Navigating the complexities of student loan debt can feel overwhelming, especially given the diverse repayment options and potential involvement of collection agencies. This exploration delves into the intricacies of student loan debt management, offering insights into effective strategies for repayment, understanding your rights when dealing with collection agencies, and leveraging technology to streamline the process. We’ll examine various debt management systems, government programs, and the crucial role of financial literacy in achieving long-term financial well-being.

From understanding the different types of federal and private loans to exploring income-driven repayment plans and loan consolidation, this guide provides a comprehensive overview of the landscape of student loan debt. We’ll also address the consequences of default and highlight resources available to borrowers facing challenges. Ultimately, the goal is to empower students and graduates with the knowledge and tools to effectively manage their student loan debt and build a secure financial future.

Understanding Student Loan Debt

Student loan debt is a significant financial burden for many Americans, shaping their financial decisions for years after graduation. Understanding the characteristics of these loans, their various types, and the impact of interest and repayment plans is crucial for effective debt management. This section will explore these key aspects of student loan debt in the United States.

Characteristics of US Student Loan Debt

Student loan debt in the US is characterized by its substantial size and widespread impact. It’s the second-largest type of consumer debt, surpassed only by mortgage debt. The average student loan debt for borrowers is substantial, varying depending on the degree pursued and the borrower’s financial circumstances. Many borrowers face difficulties in repayment, leading to delinquency and default, which can severely damage their credit scores and limit future financial opportunities. The high cost of higher education, coupled with rising tuition fees and limited financial aid options, contributes to the growing student loan debt crisis.

Types of Student Loans

Student loans are broadly categorized into federal and private loans. Federal student loans are offered by the government and generally offer more borrower protections, such as income-driven repayment plans and loan forgiveness programs. These include subsidized and unsubsidized Stafford Loans (for undergraduates and graduate students), PLUS Loans (for parents and graduate students), and Perkins Loans (a need-based program). Private student loans, on the other hand, are offered by banks, credit unions, and other private lenders. These loans often have higher interest rates and fewer borrower protections compared to federal loans. The terms and conditions of private loans vary widely depending on the lender and the borrower’s creditworthiness.

Impact of Interest Rates and Repayment Plans

Interest rates significantly influence the total cost of student loans. Higher interest rates lead to a greater accumulation of interest over the life of the loan, increasing the total amount repaid. Federal student loans typically have lower interest rates than private loans, but the rates can still be substantial. Repayment plans also play a crucial role. Standard repayment plans involve fixed monthly payments over a set period (typically 10 years), while income-driven repayment plans adjust monthly payments based on the borrower’s income and family size. Income-driven repayment plans can result in lower monthly payments but may extend the repayment period and increase the total interest paid over the life of the loan. Choosing the right repayment plan is critical to managing student loan debt effectively.

Common Student Loan Repayment Strategies

Several strategies can help borrowers manage their student loan debt effectively. These include prioritizing high-interest loans for repayment, making extra payments to reduce the principal balance, refinancing loans to secure a lower interest rate (if eligible), and exploring loan forgiveness programs (if applicable). Careful budgeting and financial planning are essential to ensure consistent loan payments. For example, a borrower could allocate a specific portion of their monthly income towards student loan payments, or they might prioritize paying off high-interest loans first to minimize the overall interest paid. Another strategy involves creating a detailed repayment plan that Artikels the loan amounts, interest rates, and monthly payments to track progress and stay organized.

Debt Management Strategies for Students

Managing student loan debt effectively is crucial for a student’s financial well-being. A proactive approach, incorporating budgeting, exploring repayment options, and understanding consolidation, can significantly alleviate the burden of student loan debt and pave the way for a secure financial future. This section will Artikel several key strategies to help students navigate this challenge.

