health.

Loan Amount and Interest Rate Impact on Total Repayment Cost

This scenario demonstrates how varying loan amounts and interest rates influence the total amount repaid. Let’s consider two students, both borrowing for a four-year undergraduate degree. Student A borrows $20,000 at a 5% interest rate, while Student B borrows $30,000 at the same 5% rate. Assuming a standard 10-year repayment plan, Student A’s monthly payment would be lower than Student B’s, but both would pay significantly more than the initial loan amount due to accumulated interest. Student B would naturally pay considerably more in total due to the larger principal. A higher interest rate would exacerbate this difference for both students. For instance, if both borrowed the same amounts but at a 7% interest rate, their total repayment costs would be substantially higher. This highlights the importance of borrowing only what’s necessary and seeking the lowest possible interest rate.

Impact of Making Extra Loan Payments

This scenario illustrates the benefits of making extra principal payments on your student loan. Imagine a student with a $25,000 loan at a 6% interest rate over 10 years. Their monthly payment would be approximately $270. By making an extra $100 payment each month, this student could significantly reduce the loan’s lifespan and the total interest paid. This accelerated repayment strategy can save thousands of dollars over the life of the loan. For example, the extra payments could shorten the repayment period by several years and reduce the total interest paid by a substantial amount, perhaps several thousand dollars. A visual representation, such as a chart comparing the repayment schedules with and without extra payments, would clearly show this financial advantage.

Comparison of Long-Term Costs of Different Repayment Plans

This scenario compares the long-term costs of different repayment plans offered by DCU. Let’s assume a $30,000 loan. A standard 10-year repayment plan will have higher monthly payments but a shorter repayment period and lower overall interest paid compared to a longer, say 20-year, repayment plan. While the monthly payments on the 20-year plan would be lower, the total interest paid would be significantly higher over the life of the loan. This illustrates the trade-off between lower monthly payments and a higher overall repayment cost. A detailed comparison, including a table outlining monthly payments, total interest paid, and total repayment amount for each plan, would clearly highlight this difference.

Consequences of Loan Default

This scenario illustrates the severe consequences of student loan default. Defaulting on a student loan can result in a significant negative impact on credit score, wage garnishment, and tax refund offset. Furthermore, it can make it difficult to obtain future loans, rent an apartment, or even secure certain jobs. For instance, a default could lead to a substantial drop in credit score, making it challenging to qualify for mortgages, car loans, or credit cards in the future. The financial repercussions of defaulting can be long-lasting and far-reaching, making it crucial to prioritize loan repayment even during challenging financial periods. Exploring options such as deferment or forbearance with DCU before defaulting is strongly advised.

Concluding Remarks

Securing funding for your education is a significant step, and choosing the right lender is crucial. This guide has provided a detailed overview of DCU student loan rates, highlighting the factors influencing costs, the application process, repayment options, and potential benefits and drawbacks. By carefully considering the information presented and utilizing the resources provided, you can confidently navigate the complexities of student loan financing and make informed decisions that align with your financial goals. Remember to always explore all available options and compare rates before committing to a loan.

FAQ Overview

What credit score is needed for a DCU student loan?

While DCU doesn’t publicly state a minimum credit score, a good credit history generally improves your chances of approval and securing a favorable interest rate. Co-signers can also help if your credit is limited.

Can I refinance my existing student loans with DCU?

DCU may offer refinancing options, but this depends on their current offerings. It’s best to check directly with DCU to see if refinancing is available and what the terms are.

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage to your credit score, and potential collection actions. Contact DCU immediately if you anticipate difficulty making a payment to explore options like forbearance or deferment.

Does DCU offer any student loan forgiveness programs?

DCU itself doesn’t offer loan forgiveness programs. However, borrowers may be eligible for federal forgiveness programs depending on their employment and loan type. Check the official government websites for eligibility criteria.