Sample Student Budget with Significant Student Loan Debt

Creating a realistic budget is the cornerstone of effective debt management. This example budget considers a student with significant student loan debt, highlighting the importance of prioritizing loan payments while maintaining essential living expenses. The budget assumes a monthly loan payment of $500 and a monthly income of $2000 (part-time job + potential financial aid). Adjustments should be made based on individual circumstances.

| Income | Amount ($) |

|---|---|

| Part-time Job | 1200 |

| Financial Aid/Other Income | 800 |

| Total Income | 2000 |

| Expenses | Amount ($) |

| Student Loan Payment | 500 |

| Rent/Housing | 600 |

| Groceries | 300 |

| Transportation | 150 |

| Utilities | 100 |

| Books/Supplies | 50 |

| Other Expenses (Entertainment, etc.) | 100 |

| Total Expenses | 1800 |

| Savings/Emergency Fund | 200 |

This budget shows a surplus, which can be used to further reduce the principal loan balance, contribute to an emergency fund, or be allocated to other financial goals. Remember, budgeting requires careful tracking and regular adjustments.

Strategies for Reducing Monthly Student Loan Payments

Several effective strategies can help reduce monthly student loan payments. These include refinancing (if interest rates are lower), exploring income-driven repayment plans, and making extra payments whenever possible.

- Refinancing: Refinancing involves obtaining a new loan with a lower interest rate, thereby reducing the monthly payment. This option is generally available to borrowers with good credit scores.

- Income-Driven Repayment Plans: These plans adjust monthly payments based on income and family size. They are designed to make repayment more manageable for borrowers with lower incomes.

- Extra Payments: Making even small extra payments towards the principal loan balance can significantly reduce the overall repayment period and interest paid.

Benefits and Drawbacks of Income-Driven Repayment Plans

Income-driven repayment (IDR) plans offer significant advantages and disadvantages that borrowers should carefully consider.

- Benefits: Lower monthly payments, potentially making repayment more manageable, especially during periods of low income. Some plans may offer loan forgiveness after a specified period of time (often 20 or 25 years).

- Drawbacks: Longer repayment periods leading to higher total interest paid over the life of the loan. Potential tax implications on forgiven loan amounts.

Step-by-Step Guide for Student Loan Consolidation

Consolidating student loans combines multiple loans into a single loan with a new interest rate and repayment schedule. This can simplify repayment but may not always reduce the total interest paid.

- Check your eligibility: Determine if you meet the eligibility requirements for consolidation. This often involves having multiple federal student loans.

- Compare loan options: Research different lenders and compare interest rates, fees, and repayment terms.

- Complete the application: Fill out the necessary paperwork and submit your application to the chosen lender.

- Review the terms: Carefully review the terms of the consolidated loan before signing the agreement.

- Make payments: Begin making payments according to the new repayment schedule.

The Role of Debt Collection Agencies

When student loan borrowers fall behind on payments, their loans may be transferred to debt collection agencies. These agencies are hired by lenders to recover outstanding debt. Understanding their role, legal boundaries, and common practices is crucial for borrowers navigating this challenging situation.

Debt collection agencies operate under specific legal frameworks designed to protect both lenders and borrowers. They are bound by the Fair Debt Collection Practices Act (FDCPA), a federal law that prohibits abusive, deceptive, and unfair practices. This legislation sets clear guidelines on how agencies can contact borrowers, what information they can request, and the methods they can use to collect payments. Violation of the FDCPA can lead to significant legal consequences for the agency.

Borrower Rights and Responsibilities

Borrowers facing debt collection agencies possess several key rights. They have the right to request validation of the debt, meaning they can ask the agency to prove they legitimately owe the debt. They also have the right to dispute the debt if they believe it’s inaccurate or they’ve already paid it. Furthermore, borrowers have the right to limit communication to specific times and methods, and to request that the agency cease all communication except for specific information regarding the debt. However, borrowers also have a responsibility to engage honestly and provide accurate information to the agency. Ignoring the debt or refusing to communicate will not make it disappear; it may even lead to further legal action, such as wage garnishment or lawsuits.

Common Tactics Employed by Debt Collection Agencies

Debt collection agencies employ various strategies to encourage repayment. These can include repeated phone calls, letters, and emails demanding payment. Some agencies may attempt to negotiate payment plans, offering reduced balances or extended repayment periods. Others might threaten legal action, such as lawsuits or wage garnishment, if payments are not made. While these tactics are often legal when used within the bounds of the FDCPA, aggressive or harassing behavior is strictly prohibited. Examples of prohibited tactics include calling repeatedly at inconvenient times, using abusive language, or threatening actions they cannot legally perform.

Comparison of Debt Collection Agency Practices

Different debt collection agencies may vary in their approach to debt recovery. Some agencies are known for their more lenient and collaborative approach, prioritizing negotiation and finding mutually agreeable payment plans. Others may adopt a more aggressive strategy, focusing on legal action and leveraging the full extent of their legal powers. The size and specialization of the agency also play a role. Larger agencies might have more resources for pursuing legal action, while smaller agencies may focus more on direct negotiation. However, regardless of their approach, all agencies must adhere to the FDCPA. Choosing to work with a particular agency does not guarantee a more favorable outcome, but understanding their general practices can help borrowers anticipate their approach.

Negotiating with a Debt Collection Agency

Negotiating with a debt collection agency requires careful preparation and a clear understanding of your financial situation. Begin by gathering all relevant documentation, including loan agreements and payment history. Before engaging in any negotiation, request debt validation to ensure the debt is legitimate and accurate. During negotiations, clearly state your financial limitations and propose a payment plan that you can realistically afford. Consider documenting all communication with the agency, including dates, times, and the content of conversations. It’s often beneficial to negotiate in writing to create a clear record of the agreement. Remember, a successful negotiation requires a balance of firmness and cooperation, aiming for a solution that is both feasible and protects your rights.

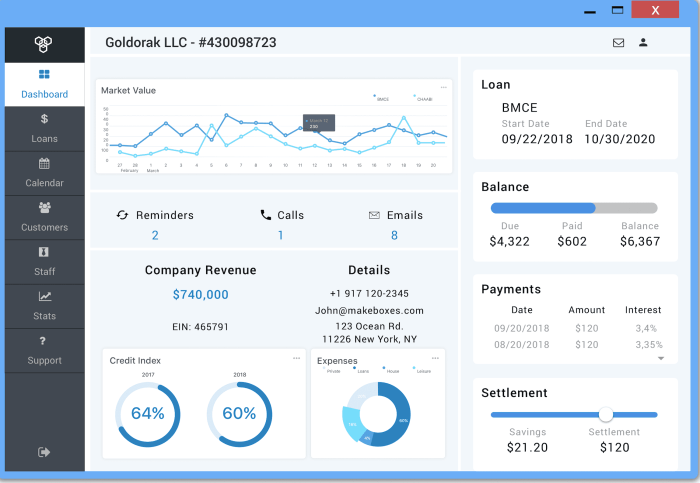

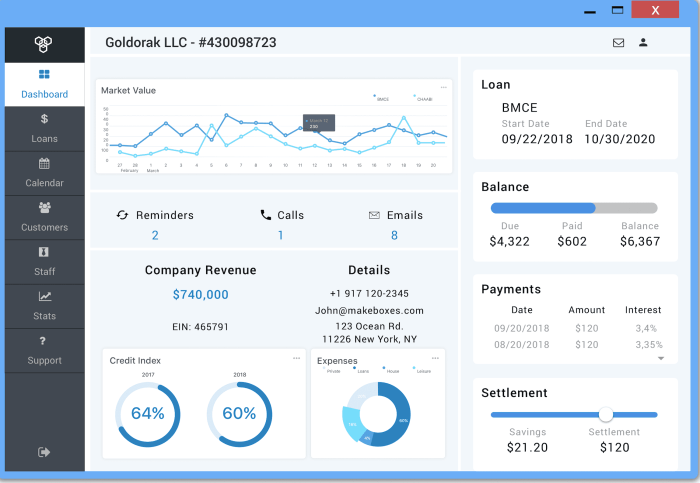

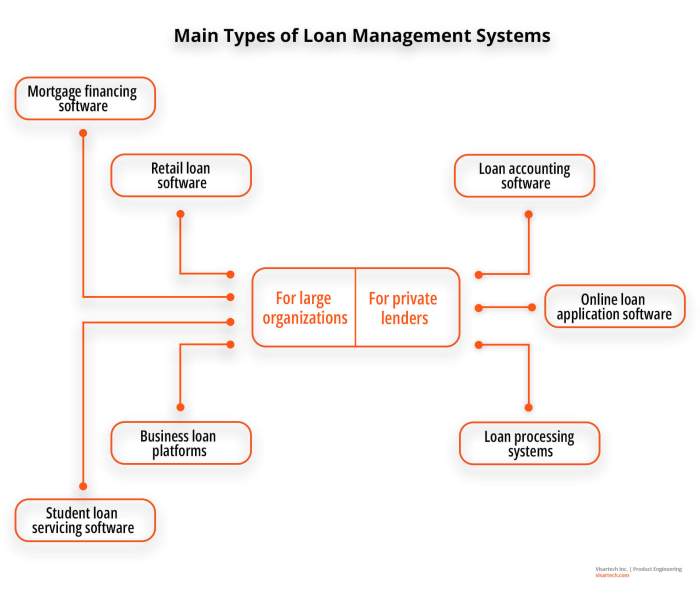

Technology in Debt Management and Collections

The efficient management and collection of student loan debt relies heavily on technology. Sophisticated software systems are crucial for tracking borrowers, managing payments, automating communication, and ensuring compliance with regulations. These systems significantly improve operational efficiency and reduce the manual workload associated with managing large portfolios of student loans.

Software is used to manage student loan debt portfolios by centralizing all borrower information, automating processes, and providing analytical tools for decision-making. This allows for efficient tracking of payments, identification of delinquent accounts, and proactive management of risk. The software also facilitates communication with borrowers, enabling automated reminders, personalized messaging, and efficient handling of inquiries. Furthermore, it generates reports and analytics that provide insights into portfolio performance, helping lenders optimize their strategies.

Features of a Debt Management and Collections System

A typical debt management and collections system offers a range of features designed to streamline the entire loan lifecycle. These features include robust data management capabilities, allowing for the storage and retrieval of all relevant borrower information. Automated workflows are essential for tasks such as payment processing, delinquency tracking, and communication scheduling. Reporting and analytics dashboards provide real-time insights into key performance indicators, allowing for data-driven decision-making. Finally, integrated communication tools facilitate efficient interaction with borrowers through various channels, such as email, SMS, and phone. Security features are paramount, ensuring the protection of sensitive borrower data in compliance with relevant regulations.

Comparison of Debt Management Software Features

The following table compares the features of three hypothetical debt management software systems: System A, System B, and System C. Note that this is a simplified comparison and actual software offerings will vary considerably.

| Feature | System A | System B | System C |

|---|---|---|---|

| Data Management | Centralized database, customizable fields | Centralized database, limited customization | Decentralized database, high customization |

| Automation | Payment processing, delinquency alerts, communication scheduling | Payment processing, delinquency alerts | Payment processing, delinquency alerts, automated collections calls |

| Reporting & Analytics | Standard reports, basic dashboards | Customizable reports, advanced dashboards | Predictive analytics, AI-driven insights |

| Communication Tools | Email, SMS | Email, SMS, phone integration | Email, SMS, phone integration, chatbot |

Automation in Debt Collection

Automation significantly improves efficiency in debt collection through various applications. For example, automated payment reminders via email or SMS reduce the need for manual follow-up calls, freeing up staff to focus on more complex cases. Automated delinquency tracking systems identify accounts at risk of default early, allowing for timely intervention and reducing the likelihood of significant losses. Furthermore, automated scoring models can prioritize accounts based on risk level, enabling collection agents to focus their efforts on the most promising cases. Automated communication tools personalize messages based on individual borrower circumstances, improving communication effectiveness and potentially increasing payment rates. For instance, a system could automatically send a personalized message offering a payment plan to a borrower who is consistently late with payments, rather than a generic reminder. This personalized approach can foster better borrower relationships and improve collection outcomes.

The Impact of Default on Student Loans

Defaulting on student loans carries significant and long-lasting negative consequences that extend far beyond simply owing the money. It impacts your financial future in profound ways, affecting your creditworthiness, employment opportunities, and overall financial well-being. Understanding these repercussions is crucial for responsible loan management.

Defaulting on a student loan means you have failed to make payments for a specific period, typically 270 days or nine months. This triggers a series of actions by the loan servicer and the government, ultimately leading to substantial financial penalties and a severely damaged credit history. The severity of the consequences depends on the loan type (federal or private) and the amount owed.

Consequences of Student Loan Default

Defaulting on student loans results in several serious consequences. Your credit score will plummet, making it extremely difficult to obtain credit in the future, such as mortgages, car loans, or even credit cards. The government may garnish your wages, seize your tax refunds, or even suspend your professional licenses. Furthermore, default may affect your ability to secure government jobs or certain types of security clearances. In some cases, default can lead to legal action and even wage garnishment. The financial penalties can be substantial, including late fees, collection costs, and potentially, even the entire loan balance. For example, a defaulted loan of $10,000 could easily balloon to $20,000 or more due to accrued penalties and interest.

Loan Rehabilitation After Default

Rehabilitation is a process that allows you to restore your defaulted federal student loans to good standing. It involves making nine consecutive on-time payments within a specific timeframe, usually within 20 days of each monthly due date. Once you successfully complete the rehabilitation process, the default is removed from your credit report, and your loan will be reinstated to its original terms. However, this does not erase the fact that you defaulted, and it may still negatively impact your credit score, albeit less severely than if you remained in default. Rehabilitation offers a second chance to manage your debt effectively and restore your financial standing.

Resources for Borrowers Facing Default

Several resources are available to help borrowers facing default. The National Foundation for Credit Counseling (NFCC) provides free and low-cost credit counseling services, helping borrowers create a budget, negotiate with lenders, and develop a plan to repay their loans. The U.S. Department of Education’s website offers comprehensive information on federal student loan programs, repayment options, and default prevention strategies. Additionally, many non-profit organizations and community colleges offer free financial literacy workshops and individual counseling to assist borrowers in managing their student loan debt. These resources provide crucial support and guidance to those struggling with repayment.

Impact of Default on Credit Scores and Future Borrowing

Defaulting on student loans significantly damages your credit score, making it challenging to obtain credit in the future. A low credit score can lead to higher interest rates on loans, making it more expensive to borrow money. It can also impact your ability to rent an apartment, secure a job, or even purchase insurance. The negative impact on your credit report can last for seven years or more, severely hindering your financial opportunities. Even after rehabilitation, the default will remain on your credit report for a period of time, though its negative impact will be lessened. This highlights the importance of proactive debt management and seeking help when facing financial difficulties.

Government Programs and Initiatives

Navigating the complexities of student loan debt can be daunting, but several government programs are designed to alleviate the burden and provide pathways to repayment. Understanding these initiatives is crucial for borrowers seeking relief and responsible debt management. This section will explore key programs and their impact, focusing on eligibility and practical application.

The US government offers a range of programs aimed at making student loan repayment more manageable. These programs vary in their approach, from income-driven repayment plans that adjust monthly payments based on earnings to loan forgiveness programs for specific professions. Recent legislative changes have also significantly impacted the availability and terms of these programs, affecting millions of borrowers.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make monthly payments more affordable by basing them on your income and family size. Several plans exist, each with slightly different eligibility requirements and payment calculations. These plans typically extend the repayment period, potentially reducing monthly payments but increasing the total interest paid over the life of the loan. Careful consideration of the long-term implications is crucial before enrolling in an IDR plan.

Public Service Loan Forgiveness (PSLF) Program

The PSLF program offers loan forgiveness after 120 qualifying monthly payments under an IDR plan for those working full-time in public service jobs. This program aims to incentivize individuals to pursue careers in public service sectors like government, non-profit organizations, and the military. Strict adherence to the program’s requirements is essential, as even minor inconsistencies can delay or prevent forgiveness.

Eligibility Criteria for Government Student Loan Programs

Understanding eligibility is paramount. The following Artikels key criteria for some prominent programs:

- Income-Driven Repayment Plans: Generally requires a federal student loan and completion of an application process. Specific income and family size requirements vary by plan.

- Public Service Loan Forgiveness (PSLF): Requires federal student loans, employment in a qualifying public service job, and consistent monthly payments under an IDR plan for 10 years (120 qualifying payments).

- Teacher Loan Forgiveness: Requires teaching full-time for five consecutive academic years in a low-income school or educational service agency.

Impact of Recent Legislation

Recent legislative changes, such as the COVID-19 pandemic-related payment pauses and subsequent extensions, have significantly impacted student loan debt. These temporary measures provided relief to borrowers, but also highlighted the ongoing need for comprehensive reform. Furthermore, the ongoing debate surrounding potential loan forgiveness initiatives demonstrates the continuous evolution of government policies aimed at addressing student loan debt. For example, the temporary pause on student loan payments during the pandemic provided significant short-term relief to millions of borrowers, allowing them to manage their finances more effectively. However, the long-term implications of such measures and the eventual resumption of payments remain significant factors to consider.

How Government Programs Assist in Debt Management

Government programs offer various pathways to manage and reduce student loan debt. IDR plans can lower monthly payments, making them more manageable for borrowers facing financial hardship. PSLF offers the potential for complete loan forgiveness after a period of qualifying payments, providing substantial long-term relief. Other programs, such as loan rehabilitation and consolidation, can also help borrowers avoid default and improve their repayment options. For instance, a borrower struggling with high monthly payments might opt for an IDR plan, significantly reducing their immediate financial burden. Alternatively, a public servant might utilize the PSLF program, ultimately leading to complete loan forgiveness after 10 years of service. These programs demonstrate the government’s commitment to providing support and pathways to debt relief for student loan borrowers.

Financial Literacy and Education

Financial literacy is paramount for students navigating the complexities of higher education and beyond. A strong understanding of personal finance empowers students to make informed decisions about borrowing, budgeting, and managing their finances effectively, ultimately reducing the risk of overwhelming student loan debt. This understanding extends beyond simply repaying loans; it encompasses responsible financial behaviors that contribute to long-term financial well-being.

The Importance of Financial Literacy for Students

Possessing strong financial literacy skills equips students with the tools to understand and manage their finances responsibly. This includes budgeting effectively, tracking expenses, understanding credit scores and interest rates, and making informed decisions regarding borrowing and saving. Without these skills, students may find themselves struggling with debt long after graduation, hindering their ability to achieve their career and life goals. A solid foundation in financial literacy promotes responsible spending habits, prevents impulsive borrowing, and encourages proactive planning for the future. This ultimately leads to improved financial health and reduces the likelihood of defaulting on student loans.

A Hypothetical Financial Literacy Program for College Students

A comprehensive financial literacy program for college students should be multifaceted, incorporating various learning methods and resources. The program could begin with an introductory module covering fundamental concepts such as budgeting, saving, and understanding credit. Subsequent modules could delve into more complex topics like investing, debt management, and planning for retirement. Interactive workshops, online modules, and one-on-one counseling sessions with financial advisors could provide a blended learning experience catering to diverse learning styles. The program could also include case studies of successful financial management and the consequences of poor financial decisions, making the learning more relatable and impactful. Regular assessments and feedback mechanisms would ensure students are grasping the concepts and applying them effectively.

Examples of Resources that Promote Financial Education

Numerous resources are available to promote financial education among students. The National Endowment for Financial Education (NEFE) offers a wide range of free online resources, including interactive tools and educational materials. Many universities and colleges incorporate financial literacy programs into their curriculum or offer workshops and seminars led by financial professionals. Non-profit organizations like the Jump$tart Coalition for Personal Financial Literacy provide educational materials and programs focused on improving financial literacy among young adults. Government agencies such as the Consumer Financial Protection Bureau (CFPB) offer valuable resources and guidance on various financial topics. Finally, numerous reputable websites and mobile applications offer budgeting tools, financial tracking capabilities, and personalized financial advice.

How Financial Literacy Can Help Prevent Student Loan Debt Problems

Financial literacy plays a crucial role in preventing student loan debt problems. By understanding the terms and conditions of student loans, students can make informed borrowing decisions, avoiding unnecessary debt. A solid understanding of budgeting and expense tracking enables students to manage their finances effectively, reducing their reliance on loans. Knowledge of credit scores and interest rates helps students make responsible credit decisions, preventing the accumulation of high-interest debt. Furthermore, financial literacy empowers students to explore alternative funding options and develop strategies for repayment, minimizing the risk of default. Proactive financial planning, enabled by financial literacy, can significantly reduce the burden of student loan debt and pave the way for a more secure financial future.

Visual Representation of Debt Management Strategies

Visual aids are crucial for understanding complex financial information, particularly when dealing with student loan debt. Effective visualizations can clarify repayment plans and the long-term impact of different repayment strategies, enabling informed decision-making. The following sections describe visual representations that can be used to effectively illustrate key aspects of student loan debt management.

Sample Debt Repayment Plan Visualization

A sample debt repayment plan could be represented using a combination of a bar chart and a timeline. The bar chart would visually display the outstanding balance for each loan, color-coded to differentiate between loans (e.g., federal subsidized, federal unsubsidized, private). The length of each bar would correspond to the loan balance, allowing for immediate visual comparison of loan sizes. The timeline, running horizontally beneath the bar chart, would illustrate the planned repayment schedule. Each loan’s repayment period would be represented by a colored segment along the timeline, with markers indicating scheduled payments. The timeline would clearly show the projected payoff date for each loan and the overall debt. A key would define the color coding for each loan type.

Impact of Different Repayment Options on Total Interest Paid

This could be illustrated using a line graph. The x-axis would represent the repayment period (in years), and the y-axis would represent the total interest paid. Multiple lines would be plotted on the graph, each representing a different repayment option (e.g., standard repayment, extended repayment, income-driven repayment). The graph would clearly show how the total interest paid varies across different repayment plans over time. For instance, a line representing the standard repayment plan might show a steeper initial decline in the principal but a lower overall interest paid compared to an extended repayment plan, which would show a gentler decline in principal but a higher overall interest paid due to the longer repayment period. A legend would clearly identify each repayment option. Data points could be labeled to show the cumulative interest paid at specific years. This allows for a direct comparison of the financial implications of each plan.

Conclusion

Successfully managing student loan debt requires a proactive and informed approach. By understanding your loan type, exploring available repayment options, and knowing your rights when interacting with collection agencies, you can navigate this process effectively. Remember that resources are available to assist you, from government programs to financial literacy initiatives. Proactive planning and a commitment to financial responsibility are key to achieving long-term financial health and avoiding the pitfalls of loan default.

FAQ Corner

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and eventually, default. Contact your loan servicer immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Can I negotiate my student loan debt with my lender?

Depending on your circumstances, you may be able to negotiate a repayment plan with your lender. This might involve modifying your payment amount or extending the repayment term. Contact your lender directly to discuss your options.

What is loan rehabilitation?

Loan rehabilitation is a process to restore your defaulted student loan to good standing. It typically involves making consistent payments over a period of time, often nine to ten months, depending on the loan type and servicer.

Where can I find free credit counseling?

Several non-profit organizations offer free or low-cost credit counseling services. The National Foundation for Credit Counseling (NFCC) is a reputable resource to find certified counselors in your area.